Financial Barriers: Practical Steps To Break Free From Lack Of Funds

Table of Contents

Understanding Your Financial Situation: The First Step to Breaking Free

Before you can break free from financial barriers, you need a clear understanding of your current financial situation. This involves gaining financial literacy and employing effective budgeting techniques. Creating a realistic budget and meticulously tracking your expenses is crucial for identifying areas where you can save and make informed financial decisions.

-

Use budgeting apps or spreadsheets: Numerous budgeting apps and spreadsheet templates are available to simplify the process. These tools allow you to categorize expenses, track spending, and project future finances. Popular options include Mint, YNAB (You Need A Budget), and Personal Capital.

-

Categorize expenses (needs vs. wants): Differentiating between essential needs (housing, food, transportation) and wants (entertainment, dining out, luxury items) helps prioritize spending and identify areas for potential savings.

-

Identify areas for potential savings: Once you have a clear picture of your spending habits, you can pinpoint areas where you can reduce expenses. This might involve cutting back on subscriptions, finding cheaper alternatives for groceries, or negotiating lower bills.

-

Analyze past spending habits to spot recurring issues: Reviewing past spending patterns can reveal recurring expenses that might be unnecessary or excessive. This analysis provides valuable insights for making informed financial decisions moving forward.

Understanding your net worth—the difference between your assets (what you own) and liabilities (what you owe)—is equally important. Knowing your net worth provides a comprehensive overview of your financial health and helps you set realistic financial goals. Effective financial planning hinges on this foundational understanding of your overall financial picture.

Strategies to Increase Your Income

Increasing your income is a powerful way to overcome financial barriers. Exploring various income-generating opportunities can significantly improve your financial situation and accelerate your journey towards financial freedom. Here are several avenues to explore:

-

Negotiate a raise at your current job: Research industry standards for your role and experience level. Prepare a compelling case highlighting your accomplishments and contributions to justify a salary increase.

-

Explore side hustles: The gig economy offers numerous opportunities for generating passive income or supplemental income. Consider freelancing, driving for ride-sharing services, or offering online tutoring or consulting services.

-

Develop and sell a product or service: If you have a unique skill or talent, consider developing a product or service and selling it online or through local markets. This can be a powerful way to create multiple income streams and build a business.

-

Invest in your skills to command higher pay: Upskilling or reskilling can make you more marketable and increase your earning potential. Consider taking online courses, attending workshops, or pursuing further education to enhance your professional profile.

Diversifying your income streams is crucial for long-term financial security. Relying solely on one income source leaves you vulnerable to unexpected setbacks. Multiple income streams provide a safety net and accelerate your progress towards achieving your financial goals.

Effective Debt Management Techniques to Overcome Financial Barriers

High levels of debt can be a significant financial barrier. Effective debt management strategies are essential for breaking free from the burden of debt and regaining financial control.

-

Create a debt repayment plan: Organize your debts by interest rate and create a repayment plan that prioritizes high-interest debts. This strategy minimizes the total interest paid and accelerates debt reduction.

-

Prioritize high-interest debts: Focus on repaying debts with the highest interest rates first to reduce the overall cost of borrowing. Strategies like the debt avalanche method prioritize high-interest debt, while the debt snowball method focuses on paying off the smallest debts first for psychological motivation.

-

Consider debt consolidation options: Debt consolidation involves combining multiple debts into a single loan with a potentially lower interest rate. This can simplify repayments and reduce the total interest paid.

-

Negotiate lower interest rates with creditors: Contact your creditors to negotiate lower interest rates or more favorable repayment terms. Many creditors are willing to work with borrowers facing financial difficulties.

Be wary of predatory lending and high-interest debt traps. These practices can exacerbate financial difficulties and hinder your progress towards financial freedom. Seek professional advice if needed, to avoid falling into these pitfalls.

Building a Strong Financial Foundation for Long-Term Stability

Building a strong financial foundation is crucial for long-term financial stability and security. This involves establishing healthy saving and investing habits.

-

Establish an emergency fund: An emergency fund, typically 3-6 months of living expenses, provides a financial safety net during unexpected events like job loss or medical emergencies.

-

Start investing early: Investing early allows your money to grow through compounding returns over time. Explore options like retirement accounts (401k, IRA), stocks, bonds, and mutual funds.

-

Explore different investment vehicles: Research and understand different investment vehicles to diversify your portfolio and manage risk effectively.

-

Seek professional financial advice: If you need guidance, consider consulting a financial advisor who can provide personalized financial planning and investment advice.

Long-term financial planning is essential for achieving significant financial goals, such as retirement and children's education. Developing a comprehensive financial plan ensures you are prepared for the future and can achieve your long-term objectives.

Conclusion

Overcoming financial barriers requires a multifaceted approach encompassing budgeting, income generation, debt management, and long-term financial planning. By implementing the strategies outlined in this article, you can take control of your finances, break free from the constraints of limited funds, and build a brighter financial future. Remember, consistent effort and smart financial decisions are key to achieving financial freedom. Start taking steps today to overcome your financial barriers and build a secure financial future. Don't let financial barriers hold you back – take control of your finances now!

