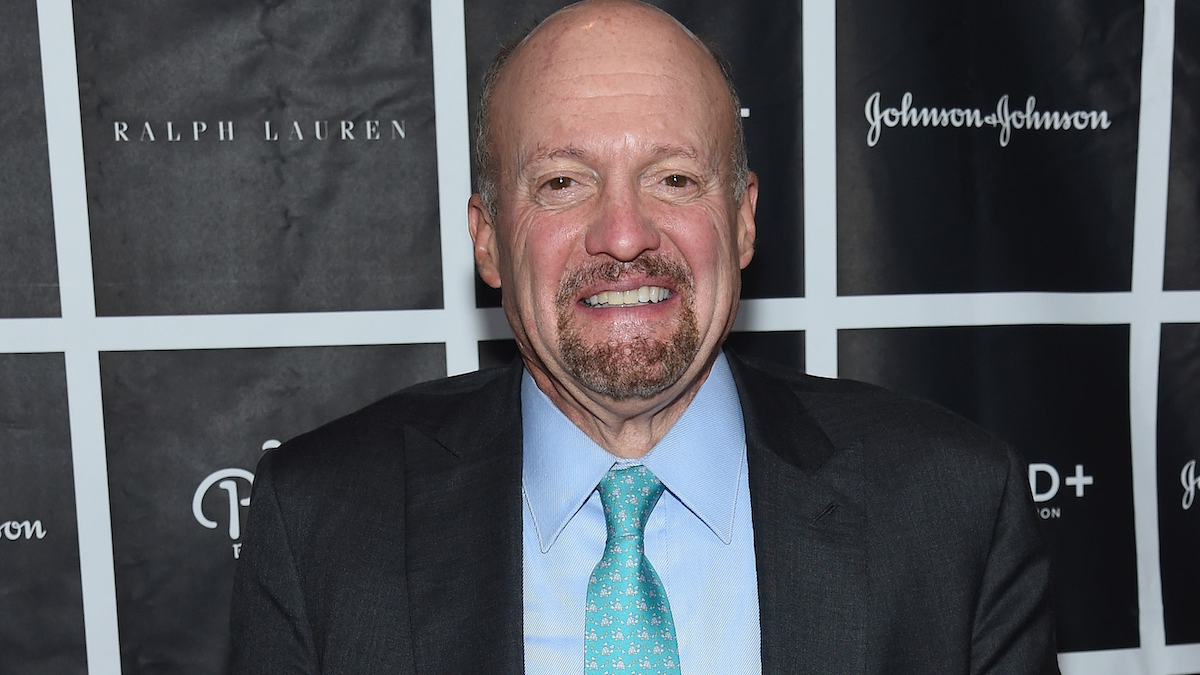

Foot Locker Inc (FL): Jim Cramer's Winning Stock Pick Analysis

Table of Contents

Jim Cramer's Rationale Behind the Foot Locker Investment

Understanding Cramer's rationale is crucial to evaluating his Foot Locker pick. While the exact specifics may vary depending on the date of his recommendation, his arguments likely centered around several key factors:

- Strong Brand Recognition and Market Position: Foot Locker enjoys significant brand recognition and a widespread physical presence, giving it a strong competitive advantage in the athletic footwear market. This established brand loyalty contributes to consistent customer traffic and sales.

- Potential for Growth in Specific Market Segments: Cramer might have highlighted Foot Locker's potential for growth in untapped or underserved markets, such as women's athletic wear or specific sneaker subcultures. Expansion into these areas could drive future revenue growth.

- Strategic Partnerships and Initiatives: Foot Locker frequently collaborates with major sneaker brands on exclusive releases and marketing campaigns. These partnerships can generate significant buzz and boost sales. Cramer likely considered the success and potential of these initiatives.

- Positive Financial Performance Indicators: Strong earnings reports, consistent revenue growth, and positive earnings per share (EPS) are key indicators that attract investors. Cramer's recommendation would likely be supported by positive financial performance data.

- Competitive Landscape Assessment: A crucial aspect of Cramer's analysis would have been an assessment of Foot Locker's standing against competitors like Nike and Adidas. His argument likely involved an evaluation of Foot Locker’s ability to differentiate itself and maintain its market share.

Analyzing Foot Locker's Financial Performance

To assess the validity of Cramer's prediction, a thorough examination of Foot Locker's financial performance is necessary. This involves analyzing key metrics from recent financial reports:

- Revenue Trends and Growth Rates: Consistent year-over-year revenue growth is a positive sign, indicating strong sales and market demand. However, flat or declining revenue would suggest potential problems.

- Profit Margins and Profitability: Examining profit margins (gross and net) reveals the company's efficiency and profitability. Healthy margins suggest effective cost management and pricing strategies.

- Debt Levels and Financial Stability: High levels of debt can pose significant risks. Analyzing Foot Locker's debt-to-equity ratio helps assess its financial stability and long-term prospects.

