First Quarter Report: Schroders Assets Fall Amid Stock Market Pullback

Table of Contents

Impact of Market Volatility on Schroders' AUM

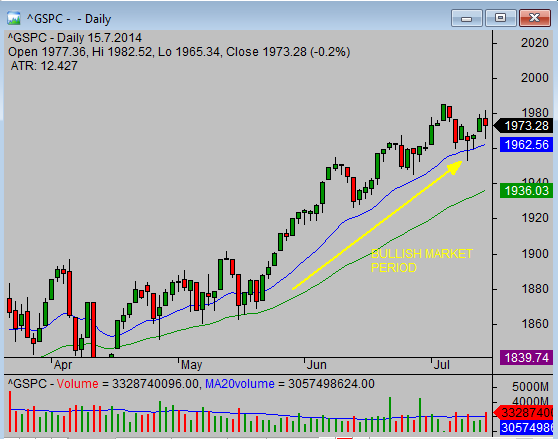

The correlation between market fluctuations and AUM changes for asset management firms like Schroders is undeniable. Market volatility directly impacts investor confidence and portfolio values. During periods of uncertainty, investors tend to withdraw funds, leading to a decrease in AUM. Schroders' Q1 report reflected this trend.

- Specific figures showing AUM decrease: Schroders reported a [Insert Actual Percentage]% decrease in AUM, totaling [Insert Actual AUM Figure] compared to the previous quarter.

- Comparison to previous quarters' performance: This represents a sharper decline than the [Insert Percentage]% decrease observed in Q4 [Year] and a significant deviation from the growth witnessed in [mention previous growth quarters].

- Mention specific asset classes that experienced the most significant declines: Equities experienced the most substantial decline, followed by a notable decrease in fixed-income investments, reflecting the impact of rising interest rates on bond yields.

Geographical Breakdown of AUM Changes

Regional variations in AUM performance were significant. While [mention region] showed relative resilience, [mention region] experienced a more pronounced decline, highlighting the diverse impact of global economic conditions. [Insert map or chart visualizing regional AUM changes here, if available]. This geographic disparity underscores the importance of diversified investment strategies and regional market analysis.

Client Outflows and Their Contributing Factors

Client redemptions contributed to the overall AUM decrease. Investor sentiment, fueled by market uncertainty and concerns about future economic growth, played a crucial role. Many investors opted for safer, more conservative investment options, leading to outflows from higher-risk investment funds managed by Schroders.

Schroders' Strategic Response to Market Conditions

In response to the challenging market environment, Schroders implemented several strategic initiatives to mitigate the impact of the downturn.

- Cost-cutting measures: The company implemented cost-cutting measures, including [mention specific examples, e.g., streamlining operations, reducing workforce].

- Changes in investment strategies: Schroders adjusted its investment strategies, shifting towards more defensive positions in certain asset classes and exploring opportunities in alternative investments.

- Focus on specific investment opportunities: The firm focused on specific investment opportunities that presented value in the current market environment, such as [mention examples, e.g., undervalued equities, emerging markets].

- Communication strategies with investors: Schroders maintained open communication with investors, providing regular updates on market conditions and outlining its strategic response.

Performance of Key Investment Strategies

Despite the overall market downturn, some of Schroders' flagship funds and strategies demonstrated relative resilience. [Mention specific examples and their performance]. However, the overall performance was significantly impacted by the broader market decline.

Outlook and Future Projections

Schroders' outlook for the remaining quarters of 2024 remains cautious, with projections dependent on the trajectory of global economic conditions and market stability. The company anticipates continued volatility and is prepared for potential further downturns. However, it also identifies potential opportunities for growth in specific sectors and regions.

Comparison to Competitors' Q1 Performance

Benchmarking Schroders' performance against its main competitors reveals a mixed picture. While [mention competitor] experienced a similar AUM decline, [mention another competitor] showed comparatively better resilience.

- Comparative data on AUM changes for competitors: [Insert comparative data table showing AUM changes for Schroders and its key competitors].

- Analysis of their strategic responses: Competitors employed various strategies, including similar cost-cutting measures, portfolio adjustments, and increased client communication.

- Highlight areas where Schroders outperformed or underperformed the competition: Schroders' performance in [mention specific asset class or region] was comparatively stronger/weaker than its peers.

Industry-Wide Trends and Challenges

The asset management industry faces several challenges, including increased competition, regulatory changes, and technological disruption. These broader trends further complicate Schroders' efforts to navigate the current market environment and maintain its market share.

Conclusion: Analyzing the Schroders Q1 Report and Looking Ahead

The Schroders Q1 report highlights a significant decline in AUM, primarily driven by market volatility and resulting investor sentiment. Schroders' strategic response, encompassing cost-cutting measures and adjustments to investment strategies, aimed to mitigate the impact of this downturn. While certain segments showed resilience, the overall performance reflects the challenging market conditions faced by the entire asset management industry. Monitoring future market trends and their effects on Schroders' performance is crucial for investors. Stay updated on Schroders' performance and the broader market landscape by regularly checking for their future quarterly reports and financial news. Understanding the impact of market volatility on Schroders assets is crucial for informed investment decisions.

