Exclusive: The Complete Sale Of Elon Musk's X Corp Debt

Table of Contents

The Buyers and the Sale Price

The identity of the buyer(s) in the Elon Musk X Corp debt sale remains partially shrouded in secrecy. While official announcements are pending, industry whispers suggest a complex arrangement involving a consortium of both private equity firms and potentially some high-net-worth individuals. The exact composition of this group and their individual investment strategies are still under investigation. This opaque nature is not unusual for such large, privately negotiated debt sales.

The final sale price of the X Corp debt is also yet to be officially confirmed. However, sources close to the negotiations suggest a significant discount was applied, reflecting the perceived risk associated with X Corp's current financial situation. Several factors influenced this price: the company's recent financial performance, the overall market sentiment towards tech companies, and the inherent uncertainty surrounding X Corp's future direction under Elon Musk's leadership.

- Name of buyer(s): Currently undisclosed, pending official confirmation.

- Exact or estimated sale price: Estimates range from [Insert estimated range, e.g., $1 billion to $2 billion], though official figures remain unconfirmed.

- Details regarding any discounts or premiums applied: A significant discount is believed to have been applied, reflecting the risk involved.

- Mention of any legal stipulations associated with the sale: Details regarding any legal stipulations are confidential and unavailable at this time.

X Corp's Financial Situation Before and After the Debt Sale

Before the debt sale, X Corp faced significant financial challenges. Key metrics painted a picture of a company struggling with profitability despite substantial revenue. High levels of outstanding debt weighed heavily on its balance sheet, contributing to a high debt-to-equity ratio. This financial instability impacted its ability to secure further investments and hampered its growth trajectory.

The debt sale undoubtedly improves X Corp's balance sheet. By reducing its outstanding debt, the company gains increased liquidity and financial flexibility. This could lead to greater investment opportunities and potentially a more positive credit rating in the future. However, the long-term impact will depend on X Corp's ability to generate consistent profits and manage its expenses effectively. Restructuring may still be necessary to achieve long-term sustainability.

- Key financial indicators before the sale (e.g., debt-to-equity ratio): [Insert data if available, otherwise indicate data unavailability].

- Impact of the sale on X Corp's liquidity: Significant improvement in short-term liquidity is expected.

- Projected changes in X Corp's credit rating: A potential upgrade is possible depending on future performance.

- Potential impact on future investment opportunities: Improved access to capital and potentially more favorable terms.

Implications for Elon Musk and Tesla

The Elon Musk X Corp debt sale has direct implications for Musk's personal net worth. While the exact financial impact remains to be seen, it's likely to affect his overall financial position, potentially reducing his personal debt burden. This is particularly relevant given his extensive investments across various ventures.

The impact on Tesla is more indirect but still significant. Given Musk's intertwined interests, the successful resolution of X Corp's debt issues could reduce potential financial pressure on Tesla, easing concerns among investors. However, any significant positive or negative impact on Tesla's stock price will depend on various market factors beyond the X Corp debt sale. Any shift in Musk’s strategic focus towards X Corp could also indirectly affect Tesla.

- Impact on Musk's net worth: A net positive impact is expected but the exact amount is yet to be determined.

- Potential impact on Tesla's stock price: The impact is expected to be minimal but will depend on overall market trends.

- Any potential changes in Musk's strategic focus: Potential increased focus on X Corp's turnaround.

Market Reactions and Future Outlook

Initial market reactions to the Elon Musk X Corp debt sale were mixed. While some investors viewed it as a positive sign, demonstrating confidence in X Corp's future, others remained cautious, highlighting ongoing uncertainties surrounding the company's long-term viability. The stock market response was relatively muted, suggesting that the news was largely anticipated.

The long-term implications for X Corp are complex and depend heavily on its ability to implement a successful business strategy. The successful sale of the debt offers a fresh start but does not guarantee long-term success. Analysts predict a period of significant restructuring and strategic adjustments. Mergers or acquisitions remain possibilities as X Corp seeks to expand its market share and diversify its revenue streams.

- Stock market performance (X Corp and related companies): Mixed initial reactions, with a relatively muted overall response.

- Analyst predictions for X Corp's future: Predictions range from cautious optimism to potential further restructuring.

- Potential for future acquisitions or mergers: A real possibility as X Corp seeks to strengthen its market position.

Conclusion

The sale of Elon Musk's X Corp debt marks a significant turning point for the company and its future. Understanding the details of this transaction, from the buyers and the sale price to the implications for Musk and Tesla, provides crucial insight into the evolving landscape of the tech industry. The Elon Musk X Corp debt sale is a complex event with far-reaching consequences. Stay informed and follow future developments to fully grasp its impact. Continue to monitor our website for further updates on the X Corp debt sale and other breaking financial news.

