Falling Retail Sales: Will The Bank Of Canada Cut Rates Again?

Table of Contents

The Current State of Retail Sales in Canada

The Canadian retail sector is experiencing a significant slowdown. According to Statistics Canada's latest figures, retail sales declined by [Insert Percentage]% in [Month, Year] compared to the previous month and [Insert Percentage]% compared to the same period last year. This represents a considerable drop in Canadian retail sales and signifies a troubling trend in the broader consumer spending landscape. The decline isn't uniform across all sectors. Key areas experiencing the most significant downturns include:

- Automotive Sales: The automotive sector has been particularly hard hit, experiencing a [Insert Percentage]% decrease due to [mention specific reasons like high vehicle prices, supply chain issues].

- Furniture and Home Furnishings: With the housing market cooling, sales in this sector have also fallen significantly by [Insert Percentage]%.

- Clothing and Apparel: Consumers are cutting back on discretionary spending, leading to a [Insert Percentage]% decrease in clothing sales.

Geographic variations exist, with [mention specific regions and their performance]. Furthermore, consumer confidence indices, as reported by [mention source], indicate a marked decrease in optimism regarding future economic prospects. These figures paint a clear picture of a struggling retail sector downturn within the Canadian economy.

Factors Contributing to Falling Retail Sales

Several interconnected factors are contributing to the decline in Canadian retail sales. The most significant include:

- High Inflation: Persistent high inflation is eroding purchasing power, leaving consumers with less disposable income to spend on non-essential goods and services. The rising cost of living is forcing many to prioritize essential spending over discretionary purchases.

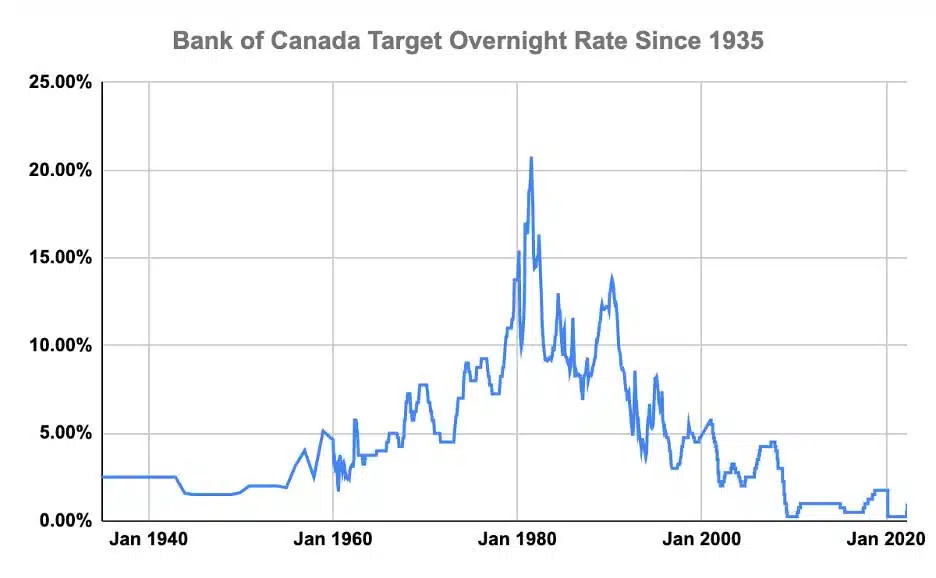

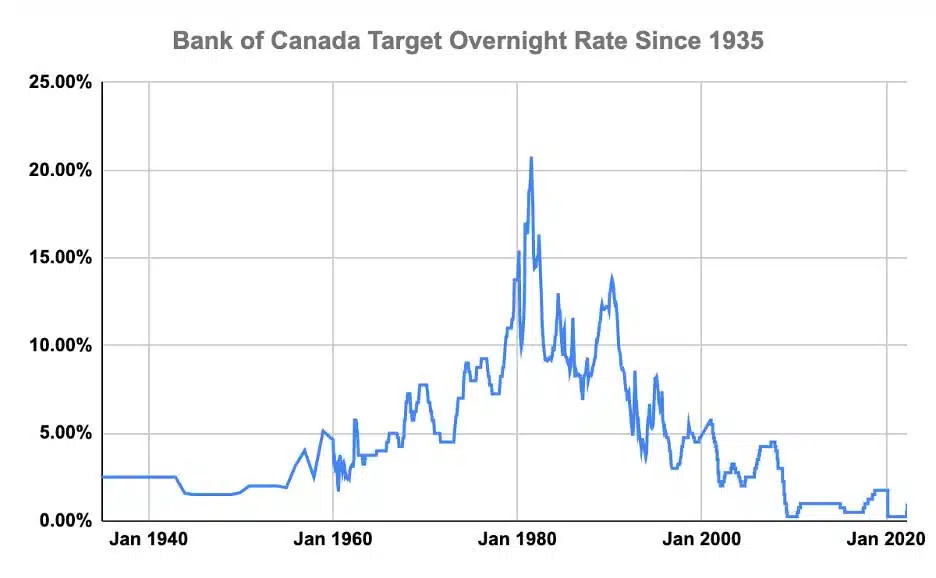

- Rising Interest Rates: The Bank of Canada's recent interest rate hikes are significantly impacting consumer borrowing. Higher interest rates make it more expensive to finance purchases, leading to reduced consumer spending on big-ticket items like homes and vehicles. This directly impacts the consumer spending patterns across various sectors.

