Find The Lowest Personal Loan Interest Rates Today

Table of Contents

Understanding Personal Loan Interest Rates

Before you embark on your search for low interest personal loans, understanding the factors that influence interest rates is essential. This knowledge will empower you to make informed decisions and improve your chances of securing the best possible deal.

Factors Influencing Interest Rates

Several key factors determine the interest rate you'll receive on a personal loan. Let's explore them in detail:

-

Credit Score: Your credit score is the most significant factor influencing your interest rate. A higher credit score (generally above 700) signifies lower risk to lenders, leading to lower interest rates. Conversely, a lower credit score will result in higher interest rates, or even loan denial. To improve your credit score, focus on:

- Paying all bills on time.

- Keeping your credit utilization low (ideally below 30%).

- Maintaining a diverse mix of credit accounts.

- Dispute any errors on your credit report.

-

Debt-to-Income Ratio (DTI): Your DTI is the percentage of your monthly income that goes towards debt payments. A lower DTI indicates better financial stability, making you a less risky borrower and potentially leading to lower interest rates. For example, a DTI of 30% is generally considered good, while a DTI above 43% may raise concerns for lenders.

-

Loan Amount and Term: The amount you borrow and the repayment period significantly impact your interest rate. Larger loan amounts often come with higher interest rates, as they represent greater risk to the lender. Similarly, longer loan terms generally result in higher interest rates because of the extended repayment period.

-

Loan Type: The type of personal loan you choose also affects the interest rate.

- Secured loans, which require collateral (like a car or savings account), usually offer lower interest rates because the lender has less risk.

- Unsecured loans, which don't require collateral, typically come with higher interest rates because of the increased risk for the lender.

Types of Personal Loans and Their Rates

Several options exist when it comes to personal loans, each with its own interest rate range. Understanding these differences is crucial for finding the lowest personal loan interest rates.

- Bank Loans: Typically offer competitive rates, especially for borrowers with good credit.

- Credit Union Loans: Often provide lower rates than banks, particularly for members.

- Online Loans: Offer convenience but may have varying interest rates, some higher than traditional lenders.

- Peer-to-Peer (P2P) Loans: Connect borrowers directly with individual lenders, potentially offering competitive rates but also increased risk if not carefully vetted.

Strategies to Secure the Lowest Personal Loan Interest Rates

Now that you understand the factors influencing interest rates, let's explore strategies to secure the best possible deal. Finding the lowest personal loan interest rates requires proactive effort.

Shop Around and Compare

This is the single most important step. Don't settle for the first offer you receive. Compare offers from multiple lenders—banks, credit unions, and online lenders—to find the most competitive interest rate. Utilize online comparison tools and resources to streamline this process.

Improve Your Credit Score

As mentioned earlier, your credit score is paramount. Take proactive steps to improve it before applying for a loan. Even a small improvement can significantly impact your interest rate.

- Pay down existing debts.

- Correct any errors on your credit report.

- Monitor your credit utilization regularly.

Negotiate with Lenders

Don't be afraid to negotiate! Many lenders are willing to adjust interest rates based on your circumstances. Highlight your positive financial aspects, such as a stable job and low debt-to-income ratio.

Consider Secured Loans

If you qualify, secured loans often come with lower interest rates than unsecured loans. However, remember that you risk losing your collateral if you default on the loan.

Avoiding Personal Loan Scams and High-Interest Traps

Beware of predatory lenders and scams that prey on borrowers desperate for cash.

Red Flags to Watch Out For:

- Extremely high interest rates.

- Hidden fees and charges.

- Unrealistic promises or guarantees.

- Pressure to apply quickly.

- Lack of transparency regarding loan terms.

Choosing Reputable Lenders:

- Check the lender's reputation through online reviews and ratings.

- Verify their licensing and registration.

- Read the fine print carefully before signing any documents.

Conclusion: Find Your Lowest Personal Loan Interest Rates Today

Finding the lowest personal loan interest rates requires careful planning and comparison shopping. By understanding the factors that influence rates, improving your credit score, negotiating with lenders, and avoiding scams, you can significantly reduce the cost of borrowing. Don't delay – find your best personal loan interest rate today! Begin your search for the lowest personal loan interest rates now! Secure the lowest personal loan interest rates with our helpful tips!

Featured Posts

-

Personal Loans Interest Rates Starting Under 6 Today

May 28, 2025

Personal Loans Interest Rates Starting Under 6 Today

May 28, 2025 -

Pacers Knicks Game Nba Responds To Tyrese Haliburtons Showing

May 28, 2025

Pacers Knicks Game Nba Responds To Tyrese Haliburtons Showing

May 28, 2025 -

Info Cuaca Terbaru Sumatra Utara Medan Karo Nias Toba Dan Sekitarnya

May 28, 2025

Info Cuaca Terbaru Sumatra Utara Medan Karo Nias Toba Dan Sekitarnya

May 28, 2025 -

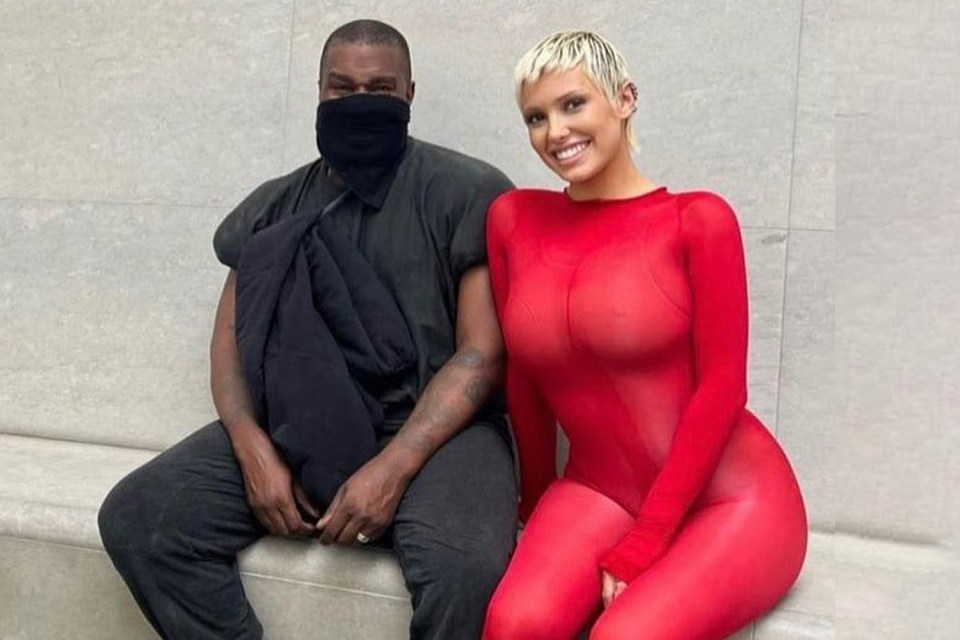

Is This Bianca Censoris Twin Kanye West Seen With Striking Look Alike In Los Angeles

May 28, 2025

Is This Bianca Censoris Twin Kanye West Seen With Striking Look Alike In Los Angeles

May 28, 2025 -

Alejandro Garnacho Manchester Uniteds Stance On Potential Chelsea Bid Revealed

May 28, 2025

Alejandro Garnacho Manchester Uniteds Stance On Potential Chelsea Bid Revealed

May 28, 2025