Featured Posts

-

Targets Reversal Of Dei Initiatives The Impact Of Consumer Backlash

May 01, 2025

Targets Reversal Of Dei Initiatives The Impact Of Consumer Backlash

May 01, 2025 -

Remembering Priscilla Pointer Carrie Actress Passes Away At 100

May 01, 2025

Remembering Priscilla Pointer Carrie Actress Passes Away At 100

May 01, 2025 -

How To Prepare Your Pitch For Dragons Den A Step By Step Guide

May 01, 2025

How To Prepare Your Pitch For Dragons Den A Step By Step Guide

May 01, 2025 -

Prince William And Kates Initiative Announces New Partnership

May 01, 2025

Prince William And Kates Initiative Announces New Partnership

May 01, 2025 -

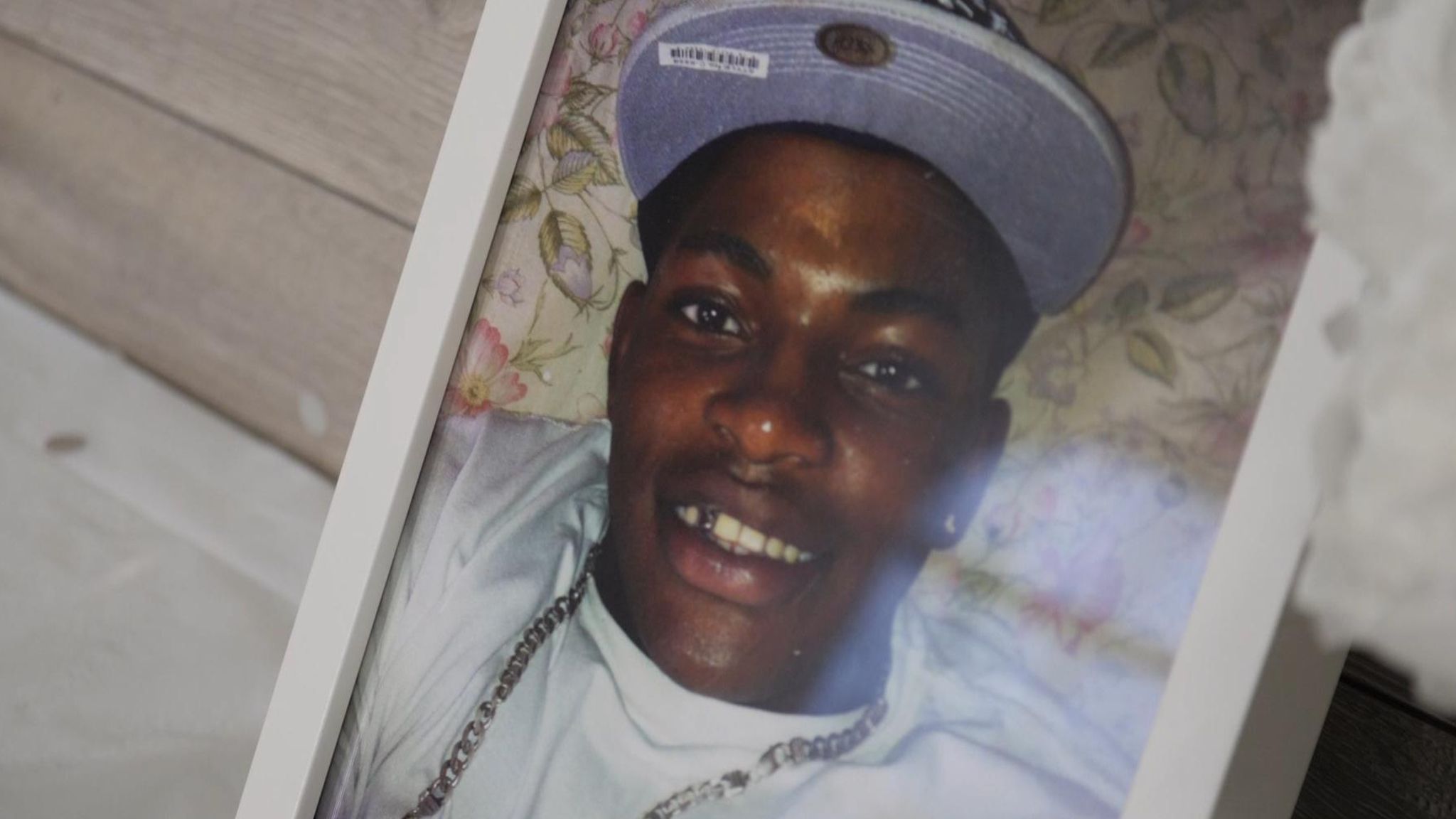

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

May 01, 2025

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

May 01, 2025