Examining A 1,500% Bitcoin Price Increase Projection

Table of Contents

Factors Contributing to a Potential Bitcoin Price Surge

Several factors could potentially contribute to a significant Bitcoin price increase, even one as dramatic as 1,500%. While this is a highly ambitious prediction, understanding these drivers is crucial for any Bitcoin price prediction analysis.

Increased Institutional Adoption

- Growing interest from major corporations and financial institutions: Many large corporations and financial institutions are increasingly exploring Bitcoin as an asset class, recognizing its potential for diversification and long-term growth. This institutional investment is a key driver of price appreciation.

- Increased regulatory clarity in certain jurisdictions: As regulatory frameworks for cryptocurrencies evolve and become clearer in various jurisdictions, it fosters greater institutional confidence and encourages increased participation.

- Development of Bitcoin-related financial products (ETFs, etc.): The introduction of Bitcoin exchange-traded funds (ETFs) and other financial products simplifies investment access for institutional and retail investors alike, boosting demand.

The entrance of institutional investors brings significant capital inflows into the Bitcoin market. For example, MicroStrategy's substantial Bitcoin holdings have already demonstrated the impact of large-scale corporate investments on the cryptocurrency's price. This trend is likely to continue, further fueling Bitcoin's price growth.

Global Economic Uncertainty and Inflation

- Bitcoin as a hedge against inflation: Many see Bitcoin as a potential hedge against inflation, as its supply is capped at 21 million coins. During periods of high inflation, investors may seek alternative stores of value, driving up Bitcoin's demand.

- Increased demand during economic downturns: During times of economic uncertainty, investors often look for safe haven assets. Bitcoin's decentralized nature and limited supply can make it an attractive option during such periods, leading to increased demand.

- Flight to safety from traditional assets: Concerns about the stability of traditional financial systems can encourage investors to diversify their portfolios by allocating funds to Bitcoin and other cryptocurrencies.

The current macroeconomic environment, characterized by rising inflation and geopolitical instability, might be a catalyst for a Bitcoin price surge as investors seek alternatives to traditional assets. Monitoring key economic indicators like inflation rates and interest rates is vital when analyzing Bitcoin price prediction models.

Technological Advancements and Network Upgrades

- The Lightning Network scaling solution: The Lightning Network enables faster and cheaper Bitcoin transactions, addressing scalability concerns and broadening its usability.

- Increased transaction speed and lower fees: Technological improvements constantly enhance Bitcoin's functionality, making it more accessible and appealing to a wider range of users.

- Improved privacy features: Developments focused on privacy enhance Bitcoin's attractiveness as a secure and private alternative to traditional financial systems.

- Second-layer solutions: Innovation in second-layer solutions like the Lightning Network further increases Bitcoin’s efficiency and scalability.

These ongoing advancements directly impact Bitcoin's usability and adoption rate, which are key drivers of price appreciation. As Bitcoin becomes more efficient and user-friendly, it’s more likely to see widespread adoption and, consequently, higher prices.

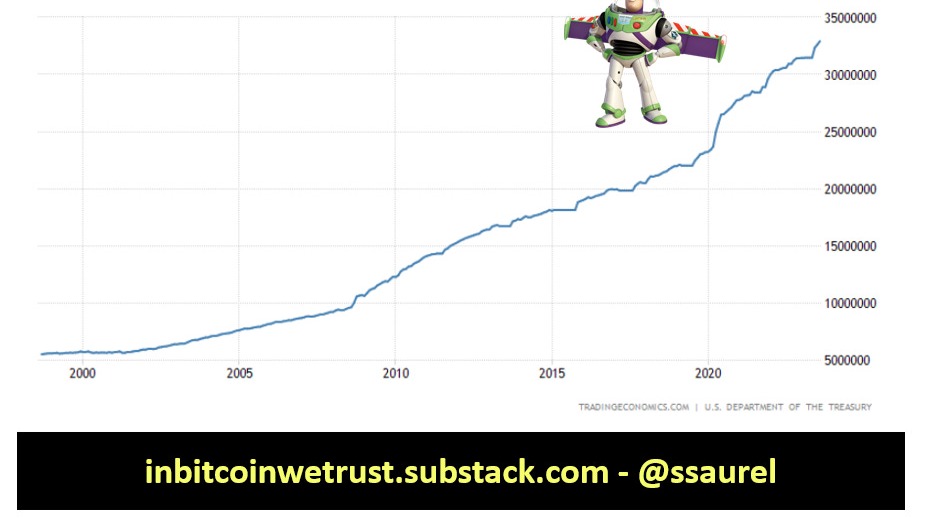

Halving Events and Scarcity

- The impact of Bitcoin's halving events on supply: Bitcoin's protocol dictates that the reward for miners is halved approximately every four years. This predictable reduction in supply creates scarcity and can drive up prices.

