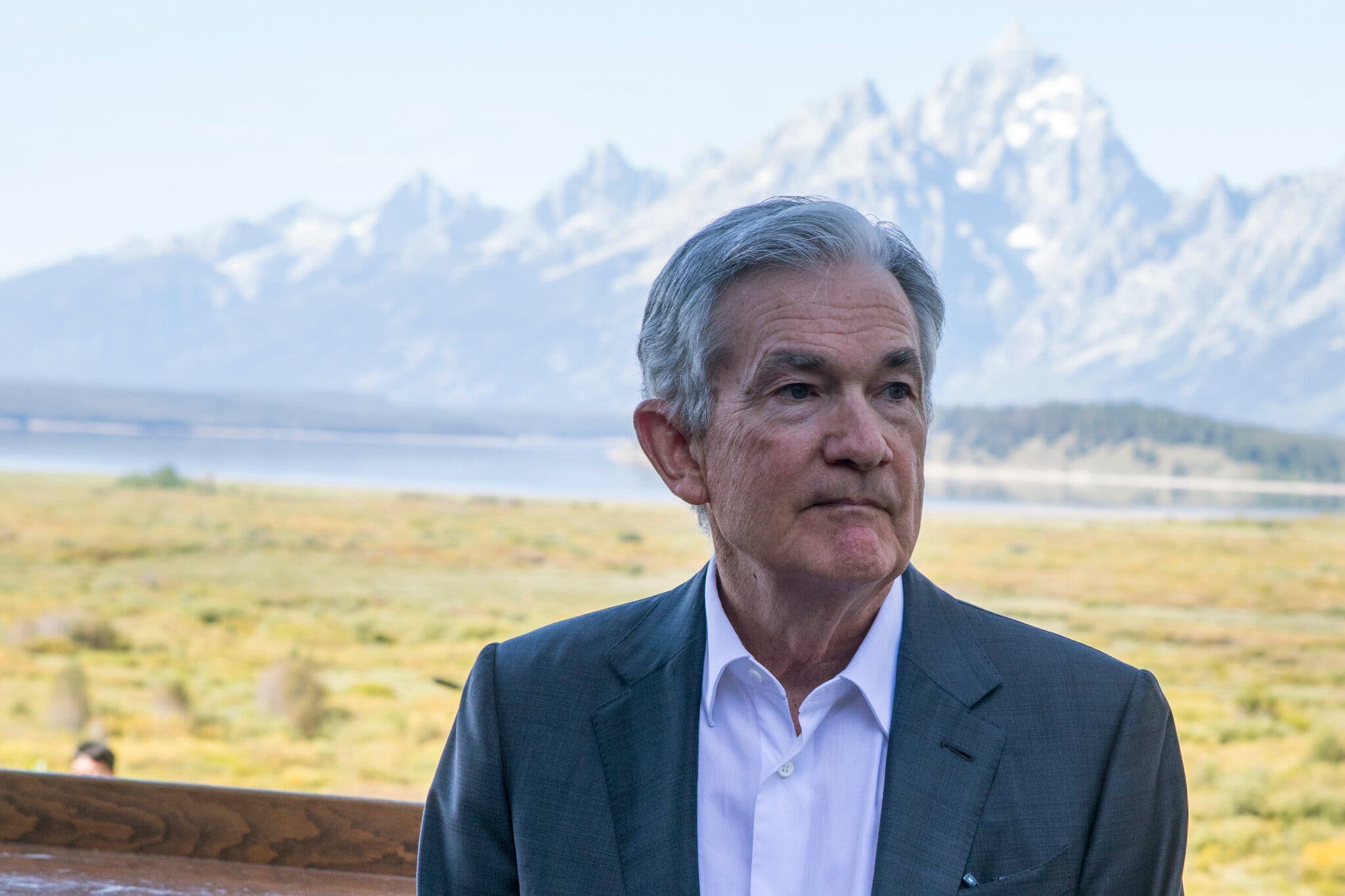

Fed Chair Powell And President Trump's Economic Discussion At The White House

Table of Contents

The Pre-Meeting Context: Setting the Stage for the Economic Discussion

The economic climate leading up to the meeting was characterized by a complex interplay of factors. Several key economic indicators painted a mixed picture:

- GDP Growth: While GDP growth remained positive, it showed signs of slowing, raising concerns about the sustainability of the economic expansion.

- Inflation Rate: Inflation was hovering near the Federal Reserve's target, but there were concerns about potential inflationary pressures due to factors such as rising energy prices and a strengthening dollar.