Featured Posts

-

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure

May 22, 2025

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure

May 22, 2025 -

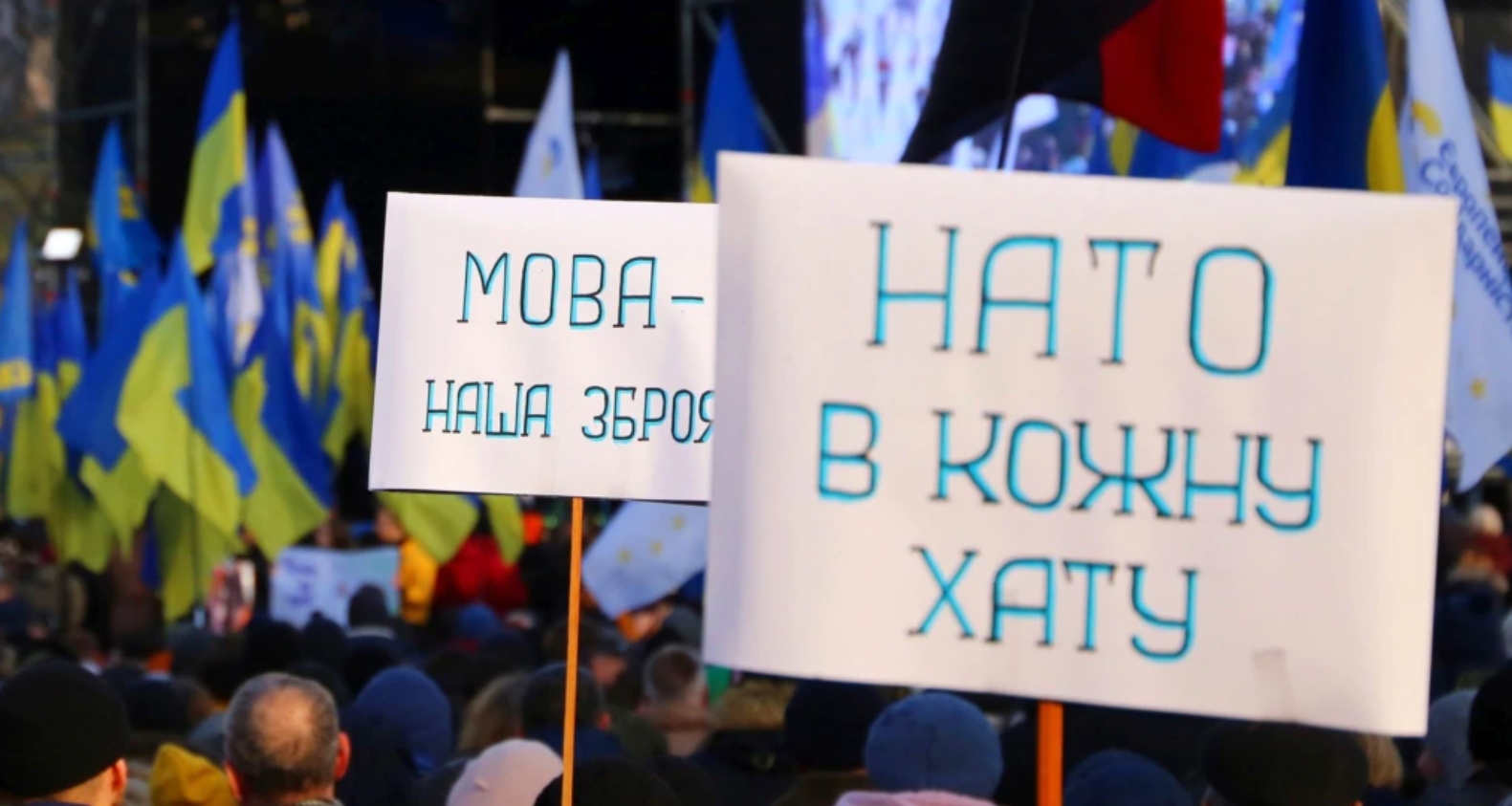

Vstup Ukrayini Do Nato Chi Stane Vidmova Zaporukoyu Podalshoyi Eskalatsiyi Konfliktu Z Rosiyeyu

May 22, 2025

Vstup Ukrayini Do Nato Chi Stane Vidmova Zaporukoyu Podalshoyi Eskalatsiyi Konfliktu Z Rosiyeyu

May 22, 2025 -

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025 -

Pivdenniy Mist Aktualniy Stan Remontno Budivelnikh Robit

May 22, 2025

Pivdenniy Mist Aktualniy Stan Remontno Budivelnikh Robit

May 22, 2025 -

Canada Post Workers Strike A Critical Time For Businesses

May 22, 2025

Canada Post Workers Strike A Critical Time For Businesses

May 22, 2025