European Futures Market Update: Swissquote Bank Perspective

Table of Contents

Current Market Trends and Volatility Analysis

Market volatility remains a significant factor influencing the European Futures Market. Understanding current market sentiment and employing effective trading indicators are crucial for successful navigation. We'll analyze volatility levels and their impact on trading strategies, considering both technical and fundamental analysis.

-

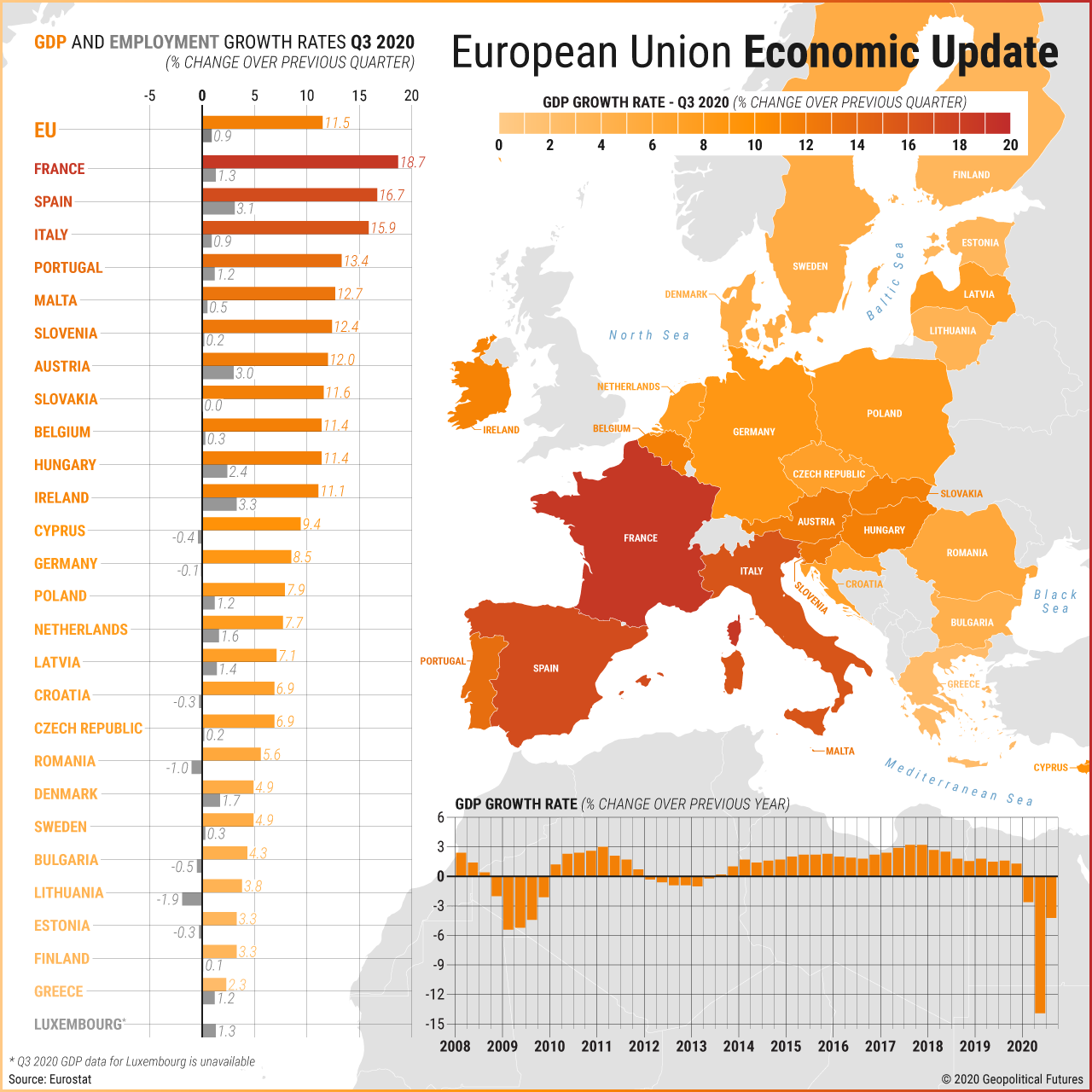

Recent Market Movements: Major European futures contracts like the DAX, CAC 40, and FTSE 100 have shown considerable fluctuation in recent weeks. These movements are largely attributed to fluctuating inflation rates, shifts in investor sentiment, and ongoing geopolitical tensions. A careful analysis of these price movements is key to understanding current market trends.

