Exclusive: Elliott's High-Stakes Gamble On Russian Gas Pipeline

Table of Contents

Understanding Elliott Management's Investment Strategy

Elliott Management, a prominent global hedge fund, is known for its activist investing approach and its willingness to take on significant risks for potentially substantial returns. Their investment philosophy centers on rigorous due diligence, identifying undervalued assets, and employing various strategies, including shareholder activism and corporate restructuring, to unlock value. This often involves navigating complex legal and political landscapes, as seen in their past high-profile engagements.

-

Past Successes and Failures: Elliott's track record includes high-profile successes such as [cite specific examples of successful high-stakes investments]. However, they have also faced setbacks, demonstrating that their strategy, while potentially lucrative, is inherently risky. [Cite examples of past unsuccessful investments, analyzing the reasons for failure].

-

Expertise in Activist Investing: Elliott is a master of activist investing, using its considerable influence to pressure companies to make changes that increase shareholder value. This expertise could be crucial in navigating the challenges of investing in a politically sensitive sector like Russian energy.

-

Due Diligence in this Case: While details regarding the specific due diligence conducted for this Russian pipeline investment remain confidential, it's reasonable to assume that Elliott has carefully considered the geopolitical risks, sanctions landscape, and potential regulatory hurdles. Their thorough approach suggests a belief in the potential upside, despite the acknowledged challenges.

The Geopolitical Risks of Investing in Russian Gas Pipelines

Investing in Russian gas pipelines carries substantial geopolitical risks. The current international climate is characterized by heightened tensions, sanctions imposed on Russia due to its actions in [mention relevant geopolitical events], and ongoing uncertainty regarding future relations. This volatile environment creates a complex landscape for any investor.

-

Sanctions and their Impact: Several sanctions currently target the Russian energy sector. These sanctions could directly impact the pipeline's operations, potentially restricting access to financing, technology, or even the ability to transport gas. The sanctions' impact on the pipeline’s profitability needs to be carefully evaluated.

-

Political Instability and Conflict: Political instability or further escalation of conflict could severely disrupt the pipeline's operations, leading to significant financial losses. This includes potential physical damage to infrastructure or interruptions in gas transit.

-

Fluctuating Energy Prices: The price of oil and gas is highly volatile and subject to numerous factors, including global supply and demand, geopolitical events, and seasonal variations. Fluctuations in these prices directly affect the pipeline's revenue streams and overall profitability.

Financial Analysis of Elliott's Potential Return on Investment (ROI)

The potential ROI for Elliott's investment is highly contingent on a number of factors. A successful investment could yield substantial returns through increased gas prices, expanded pipeline capacity, and efficient operations. However, the risks of failure are equally significant.

-

Potential Gains: If gas prices rise significantly, the pipeline's revenue would increase, leading to substantial profits for Elliott. Similarly, increased pipeline capacity or efficient operational improvements could further boost returns.

-

Potential Losses: Failure could result in substantial losses due to sanctions, pipeline damage, political instability, or a decline in gas prices. The investment could become entirely worthless if the pipeline is shut down due to geopolitical issues.

-

Estimated ROI: Providing precise ROI figures is impossible due to the inherent uncertainty. However, we can analyze potential scenarios based on varying gas prices, operational efficiency, and geopolitical factors. [Include hypothetical scenarios, perhaps illustrated with charts or graphs, showcasing potential ranges for ROI].

The Broader Implications for the Global Energy Market

Elliott's investment in a Russian gas pipeline has broader implications for the global energy market. Its impact could extend far beyond the immediate financial implications of the investment itself.

-

Increased Competition: Elliott's involvement could increase competition in the energy market, influencing prices and supply chains. This could benefit consumers in some regions while potentially disadvantaging others.

-

Impact on Russia's Energy Strategy: The investment could subtly influence Russia's energy strategy and its relationships with other countries. This is especially true given the significant role pipelines play in Russia’s energy exports.

-

Knock-on Effects on Global Energy Policy: The success or failure of Elliott’s gamble could have ripple effects on global energy policy, influencing future investments in similar high-risk, high-reward projects in politically unstable regions.

