European Stock Market Forecast: Strategists' Concerns Grow Over Trump's Trade Policies

Table of Contents

Trump's Trade Policies: A Looming Threat to European Markets

President Trump's "America First" approach, characterized by aggressive tariffs and trade disputes, casts a long shadow over the European Union. This section examines the direct and indirect consequences of these policies on European markets.

Tariff Impacts on Key European Sectors

The imposition of US tariffs has significantly impacted key European sectors. These tariffs, often retaliatory in nature, have created a challenging environment for businesses and investors alike.

-

Automobiles: The US tariffs on imported cars and car parts have hit European automakers hard, impacting profitability and potentially leading to job losses. Companies like BMW, Daimler, and Volkswagen have been particularly affected, facing decreased sales and increased production costs. Keywords: US tariffs on cars, EU auto industry, trade war impact on autos.

-

Aerospace: The aerospace industry, a vital sector for European economies, faces similar challenges. Boeing's dominance in the US market creates an uneven playing field, and trade disputes could further exacerbate the situation. Keywords: Aerospace tariffs, Airbus vs Boeing, trade disputes in aviation.

-

Agriculture: European agricultural exports to the US have suffered significantly under Trump's trade policies. Farmers face reduced market access and lower prices for their goods, impacting livelihoods and economic stability in rural areas. Keywords: Agricultural tariffs, EU farm exports, trade war impact on agriculture.

-

Potential Consequences:

- Decreased profitability and reduced margins.

- Job losses and factory closures.

- Reduced investment and innovation.

- Increased prices for consumers.

Uncertainty and Investor Sentiment

The unpredictable nature of Trump's trade policies is perhaps the most significant threat to the European stock market. This constant uncertainty undermines investor confidence, leading to increased market volatility.

-

Impact on Investment Decisions: Investors become hesitant to commit capital in an environment marked by unpredictable policy changes. This risk aversion translates to lower investment and slower economic growth. Keywords: investor behavior, market risk, uncertainty in investments.

-

Market Volatility: Sudden shifts in trade policy lead to sharp fluctuations in stock prices, creating a challenging environment for long-term investment strategies. Keywords: stock market fluctuations, volatility index, risk assessment.

-

Capital Flight: Investors may seek safer havens outside of Europe, leading to capital flight and further weakening the European economy. Keywords: capital flight from Europe, safe haven assets, investment diversification.

Potential Economic Slowdown in Europe

The ripple effects of trade disputes extend beyond specific sectors, posing a significant threat to overall European economic growth.

Ripple Effects of Trade Disputes

The interconnectedness of the global economy means that trade disputes can trigger a domino effect, negatively impacting various sectors and countries. A slowdown in one area quickly affects others, creating a chain reaction. Keywords: global trade impact, economic interdependence, supply chain disruption.

-

Reduced Consumer Spending: Uncertainty and higher prices can lead to reduced consumer spending, dampening economic activity.

-

Decreased Business Investment: Businesses hesitate to invest in expansion or new projects amidst trade uncertainty, further slowing economic growth.

-

Supply Chain Disruptions: Trade disputes can disrupt supply chains, leading to production delays and shortages.

Impact on Specific European Economies

The impact of an economic slowdown will not be felt equally across Europe. Countries with strong export ties to the US, such as Germany, will likely be disproportionately affected. Keywords: Germany economic outlook, France economic forecast, Eurozone economic impact.

-

Germany: Germany's export-oriented economy is highly vulnerable to trade disputes with the US. A significant slowdown in US demand for German goods could have severe repercussions.

-

France: While France's economy is more diversified, it is still susceptible to the negative impacts of a global economic slowdown.

-

UK: The UK's economic future is further complicated by Brexit, adding another layer of uncertainty to its already vulnerable position in the global trade landscape.

Strategies for Navigating Market Uncertainty

Despite the challenges, investors can employ strategies to mitigate risks and capitalize on potential opportunities.

Diversification and Risk Management

Diversification is key to managing risk in this turbulent environment. Investors should spread their investments across different sectors, geographies, and asset classes. Keywords: portfolio diversification, asset allocation, hedging strategies, risk mitigation.

-

Geographic Diversification: Investing in markets outside of Europe and the US can reduce exposure to trade war-related risks.

-

Sector Diversification: Investing in sectors less exposed to trade disputes can help mitigate losses.

-

Asset Class Diversification: Diversifying across different asset classes, such as stocks, bonds, and real estate, can improve overall portfolio resilience.

Opportunities Amidst Uncertainty

While the outlook appears challenging, periods of market uncertainty often create attractive investment opportunities.

