Federal Reserve Chairman Jerome Powell Expresses Tariff-Related Concerns

Table of Contents

Powell's Specific Concerns Regarding Tariffs

Jerome Powell's pronouncements haven't minced words: tariffs pose significant risks to the US economy. His concerns center around three key areas: uncertainty and investment, inflationary pressures, and the disruption of supply chains.

Uncertainty and Investment

Tariffs introduce a significant layer of uncertainty for businesses, making long-term planning and investment decisions exceedingly difficult. This uncertainty stems from several factors:

- Fluctuating Import Costs: The unpredictable nature of tariffs makes it challenging for businesses to accurately forecast future costs, hindering their ability to make sound financial projections.

- Delayed Capital Expenditures: Businesses may delay or cancel planned investments in new equipment, technology, and expansion projects due to the uncertainty surrounding tariff implications.

- Reduced Foreign Investment: The added costs and risks associated with tariffs can deter foreign investment in the US, limiting economic growth potential.

A recent study by the [insert credible source here, e.g., Congressional Budget Office] indicated a [insert statistic, e.g., 10%] reduction in business investment due to tariff uncertainty. This impacts both domestic companies relying on imported goods and foreign firms considering investments in the US market.

Inflationary Pressures

Tariffs directly increase the cost of imported goods, leading to higher prices for consumers. This inflationary pressure can have a domino effect, impacting various sectors of the economy:

- Increased Consumer Prices: Tariffs on imported goods translate directly to increased prices at the retail level, squeezing consumer budgets.

- Wage-Price Spiral: Higher prices can lead to demands for higher wages, further fueling inflation in a potentially damaging wage-price spiral.

- Reduced Consumer Spending: Higher prices may also reduce consumer spending, slowing economic growth and potentially triggering a recession.

Key economic indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI) are closely monitored to gauge the extent of tariff-induced inflation. Any significant upward trend in these indices could prompt the Federal Reserve to take action.

Impact on Supply Chains

Tariffs disrupt global supply chains, creating bottlenecks and increasing the cost of production for businesses reliant on imported inputs:

- Disrupted Production: Businesses that depend on imported components or raw materials face delays and increased costs, hindering their ability to meet production targets.

- Increased Input Costs: The added tariff costs on imported inputs directly increase the overall cost of production, potentially impacting businesses' competitiveness.

- Shifting Production: Some businesses may attempt to relocate production to avoid tariffs, but this often involves substantial costs and complexities.

Industries like manufacturing and agriculture are particularly vulnerable to supply chain disruptions caused by tariffs. The automotive industry, for example, relies heavily on imported parts, making it highly susceptible to tariff-related disruptions.

The Federal Reserve's Response to Tariff-Related Risks

The Federal Reserve, under Chairman Powell's leadership, has a crucial role in mitigating the economic risks associated with tariffs. Their response involves two main strategies: monetary policy adjustments and transparent communication.

Monetary Policy Adjustments

The Federal Reserve might adjust monetary policy tools, such as interest rates and quantitative easing, to counteract the economic effects of tariffs.

- Interest Rate Adjustments: Lowering interest rates can stimulate borrowing and investment, helping to offset the negative impact of tariffs on economic growth.

- Quantitative Easing: This involves injecting liquidity into the market by purchasing assets, potentially mitigating financial market instability.

However, the Fed faces a delicate balancing act. Lowering interest rates to boost growth could also exacerbate inflationary pressures already heightened by tariffs.

Communication and Transparency

Clear and consistent communication from the Federal Reserve is crucial for managing market expectations and maintaining stability during periods of uncertainty.

- Market Guidance: The Fed's statements and press releases help inform market participants about their assessment of the situation and their intended policy responses.

- Confidence Building: Transparent communication helps build confidence among businesses and consumers, encouraging continued investment and spending.

- Powell's Role: Chairman Powell plays a vital role in communicating the Fed's stance and guiding market expectations.

Broader Economic Implications of Powell's Statements

Jerome Powell's concerns extend beyond the immediate US economy; his statements highlight the interconnectedness of global markets and the potential for broader negative consequences.

Global Economic Slowdown

Escalating trade tensions and tariff disputes have the potential to trigger a global economic slowdown.

- Interconnected Economies: The US economy is deeply intertwined with global markets. US trade policies can have far-reaching effects on other countries.

- Reduced Global Trade: Tariffs reduce global trade volumes, hindering economic growth worldwide.

- Global Growth Forecasts: Several international organizations have revised downward their forecasts for global economic growth due to trade tensions.

Market Volatility

Powell's comments and the overall uncertainty surrounding tariffs can lead to increased market volatility.

- Investor Sentiment: Concerns about tariff-related risks can negatively impact investor sentiment, leading to fluctuations in stock markets and other financial instruments.

- Currency Fluctuations: Trade tensions can cause significant fluctuations in exchange rates, affecting businesses involved in international trade.

- Increased Risk Aversion: Investors may become more risk-averse, reducing investment in potentially high-growth sectors.

Conclusion:

Jerome Powell's expressed concerns about tariffs highlight significant risks to the US and global economies. The uncertainty surrounding tariffs impacts investment, fuels inflationary pressures, and disrupts global supply chains. The Federal Reserve's response, involving monetary policy adjustments and transparent communication, is crucial in mitigating these risks. However, the broader economic implications, including the potential for a global slowdown and increased market volatility, underscore the seriousness of these tariff-related concerns. Stay updated on the latest developments concerning Jerome Powell's tariff concerns, learn more about the economic impact of tariffs, and follow the Federal Reserve's response to Jerome Powell's tariff concerns to navigate these complex economic times effectively.

Featured Posts

-

La Fire Aftermath Rising Rent And Accusations Of Price Gouging

May 26, 2025

La Fire Aftermath Rising Rent And Accusations Of Price Gouging

May 26, 2025 -

Ovde Penzioneri Uzivaju Luksuz Skupine Vile I Bogatstvo

May 26, 2025

Ovde Penzioneri Uzivaju Luksuz Skupine Vile I Bogatstvo

May 26, 2025 -

Spectator Who Spat At Van Der Poel Faces 300 Fine

May 26, 2025

Spectator Who Spat At Van Der Poel Faces 300 Fine

May 26, 2025 -

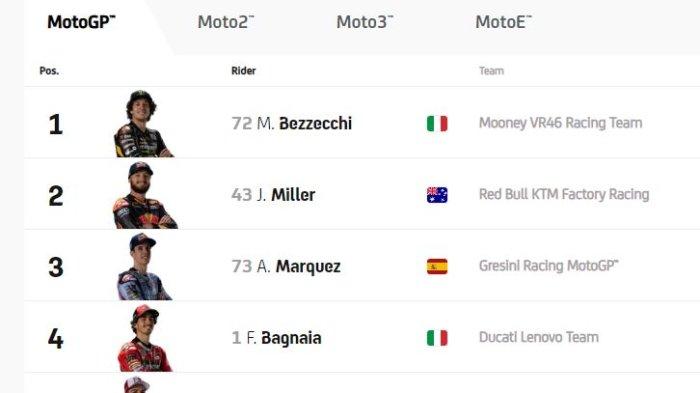

Link Live Streaming And Hasil Fp 1 Moto Gp Inggris 2025 Di Trans7

May 26, 2025

Link Live Streaming And Hasil Fp 1 Moto Gp Inggris 2025 Di Trans7

May 26, 2025 -

Qdyt Qtl Alasrt Alfrnsyt Ahdth Almstjdat Fy Althqyq

May 26, 2025

Qdyt Qtl Alasrt Alfrnsyt Ahdth Almstjdat Fy Althqyq

May 26, 2025