Conclusion: Evaluating the Risks and Rewards of Elliott's Russian Gas Pipeline Gamble

Elliott Management's reported investment in a Russian gas pipeline presents a classic high-stakes gamble. The potential for substantial returns is undeniable, but the risks associated with geopolitical instability, sanctions, and fluctuating energy prices are equally substantial. The complex interplay between financial and geopolitical factors makes this investment particularly unpredictable. The potential for both significant profit and devastating loss highlights the complexities of investing in this volatile sector. Follow the latest updates on Elliott's high-stakes gamble to stay informed about this high-risk, high-reward investment in the Russian energy sector and its broader impact on the global energy market. Learn more about the intricacies of investing in Russian gas pipelines and the implications of geopolitical risks in the energy sector.

Featured Posts

-

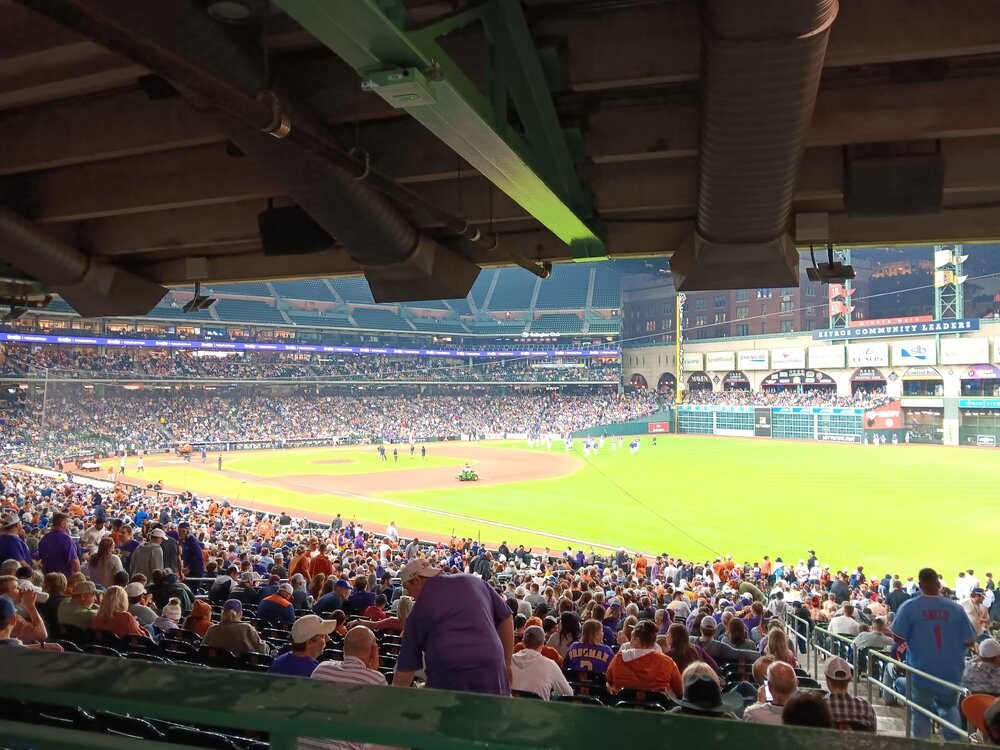

2024 Houston Astros Foundation College Classic A Preview Of The Tournament

May 11, 2025

2024 Houston Astros Foundation College Classic A Preview Of The Tournament

May 11, 2025 -

Nba Prediction Knicks Vs Bulls Expert Betting Advice February 20 2025

May 11, 2025

Nba Prediction Knicks Vs Bulls Expert Betting Advice February 20 2025

May 11, 2025 -

Resurfaced Stadium Track A Championship Ready Venue

May 11, 2025

Resurfaced Stadium Track A Championship Ready Venue

May 11, 2025 -

Instagrams Survival Strategy Ceo Addresses Tik Tok Threat

May 11, 2025

Instagrams Survival Strategy Ceo Addresses Tik Tok Threat

May 11, 2025 -

Faber Now Backs Royal Honors For Asylum Volunteers A Complete Policy Shift

May 11, 2025

Faber Now Backs Royal Honors For Asylum Volunteers A Complete Policy Shift

May 11, 2025