Fed Rate Cuts: Why The US Is Different From Other Central Banks

The Unique Position of the US Dollar

The US dollar's status as the world's primary reserve currency fundamentally shapes the Fed's decision-making process. This unique position bestows significant influence on global financial markets. The dominance of the US dollar means that Fed rate cuts have far-reaching consequences, impacting international trade, capital flows, and exchange rates across the globe.

- Global Inflation and Interest Rates: Changes in US interest rates ripple through the global financial system, influencing inflation and interest rates in other countries. A reduction in US interest rates can lead to capital outflows from other countries seeking higher returns, putting downward pressure on their currencies and potentially fueling inflation.

- Broad Global Ramifications: The Fed's actions are not confined to the US. A rate cut can trigger a chain reaction, affecting everything from commodity prices to international investment strategies.

- Capital Flows: Changes in US interest rates significantly influence international capital flows. Lower US rates can attract investment into other higher-yielding markets, while higher rates can draw capital into the US, potentially destabilizing other economies.

Different Inflation Dynamics

Inflation narratives vary significantly across nations. While the US, like many other countries, experienced elevated inflation in recent years, the underlying drivers and the resulting policy responses differ. A key differentiating factor is the strength of the US labor market and its influence on wage growth, a significant component of inflation. Other economies may face different challenges, such as supply chain disruptions unique to their region or reliance on specific energy sources.

- Diverse Inflation Drivers: The US inflation picture might be driven more by robust domestic demand and wage growth compared to other countries, where supply chain bottlenecks or energy prices play a more dominant role.

- Supply-Side Shocks: Global supply chain disruptions and geopolitical events impact various economies differently. For example, a country heavily reliant on Russian energy faces distinct inflationary pressures compared to the US.

- Geopolitical Influence on Inflation: The impact of international conflict or sanctions can vary dramatically based on a country's economic structure and trade relationships.

Political and Economic Independence

The Federal Reserve enjoys a relatively high degree of independence from political interference compared to many other central banks globally. This independence allows the Fed to prioritize long-term economic stability, even if it means facing short-term political backlash. However, this level of independence isn't universally shared; many central banks operate under greater political pressure, which can influence their decisions concerning interest rate adjustments.

- Reduced Political Interference: The US Fed's relatively autonomous status enables it to make decisions based on economic data and analysis, minimizing short-term political considerations.

- Political Pressure on Other Central Banks: In some countries, central banks face substantial political pressure to prioritize specific economic goals, such as employment or growth, potentially overshadowing inflation control.

- Government Debt and Central Bank Actions: High levels of government debt can constrain central bank actions, particularly when it comes to interest rate cuts, as lower rates increase borrowing costs for the government.

Varying Economic Structures and Priorities

The US boasts a diverse and complex economy, less reliant on specific sectors compared to some other nations. This diversity influences the Fed’s priorities when it comes to rate cuts. A country highly dependent on a particular industry, for example, might prioritize supporting that sector even if it means tolerating higher inflation, unlike the US's more diversified approach.

- Economic Diversification: The US economy's resilience allows the Fed to prioritize a broader range of economic goals, including employment and inflation control, without being overly constrained by specific sectoral concerns.

- Differing Economic Priorities: Other countries might prioritize economic growth above all else, even if it means accepting higher inflation. These priorities influence the timing and scale of any interest rate adjustments.

- Recession Risk Tolerance: The appetite for risk and tolerance towards potential recessions vary across nations. The Fed's decisions are informed by its assessment of the US economy's resilience and capacity to withstand potential downturns.

Conclusion

The Fed's approach to rate cuts differs significantly from many global central banks due to a confluence of factors: the US dollar's unique global role, differing inflation dynamics, the Fed's relative political independence, and the diverse structure of the US economy. Understanding these nuances is vital for investors, businesses, and policymakers navigating the complexities of the global financial landscape. The ramifications of Fed rate cuts extend far beyond US borders, affecting US interest rates, global monetary policy, and the international economic environment. Stay informed about future Fed rate cuts and their global implications. Understand the nuances of US interest rates and their impact on your investment strategy. Learn more about the complexities of monetary policy by exploring our other insightful articles and subscribing to our newsletter.