- Cooling Housing Market: The slowdown in the housing market is affecting consumer confidence. Decreased home values and reduced affordability are impacting consumer sentiment and willingness to spend. This further contributes to the overall decrease in retail sales.

- Increasing Household Debt Levels: Canadians are already grappling with significant household debt levels. Rising interest rates exacerbate this issue, leaving less room for additional borrowing and spending.

- Global Economic Uncertainty: Global economic headwinds, including geopolitical instability and recessionary fears, are also contributing to consumer uncertainty and reduced spending. This external factor adds to the pressure on the already struggling Canadian retail sales.

The Bank of Canada's Current Stance

The Bank of Canada is closely monitoring the situation. Recent statements emphasize their commitment to controlling inflation, even if it means accepting some economic slowdown. The Bank's current monetary policy focuses on:

- Inflation Target: Maintaining their inflation target of [Insert Target Percentage]%.

- Interest Rate Hikes: While past actions focused on interest rate hikes, recent announcements indicate a more cautious approach.

- Economic Growth Considerations: The Bank is carefully weighing the risks to economic growth against the need to curb inflation. They are considering the potential impact of their policies on various economic sectors, including retail sales.

The Bank acknowledges the risks posed by falling retail sales to the overall economy.

Likelihood of Another Rate Cut

The possibility of another interest rate cut by the Bank of Canada is a subject of intense debate. Arguments for a rate cut include:

- Weakening Economy: The decline in retail sales signals a weakening economy, necessitating stimulative measures.

- Low Consumer Spending: The low consumer spending levels suggest a need for monetary easing to boost economic activity.

However, arguments against a rate cut exist:

- Persistent Inflation: Inflation remains stubbornly high, making a rate cut risky, as it could further fuel inflationary pressures.

- Potential Inflationary Pressures: A rate cut could potentially reignite inflationary pressures, negating the positive effects of previous interest rate hikes.

Leading economists and financial analysts offer differing opinions. Some believe a rate cut is imminent, given the weakening economy and falling retail sales. Others argue that maintaining current rates is necessary to control inflation, even at the risk of a more significant economic slowdown. The Bank of Canada may also consider alternative policy responses, such as targeted fiscal stimulus measures, instead of another broad-based interest rate cut. The probability therefore remains uncertain and depends heavily on future economic data and the Bank's assessment of the risks involved.

Conclusion

In conclusion, falling retail sales in Canada are a significant concern, driven by a combination of high inflation, rising interest rates, a cooling housing market, and global economic uncertainty. The Bank of Canada is carefully considering its next move, weighing the need to curb inflation against the risks of further economic slowdown. The likelihood of another interest rate cut remains uncertain, dependent on evolving economic indicators and the Bank's assessment of the risks involved. The future direction of the Canadian economy hinges on the interplay between these factors. Stay informed about the evolving situation and monitor future announcements regarding interest rates to make informed financial decisions. Regularly check for updates on falling retail sales and the Bank of Canada's monetary policy to understand the potential impact on your personal finances.

Featured Posts

-

Dows 9 B Alberta Project Delayed Collateral Damage From Tariffs

Apr 28, 2025

Dows 9 B Alberta Project Delayed Collateral Damage From Tariffs

Apr 28, 2025 -

Latest Mets News Megill Joins Rotation Nez To Syracuse

Apr 28, 2025

Latest Mets News Megill Joins Rotation Nez To Syracuse

Apr 28, 2025 -

Contempt Of Parliament Yukon Politicians Confront Mine Manager

Apr 28, 2025

Contempt Of Parliament Yukon Politicians Confront Mine Manager

Apr 28, 2025 -

Nfl Draft 2024 Shedeur Sanders Journey To Cleveland

Apr 28, 2025

Nfl Draft 2024 Shedeur Sanders Journey To Cleveland

Apr 28, 2025 -

Uae Tourist Sim Card 10 Gb Data And 15 Off Abu Dhabi Attractions

Apr 28, 2025

Uae Tourist Sim Card 10 Gb Data And 15 Off Abu Dhabi Attractions

Apr 28, 2025