- The concept of scarcity and its effect on price: The finite supply of Bitcoin contributes to its perceived value as a scarce asset. This scarcity is a major factor supporting its long-term price potential.

- Historical data on price increases after halvings: Historically, Bitcoin's price has often increased following halving events, reinforcing the significance of this factor.

The next Bitcoin halving is expected to further tighten supply, potentially contributing to significant price appreciation in the following years. Studying historical price movements after previous halving events is valuable when assessing the plausibility of future price increases.

Challenges and Risks Associated with a 1,500% Bitcoin Price Increase Projection

While a significant price increase is possible, it's crucial to acknowledge the challenges and risks involved. A 1500% Bitcoin increase projection is exceptionally ambitious and needs careful consideration.

Market Volatility and Price Corrections

- The inherent volatility of cryptocurrencies: Bitcoin's price is known for its significant volatility. Sharp price swings are common, and substantial corrections are expected even during bull markets.

- The risk of significant price drops: A dramatic price increase could be followed by an equally dramatic correction, resulting in substantial losses for investors.

- The importance of risk management strategies: Investors must employ sound risk management strategies, such as diversification and careful position sizing, to mitigate potential losses.

The unpredictable nature of the cryptocurrency market necessitates a cautious approach, even during periods of optimistic price predictions. Understanding and accepting the inherent volatility is essential for responsible investing.

Regulatory Uncertainty and Governmental Intervention

- The impact of government regulations on cryptocurrency adoption: Government regulations can significantly impact cryptocurrency adoption and price. Strict regulations can hinder growth, while supportive policies can encourage it.

- Potential for bans or restrictions: There is always a risk that governments may impose bans or restrictions on cryptocurrencies, impacting their price and usability.

- The influence of regulatory frameworks on market stability: Clear and consistent regulatory frameworks can contribute to greater market stability and investor confidence.

The evolving regulatory landscape presents uncertainty that could significantly affect Bitcoin's price. Monitoring regulatory developments across different jurisdictions is vital for informed decision-making.

Competition from Other Cryptocurrencies

- The emergence of alternative cryptocurrencies: The cryptocurrency market is dynamic, with new cryptocurrencies and technologies emerging constantly.

- The competition for market share and investor attention: Bitcoin faces competition from other cryptocurrencies vying for market share and investor attention.

- The potential for market share shifts: The emergence of superior technologies or more attractive investment opportunities could lead to shifts in market share, potentially impacting Bitcoin's price.

The competitive landscape of the cryptocurrency market is a critical factor to consider. While Bitcoin maintains its dominance, the potential for competition and technological disruption needs to be acknowledged.

Analyzing the Plausibility of the 1,500% Projection

A 1,500% Bitcoin price increase is an extremely bold prediction. While the factors discussed above could contribute to significant price appreciation, such a dramatic surge is unlikely in the short term. Past price movements indicate that Bitcoin's price tends to follow cyclical patterns, with periods of rapid growth followed by significant corrections. Achieving a 1500% increase would require a confluence of exceptionally positive developments and a sustained period of intense bullish sentiment, mitigating the influence of inherent volatility and potential regulatory headwinds.

Conclusion

Several factors, including increased institutional adoption, global economic uncertainty, technological advancements, and halving events, could contribute to a significant Bitcoin price increase. However, challenges such as market volatility, regulatory uncertainty, and competition from other cryptocurrencies must also be considered. A 1,500% Bitcoin price increase is a highly ambitious projection, requiring a confluence of extremely favorable conditions. While the potential for substantial growth exists, a balanced perspective is crucial.

While a 1,500% Bitcoin price increase is a bold prediction, understanding the potential drivers and risks is crucial for navigating the volatile cryptocurrency market. Continue your research on Bitcoin price prediction and stay informed about the latest developments to make informed investment decisions. Remember to always conduct your own thorough research before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

Is The Recent Bitcoin Rebound Sustainable Experts Weigh In

May 08, 2025

Is The Recent Bitcoin Rebound Sustainable Experts Weigh In

May 08, 2025 -

Counting Crows The Saturday Night Live Effect

May 08, 2025

Counting Crows The Saturday Night Live Effect

May 08, 2025 -

Kyle Kuzma Responds To Jayson Tatums Controversial Instagram Post

May 08, 2025

Kyle Kuzma Responds To Jayson Tatums Controversial Instagram Post

May 08, 2025 -

Path Of Exile 2 Everything You Need To Know About Rogue Exiles

May 08, 2025

Path Of Exile 2 Everything You Need To Know About Rogue Exiles

May 08, 2025 -

Nathan Fillions Iconic Wwii Movie Role A Look Back

May 08, 2025

Nathan Fillions Iconic Wwii Movie Role A Look Back

May 08, 2025