Find The Best Tribal Loans With Guaranteed Approval For Bad Credit

Table of Contents

Understanding Tribal Loans and Their Advantages for Bad Credit

Tribal loans are offered by lenders who are owned or operated by Native American tribes. These loans differ from traditional bank loans because they are often governed by tribal law, potentially offering different regulatory frameworks. This can translate into advantages for borrowers with bad credit, including:

- Higher Approval Rates: Tribal lenders may have less stringent credit score requirements than traditional banks, making them a more accessible option for those with less-than-perfect credit history. This makes them a viable option for those seeking high-approval loans.

- Flexible Repayment Options: Some tribal lenders offer flexible repayment plans that can accommodate individual financial situations. This can be crucial for managing debt and avoiding default.

- Potential for Faster Processing: Compared to the sometimes lengthy processes of traditional banks, tribal loan applications can often be processed and funded more quickly. This is especially attractive for those facing urgent financial needs.

Keywords: Native American loans, tribal lenders, high-approval loans, bad credit loans, tribal installment loans

Finding Reputable Tribal Lenders

The tribal loan market, like any lending sector, includes both reputable and predatory lenders. Thorough research is crucial to protect yourself from loan scams and ensure responsible borrowing. Consider these factors when choosing a lender:

- Interest Rates and Fees: Compare interest rates and fees from multiple lenders to find the most competitive offer. Be wary of excessively high rates or hidden fees.

- Repayment Terms: Understand the loan repayment schedule and ensure it aligns with your financial capabilities. Flexible repayment options are a positive sign.

- Customer Reviews: Read online reviews and testimonials from previous borrowers to gauge the lender's reputation and customer service.

- Licensing and Registration: Verify the lender's licensing and registration information to ensure they operate legally and transparently. Look for evidence of responsible lending practices.

Keywords: reliable lenders, best tribal loan companies, avoid loan scams

The Application Process for Tribal Loans

Applying for a tribal loan typically involves these steps:

- Online Application: Most tribal lenders offer online application forms for convenience. You'll need to provide accurate personal and financial information.

- Documentation: Be prepared to provide necessary identification and financial documents, such as proof of income and bank statements. Accuracy is key during this stage.

- Approval: After submitting your application, you'll typically receive a decision within a short time frame. Remember that "guaranteed approval" is rarely a true guarantee – lenders assess your application based on their criteria.

- Review and Signing: Carefully review all loan terms and conditions before signing the agreement. Understand the total cost, including interest and fees, and repayment schedule.

Keywords: tribal loan application, online loan application, quick loan application

Responsible Borrowing Practices with Tribal Loans

Securing a loan is only half the battle; responsible repayment is critical. Follow these steps to manage your debt effectively:

- Budgeting: Create a detailed budget that accurately reflects your income and expenses. Ensure the loan repayment fits comfortably within your budget.

- Repayment Plan: Develop a clear repayment plan to avoid missed payments and potential penalties. Explore options like debt consolidation if necessary.

- Total Cost: Understand the total cost of the loan, including interest and fees, before you commit. This will give you a clearer picture of your financial obligations.

- Seek Help: If you're struggling to repay your loan, contact the lender to discuss options. Consider seeking guidance from a credit counselor for support.

Keywords: responsible lending, debt management, avoiding loan defaults

Conclusion: Making Informed Decisions about Tribal Loans for Bad Credit

Tribal loans can offer a lifeline for individuals with bad credit seeking financial assistance. However, it's crucial to approach the process responsibly and choose reputable lenders. This article highlighted the importance of researching lenders, understanding loan terms, and developing a robust repayment plan. Remember, "guaranteed approval" is often a marketing claim, and responsible borrowing habits are key to avoiding debt traps. Start your search for the best tribal loan that fits your needs today! Research carefully and borrow responsibly. Finding the right tribal loan for your bad credit situation requires careful consideration and planning. For additional resources on managing your finances, consider consulting a credit counselor or exploring reputable financial literacy websites.

Featured Posts

-

The Kanye West Bianca Censori Relationship A Look At Control And Influence

May 28, 2025

The Kanye West Bianca Censori Relationship A Look At Control And Influence

May 28, 2025 -

2025 American Music Awards Free Online Streaming Guide

May 28, 2025

2025 American Music Awards Free Online Streaming Guide

May 28, 2025 -

Perjalanan Mudah Penerbangan Direct Bali Ke Jeddah Via Saudia

May 28, 2025

Perjalanan Mudah Penerbangan Direct Bali Ke Jeddah Via Saudia

May 28, 2025 -

Trumps Plan Diverting Harvard Funding To Support Trade Schools

May 28, 2025

Trumps Plan Diverting Harvard Funding To Support Trade Schools

May 28, 2025 -

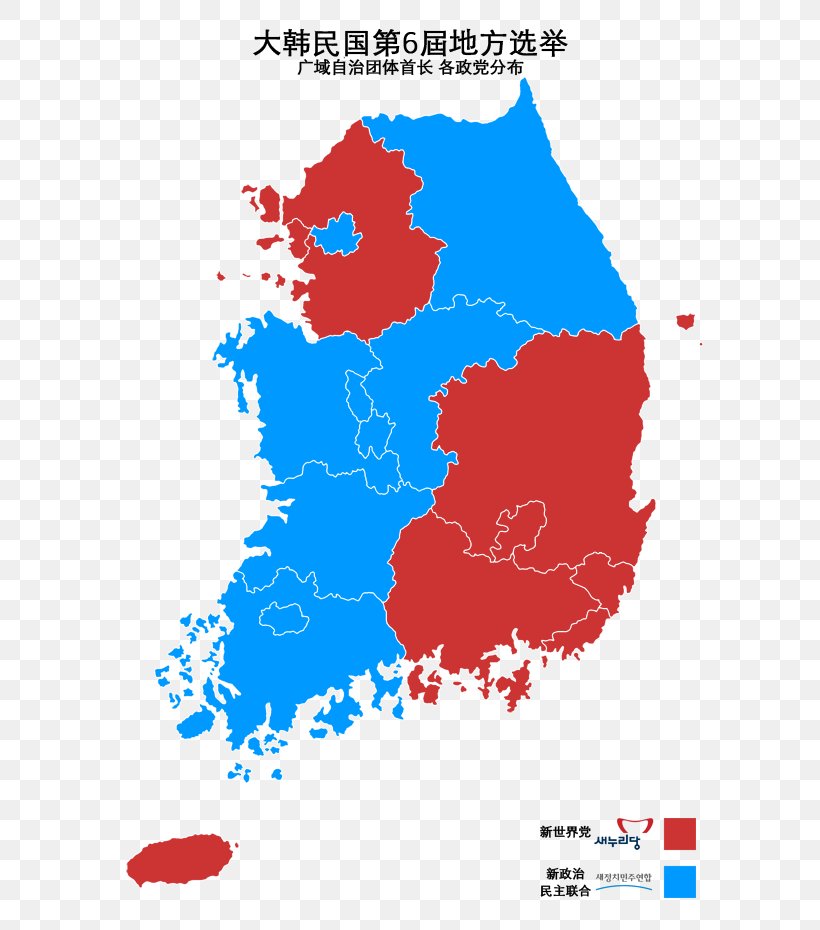

The 2024 South Korean Presidential Election Who Are The Leading Contenders

May 28, 2025

The 2024 South Korean Presidential Election Who Are The Leading Contenders

May 28, 2025