-

Volatility Levels and Impact: The Volatility Index (VIX), a key indicator of market fear and uncertainty, has shown increased levels, reflecting the current volatile environment. High volatility can present both opportunities and risks for futures traders, requiring adaptable strategies and careful risk management. Understanding how to interpret and utilize the VIX is crucial for successful futures trading.

-

Macroeconomic Indicators and Sentiment: Key macroeconomic indicators, such as inflation data released by the European Central Bank (ECB) and decisions regarding interest rates, significantly impact market sentiment. Positive economic news can lead to increased investor confidence, while negative news can trigger sell-offs and increased volatility. Staying informed about these releases is paramount.

-

Swissquote Bank's Volatility Management Tools: Swissquote Bank's advanced trading platforms offer tools designed to help traders effectively manage volatility. These include real-time market data, advanced charting capabilities, and a range of analytical tools, allowing for informed decision-making even in highly volatile conditions. The platform provides easy access to the VIX and other relevant volatility indices.

Key Futures Contracts Performance Review

Analyzing the performance of key European index futures contracts and relevant commodity futures is essential for understanding the current market landscape. We will examine the DAX Futures, CAC 40 Futures, FTSE 100 Futures, and relevant commodity futures contracts.

-

Major European Index Futures: The DAX, CAC 40, and FTSE 100 futures contracts have shown varied performance recently, reflecting the diverse economic situations and investor sentiments across different European countries. We'll provide a detailed analysis of each contract’s performance, highlighting key trends and potential turning points.

-

Commodity Futures Performance: The performance of commodity futures, particularly energy and metals, significantly impacts the European futures market. Factors such as global supply chains, geopolitical events, and demand fluctuations influence price movements in these contracts. This analysis will incorporate the impact of these factors on European Futures trading.

-

Opportunities and Risks: Each contract presents unique opportunities and risks. Our analysis will identify potential trading opportunities while highlighting associated risks, enabling traders to make informed decisions based on their risk tolerance and investment objectives. Charts and graphs will illustrate performance trends.

Swissquote Bank's Trading Solutions and Resources

Swissquote Bank provides a comprehensive suite of trading solutions and resources to empower traders in the European Futures Market. Our advanced platform, educational resources, and customer support are designed to enhance your trading experience.

-

Advanced Trading Platforms: Swissquote's trading platforms offer advanced charting tools, real-time market data, and fast order execution, providing traders with the tools they need to make informed decisions quickly. These tools are essential for navigating the dynamic nature of the European Futures Market.

-

Educational Resources: We offer a wide range of educational resources, including webinars, tutorials, and market analysis reports, to help traders of all levels enhance their knowledge and skills. These resources are designed to help traders better understand the complexities of futures trading.

-

Risk Management and Customer Support: Effective risk management is paramount in futures trading. Swissquote Bank emphasizes the importance of implementing appropriate risk management strategies. Our customer support team is readily available to answer your questions and provide assistance.

Leveraging Swissquote's Tools for Successful Futures Trading

Swissquote Bank’s tools are designed to support the development and implementation of effective trading strategies and risk management plans.

-

Developing Effective Trading Strategies: Our platform and resources facilitate the development and execution of various trading strategies, from fundamental to technical analysis. Understanding different market conditions and utilizing the appropriate tools are crucial for success.

-

Risk Management on Swissquote's Platform: Effective risk management involves understanding leverage, setting stop-loss orders, and diversifying your portfolio. Swissquote's platform provides the tools to manage risk effectively, helping you protect your capital.

-

Order Types and Market Conditions: Swissquote offers various order types, such as market orders, limit orders, and stop orders, to suit different trading strategies and market conditions. Understanding the nuances of each order type is vital for executing trades efficiently and managing risk effectively.

Conclusion

This European Futures Market Update from Swissquote Bank has provided an in-depth analysis of current market trends, key contract performances, and the valuable resources available through our platform to navigate market volatility. We highlighted the importance of leveraging tools and strategies for successful futures trading. Understanding the complexities of the European Futures Market, and utilizing the resources available through Swissquote Bank is crucial for success.

Call to Action: Stay ahead of the curve in the dynamic European futures market. Access insightful analysis and powerful trading tools with Swissquote Bank. [Link to Swissquote Bank's Futures Trading Page]. Begin your journey to successful futures trading with our expert resources and supportive platform. Learn more about the European futures market and Swissquote Bank's offerings today!

