Europe Stocks: Positive Movement Amidst Trump's Tariff Statements, LVMH Drop

Table of Contents

The Unexpected Resilience of European Markets

While global economic uncertainty casts a shadow, Europe stock markets have displayed surprising strength. Despite negative news cycles, many key indices have shown positive growth, defying initial predictions of a significant downturn. This resilience suggests underlying economic strength and investor confidence.

- DAX (Germany): The DAX has shown a [insert percentage]% increase in the last [time period], indicating robust German economic performance.

- CAC 40 (France): Similarly, the CAC 40 experienced a [insert percentage]% rise in the same period, suggesting strength within the French economy.

- FTSE 100 (UK): The FTSE 100 also demonstrated growth of [insert percentage]%, showcasing resilience in the face of Brexit-related uncertainties.

- Strong Performing Sectors: The technology and energy sectors have particularly outperformed, driven by [explain specific reasons, e.g., technological advancements, increased energy demand].

Several factors contribute to this surprising resilience: strong corporate earnings in key sectors, relatively stable investor confidence, and supportive monetary policies from the European Central Bank (ECB). The ECB's ongoing quantitative easing program continues to inject liquidity into the market, helping to offset some of the negative effects of global uncertainty.

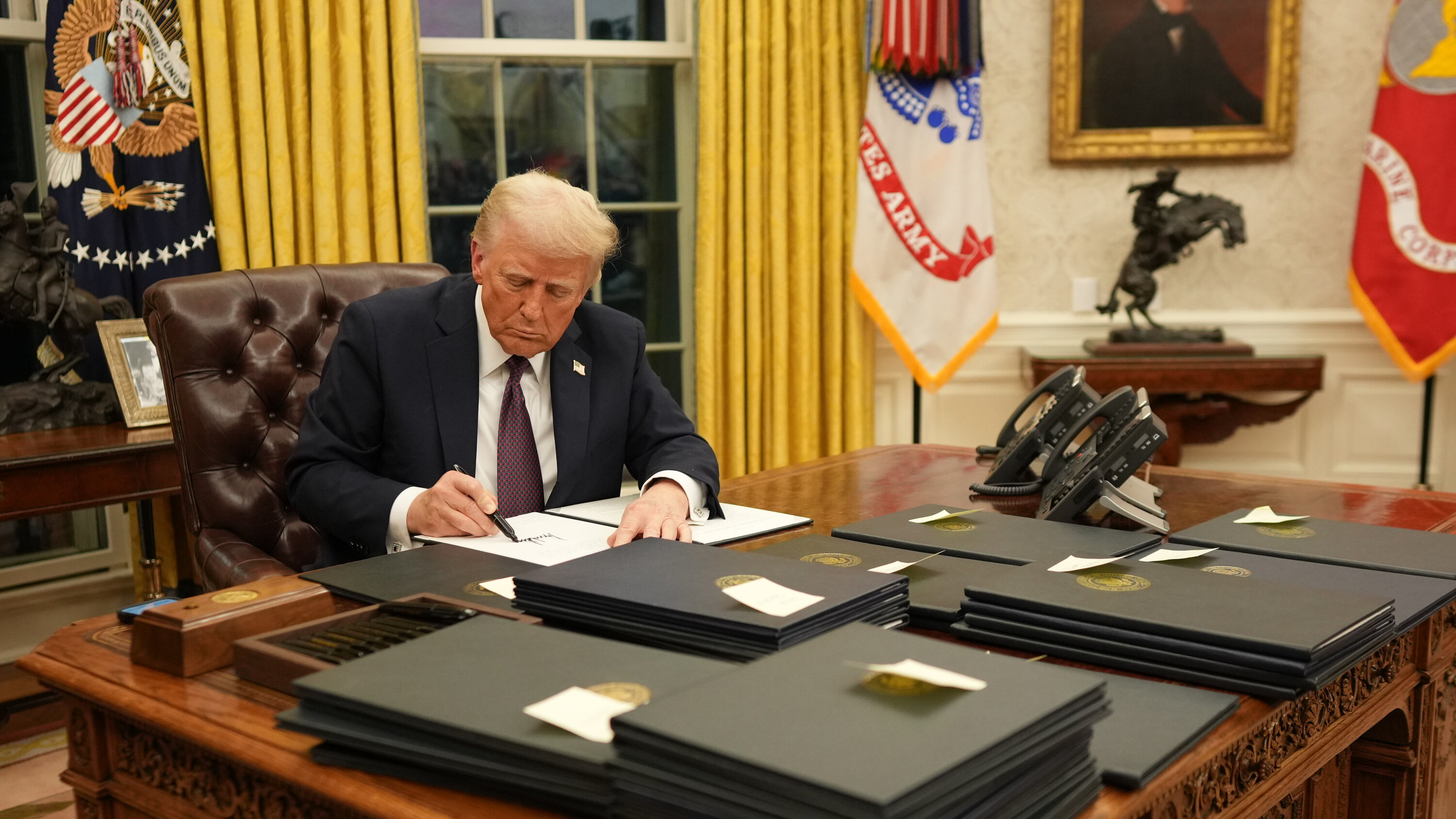

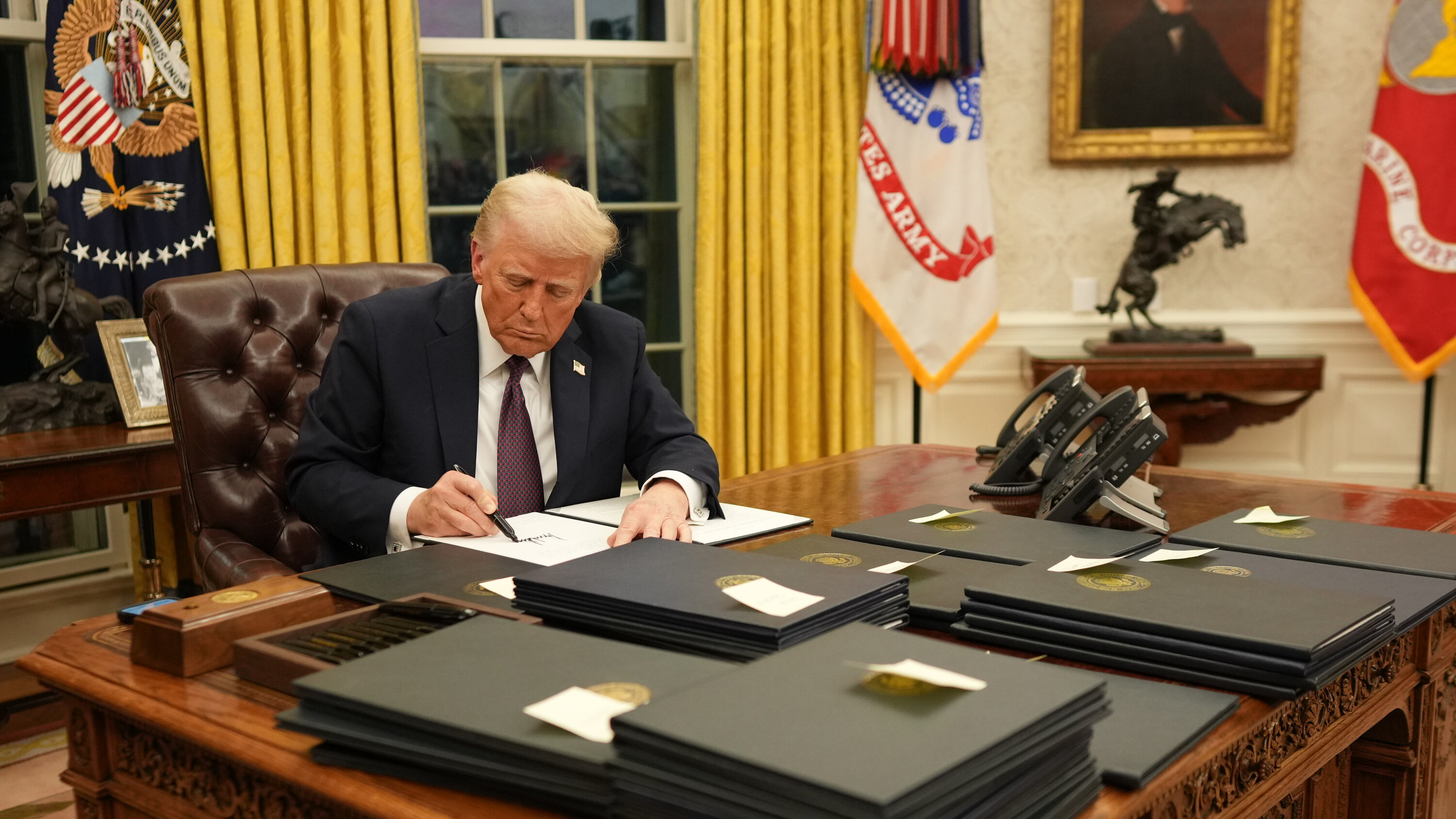

Impact of Trump's Tariff Statements on Europe Stocks

Trump's pronouncements on tariffs, particularly those targeting specific European goods, initially sparked concerns about their potential impact on Europe stocks. However, the market reaction has been more muted than anticipated.

