Executive Chair's Offer, Sovereign Wealth Fund Participation In InterRent REIT Deal

Table of Contents

The Executive Chair's Offer: A Closer Look

The Executive Chair's proposed investment in InterRent REIT represents a significant commitment to the company's future. This strategic investment demonstrates confidence in the long-term growth potential of InterRent and its position within the real estate market.

- Details of the Executive Chair's proposed investment: The Executive Chair has offered to acquire [Insert Number] shares at a premium of [Insert Percentage]% above the current market price. This represents a substantial investment, signifying a strong belief in the company's prospects.

- Premium offered compared to current market price: This premium reflects the Executive Chair's assessment of InterRent's undervalued potential and the strategic benefits of consolidating ownership. This move signals to the market that the current share price doesn't fully reflect the company's intrinsic value.

- Potential impact on shareholder value: The Executive Chair's offer, if successful, is expected to significantly enhance shareholder value. The premium offered exceeds the current market price, providing an immediate return for existing shareholders. Furthermore, the increased capital injection can fuel growth and further increase value over time.

- Analysis of the Executive Chair's motivations: The Executive Chair's motivations likely include a desire to solidify their control over the company, increase their personal stake, and capitalize on a perceived undervaluation of InterRent REIT in the market.

- Discussion of any potential conflicts of interest: While the Executive Chair's significant investment is a positive sign, independent scrutiny is crucial to ensure transparency and avoid any potential conflicts of interest. This needs thorough investigation by regulatory bodies and independent financial advisors.

Sovereign Wealth Fund Involvement: Implications and Analysis

The participation of a Sovereign Wealth Fund adds another layer of complexity and significance to the InterRent REIT deal. The involvement of these long-term investors often signals a vote of confidence in the target company and its future growth prospects.

- Identification of the participating Sovereign Wealth Fund: [Insert Name of Sovereign Wealth Fund] has committed to investing [Insert Amount] in InterRent REIT, reflecting their global investment strategy and interest in the real estate sector.

- The fund's investment strategy and previous real estate investments: [Insert details about the Sovereign Wealth Fund's investment strategy, focusing on their previous real estate investments and their typical investment horizon (long-term)]. This indicates a preference for stable, long-term assets and contributes to InterRent's stability.

- Reasons for their interest in InterRent REIT: [Insert details regarding why the Sovereign Wealth Fund is interested in InterRent REIT, including factors such as InterRent's market position, growth potential, and alignment with the fund's investment criteria]. This provides valuable context for their decision.

- Potential impact on InterRent's long-term growth strategy: The significant capital injection from the Sovereign Wealth Fund will likely enable InterRent to pursue aggressive growth strategies, including acquisitions, expansions, and upgrades to its existing portfolio. This could lead to faster long-term growth.

- Assessment of the geopolitical implications of this investment: The involvement of a Sovereign Wealth Fund introduces a geopolitical element to the deal, with potential implications for InterRent's international operations and relationships. However, this can also lead to potential synergies and connections globally.

Market Reaction and Future Outlook for InterRent REIT

The announcement of the Executive Chair's offer and the Sovereign Wealth Fund's involvement has already generated significant interest in the market.

- Analysis of the market's reaction to the news: The market reacted positively to the news, with InterRent REIT's stock price showing a [Insert Percentage]% increase. This demonstrates confidence in the future of the deal.

- Impact on InterRent REIT's stock price: The stock price surge indicates positive market sentiment. The long-term impact will depend on the successful completion of the deal and InterRent's ability to deliver on its growth strategy.

- Expert opinions and predictions about future performance: Financial analysts predict [Insert positive predictions about InterRent's future performance, including growth rates and return on investment]. These predictions are backed by the current positive sentiment.

- Discussion of potential risks and opportunities: While the outlook is positive, potential risks include regulatory hurdles, unexpected market downturns, and challenges in integrating the increased capital effectively. Opportunities include expansion into new markets and the acquisition of valuable properties.

- Comparison to similar REIT deals and market trends: The deal aligns with current market trends, showing a continued preference for stable, high-yielding real estate investments. The premium offered aligns with successful comparable REIT deals in the past.

Competitive Landscape and Strategic Advantages

The combined effect of the Executive Chair's offer and the Sovereign Wealth Fund's investment significantly enhances InterRent REIT's competitive position.

- Analysis of InterRent's competitors in the real estate market: InterRent competes with [List Key Competitors], but this investment allows them to potentially expand into new markets.

- How the Executive Chair's offer and Sovereign Wealth Fund investment enhance InterRent's competitive standing: The influx of capital and strategic direction provides InterRent with a significant competitive edge, allowing them to pursue acquisitions and expansion opportunities not available to competitors.

- Discussion of any potential synergies between InterRent and its new investors: The new investors' expertise and connections could unlock significant synergies, leading to improved operational efficiency and enhanced growth opportunities.

