Expect The Worst: Philippine Banking CEO On US-China Trade Tensions

Table of Contents

The CEO's Pessimistic Outlook and its Rationale

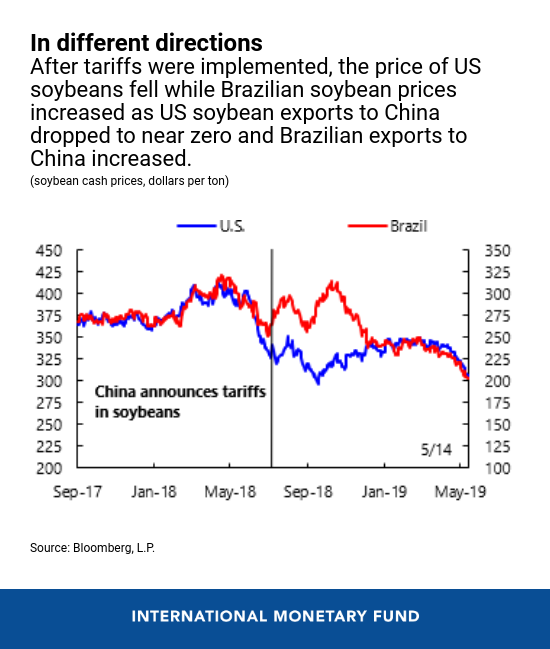

[CEO Name]'s prediction of negative consequences stems from a realistic assessment of the interconnectedness of the Philippine economy with both the US and China. The CEO anticipates significant challenges ahead, primarily due to the disruption of global trade flows and investment patterns. Specific concerns include:

-

Impact on Philippine Exports: The Philippines' export-oriented economy, particularly sectors like electronics manufacturing and agricultural products (e.g., bananas, mangoes), is highly vulnerable to trade disruptions. Reduced demand from both the US and China could severely impact export revenues and economic growth. This vulnerability necessitates exploring alternative markets and diversifying export strategies.

-

Reduced Foreign Direct Investment (FDI): Uncertainty surrounding the trade war discourages foreign investment. The Philippines, relying heavily on FDI for economic development, risks a significant slowdown in capital inflows, impacting infrastructure projects and overall economic growth. This reduction could exacerbate existing economic challenges and hinder future development initiatives.

-

Potential Slowdown in Economic Growth: The combined effect of reduced exports and FDI could lead to a substantial slowdown in the Philippines' overall economic growth. This necessitates the adoption of proactive measures to cushion the blow and stimulate domestic demand.

-

Increased Volatility in the Philippine Peso: Trade tensions often lead to currency fluctuations. The Philippine peso could experience increased volatility, making imports more expensive and potentially impacting inflation. This necessitates effective currency hedging strategies to mitigate risk.

-

Risk to the Banking Sector’s Loan Portfolio: Philippine banks with significant exposure to industries heavily reliant on trade with China or the US face increased credit risk. Businesses facing reduced demand or supply chain disruptions might struggle to repay their loans, potentially leading to an increase in non-performing loans. This highlights the need for comprehensive risk assessment and mitigation strategies.

Potential Impacts on Philippine Businesses

The US-China trade war doesn't impact all businesses equally. Certain sectors are particularly vulnerable:

-

Manufacturing: Industries like electronics manufacturing, garments, and footwear, heavily reliant on export markets, are particularly vulnerable to reduced demand and supply chain disruptions.

-

Agriculture: The agricultural sector, exporting products like bananas and mangoes primarily to China and the US, faces significant risks from tariffs and reduced demand. This underscores the importance of trade diversification and exploring new markets.

-

Tourism: Reduced Chinese tourist arrivals due to economic uncertainty in China could significantly impact the tourism sector, a major contributor to the Philippine economy.

-

Technology and Related Sectors: The technology sector, dependent on global supply chains and investment, could face disruptions due to trade restrictions and uncertainty.