- Specific Tariffs: The most impactful tariffs have been [list specific examples, e.g., tariffs on steel and aluminum imports].

- Market Reaction: While there were initial short-term dips, the impact on major European indices has been surprisingly limited, suggesting that markets may have already priced in some of the expected negative effects.

- Protective Measures: European companies have responded by [explain strategies, e.g., diversifying supply chains, seeking alternative markets]. Governments have also implemented [mention government support measures, e.g., subsidies, tax breaks].

- Sector-Specific Impacts: The automotive sector, heavily reliant on international trade, was expected to be most affected but has shown a more moderate impact than initially feared. [Explain specifics and the reason]

The relatively limited impact of Trump's tariff threats may be attributed to several factors, including the anticipation of the tariffs and the proactive steps taken by European businesses and governments to mitigate their effect.

Deconstructing the LVMH Stock Drop

The substantial drop in LVMH shares has raised concerns about the broader luxury goods sector and its potential impact on related European stocks.

- Reasons for the Drop: The decline can be attributed to a combination of factors, including slowing growth in the crucial Chinese market and underperformance of specific product lines. [Explain specifics on slowing growth and product underperformance].

- Sector-Wide Implications: While the drop is significant for LVMH, whether it reflects broader concerns within the luxury goods sector remains to be seen. [Explain whether this is isolated or not, providing relevant data].

- Impact on Related Stocks: The LVMH drop may trigger a reassessment of other luxury brands, potentially leading to price adjustments in related European stocks. [Discuss likely impacts on related stocks].

- Analyst Predictions: Analysts have offered diverse predictions, with some suggesting a temporary correction, while others express longer-term concerns. [Summarize relevant opinions and predictions].

Analyzing the Interplay Between Geopolitical Factors and Europe Stocks

The resilience of Europe stocks is not solely dependent on internal factors. The broader geopolitical landscape significantly influences market performance.

- Global Events: Other events impacting markets include [mention other significant global events, e.g., Brexit developments, US-China trade relations].

- Uncertainty and Resilience: Despite global uncertainty, the continued resilience of European markets suggests underlying strength and adaptability. [Explain reasons for resilience and adaptive capacity of European markets].

- Future Market Trends: Expert predictions suggest that [summarize expert predictions regarding future market trends, both positive and negative].

Conclusion: Navigating the Future of Europe Stocks

Despite Trump’s tariff pronouncements and the LVMH stock drop, Europe stocks have shown remarkable resilience. The market's response demonstrates underlying economic strength, proactive adaptation by companies and governments, and supportive monetary policy from the ECB. While global geopolitical factors remain influential, the overall outlook remains relatively positive. The limited impact of tariffs and the potential for isolated incidents like the LVMH drop highlight the complexities of navigating the European stock market.

To make informed investment decisions, staying abreast of Europe stock market trends is crucial. Continue monitoring financial news, analyzing key indices like the DAX, CAC 40, and FTSE 100, and paying close attention to geopolitical developments. Utilize resources such as the Financial Times, Bloomberg, and Reuters for in-depth analysis of European equities and European stock market trends. Understanding these factors will empower you to navigate the dynamic world of European stocks effectively.

Featured Posts

-

Indian Wells 2025 Swiatek And Rybakinas Path To The Quarterfinals

May 24, 2025

Indian Wells 2025 Swiatek And Rybakinas Path To The Quarterfinals

May 24, 2025 -

Astrologia Semanal Horoscopo Del 1 Al 7 De Abril De 2025

May 24, 2025

Astrologia Semanal Horoscopo Del 1 Al 7 De Abril De 2025

May 24, 2025 -

Los Angeles Wildfires And The Unethical World Of Disaster Betting

May 24, 2025

Los Angeles Wildfires And The Unethical World Of Disaster Betting

May 24, 2025 -

Dylan Dreyers Postpartum Weight Loss Her Inspiring Story On The Today Show

May 24, 2025

Dylan Dreyers Postpartum Weight Loss Her Inspiring Story On The Today Show

May 24, 2025 -

Michael Caine On Filming A Sex Scene With Mia Farrow An Unforgettable Experience

May 24, 2025

Michael Caine On Filming A Sex Scene With Mia Farrow An Unforgettable Experience

May 24, 2025