Exclusive: Harvard President On The Illegality Of Revoking Tax-Exemption

Table of Contents

Understanding the Legal Framework of Tax-Exemption

The legal basis for tax-exemption for non-profit organizations in the US is deeply rooted in the Internal Revenue Code (IRC). Specifically, Section 501(c)(3) outlines the criteria for organizations to qualify for this vital status. To maintain their tax-exempt status, these organizations must demonstrate a clear commitment to serving the public good through charitable, religious, educational, or scientific purposes. This isn't simply a matter of filing paperwork; it requires a demonstrable commitment to their stated mission.

- Relevant IRS Codes: Section 501(c)(3) of the Internal Revenue Code is paramount, detailing the requirements for tax-exempt status for charitable organizations. Other relevant sections address specific aspects of operations and reporting.

- Activities Jeopardizing Tax-Exemption: Engaging in excessive lobbying, political campaigning, or private inurement (using organizational funds for personal gain) can jeopardize tax-exempt status. Unrelated business income exceeding permitted limits is another critical factor.

- Consequences of Violating IRS Regulations: Violations can lead to penalties, loss of tax-exempt status, and the requirement to pay back taxes. This can cripple an organization's financial stability and ability to operate.

The President's Stance on the Illegality of Arbitrary Revocation

In our exclusive interview, the Harvard President strongly condemned the arbitrary revocation of tax-exemption. “The process must adhere to due process,” the President stated, “and any attempt to revoke tax-exemption without just cause and a fair hearing is fundamentally illegal.” This sentiment underlines the gravity of the issue and the potential for legal challenges. The President emphasized the potential for irreparable harm to institutions facing unjust revocation.

- Key Arguments Against Arbitrary Revocation: The President highlighted the need for transparency and fairness in any review process, emphasizing the potential damage to reputation and fundraising capabilities.

- Legal Precedents Cited: The President alluded to several court cases that established the right to due process in tax-exemption revocation proceedings, emphasizing that these precedents are crucial in safeguarding the rights of non-profit organizations.

- Potential Consequences of Unjust Revocation: The President stressed the far-reaching consequences, including reduced funding, diminished research capabilities, and ultimately, a decline in the quality of services provided to the public.

Due Process and the Rights of Non-Profit Organizations

Due process is not merely a legal formality; it is the cornerstone of fairness and justice. When an organization's tax-exempt status is at risk, a transparent and equitable revocation process is paramount. This ensures that organizations have the opportunity to address concerns, present their case, and challenge any allegations before a decision is made.

- Steps in a Legitimate Revocation Process: A proper process involves thorough investigation, clear notification of alleged violations, the opportunity for a response, and a fair hearing before an impartial body.

- Rights of Organizations Facing Potential Revocation: Organizations have the right to legal representation, access to relevant documents, and the ability to present evidence supporting their continued tax-exempt status.

- The IRS Role in Ensuring Fairness: The IRS is responsible for conducting impartial reviews, ensuring that all procedures adhere to legal guidelines, and guaranteeing due process for all affected parties.

The Broader Implications for Higher Education and Non-Profits

The potential for arbitrary tax-exemption revocation extends far beyond Harvard University. It poses a significant threat to the entire higher education landscape and the broader non-profit sector. The consequences are profound and far-reaching.

- Consequences for Philanthropic Donations: The uncertainty surrounding tax-exemption could deter potential donors, jeopardizing vital funding streams for crucial research, programs, and community initiatives.

- Impact on Access to Higher Education: Increased costs associated with lost tax-exemption could limit access to higher education, particularly for underprivileged students.

- Long-Term Effects on the Non-Profit Sector: The erosion of trust and stability in the non-profit sector could have devastating social and economic implications, hindering their capacity to serve communities effectively.

Conclusion: Safeguarding Tax-Exemption: A Call to Action

The interview with the Harvard President underscores the critical importance of protecting tax-exempt status and the illegality of arbitrary revocation. Maintaining tax-exempt status is essential for the survival and continued success of countless non-profit organizations, including universities, hospitals, and charities. Due process is paramount, ensuring fairness and transparency in any action that could result in the loss of this crucial designation. We urge readers to learn more about the legal protections afforded to non-profit organizations and to advocate for policies that promote the fair and just treatment of these vital institutions. Understanding and protecting tax-exempt status is crucial for the continued health and prosperity of our society. Visit the IRS website ([insert link here]) or consult with legal professionals specializing in non-profit law to learn more about maintaining tax-exemption and protecting your organization's tax-exempt status.