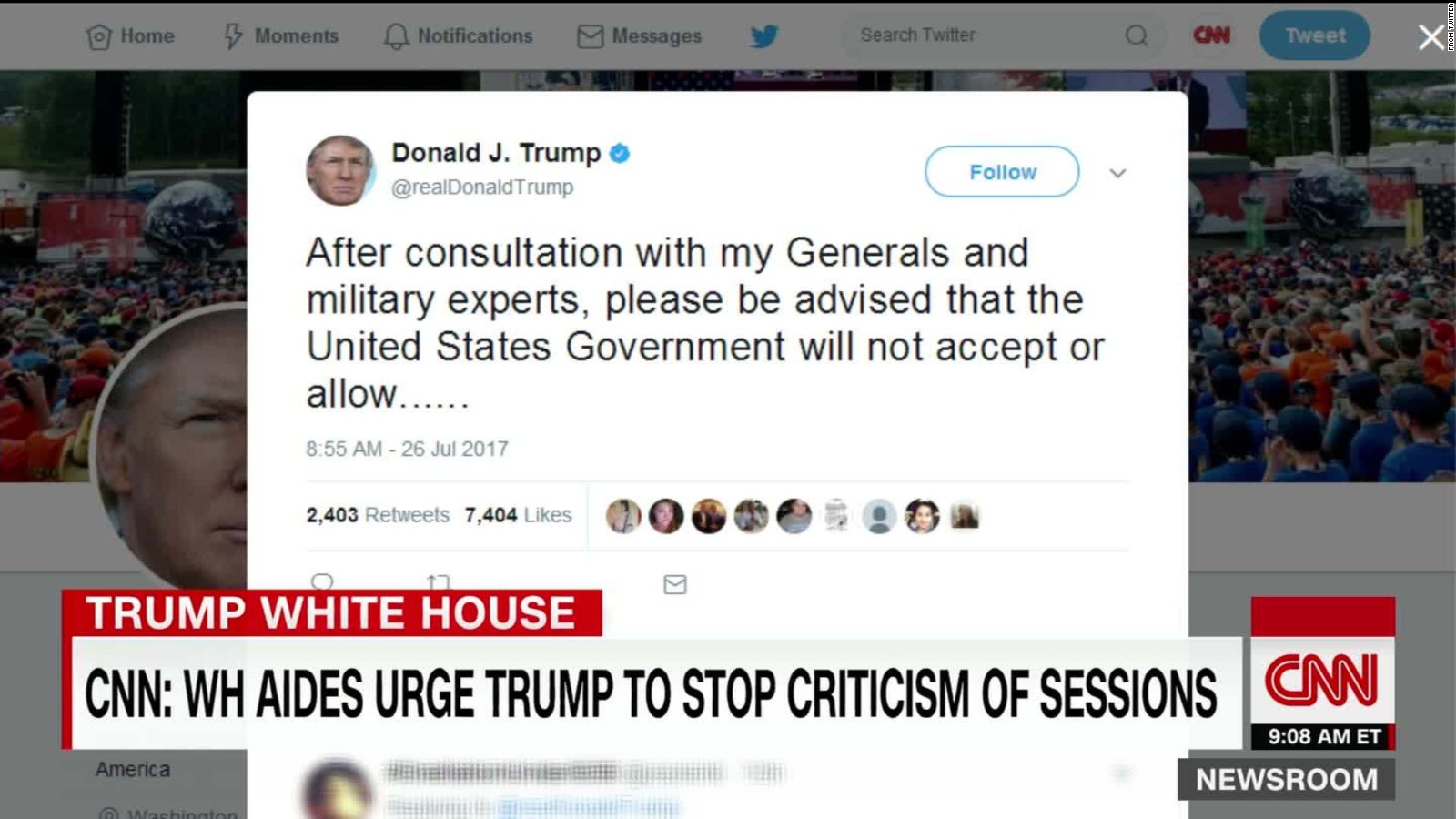

Trumps Transgender Military Ban Fact Vs Fiction

Trumps Transgender Military Ban Fact Vs Fiction

Go Compares Wynne Evans Axed Following Strictly Controversy

Go Compares Wynne Evans Axed Following Strictly Controversy

Nicolas Cage Lawsuit Update Dismissal For Ex Wife Weston Cage Still Involved

Nicolas Cage Lawsuit Update Dismissal For Ex Wife Weston Cage Still Involved

Rhlt Fyraty Mn Alahly Almsry Ila Alerby Tqyym Mstwah

Rhlt Fyraty Mn Alahly Almsry Ila Alerby Tqyym Mstwah

Broad Street Diner To Be Demolished For New Hyatt Hotel Construction

Broad Street Diner To Be Demolished For New Hyatt Hotel Construction