Forecasting Apple Stock (AAPL) Price: Important Levels To Consider

Table of Contents

Understanding Fundamental Analysis for AAPL Forecasting

Fundamental analysis examines the intrinsic value of a company to predict its future stock price. For Apple, this involves scrutinizing several key performance indicators.

H3: Revenue and Earnings Growth: Apple's historical financial performance provides a strong foundation for forecasting future growth. Analyzing metrics like Earnings Per Share (EPS), revenue growth rate, and profit margins reveals the company's financial health and potential for expansion.

- EPS Growth: Consistent year-over-year EPS growth is a positive indicator of strong profitability and future stock price appreciation.

- Revenue Growth Rate: A steadily increasing revenue growth rate, particularly in key product segments like iPhones, services, and wearables, signals a healthy market position.

- Profit Margins: High and stable profit margins demonstrate Apple's pricing power and operational efficiency. Reliable sources for accessing this data include the SEC's EDGAR database, Apple's investor relations website, and reputable financial news outlets like Yahoo Finance and Bloomberg.

H3: Product Innovation and Market Share: Apple's success hinges on its ability to innovate and maintain a strong market share. New product launches, like the iPhone 14 series or the Apple Watch Ultra, significantly impact investor sentiment and stock price.

- New Product Launches: The reception of new products, as measured by sales figures and critical reviews, is a crucial factor influencing stock price. A highly anticipated product launch can drive significant short-term price increases.

- Market Share Analysis: Maintaining or expanding market share in key segments, such as smartphones and wearables, demonstrates the strength of Apple's brand and its ability to compete effectively. Analyzing market share data from research firms like Gartner and IDC provides valuable insights.

- Competitive Landscape: Understanding the competitive landscape, including competitors like Samsung and Google, is crucial. Apple's competitive advantages, such as its strong brand loyalty and robust ecosystem, are essential to forecasting its future performance.

H3: Economic Factors and Global Trends: Macroeconomic conditions influence consumer spending and Apple's profitability.

- Interest Rates: Rising interest rates can impact consumer borrowing and spending, potentially affecting demand for Apple products.

- Inflation: High inflation can reduce consumer purchasing power, potentially affecting sales and impacting the stock price.

- Global Economic Growth: Slowing global economic growth can lead to reduced consumer spending and negatively impact Apple's performance.

- Geopolitical Risks: Global events such as trade wars or supply chain disruptions can also create uncertainty and volatility in Apple's stock price.