- Unemployment Rate: The unemployment rate was low, suggesting a strong labor market, but there were concerns about potential wage inflation.

- Trade Tensions: The ongoing trade war with China and other countries significantly impacted investor sentiment and created uncertainty in the business community. This uncertainty contributed to market volatility and dampened business investment.

These factors created a challenging backdrop for the meeting, fueling speculation about the direction of monetary policy and the potential for further economic adjustments. Market volatility leading up to the meeting reflected this uncertainty, with investors closely watching for any signals about the future path of interest rates and the overall economic outlook.

Key Discussion Points During the White House Meeting

The White House meeting involved a frank exchange of views on crucial economic matters. The discussion centered around:

-

President Trump's Views: President Trump consistently expressed his preference for lower interest rates, believing that they would stimulate economic growth and boost the stock market. He frequently criticized the Fed's monetary policy, suggesting that rate hikes were hindering economic progress and were politically motivated.

-

Fed Chair Powell's Stance: Chair Powell, on the other hand, emphasized the importance of the Federal Reserve's independence and its commitment to price stability and maximum employment. He highlighted the need to maintain a data-driven approach to monetary policy, adjusting interest rates based on economic indicators rather than political considerations. He defended the Fed's actions, arguing that they were necessary to address inflationary pressures and prevent overheating of the economy.

-

Points of Contention: Significant disagreements arose regarding the appropriate level of interest rates and the timing of future rate adjustments. President Trump's public pressure on the Fed to lower interest rates raised concerns about the potential erosion of the central bank's independence.

Specific economic data and projections regarding inflation, unemployment, and GDP growth were undoubtedly part of the detailed discussion, though the exact figures and their interpretations remained largely confidential.

The Role of Interest Rates in the Discussion

The discussion regarding interest rate policy was the most contentious aspect of the meeting. Central to the debate were:

- Different Viewpoints: President Trump advocated for lower interest rates to boost economic growth, arguing that the current rates were stifling businesses and consumers. Chair Powell, conversely, emphasized a cautious approach, mindful of the potential risks of excessively low rates, including increased inflation and asset bubbles.

- Impact of Interest Rate Changes: Both parties recognized the significant influence of interest rate changes on various sectors of the economy. Lower rates stimulate borrowing and investment, potentially boosting economic growth but also risking inflation. Higher rates curb inflation but might slow down economic activity.

- Fed's Independence: President Trump's public criticism of the Fed's interest rate decisions directly challenged the central bank's independence, a vital principle for maintaining its credibility and effectiveness in managing the economy. Powell firmly reiterated the importance of the Fed's autonomy in conducting monetary policy.

Post-Meeting Market Reactions and Analyses

The meeting's aftermath triggered immediate and sustained market reactions:

- Market Responses: Stock markets initially reacted negatively to the meeting, reflecting uncertainty about the future direction of monetary policy. Bond yields also fluctuated, indicating shifting investor sentiment.

- Expert Opinions: Economists and market analysts offered diverse interpretations of the meeting's impact. Some believed the public pressure from the President could force the Fed to adopt a more accommodative monetary policy. Others argued that the Fed would remain committed to its data-driven approach, prioritizing price stability over political pressure.

- Long-Term Implications: The long-term consequences of the meeting remained uncertain, but it highlighted the ongoing tension between the executive branch and the central bank concerning economic policy. This tension could potentially lead to increased uncertainty and volatility in the markets.

Conclusion

The meeting between Fed Chair Powell and President Trump at the White House underscored the complex interplay between political pressures and the Federal Reserve's mandate to maintain economic stability. While the meeting didn't lead to immediate policy changes, it highlighted significant disagreements about the appropriate level of interest rates and the role of monetary policy in achieving economic growth. The exchange emphasized the delicate balance the Fed must strike between responding to political pressures and maintaining its independence in managing the economy. The potential short-term and long-term consequences of this discussion remain to be seen, but it serves as a critical case study in the ongoing relationship between the Federal Reserve and the executive branch.

Stay updated on the latest developments in the relationship between Fed Chair Powell and the White House by [linking to relevant resources, subscribing to a newsletter, etc.]. Understanding the implications of the Fed Chair Powell and President Trump's economic discussion at the White House is crucial for navigating the complexities of the US and global economies.

