European Stock Market Briefing: PMI Data Drives Trading Activity

Table of Contents

Impact of PMI Data on European Stock Markets

Purchasing Managers' Indices (PMIs) are leading economic indicators that provide valuable insights into the health of various sectors within an economy. They're compiled from surveys of purchasing managers in different industries, offering a snapshot of current business conditions. These indices are particularly crucial for understanding the direction of the European economy and its impact on stock market performance. Different PMI sub-indices, such as manufacturing PMI and services PMI, offer a more granular view, affecting specific sectors differently.

- Manufacturing PMI: A strong manufacturing PMI typically indicates robust industrial production, positively affecting industrial stocks. Conversely, a weak reading can trigger sell-offs in this sector.

- Services PMI: The services PMI reflects the health of the service sector, a major component of many European economies. A strong services PMI often translates into positive sentiment for consumer discretionary stocks, while a weak reading can signal potential economic slowdown.

Recent PMI Releases and Market Reactions:

- September PMI data showed a slight contraction in the German manufacturing sector, leading to a minor dip in the DAX index. This highlighted concerns about weakening global demand and supply chain disruptions.

- Stronger-than-expected Services PMI data in France boosted investor sentiment, pushing the CAC 40 higher. This reflected the resilience of the French service sector despite inflationary pressures.

Sector-Specific Analysis based on PMI Data

The latest PMI releases haven't impacted all European stock market sectors uniformly. Analyzing sector-specific reactions reveals valuable insights for targeted investment strategies.

- Technology Sector: Recent PMI data showing a slowdown in manufacturing has had a mixed impact on the tech sector. Some technology companies heavily reliant on industrial clients experienced decreased stock prices, while others less exposed to this sector showed resilience.

- Financial Sector: Concerns highlighted in the services PMI, particularly regarding consumer spending, have led to slight dips in the stock prices of some large banking institutions.

- Energy Sector: The energy sector's performance remains closely tied to geopolitical events and global energy prices, with PMI data offering only a secondary influence. However, weaker PMI readings can indicate reduced energy demand, potentially impacting energy company valuations.

Specific Company Performances:

- Company X (automotive): This major player saw its stock price increase following a positive manufacturing PMI report reflecting increased demand for automobiles.

- Company Y (banking): This large banking institution experienced a slight dip following concerns about decreased consumer spending highlighted in the services PMI report.

Trading Strategies Informed by PMI Data

Savvy investors utilize PMI data to enhance their trading decisions and manage risk effectively. The information provided by PMI data can inform both long-term and short-term investment strategies.

- Long-term Investments: PMI data can help identify sectors poised for long-term growth. Strong and consistently improving PMI readings for a particular sector can suggest investing in companies within that sector for sustained returns.

- Short-term Trading: Short-term traders might use PMI releases as catalysts for quick trades. Unexpectedly strong or weak PMI data can lead to short-term price fluctuations, creating opportunities for profit.

Practical Applications of PMI Data in Investment Strategies:

- Identify undervalued stocks: PMI data can help identify stocks in sectors showing signs of recovery, potentially offering attractive entry points for long-term investors.

- Hedge against market downturns: Weakening PMI indicators can signal potential economic slowdowns, prompting investors to adjust their portfolio allocation to mitigate risk. This could involve shifting investments to more defensive sectors or increasing cash holdings.

Overall European Economic Outlook and Market Sentiment

The overall European economic outlook remains somewhat cautious, with PMI data indicating a possible slowdown in growth in certain sectors. However, other factors such as inflation rates and interest rate decisions by the European Central Bank significantly influence market sentiment.

- Inflation: High inflation continues to be a significant concern, affecting consumer spending and impacting the services PMI. The ECB’s actions to control inflation directly impact market sentiment and investment decisions.

- Interest Rates: Increasing interest rates aimed at controlling inflation can slow economic growth, impacting PMI readings and consequently stock market performance.

Overall Market Outlook and Potential Future Trends:

- The overall European economic outlook remains cautious, with PMI data indicating a possible slowdown in growth for some sectors. However, the resilience of the service sector in certain countries suggests a degree of economic stability.

- Investor sentiment remains mixed, with ongoing uncertainty surrounding geopolitical factors and the war in Ukraine. These uncertainties continue to influence market volatility and investment decisions.

Conclusion

This European stock market briefing highlights the significant role of PMI data in driving trading activity. Understanding PMI data, its nuances, and its impact on different sectors is crucial for developing effective investment strategies. By analyzing PMI releases and integrating this information into your investment approach, you can navigate the complexities of the European stock market more effectively. Stay informed about upcoming PMI releases and their potential impact on your European stock market investments. Regularly check for our European stock market briefings for further analysis and insights on how PMI data drives trading activity and enhances your understanding of European stock market performance.

Featured Posts

-

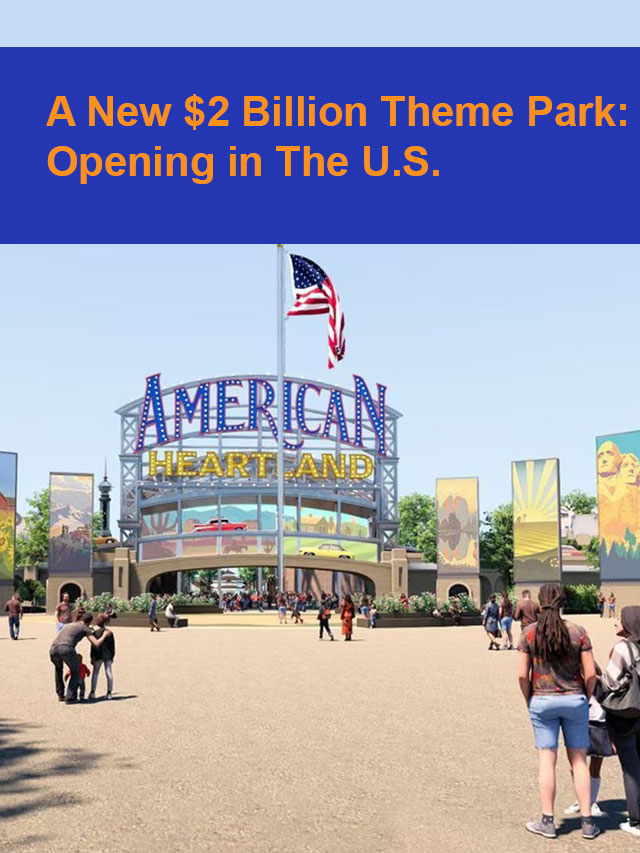

7 Billion Theme Park Universals Aggressive Bid To Challenge Disneys Dominance

May 23, 2025

7 Billion Theme Park Universals Aggressive Bid To Challenge Disneys Dominance

May 23, 2025 -

Meteorologia Prevision De Lluvias Moderadas Para Hoy

May 23, 2025

Meteorologia Prevision De Lluvias Moderadas Para Hoy

May 23, 2025 -

Tochnye Goroskopy I Predskazaniya Na Nedelyu

May 23, 2025

Tochnye Goroskopy I Predskazaniya Na Nedelyu

May 23, 2025 -

Kazakhstans Billie Jean King Cup Victory Over Australia

May 23, 2025

Kazakhstans Billie Jean King Cup Victory Over Australia

May 23, 2025 -

From Prison To Studio Vybz Kartels Update On Life And Music

May 23, 2025

From Prison To Studio Vybz Kartels Update On Life And Music

May 23, 2025