Featured Posts

-

Lange Wachttijden Enexis Over 1000 Limburgse Ondernemers Getroffen

May 02, 2025

Lange Wachttijden Enexis Over 1000 Limburgse Ondernemers Getroffen

May 02, 2025 -

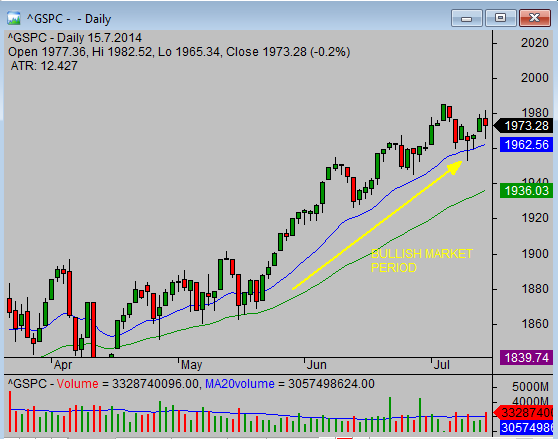

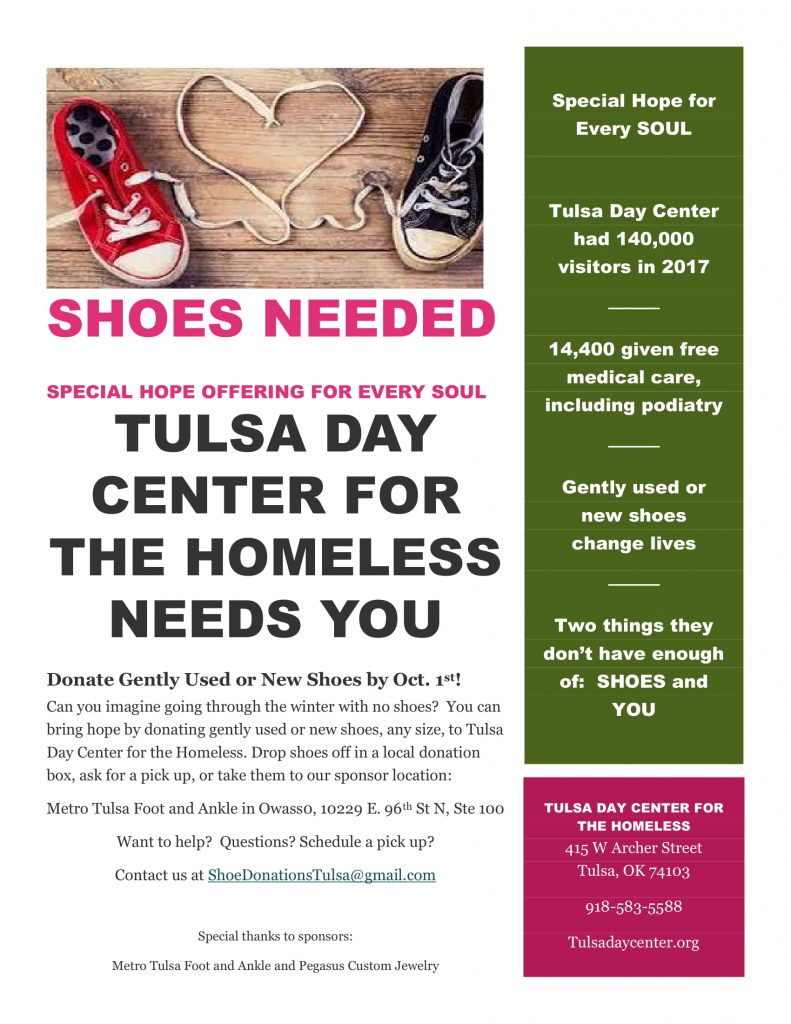

Tulsa Homeless Crisis The Tulsa Day Centers Observations

May 02, 2025

Tulsa Homeless Crisis The Tulsa Day Centers Observations

May 02, 2025 -

East Palestine Ohio Prolonged Exposure To Toxic Chemicals After Train Derailment

May 02, 2025

East Palestine Ohio Prolonged Exposure To Toxic Chemicals After Train Derailment

May 02, 2025 -

The Closure Of Anchor Brewing Company Whats Next For San Franciscos Iconic Brewery

May 02, 2025

The Closure Of Anchor Brewing Company Whats Next For San Franciscos Iconic Brewery

May 02, 2025 -

Sony Play Station Beta Program Registration Now Open Check Requirements

May 02, 2025

Sony Play Station Beta Program Registration Now Open Check Requirements

May 02, 2025