Fintech IPO Market Collapse: Tracing The Impact Of Trump's Tariffs On Affirm Holdings (AFRM)

Table of Contents

The Boom and Bust of the Fintech IPO Market

The period leading up to the implementation of Trump's tariffs witnessed a surge of enthusiasm surrounding Fintech IPOs. Technological advancements, particularly in mobile payments, AI-driven lending, and blockchain technology, fueled investor interest in disruptive financial technologies. Increased investor confidence, coupled with a low-interest-rate environment, created a perfect storm for a Fintech IPO boom.

- Rapid Technological Advancements: Innovations like mobile wallets and peer-to-peer lending platforms attracted significant investment.

- Increased Investor Appetite for Disruptive Tech: Investors sought high-growth potential, viewing Fintech as a sector ripe for disruption.

- Low Interest Rates: The prevailing low-interest-rate environment encouraged investment in higher-risk, higher-reward ventures.

However, this boom quickly turned to bust. Shifting market sentiment, driven by various factors including escalating trade tensions and growing economic uncertainty, led to a significant decline in investor confidence. The initial excitement gave way to caution as investors reassessed risk and sought safer investment options. Keywords: Fintech IPO Market, IPO Boom, Market Sentiment, Investor Confidence, Technological Disruption.

Trump's Tariffs and Their Macroeconomic Impact

The implementation of Trump's tariffs triggered a trade war, significantly impacting the US and global economy. These tariffs increased the cost of imported goods, leading to:

- Increased Inflation: Higher prices for imported goods fueled inflation, eroding consumer purchasing power.

- Reduced Consumer Spending: Inflation and uncertainty about future economic conditions dampened consumer confidence, leading to decreased spending.

- Higher Interest Rates: In response to inflation, the Federal Reserve raised interest rates, increasing borrowing costs for businesses and consumers.

- Reduced Business Investment: The increased uncertainty and higher borrowing costs discouraged business investment, slowing economic growth.

This macroeconomic fallout had a ripple effect across various sectors, significantly impacting consumer-facing businesses like Affirm Holdings. Keywords: Trump Tariffs, Trade War, Inflation, Interest Rates, Macroeconomic Impact, Global Economy.

The Specific Impact of Tariffs on Affirm Holdings (AFRM)

Affirm's "Buy Now, Pay Later" (BNPL) business model is highly sensitive to changes in consumer spending and borrowing patterns. The macroeconomic consequences of Trump's tariffs created several challenges for AFRM:

- Reduced Consumer Demand: Decreased consumer spending directly impacted the demand for Affirm's BNPL services.

- Increased Costs: Inflationary pressures increased Affirm's operational costs.

- Investor Uncertainty: The overall economic uncertainty created a negative sentiment surrounding the Fintech sector, impacting AFRM's stock performance.

