Examining The Relationship Between Biden's Policies And Economic Slowdown

Table of Contents

Biden's Spending Policies and Inflation

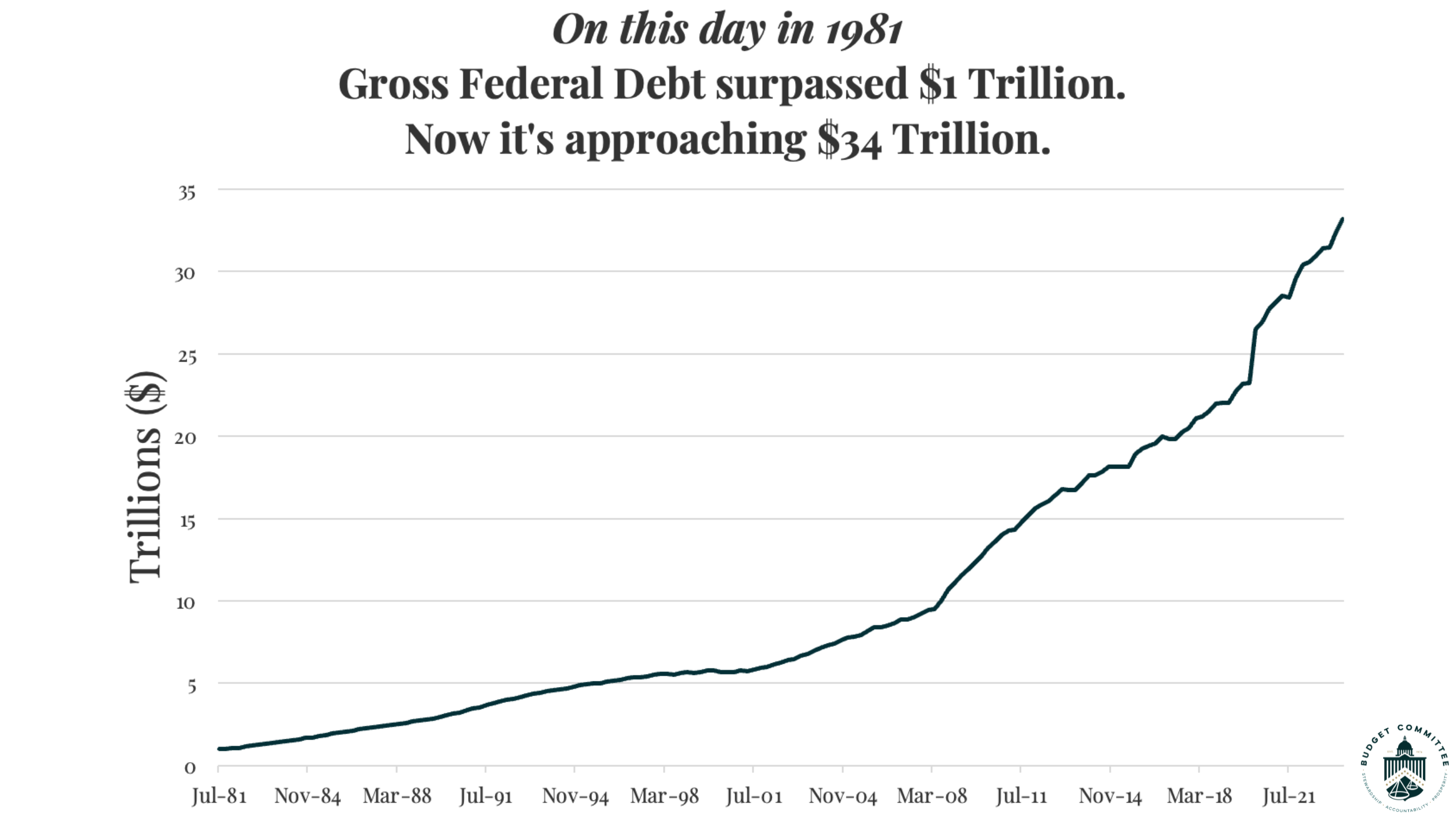

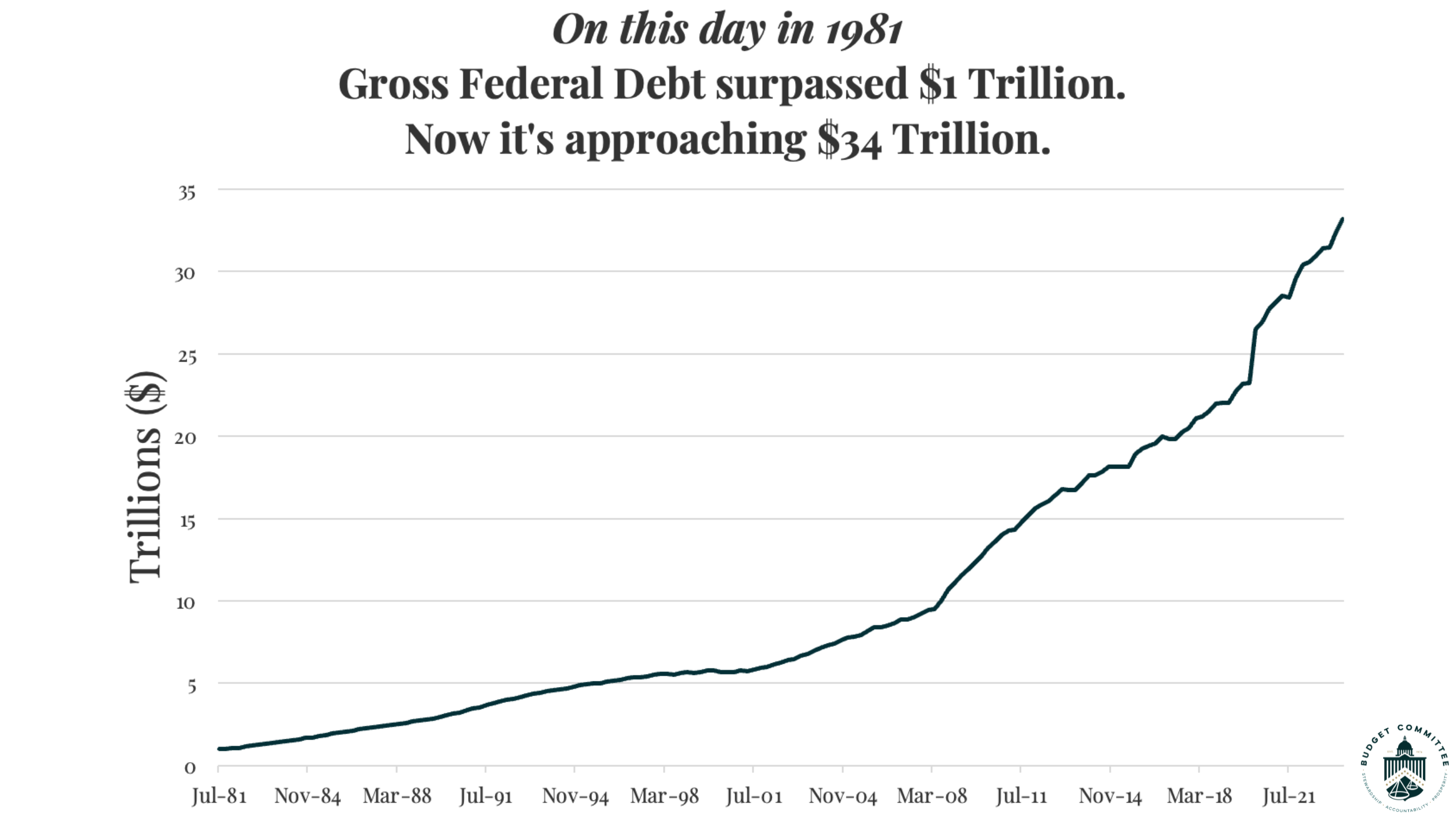

President Biden's expansive spending plans have been a central point of debate regarding the current economic slowdown. The sheer scale of these initiatives raises questions about their contribution to inflationary pressures.

The American Rescue Plan and its Impact

The American Rescue Plan, a massive stimulus package enacted early in Biden's presidency, aimed to address the economic fallout from the COVID-19 pandemic. However, critics argue that its substantial injection of government spending contributed significantly to demand-pull inflation.

- Increased Government Spending: The ARP injected trillions of dollars into the US economy, significantly increasing aggregate demand.

- Overheating the Economy: This surge in demand, coupled with existing supply chain constraints, led to rapid price increases across various sectors.

- Price Increases Across Sectors: We witnessed significant price hikes in sectors like housing, automobiles, and consumer goods. The increased demand outpaced the ability of the supply chain to meet it, leading to shortages and higher prices.

The American Rescue Plan, while intended as an economic stimulus, highlights the delicate balance between boosting demand and fueling inflation. The resulting demand-pull inflation became a major contributing factor to the economic slowdown.

The Bipartisan Infrastructure Law and Long-Term Economic Growth

The Bipartisan Infrastructure Law represents a significant long-term investment in US infrastructure. While promising substantial long-term economic growth through job creation and improved infrastructure, it also carries potential short-term inflationary risks.

- Job Creation: The law is projected to create millions of jobs through construction, maintenance, and related industries.

- Infrastructure Development: Improved roads, bridges, and other infrastructure will enhance economic productivity and efficiency in the long run.

- Supply Chain Bottlenecks: The increased demand for materials and labor could exacerbate existing supply chain bottlenecks, leading to further price increases in the short term.

