Factors Contributing To CoreWeave (CRWV) Stock's Tuesday Increase

Table of Contents

Positive Earnings Report and Revenue Growth

CoreWeave's Tuesday stock surge was largely attributed to a strong earnings report that exceeded analyst expectations. The company announced impressive financial performance, showcasing robust revenue growth and profitability.

- Revenue Figures: CoreWeave reported [Insert specific revenue figures here, e.g., $X million in revenue], demonstrating a significant year-over-year growth of [Insert percentage, e.g., YY%]. This substantial increase surpassed analyst projections by [Insert percentage or dollar amount, e.g., 5% or $Y million].

- Exceeding Expectations: The positive surprise extended beyond revenue. The company's [Insert relevant metric, e.g., earnings per share (EPS)] also outperformed expectations, signaling strong operational efficiency and demand for their services.

- Future Guidance: CoreWeave's management provided optimistic guidance for future earnings, indicating continued growth and expansion in the coming quarters. This positive outlook further bolstered investor confidence. [Insert details of future guidance, e.g., projected revenue growth of ZZ%].

- Official Earnings Report: For a detailed analysis, refer to the official earnings report: [Insert link to the official earnings report here].

Increased Investor Confidence and Market Sentiment

The positive earnings report wasn't the only factor fueling CRWV's stock price increase. A surge in investor confidence and overall positive market sentiment toward CoreWeave and the broader cloud computing sector played a significant role.

- Positive News and Events: Recent announcements, such as [mention any recent partnerships, product launches, or positive industry news], contributed to improved investor sentiment. These events highlighted CoreWeave's strategic positioning and growth potential.

- Analyst Ratings and Price Targets: Several analysts revised their ratings and price targets for CRWV following the earnings announcement, reflecting increased optimism about the company's future performance. [Insert details about analyst ratings and price target changes].

- Trading Volume: Tuesday witnessed a notable increase in trading volume for CRWV stock, indicating heightened investor interest and activity. This high volume suggests a significant influx of buyers pushing the price upward.

- Broader Market Trends: The overall positive trend in the technology sector and the growing demand for cloud computing services also contributed to the positive market sentiment surrounding CRWV.

Strategic Partnerships and Business Developments

CoreWeave's strategic initiatives and partnerships have significantly contributed to its growth trajectory and investor confidence. These developments showcase the company's proactive approach to expansion and innovation.

- Impact of New Partnerships: Recent partnerships with [mention key partners] have expanded CoreWeave's market reach and enhanced its service offerings. These collaborations have unlocked new revenue streams and strengthened its competitive position.

- Technological Advancements: CoreWeave's continuous investment in research and development, resulting in [mention technological advancements or product improvements], has solidified its position as a leader in the cloud computing space.

- Market Expansion: Any expansion into new markets or geographic regions further enhances CoreWeave’s growth potential and diversification. [Mention specific examples of market expansion if applicable].

- Official Announcements: For more information on these strategic developments, refer to CoreWeave's official press releases: [Insert links to relevant press releases here].

Competition and Market Share

CoreWeave's strong performance is also viewed favorably in comparison to its competitors. While the cloud computing market is highly competitive, with key players like [mention key competitors, e.g., AWS, Azure, Google Cloud], CoreWeave's unique strengths are beginning to garner attention.

- Competitive Advantage: CoreWeave's focus on [mention CoreWeave's unique selling proposition, e.g., AI-focused cloud services or sustainable cloud solutions] provides it with a competitive edge. This specialization allows it to cater to specific market needs and gain market share.

- Market Share Gains: The recent positive performance suggests potential market share gains for CoreWeave as it successfully caters to growing demand. [Add details on market share gains if available].

Conclusion

CoreWeave (CRWV) stock's rise on Tuesday was a result of a confluence of positive factors. Strong earnings exceeding expectations, improved investor sentiment fueled by positive news and analyst upgrades, and strategic initiatives showcasing the company's growth trajectory all contributed to the significant price increase. Understanding these factors impacting CoreWeave (CRWV) stock price fluctuations is vital for informed investment decisions. Stay informed about upcoming news and developments to make well-considered decisions about your CoreWeave (CRWV) investments and other cloud computing stocks. Continue researching the dynamic landscape of the cloud computing market and its impact on CoreWeave's future performance.