-

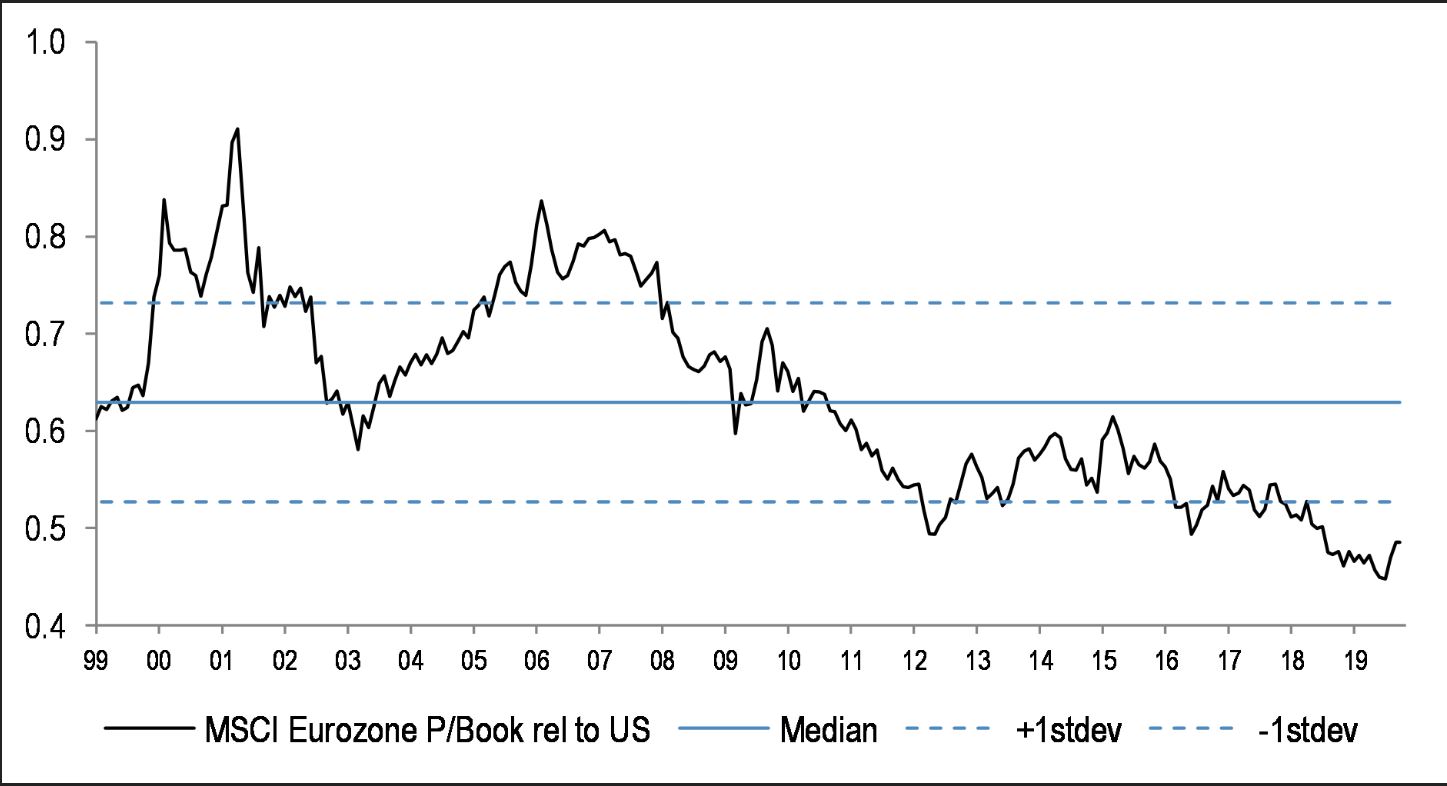

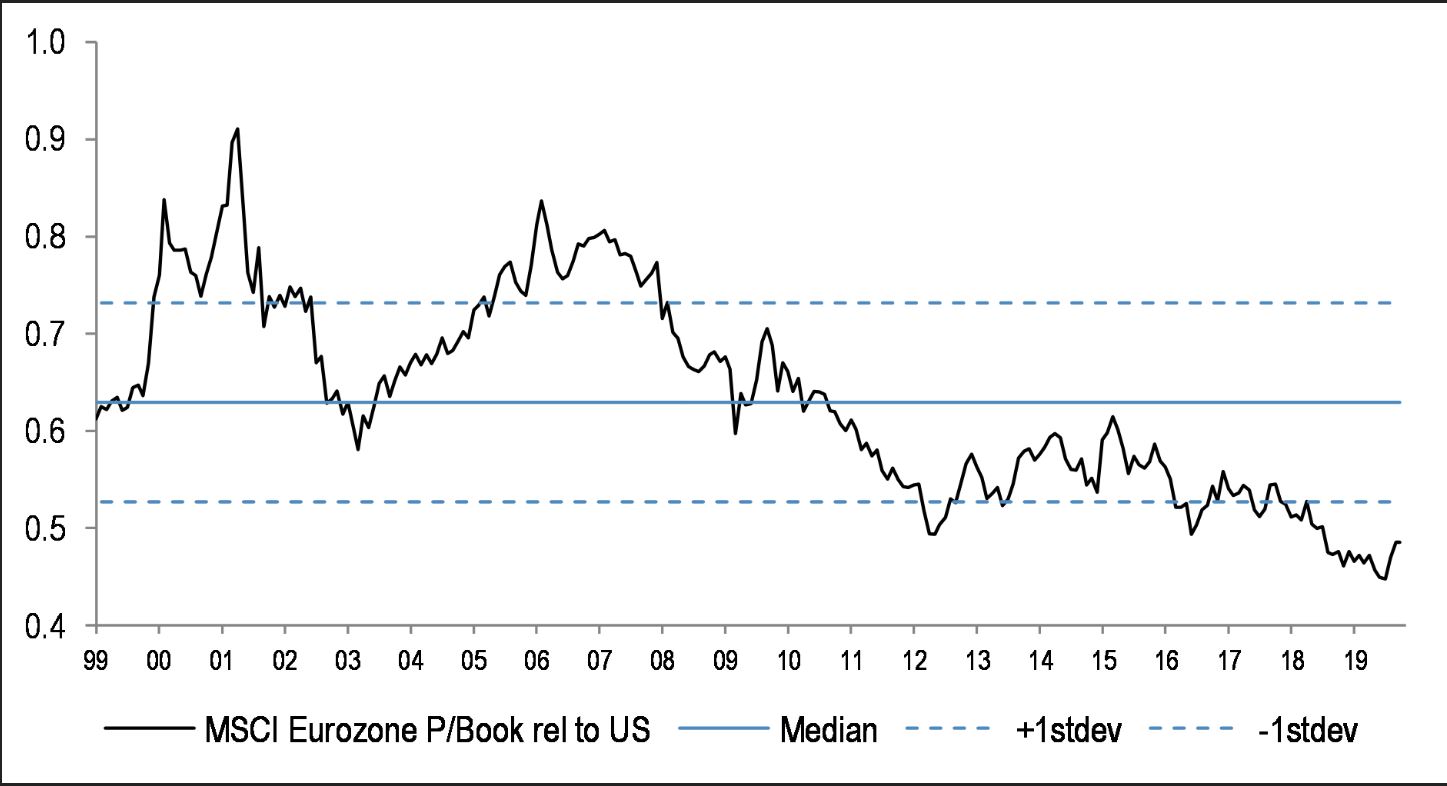

Undervalued Stocks: Some stocks may become undervalued due to market panic, presenting attractive entry points for long-term investors. Keywords: value investing, undervalued stocks, long-term investment strategy.

-

Defensive Sectors: Sectors like healthcare and consumer staples often perform better during economic downturns.

-

Emerging Markets: Emerging markets, while carrying their own risks, may offer growth potential uncorrelated with the US-EU trade relationship. Keywords: emerging markets investment, high growth markets, international diversification.

Conclusion

The European Stock Market Forecast remains clouded by uncertainty stemming from President Trump's unpredictable trade policies. The potential for economic slowdown and market volatility is real. However, proactive investors can mitigate these risks by employing robust diversification and risk management strategies. By carefully analyzing the potential impacts on various sectors and economies, and by identifying emerging opportunities, investors can position themselves for success. Stay informed on evolving trade relations and consult with financial advisors to develop a robust investment plan tailored to this evolving situation. Understanding and actively managing your exposure to the fluctuating European Stock Market Forecast is crucial for long-term investment success.