Featured Posts

-

Filth Tv Show Film4 Hd Broadcast Details

May 19, 2025

Filth Tv Show Film4 Hd Broadcast Details

May 19, 2025 -

Poitiers Nouveau Projet Immobilier 46 Appartements De Luxe

May 19, 2025

Poitiers Nouveau Projet Immobilier 46 Appartements De Luxe

May 19, 2025 -

Diversity In Higher Education Examining College Admissions Standards

May 19, 2025

Diversity In Higher Education Examining College Admissions Standards

May 19, 2025 -

Erling Haaland Injury Return Date Prediction For Man City Striker

May 19, 2025

Erling Haaland Injury Return Date Prediction For Man City Striker

May 19, 2025 -

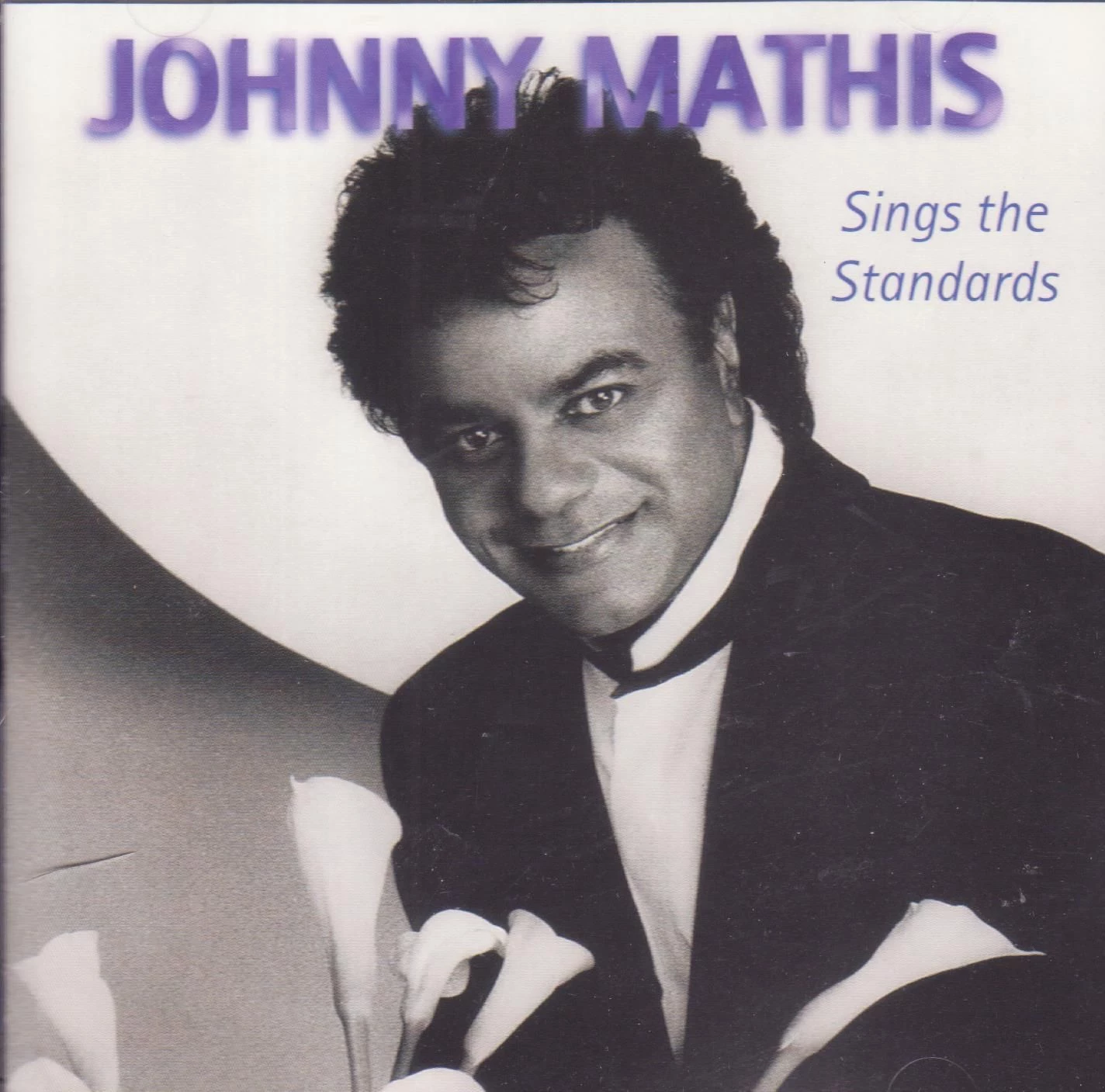

Legendary Singer Johnny Mathis Retires From Touring

May 19, 2025

Legendary Singer Johnny Mathis Retires From Touring

May 19, 2025