While information on specific mitigation strategies employed by businesses is limited, diversification of markets, cost reduction strategies, and increased focus on domestic demand are expected to be key approaches.

Strategies for Banks to Navigate the Uncertainties

To navigate the uncertainties presented by US-China trade tensions, Philippine banks need to adopt proactive risk management strategies:

-

Diversification of Loan Portfolios: Reducing concentration risk by diversifying loans across various sectors and geographies is crucial.

-

Increased Due Diligence on Loan Applications: Thorough assessment of borrowers' financial health and resilience to trade disruptions is essential for responsible lending.

-

Stress Testing of Financial Models: Banks should rigorously test their financial models under various stress scenarios, including prolonged trade tensions, to assess their resilience.

-

Improved Liquidity Management: Maintaining sufficient liquidity is crucial to withstand potential shocks to the financial system.

-

Hedging Against Currency Fluctuations: Implementing effective currency hedging strategies can mitigate the risks associated with peso volatility.

Proactive risk management is not merely a suggestion but a necessity for Philippine banks to weather this storm.

Government's Role in Mitigating the Impact

The Philippine government plays a critical role in mitigating the negative consequences of US-China trade tensions. Potential measures include:

-

Fiscal Stimulus Packages: Targeted fiscal stimulus can support affected industries and boost domestic demand.

-

Trade Diversification Initiatives: Promoting trade relationships with other countries can reduce reliance on the US and China.

-

Support for Affected Businesses: Providing financial assistance and technical support to businesses impacted by the trade war can help them weather the storm.

-

Regulatory Adjustments to Support the Banking Sector: Adjusting regulations to enhance the resilience of the banking sector could help mitigate the financial risks.

The effectiveness of these measures will depend on their timely implementation and coordination across government agencies.

Preparing for the Worst: Navigating US-China Trade Tensions in the Philippine Banking Sector

The statements and analysis highlight the significant challenges posed by US-China trade tensions on the Philippine economy and, specifically, the banking sector. The potential for reduced exports, FDI, and economic growth underscores the need for proactive measures. The importance of robust risk management strategies for banks and businesses cannot be overstated. The impact of US-China trade war requires preparedness and adaptability.

To learn more about effective strategies for managing US-China trade risks and their impact on the Philippine banking sector, explore resources from the Bangko Sentral ng Pilipinas (BSP), the Department of Finance (DOF), and reputable economic research institutions. Understanding and mitigating the impact of these tensions is crucial for navigating the uncertain economic landscape ahead.

Featured Posts

-

Zuckerbergs Meta In A Trumpian World Opportunities And Obstacles

Apr 26, 2025

Zuckerbergs Meta In A Trumpian World Opportunities And Obstacles

Apr 26, 2025 -

Liev Schreibers Daughter Paris Modeling Debut Sparks Nepo Baby Debate

Apr 26, 2025

Liev Schreibers Daughter Paris Modeling Debut Sparks Nepo Baby Debate

Apr 26, 2025 -

Mangalia Shipyard Desans Potential Acquisition And Future Of Romanian Shipbuilding

Apr 26, 2025

Mangalia Shipyard Desans Potential Acquisition And Future Of Romanian Shipbuilding

Apr 26, 2025 -

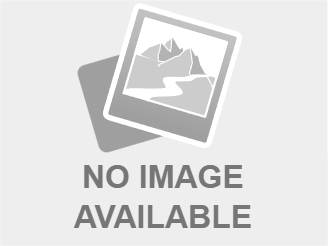

I Heart Radio Music Awards 2025 Benson Boones Striking Outfit

Apr 26, 2025

I Heart Radio Music Awards 2025 Benson Boones Striking Outfit

Apr 26, 2025 -

I Got My Switch 2 Preorder At Game Stop The In Store Experience

Apr 26, 2025

I Got My Switch 2 Preorder At Game Stop The In Store Experience

Apr 26, 2025