European Central Bank: Economists' Concerns Over Delayed Rate Cuts

Table of Contents

Inflationary Pressures and the ECB's Response

The Eurozone has been grappling with stubbornly high inflation for a considerable period. While the rate has begun to decrease from its peak, it remains significantly above the ECB's target of 2%. This persistent inflation is forcing the ECB to walk a tightrope. Their rationale for maintaining higher interest rates, despite slowing economic growth, rests on the belief that curbing inflation is paramount, even if it means risking a recession. However, prolonged high interest rates pose considerable risks:

- Increased borrowing costs: Higher interest rates make borrowing more expensive for businesses and consumers, potentially stifling investment and spending. This can lead to decreased consumer confidence and further slow economic growth.

- Deeper recession risk: The aggressive interest rate hikes implemented by the ECB could trigger a deeper and more prolonged recession than initially anticipated, particularly for highly indebted nations within the Eurozone.

- Negative impact on investment and job creation: Businesses may postpone or cancel investment projects due to increased borrowing costs, leading to reduced job creation and potentially increased unemployment.

The ECB’s monetary policy needs careful calibration. While tackling "Eurozone inflation" is crucial, the impact of sustained "interest rate hikes" on the real economy must be carefully considered. The latest data on "ECB monetary policy" should be continuously analyzed to ensure the most effective strategy is employed.

Economic Growth Slowdown and the Risk of Recession

The Eurozone economy is showing signs of a significant slowdown. "Eurozone GDP growth" has decelerated considerably, and several leading indicators point towards a potential recession. High interest rates are exacerbating this situation by:

- Decreased consumer spending: Rising borrowing costs and inflation are squeezing household budgets, leading to reduced consumer spending.

- Reduced business investment: Businesses are less likely to invest when borrowing is expensive and future economic prospects are uncertain.

- Increased unemployment: Slower economic growth and reduced business investment can lead to job losses and rising unemployment rates.

The debate rages on regarding the effectiveness of the ECB’s strategy. Some economists argue that the focus on combating inflation, even at the cost of slower growth, is justified. Others believe that the ECB is prioritizing inflation control over economic stability and that more aggressive "European Central Bank rate cuts" are necessary to prevent a deep recession. Analyzing "ECB economic forecasts" is vital to understanding the prevailing economic outlook.

Differing Opinions Among Economists

There is a significant divergence of opinion among economists regarding the optimal timing of "European Central Bank rate cuts." Some believe that delaying rate cuts is crucial to bring inflation under control, even if it means accepting some economic pain in the short term. Others warn that prolonged high interest rates risk triggering a severe recession, leading to even greater long-term economic damage.

- ECB policy critics: Many experts openly challenge the ECB's approach, arguing for more immediate action to stimulate economic growth.

- Economist forecasts: A range of differing "economist forecasts" highlight the uncertainty surrounding the Eurozone's future economic trajectory.

- Monetary policy debate: The ongoing "monetary policy debate" emphasizes the complexities and challenges facing the ECB in navigating this economic crisis.

The political pressures on the ECB are also significant, with governments facing pressure to stimulate their economies and prevent social unrest caused by high inflation and unemployment.

The Impact on Financial Markets

The ECB's decisions are having a profound impact on financial markets. The uncertainty surrounding the timing of rate cuts is leading to significant volatility:

- Euro exchange rate: Fluctuations in the Euro exchange rate reflect the market's uncertainty regarding the ECB's future actions.

- Bond market yields: Bond yields are sensitive to interest rate expectations, and the delayed rate cuts have created increased volatility in the bond market.

- Stock market volatility: Stock market performance is reflecting the economic uncertainty and the ongoing debate about the appropriate monetary policy response.

Conclusion: European Central Bank Rate Cuts - A Necessary Recalibration?

Economists are increasingly concerned about the potential consequences of delayed European Central Bank rate cuts. Prolonged high interest rates risk pushing the Eurozone into a deeper recession, harming businesses, consumers, and the overall economic outlook. While controlling "Eurozone inflation" is crucial, the current strategy’s impact on economic growth and employment needs careful reevaluation. The diverging opinions among economists highlight the complexity of the situation and the difficulty of finding the right balance between inflation control and economic growth.

Stay updated on the latest developments concerning European Central Bank rate cuts and their implications for the Eurozone's economic future. Follow our blog for regular updates and in-depth analyses.

Featured Posts

-

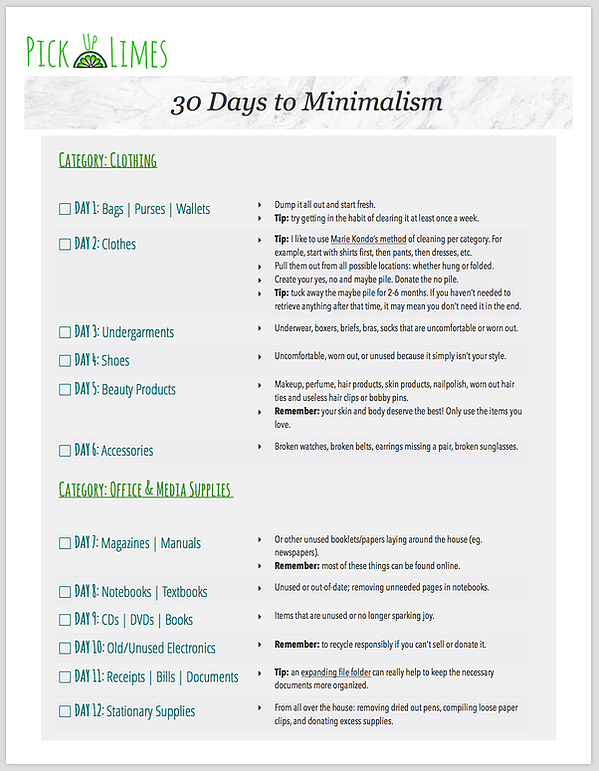

30 Days To Minimalism A Practical Guide To A Less Cluttered Home

May 31, 2025

30 Days To Minimalism A Practical Guide To A Less Cluttered Home

May 31, 2025 -

Covid 19 Who Investigating Possible Link Between New Variant And Case Spike

May 31, 2025

Covid 19 Who Investigating Possible Link Between New Variant And Case Spike

May 31, 2025 -

Canadian Red Cross Manitoba Wildfire Evacuee Support How To Help

May 31, 2025

Canadian Red Cross Manitoba Wildfire Evacuee Support How To Help

May 31, 2025 -

Lavender Milk Nails Ein Zarter Look Fuer Den Fruehling Und Sommer

May 31, 2025

Lavender Milk Nails Ein Zarter Look Fuer Den Fruehling Und Sommer

May 31, 2025 -

Dealers Intensify Fight Against Ev Sales Mandates

May 31, 2025

Dealers Intensify Fight Against Ev Sales Mandates

May 31, 2025