Featured Posts

-

Music And Community Defining The Sound Perimeter

May 22, 2025

Music And Community Defining The Sound Perimeter

May 22, 2025 -

Wordle 370 March 20th Clues And Answer

May 22, 2025

Wordle 370 March 20th Clues And Answer

May 22, 2025 -

Analyse Stijgende Occasionverkopen Bij Abn Amro En De Rol Van Autobezit

May 22, 2025

Analyse Stijgende Occasionverkopen Bij Abn Amro En De Rol Van Autobezit

May 22, 2025 -

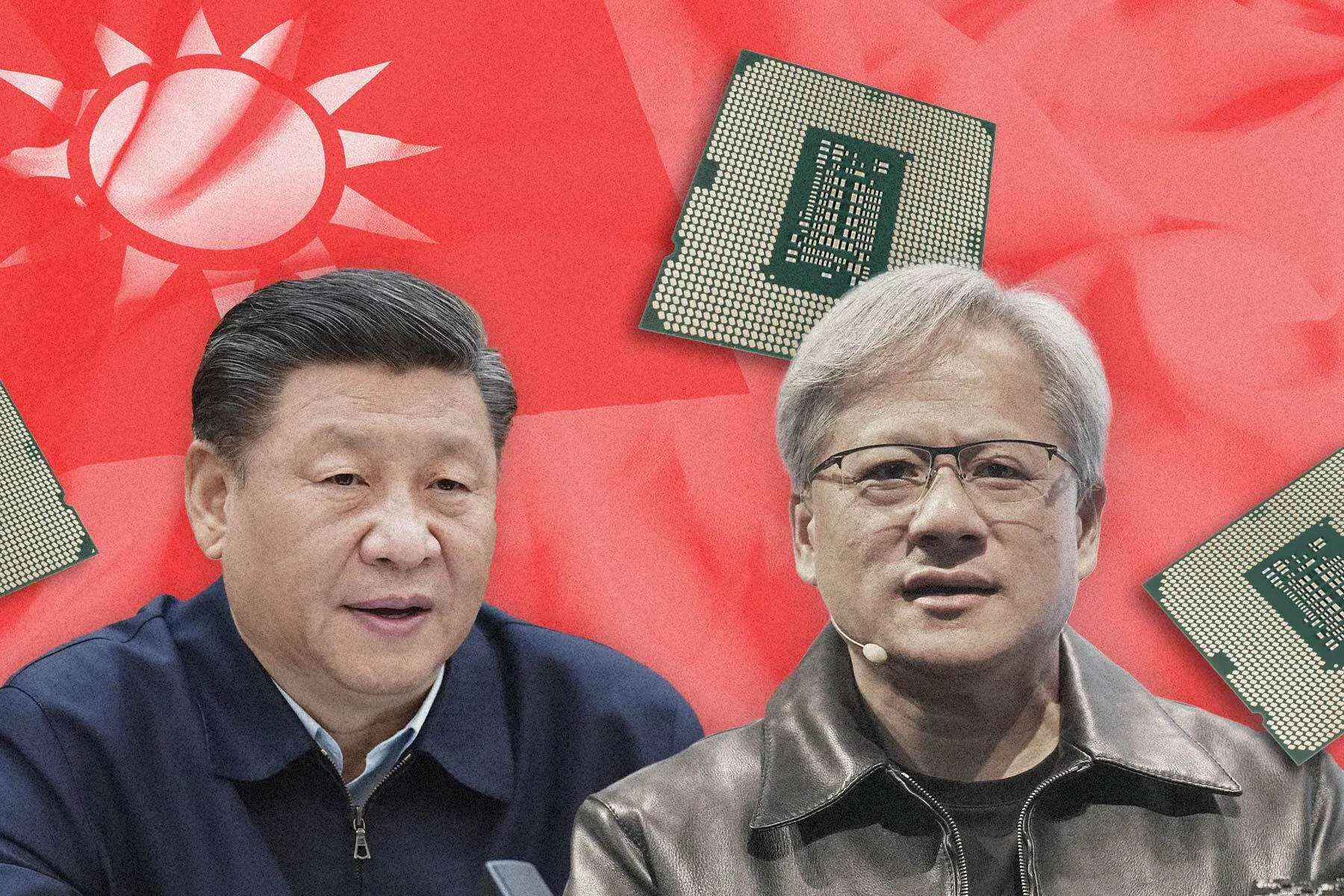

Huang Of Nvidia Condemns Us Export Controls Expresses Approval For Trump

May 22, 2025

Huang Of Nvidia Condemns Us Export Controls Expresses Approval For Trump

May 22, 2025 -

Is Blake Lively Involved In This Alleged Controversy A Deep Dive

May 22, 2025

Is Blake Lively Involved In This Alleged Controversy A Deep Dive

May 22, 2025