Featured Posts

-

April 10th Nyt Mini Crossword Full Solutions

May 31, 2025

April 10th Nyt Mini Crossword Full Solutions

May 31, 2025 -

Who Reports Surge In Covid 19 Cases Linked To New Variant

May 31, 2025

Who Reports Surge In Covid 19 Cases Linked To New Variant

May 31, 2025 -

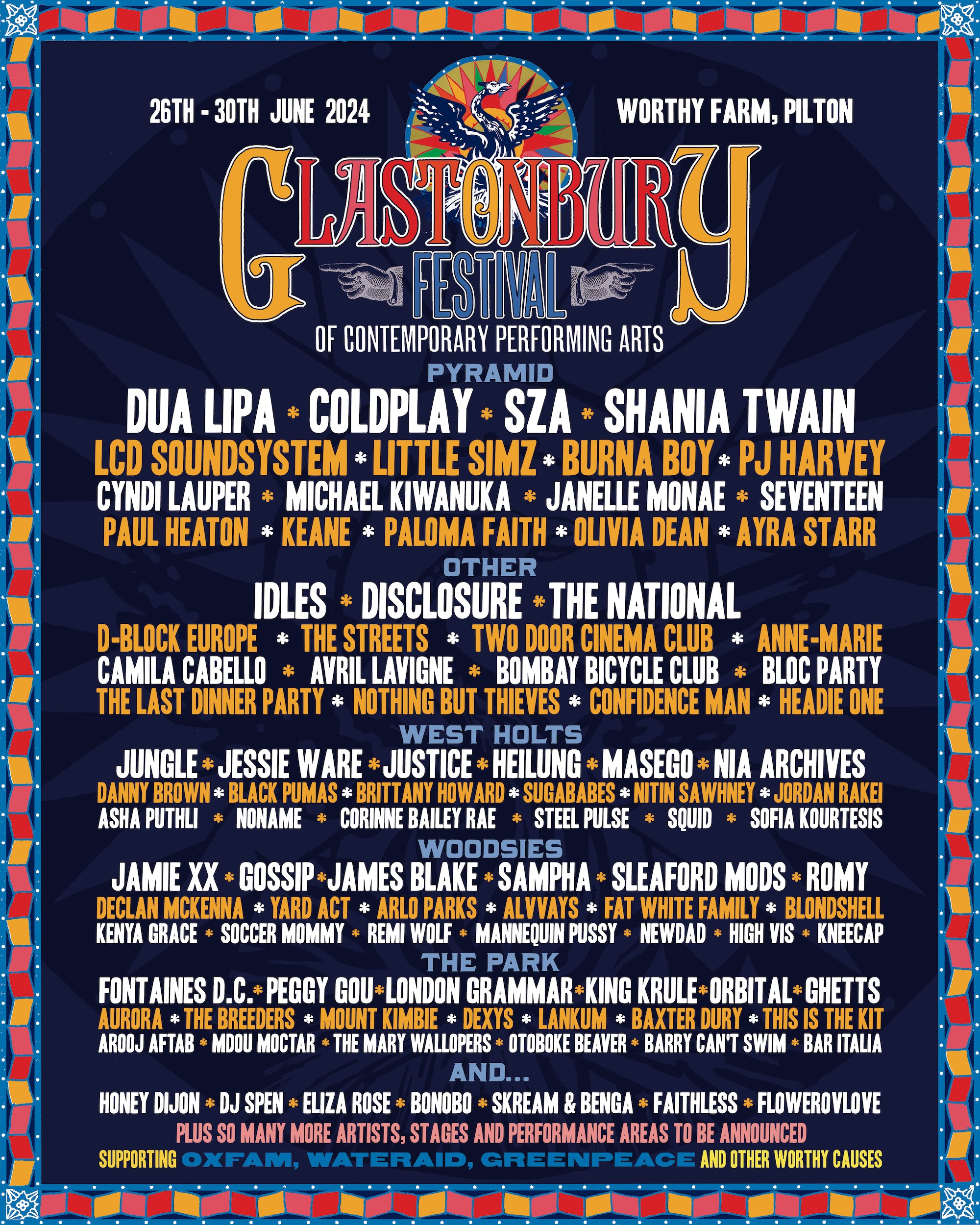

Glastonbury Festival 2025 Coach Locations Resale Ticket Availability And Pricing

May 31, 2025

Glastonbury Festival 2025 Coach Locations Resale Ticket Availability And Pricing

May 31, 2025 -

Wang Suns Table Tennis Dominance Continues Third Straight Mixed Doubles World Championship

May 31, 2025

Wang Suns Table Tennis Dominance Continues Third Straight Mixed Doubles World Championship

May 31, 2025 -

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025

Rosemary And Thyme Recipes Simple Dishes With Big Flavor

May 31, 2025