- Time Lag to Benefits: The full economic benefits of the Bipartisan Infrastructure Law are not expected to be realized for several years, meaning the short-term inflationary pressures may outweigh the immediate benefits.

The Infrastructure Law's long-term promise of economic growth must be carefully weighed against its potential to contribute to short-term inflationary pressures.

Impact of Regulatory Changes on Business Investment

Changes in economic regulation under the Biden administration have also sparked debate regarding their influence on the economic climate. Increased regulatory scrutiny and uncertainty can discourage business investment and hinder economic growth.

Increased Regulations and Business Uncertainty

A more stringent regulatory environment can create uncertainty for businesses, leading to reduced investment and hiring.

- Examples of Regulations: Specific examples of regulations impacting business investment could include stricter environmental standards, labor laws, and antitrust enforcement.

- Effects on Business Investment: These regulations can increase compliance costs, limit expansion plans, and reduce overall business confidence.

- Expert Perspectives: Many business leaders and economists express concerns that increased regulatory burdens stifle innovation and economic growth.

The impact of increased regulation is a complex issue that requires a nuanced understanding of the trade-offs between social goals and economic incentives.

Impact on Energy Policy and its Economic Consequences

Biden's energy policies, emphasizing a transition away from fossil fuels and towards renewable energy sources, have had a noticeable effect on fuel prices and the broader economy.

- Shifts in Energy Production: A reduced emphasis on fossil fuel extraction and exploration has impacted domestic energy supply.

- Impact on Energy Prices: Changes in energy production and the global energy market have significantly impacted energy prices, affecting transportation costs and the price of goods and services.

- Implications for Various Industries: Industries heavily reliant on fossil fuels, such as transportation and manufacturing, have been particularly affected by fluctuating energy prices.

International Factors and Their Influence

It's crucial to acknowledge that the economic slowdown is not solely attributable to domestic policy. Global events and supply chain issues have significantly contributed to the current economic climate.

Global Supply Chain Disruptions

The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to widespread disruptions and contributing to inflation.

- Pandemic's Lasting Effects: The pandemic's disruption to global trade and manufacturing continues to impact supply chains.

- Geopolitical Tensions: International geopolitical tensions further complicate supply chain logistics and contribute to uncertainty.

- Inflationary Pressures: Disruptions to supply chains lead to shortages of goods and services, pushing prices higher.

The War in Ukraine and its Economic Ripple Effects

The war in Ukraine has exacerbated existing economic challenges, particularly regarding energy and food prices.

- Energy Crisis: The war has disrupted global energy markets, leading to a surge in energy prices.

- Food Prices: Ukraine and Russia are major exporters of wheat and other grains, and the war has significantly disrupted food supplies, leading to higher food prices globally.

- Global Inflation: The combined effects of energy and food price increases have contributed significantly to global inflation.

Conclusion: Understanding the Relationship Between Biden's Policies and the Economic Slowdown

The relationship between President Biden's policies and the current economic slowdown is multifaceted and complex. It's challenging to isolate the precise impact of any single policy, as numerous factors, both domestic and international, have contributed to the current economic climate. While significant government spending may have fueled inflationary pressures, the long-term effects of investments in infrastructure remain to be seen. Similarly, regulatory changes have potential impacts on business investment and growth that require ongoing evaluation. Finally, global events such as the pandemic and the war in Ukraine have significantly influenced the global economy, contributing to supply chain disruptions and inflationary pressures.

Key Takeaways:

- Biden's spending policies, while aiming for economic stimulus, have contributed to inflationary pressures.

- Regulatory changes may impact business investment and growth, requiring careful consideration of their long-term effects.

- International factors, such as supply chain disruptions and the war in Ukraine, have significantly influenced the global economic landscape.

Continue the conversation about the relationship between Biden's policies and economic slowdown. Share your thoughts and perspectives on this critical issue. For further reading, explore resources from the Congressional Budget Office and the Federal Reserve.

Featured Posts

-

Reform Partys Local Election Performance A Test For Farage

May 03, 2025

Reform Partys Local Election Performance A Test For Farage

May 03, 2025 -

Kl Ma Tryd Merfth En Blay Styshn 6 Dlyl Shaml

May 03, 2025

Kl Ma Tryd Merfth En Blay Styshn 6 Dlyl Shaml

May 03, 2025 -

The Auto Industrys Resistance To Electric Vehicle Mandates Grows

May 03, 2025

The Auto Industrys Resistance To Electric Vehicle Mandates Grows

May 03, 2025 -

Alec Baldwins Rust A Film Review Following The On Set Tragedy

May 03, 2025

Alec Baldwins Rust A Film Review Following The On Set Tragedy

May 03, 2025 -

Pussy Riots Maria Alyokhina Brings Riot Day To Edinburgh Fringe 2025

May 03, 2025

Pussy Riots Maria Alyokhina Brings Riot Day To Edinburgh Fringe 2025

May 03, 2025