Evaluating Palantir Stock: Is It A Smart Investment For You?

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two platforms: Gotham and Foundry. Understanding these platforms is crucial for evaluating Palantir stock.

-

Gotham: This platform caters to government clients, providing advanced data analytics solutions for national security, intelligence, and defense agencies. Revenue is generated through substantial government contracts, often involving long-term licensing agreements and ongoing service support. Gotham's strength lies in its secure, highly customizable solutions, tailored to the specific needs of its clients. However, its dependence on government contracts can lead to revenue fluctuations and potential political risks.

-

Foundry: This platform targets commercial clients across various sectors, including finance, healthcare, and energy. Foundry offers a more generalized big data analytics platform, relying on a subscription-based model alongside custom development and licensing fees. Its strength lies in scalability and adaptability, allowing businesses of all sizes to utilize its powerful data analytics tools. However, competition in the commercial big data analytics market is fierce, potentially impacting Foundry's revenue growth.

Key Revenue Sources and Growth Areas:

- Government contracts (Gotham)

- Subscription fees (Foundry)

- Software licensing fees (both platforms)

- Consulting and implementation services

- Expansion into new commercial sectors

Financial Performance and Growth Prospects

Analyzing Palantir's financial statements is essential for any Palantir investment strategy. While the company has shown significant revenue growth, consistent profitability remains a key focus. Investors should closely examine:

- Revenue Growth Rate: Palantir has demonstrated impressive revenue growth, although the rate of growth may fluctuate.

- Operating Margin: Improving operating margins signify increased efficiency and profitability. Tracking this metric is crucial for understanding Palantir's financial health.

- Cash Flow: Positive cash flow is a critical indicator of financial stability and the ability to fund future growth initiatives.

- Debt Levels: High debt levels can pose risks to the company's financial stability. Analyzing debt-to-equity ratios is essential for evaluating financial risk.

(Include illustrative charts and graphs here showing revenue growth, operating margin, and cash flow over time)

Competitive Landscape and Market Position

Palantir faces competition from established players and emerging startups in both the big data analytics and government contracting markets. Key competitors include companies like Microsoft, AWS, Google, and various specialized analytics firms.

Palantir's Competitive Advantages:

- Proprietary technology and advanced data analytics capabilities

- Strong relationships with government agencies (Gotham)

- Growing adoption in the commercial sector (Foundry)

- Focus on high-value, complex data problems

Potential Threats and Challenges:

- Intense competition from established tech giants

- Dependence on large contracts, particularly in the government sector

- Maintaining technological leadership in a rapidly evolving market

(Include a table comparing Palantir with key competitors based on market share, technology, and customer base)

Risk Assessment and Potential Downsides

Investing in Palantir stock involves significant risks. Potential downsides include:

- Stock Market Volatility: Palantir's stock price can be highly volatile, influenced by market sentiment and company performance.

- Dependence on Government Contracts: Over-reliance on government contracts exposes Palantir to political and budgetary risks.

- Competitive Risk: Competition in the big data analytics market is fierce, potentially limiting Palantir's market share and profitability.

Mitigating Investment Risks:

- Diversification: Spread your investments across different asset classes to reduce overall portfolio risk.

- Long-term perspective: Consider Palantir as a long-term investment to ride out short-term market fluctuations.

- Thorough due diligence: Conduct comprehensive research before making an investment decision.

Valuation and Investment Strategy

Determining the fair value of Palantir stock requires careful analysis using various valuation methods.

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows and discounts them back to present value to estimate the intrinsic value of the stock.

- Comparable Company Analysis: This involves comparing Palantir's valuation metrics (e.g., P/E ratio, Price-to-Sales ratio) to those of similar companies in the industry.

Investment Strategies:

- Long-term investment: Suitable for investors with a higher risk tolerance and a longer time horizon.

- Short-term trading: Highly risky and suitable only for experienced traders.

(Based on the analysis, provide a buy/hold/sell recommendation, clearly stating the rationale. This should be followed by a discussion of appropriate risk tolerance and investment goals for different investor profiles.)

Conclusion: Is Palantir Stock Right for You?

Palantir Technologies presents a compelling investment opportunity, driven by its innovative technology and strong position in the burgeoning big data analytics market. However, investors must carefully weigh the company's growth potential against inherent risks, including stock market volatility and dependence on large contracts. This analysis highlights both the strengths and weaknesses of a Palantir investment. Ultimately, whether or not Palantir stock is a "smart investment" for you depends on your individual risk tolerance, investment goals, and thorough understanding of the company's business model and financial performance. Before making any decision, carefully evaluate Palantir stock and consider the risks and rewards of a Palantir investment.

Featured Posts

-

Significant Funding Increase For Madeleine Mc Cann Disappearance Investigation

May 09, 2025

Significant Funding Increase For Madeleine Mc Cann Disappearance Investigation

May 09, 2025 -

Uk Visa Restrictions Report Reveals Potential Nationality Limits

May 09, 2025

Uk Visa Restrictions Report Reveals Potential Nationality Limits

May 09, 2025 -

New Uk Visa Regulations Challenges For Nigerian And Pakistani Travellers

May 09, 2025

New Uk Visa Regulations Challenges For Nigerian And Pakistani Travellers

May 09, 2025 -

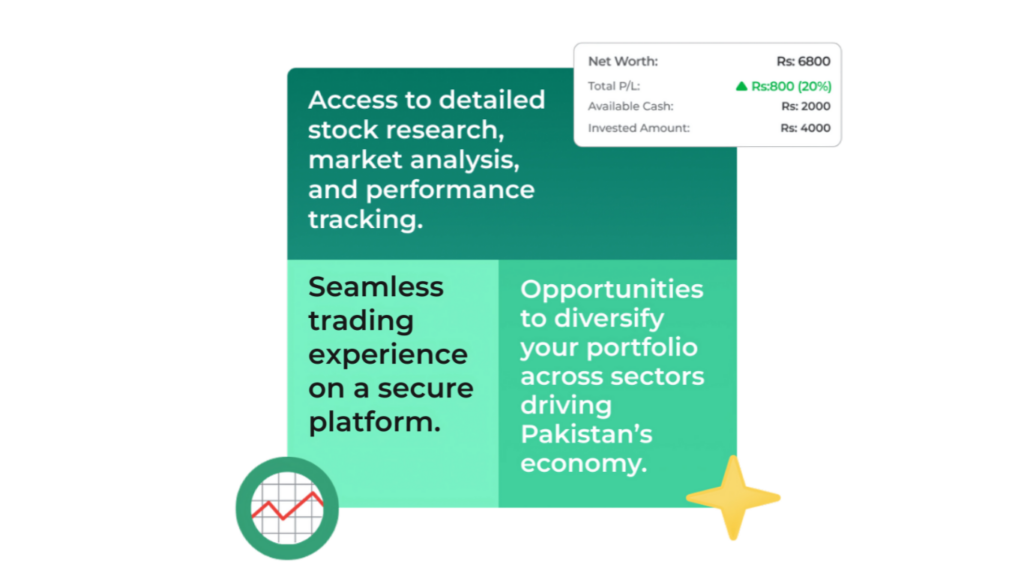

Accessible Stock Trading Jazz Cash And K Trade Partner Up

May 09, 2025

Accessible Stock Trading Jazz Cash And K Trade Partner Up

May 09, 2025 -

Indonesias Foreign Exchange Reserves Significant Drop Due To Rupiah Pressure

May 09, 2025

Indonesias Foreign Exchange Reserves Significant Drop Due To Rupiah Pressure

May 09, 2025