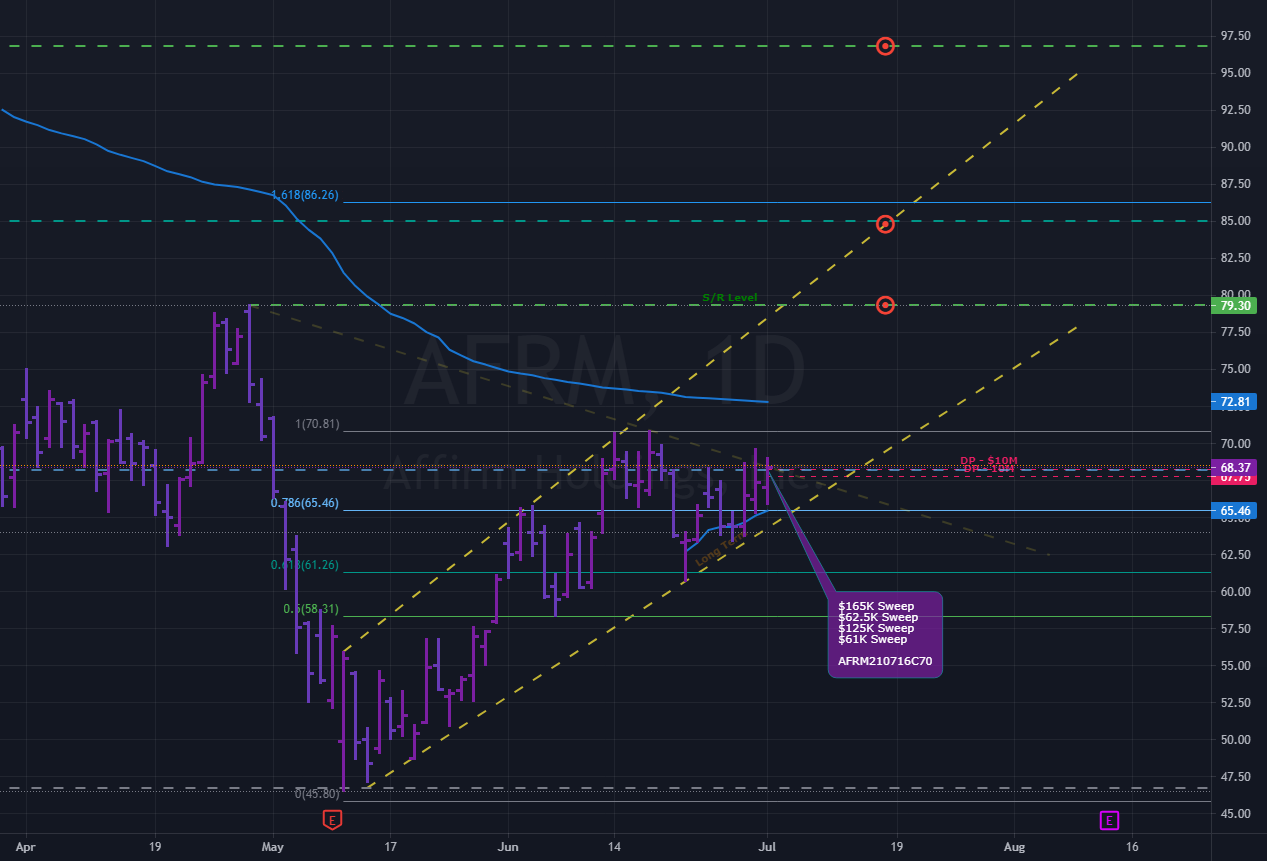

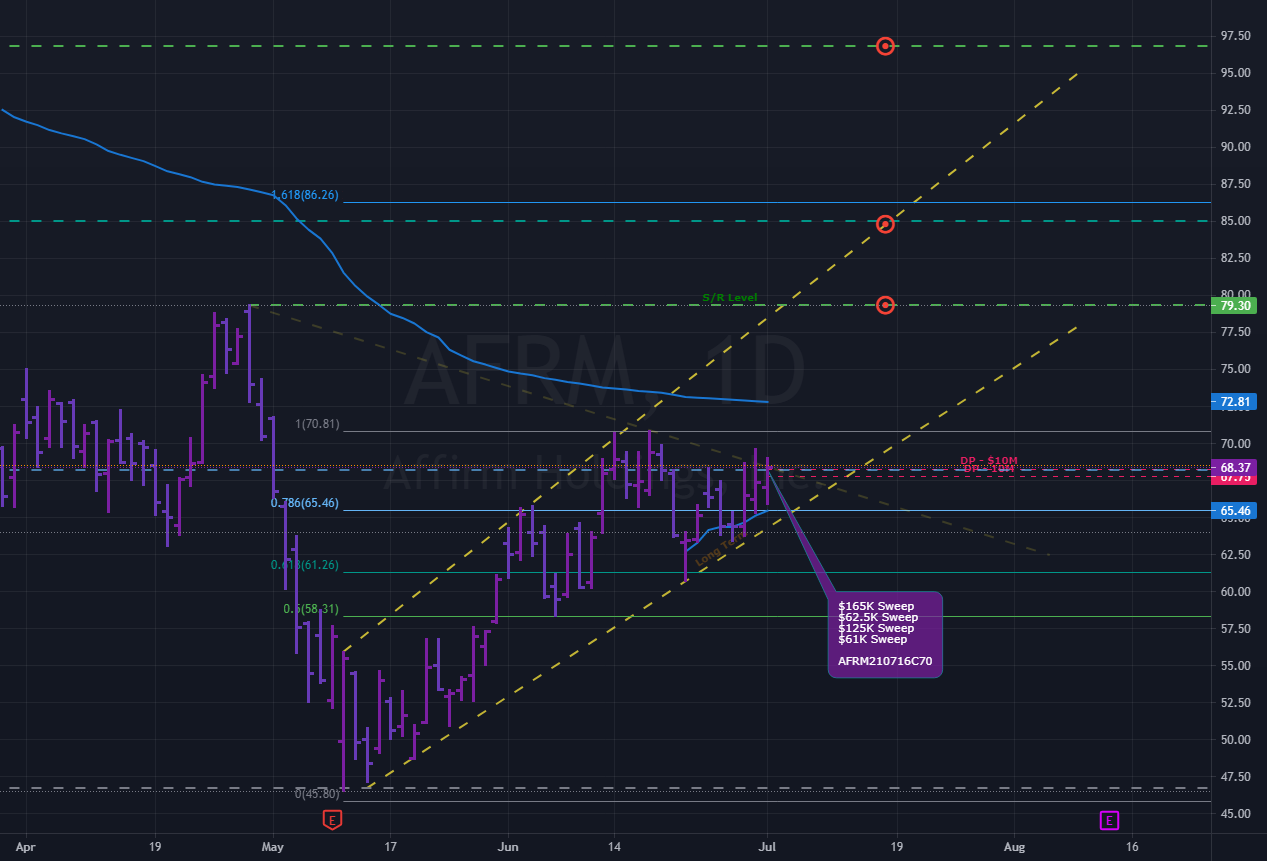

[Insert chart or graph here illustrating AFRM's stock price fluctuations during the period of tariff implementation]. The chart clearly shows a correlation between the implementation of tariffs and a downturn in AFRM's stock price. Keywords: Affirm Holdings (AFRM), Buy Now Pay Later (BNPL), Consumer Spending, Borrowing Patterns, Stock Price, Financial Performance.

Comparing AFRM's Performance to Other Fintech IPOs

While AFRM experienced challenges, it wasn't alone. Many other Fintech IPOs during the same period faced similar headwinds. However, the degree of impact varied depending on each company's business model, market position, and financial strength. A comparative analysis reveals common challenges and successes:

- Similar Downturns: Many Fintech companies experienced stock price declines mirroring AFRM's trajectory.

- Varying Degrees of Impact: The impact of tariffs differed based on company-specific factors.

- Resilience and Adaptation: Some Fintech companies demonstrated resilience by adapting to the changing economic landscape.

This peer analysis highlights the broader impact of macroeconomic factors on the Fintech sector, illustrating the interconnectedness of global events and individual company performance. Keywords: Fintech IPO Comparison, Peer Analysis, Industry Trends, Market Competition.

Conclusion: Understanding the Long-Term Effects on the Fintech IPO Market and Affirm (AFRM)