- Key Financial Ratios Compared to Industry Benchmarks: Comparing Foot Locker's key financial ratios (e.g., return on equity, return on assets) to industry averages provides context and highlights areas of strength or weakness. This comparative analysis is essential for a comprehensive evaluation.

Assessing Market Sentiment and External Factors

Foot Locker's success isn't solely dependent on its internal performance. External factors significantly influence its prospects:

- Economic Trends and Consumer Spending: Economic downturns often reduce consumer spending on discretionary items like athletic footwear, impacting Foot Locker's sales. Analyzing prevailing economic trends is crucial.

- Competitive Landscape and Competitor Actions: The actions of competitors, such as Nike and Adidas, directly influence Foot Locker's market share and profitability. New product releases, marketing campaigns, and pricing strategies all impact the competitive landscape.

- Sneakerhead Culture and Market Trends: The sneaker market is driven by trends and cultural shifts. Understanding the current trends in sneaker culture and predicting future trends is vital for assessing Foot Locker's long-term potential.

- Relevant News and Events: Any significant news or events affecting Foot Locker (e.g., supply chain disruptions, changes in management) should be considered in the analysis.

Risks and Potential Downsides

While Cramer may present a bullish outlook, it’s crucial to acknowledge potential risks:

- Increased Competition: The athletic footwear market is intensely competitive. New entrants and aggressive marketing campaigns from established players pose a constant threat to Foot Locker's market share.

- Economic Downturn: A recession or significant economic slowdown could dramatically reduce consumer spending on discretionary goods, negatively affecting Foot Locker’s sales.

- Changing Consumer Preferences: Shifts in consumer preferences towards different brands or styles of footwear could impact Foot Locker's sales and profitability.

- Supply Chain Disruptions: Global supply chain issues can lead to stock shortages and increased costs, affecting profitability.

Conclusion

Analyzing Jim Cramer's recommendation on Foot Locker requires a thorough assessment of the company's financial health, its position within the competitive landscape, and the broader macroeconomic factors influencing the retail sector. While Cramer’s bullish stance might be supported by certain positive indicators, a complete picture necessitates careful consideration of the risks and potential downsides. This analysis should inform, but not dictate, your investment decisions. Remember that past performance is not indicative of future results.

Call to Action: Conduct thorough due diligence and consider all factors before investing in Foot Locker (FL) or any other stock. Remember, this analysis is for informational purposes only and should not be considered financial advice. Diversify your investment portfolio to mitigate risk.

Featured Posts

-

Dzho Bayden Ta Dzhill Na Vistavi Otello Porivnyannya Z Inavguratsiyeyu Trampa

May 15, 2025

Dzho Bayden Ta Dzhill Na Vistavi Otello Porivnyannya Z Inavguratsiyeyu Trampa

May 15, 2025 -

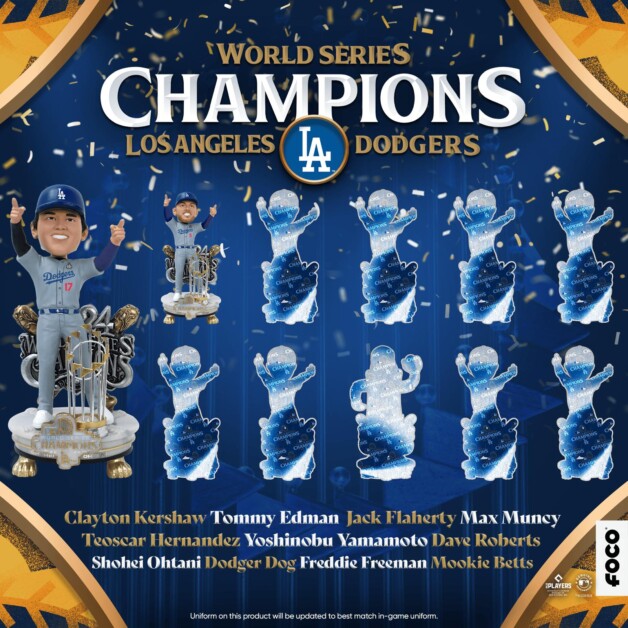

Analyzing The Los Angeles Dodgers 2024 Offseason

May 15, 2025

Analyzing The Los Angeles Dodgers 2024 Offseason

May 15, 2025 -

Elon Musks Alleged Paternity Of Amber Heards Twins A Timeline

May 15, 2025

Elon Musks Alleged Paternity Of Amber Heards Twins A Timeline

May 15, 2025 -

2024 Q2

May 15, 2025

2024 Q2

May 15, 2025 -

Analyzing The Fallout Congos Cobalt Export Ban And The Path Forward

May 15, 2025

Analyzing The Fallout Congos Cobalt Export Ban And The Path Forward

May 15, 2025