Extreme Price Increase Projected For VMware After Broadcom Acquisition

Table of Contents

Broadcom, known for its aggressive acquisition strategy and focus on maximizing shareholder value, has a history of increasing prices after acquiring companies. The VMware acquisition is likely to follow a similar pattern, resulting in substantial cost increases for existing and prospective customers.

Reasons Behind the Projected VMware Price Increase

Several factors contribute to the anticipated extreme price increase for VMware following the Broadcom acquisition.

Broadcom's Acquisition Strategy and Profit Margins

Broadcom has a well-documented history of prioritizing profitability after acquiring companies. Their acquisitions are not merely about expanding market share; they're about optimizing financial performance.

- Examples: Previous Broadcom acquisitions have often resulted in significant price increases for the acquired company's products and services. Analyzing these past instances provides a clear indication of the potential for similar price hikes with VMware.

- Financial Analysis: Examining Broadcom's financial statements reveals a consistent focus on maximizing profit margins. This financial strategy directly influences their pricing decisions post-acquisition.

- Expert Opinion: Industry experts and analysts have voiced concerns about the potential for significant price increases for VMware products, citing Broadcom's historical track record.

Reduced Competition and Market Dominance

The Broadcom-VMware merger raises significant concerns about reduced competition in the virtualization market. VMware already holds a substantial market share, and this acquisition could further consolidate power, allowing Broadcom to exert significant control over pricing.

- Market Share: VMware's dominant position in the virtualization market allows for less price sensitivity compared to a more competitive landscape.

- Antitrust Concerns: The acquisition may face scrutiny from antitrust regulators, but even with potential concessions, the impact on competition and pricing is likely to be significant.

- Barriers to Entry: The combined power of Broadcom and VMware could create significant barriers to entry for new competitors, further limiting price competition.

Integration Costs and Investment Recovery

The integration of VMware into Broadcom's existing business will undoubtedly incur substantial costs. These integration expenses, including software development, personnel, and infrastructure upgrades, are likely to be passed on to customers through price increases.

- Integration Expenses: The complexity of integrating two large technology companies will involve substantial investment in software development, personnel training, and infrastructure adjustments.

- Planned Investments: Broadcom may argue that price increases are necessary to fund further investment in VMware's technology and development.

- Cost Recovery: The acquisition's massive cost needs to be recouped, and price increases represent a direct method for Broadcom to achieve this.

Impact of the Price Increase on VMware Customers

The projected VMware price increase will have significant consequences for businesses relying on VMware's virtualization solutions.

Financial Burden on Businesses

The substantial price increase will place a significant financial burden on many organizations, particularly small and medium-sized businesses (SMBs).

- Industry Impact: Industries heavily reliant on virtualization, such as finance, healthcare, and manufacturing, will feel the brunt of the price increase.

- IT Budget Strain: IT budgets will be significantly impacted, forcing businesses to make difficult choices about other technology investments.

- Cost-Cutting Measures: Businesses may be forced to adopt cost-cutting measures, potentially compromising on other crucial aspects of their IT infrastructure.

Shift in Market Dynamics and Vendor Lock-in

The price increase may lead to greater vendor lock-in for existing VMware customers, making it challenging to switch to alternative solutions.

- Migration Challenges: Migrating from VMware to alternative platforms can be complex, time-consuming, and expensive.

- Switching Costs: The cost and effort involved in switching vendors significantly increase the risk of remaining with VMware despite the price hikes.

- Impact on Customer Loyalty: The price increase could damage customer loyalty and vendor relationships, forcing businesses to reconsider their long-term IT strategies.

Potential Alternatives and Mitigation Strategies

While the VMware price increases are a significant concern, businesses have options to mitigate the impact.

- Alternative Platforms: Exploring alternative virtualization platforms, such as OpenStack, Proxmox, or other cloud-based solutions, can offer viable alternatives.

- Negotiation Strategies: Businesses should leverage their purchasing power and negotiate favorable pricing agreements with Broadcom.

- Long-Term IT Planning: Developing a robust long-term IT strategy that accounts for potential price fluctuations is crucial.

Conclusion: Navigating the Extreme Price Increase for VMware Post-Acquisition

The projected extreme price increase for VMware after the Broadcom acquisition is a significant concern for businesses. The combination of Broadcom's acquisition strategy, reduced competition, and integration costs will likely lead to substantial financial implications and shifts in market dynamics. Prepare for the upcoming VMware price increases by exploring alternative solutions, strategically negotiating with vendors, and developing a robust long-term IT budget. Don't get caught off guard by the Broadcom acquisition's impact on VMware pricing. Proactive planning is crucial to mitigating the potential negative effects.

Featured Posts

-

Kci Michaela Schumachera Gina Maria I Njezina Obitelj

May 20, 2025

Kci Michaela Schumachera Gina Maria I Njezina Obitelj

May 20, 2025 -

Lightning 100s New Music Monday Playlist February 24th 25th

May 20, 2025

Lightning 100s New Music Monday Playlist February 24th 25th

May 20, 2025 -

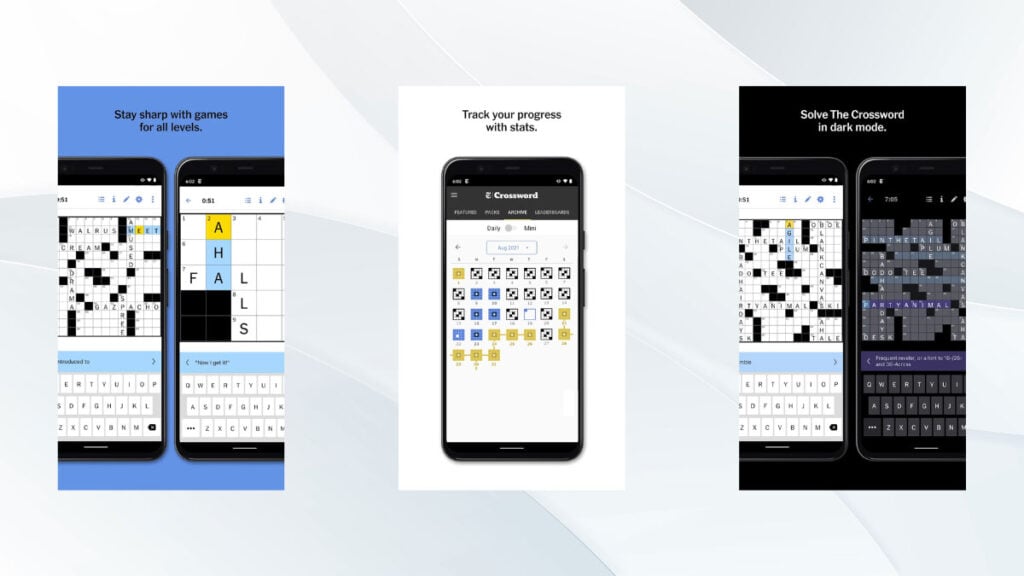

Nyt Mini Crossword March 16 2025 Complete Solutions

May 20, 2025

Nyt Mini Crossword March 16 2025 Complete Solutions

May 20, 2025 -

Robert Pattinson And Suki Waterhouses Public Display Of Affection Amidst The Batman 2 Buzz

May 20, 2025

Robert Pattinson And Suki Waterhouses Public Display Of Affection Amidst The Batman 2 Buzz

May 20, 2025 -

Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran Huuhkajat Kaksikko Etsii Uusia Haasteita

May 20, 2025

Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran Huuhkajat Kaksikko Etsii Uusia Haasteita

May 20, 2025