Trump's tariffs contributed significantly to the downturn in the Fintech IPO market, impacting companies like Affirm (AFRM) through reduced consumer spending, increased costs, and investor uncertainty. The long-term implications for the Fintech sector include increased scrutiny of risk assessment and a greater emphasis on navigating economic uncertainties. Companies like AFRM must adopt strategies that focus on operational efficiency, diversification, and a deep understanding of macroeconomic trends.

To stay informed about the evolving landscape of Fintech IPOs and the challenges facing companies like Affirm (AFRM), continue researching and follow our future articles. Understanding the long-term effects of global economic events on individual Fintech companies is crucial for making informed investment decisions. Keywords: Fintech IPO Market Outlook, Long-Term Investment, Risk Assessment, Economic Uncertainty, Affirm Holdings (AFRM) Future.

Featured Posts

-

Former Jake Paul Rival Mocks Anthony Joshua Fight Claims Pauls Response

May 14, 2025

Former Jake Paul Rival Mocks Anthony Joshua Fight Claims Pauls Response

May 14, 2025 -

Michigan Residents Urged To Check Coffee Creamer After Recall

May 14, 2025

Michigan Residents Urged To Check Coffee Creamer After Recall

May 14, 2025 -

Fin De Mission Pour Alexis Kohler Fidele Collaborateur D Emmanuel Macron

May 14, 2025

Fin De Mission Pour Alexis Kohler Fidele Collaborateur D Emmanuel Macron

May 14, 2025 -

Jose Mujica El Legado Del Expresidente Uruguayo

May 14, 2025

Jose Mujica El Legado Del Expresidente Uruguayo

May 14, 2025 -

Tommy Furys Dramatic Tassel Shorts Performance A Look Back

May 14, 2025

Tommy Furys Dramatic Tassel Shorts Performance A Look Back

May 14, 2025