Featured Posts

-

Trumps Ukraine Strategy Hampered By Russian Resistance

Apr 26, 2025

Trumps Ukraine Strategy Hampered By Russian Resistance

Apr 26, 2025 -

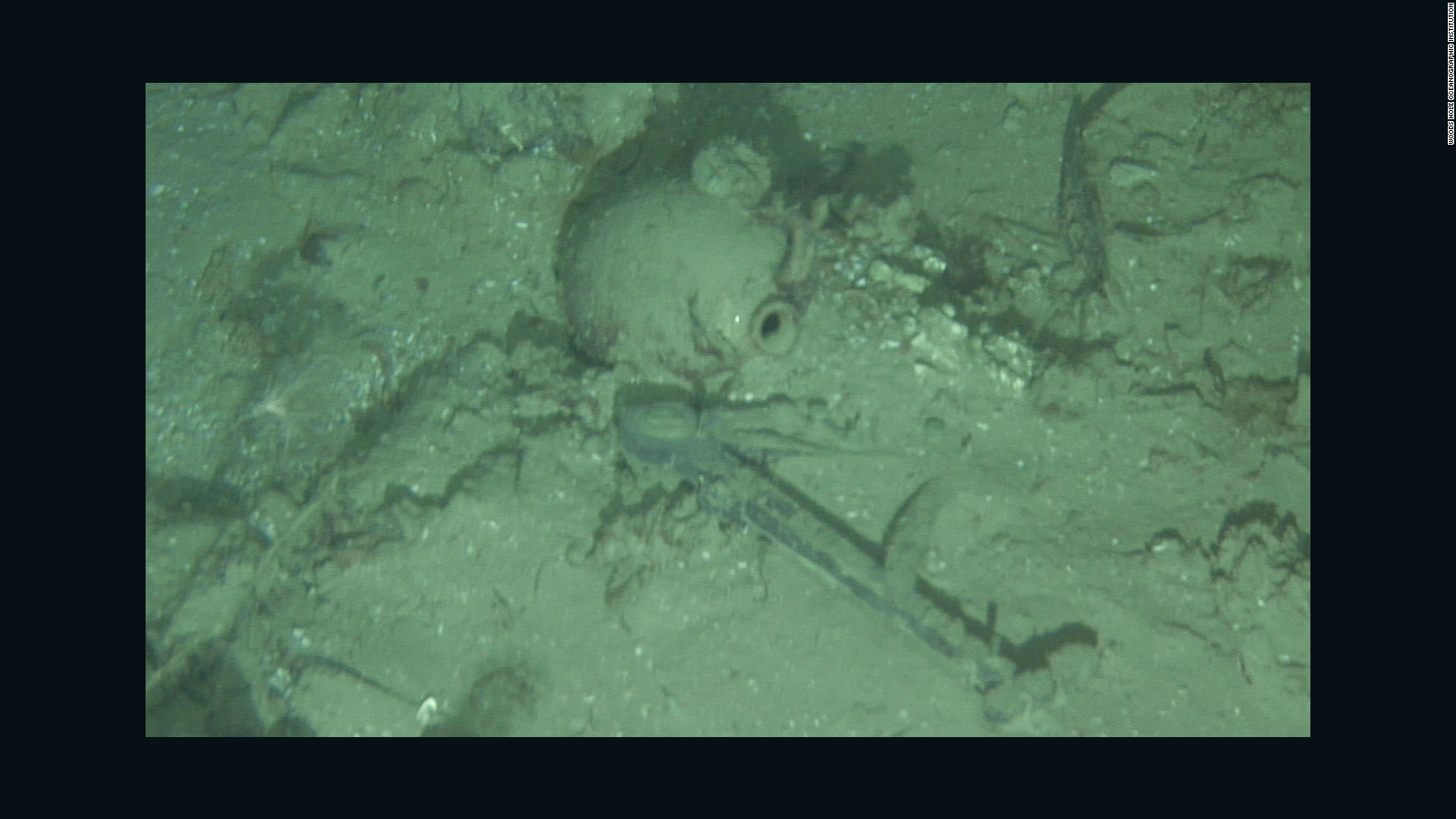

Scientists Discover Intact Car In Sunken Wwii Warship Cnn Report

Apr 26, 2025

Scientists Discover Intact Car In Sunken Wwii Warship Cnn Report

Apr 26, 2025 -

Todays Nyt Spelling Bee Hints Answers And Help For February 26th 360

Apr 26, 2025

Todays Nyt Spelling Bee Hints Answers And Help For February 26th 360

Apr 26, 2025 -

Norriss Injury What Happened At The Djs Party

Apr 26, 2025

Norriss Injury What Happened At The Djs Party

Apr 26, 2025 -

New Marine Security And Surveillance Vessel For Royal Netherlands Navy A Fugro Damen Collaboration

Apr 26, 2025

New Marine Security And Surveillance Vessel For Royal Netherlands Navy A Fugro Damen Collaboration

Apr 26, 2025