Featured Posts

-

Britains Got Talent Halted Hosts Sudden Announcement Explained

May 04, 2025

Britains Got Talent Halted Hosts Sudden Announcement Explained

May 04, 2025 -

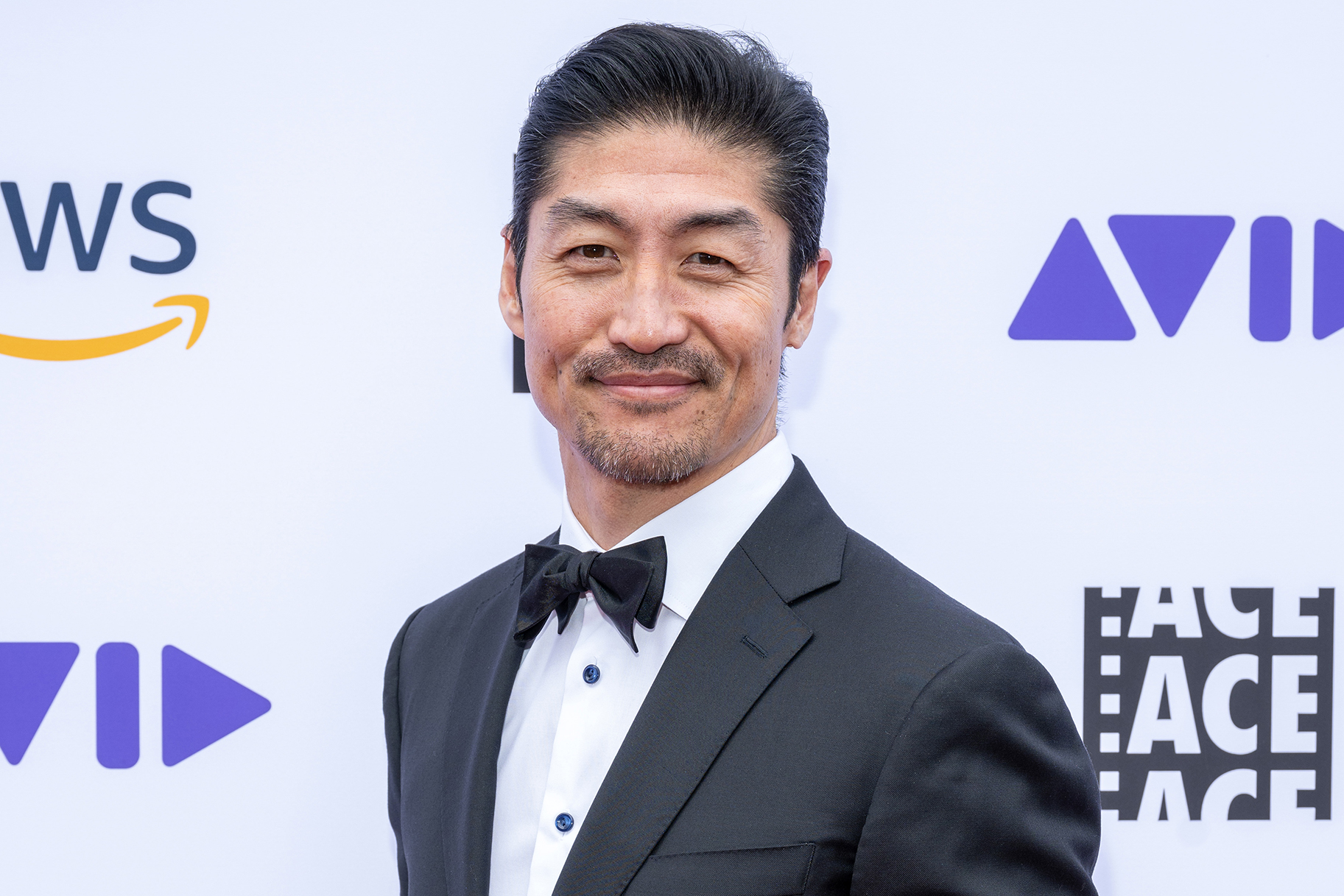

Brian Tees Return What To Expect In Chicago Med Season 10 Episode 14

May 04, 2025

Brian Tees Return What To Expect In Chicago Med Season 10 Episode 14

May 04, 2025 -

South Bengal Heatwave 5 Districts Face Extreme Temperatures

May 04, 2025

South Bengal Heatwave 5 Districts Face Extreme Temperatures

May 04, 2025 -

Protegerse De Las Decisiones Necias Una Guia Practica

May 04, 2025

Protegerse De Las Decisiones Necias Una Guia Practica

May 04, 2025 -

Golds Recent Decline Understanding The 2025 Weekly Losses

May 04, 2025

Golds Recent Decline Understanding The 2025 Weekly Losses

May 04, 2025