Conclusion

The InterRent REIT deal, bolstered by the Executive Chair's offer and the participation of a Sovereign Wealth Fund, signifies a significant development in the real estate investment landscape. This strategic partnership promises substantial benefits for InterRent, potentially accelerating its growth and enhancing its market position. The combination of experienced leadership and substantial capital injections offers a compelling future for the company.

Call to Action: Stay informed about the latest developments in this significant Executive Chair's offer and the evolving role of Sovereign Wealth Funds in the InterRent REIT deal. Follow our blog for further updates and insightful analysis on the impact of this transaction. Learn more about REIT investment opportunities by subscribing to our newsletter today!

Featured Posts

-

Mamardashvili Sorprendente Actuacion Y Clave Del Partido

May 29, 2025

Mamardashvili Sorprendente Actuacion Y Clave Del Partido

May 29, 2025 -

The State Of Us Canada Tourism Boycotts And Border Crossings

May 29, 2025

The State Of Us Canada Tourism Boycotts And Border Crossings

May 29, 2025 -

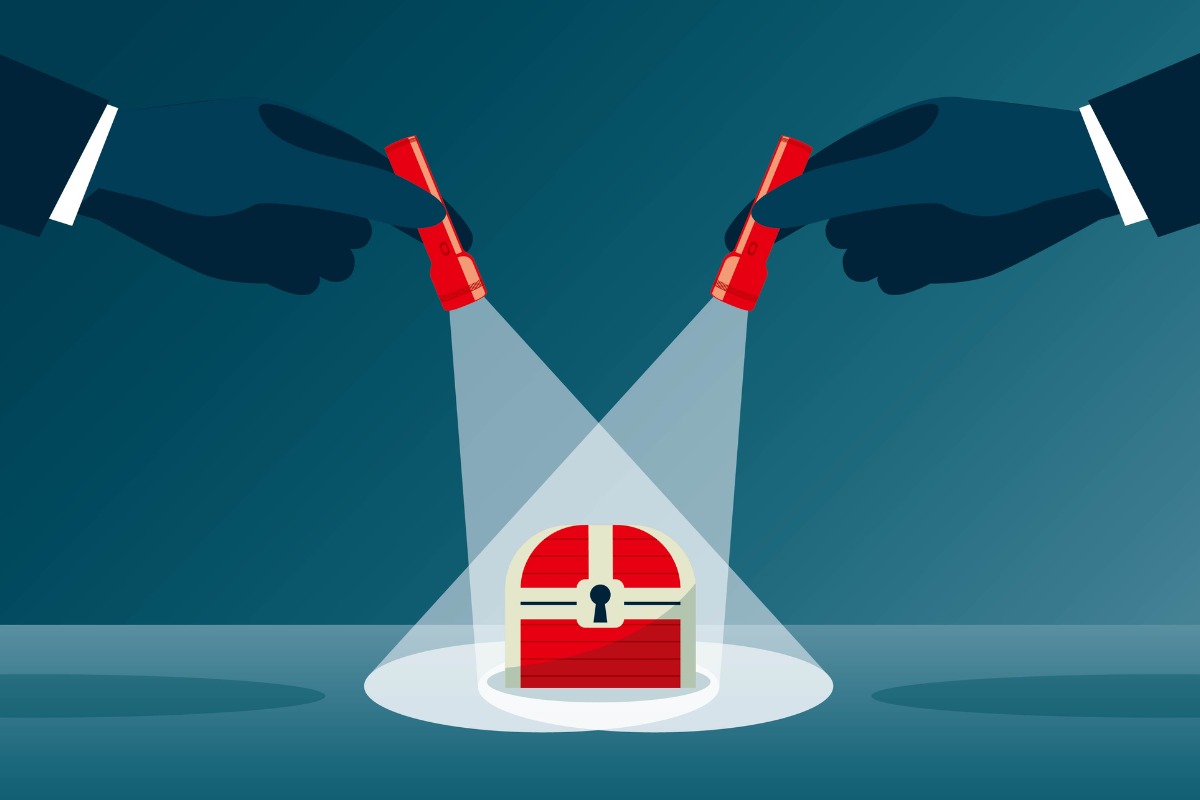

100 Forintos Bankjegyek Gyujtoi Erteke Es Befektetesi Lehetosegek

May 29, 2025

100 Forintos Bankjegyek Gyujtoi Erteke Es Befektetesi Lehetosegek

May 29, 2025 -

Stranger Things The First Shadow New Images From The Preview

May 29, 2025

Stranger Things The First Shadow New Images From The Preview

May 29, 2025 -

Eroeffnung Der Karl Weinbar Neue Weinbar An Der Venloer Strasse

May 29, 2025

Eroeffnung Der Karl Weinbar Neue Weinbar An Der Venloer Strasse

May 29, 2025