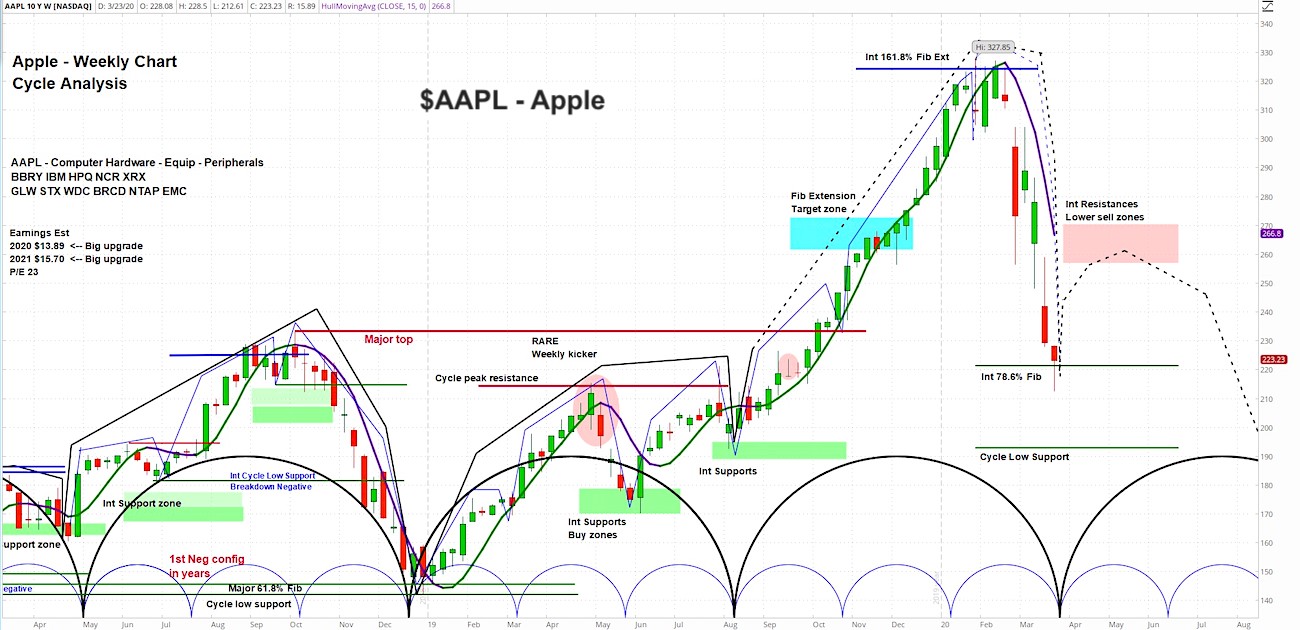

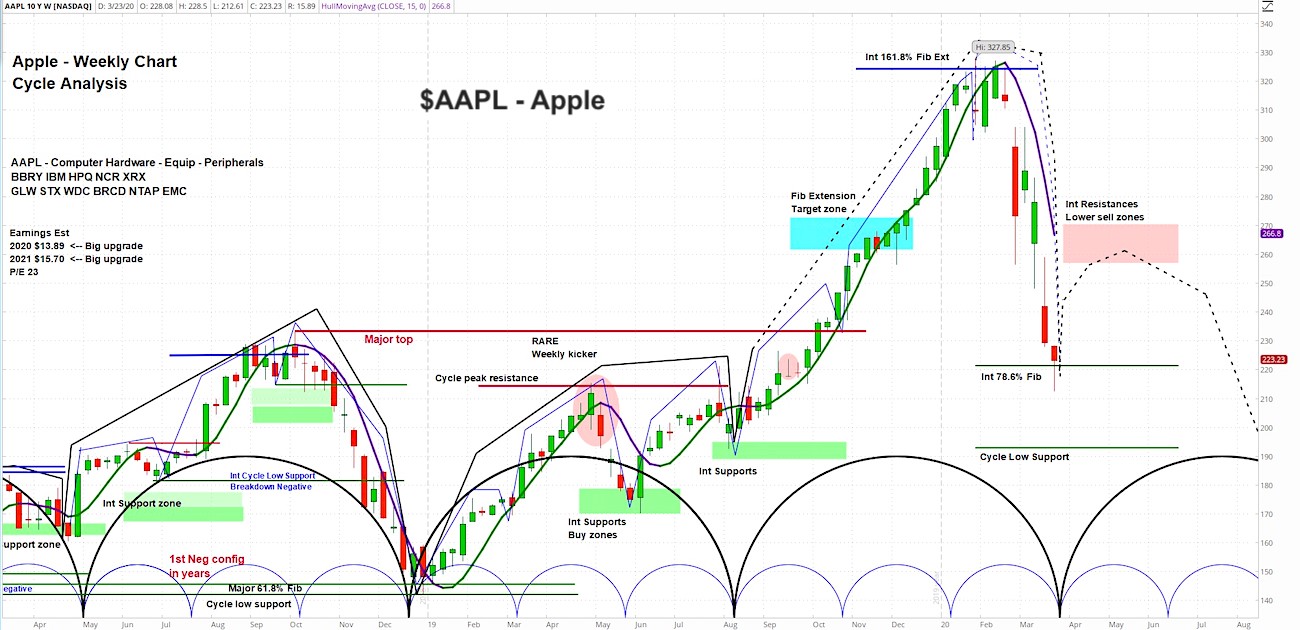

Technical Analysis for Apple Stock Price Prediction

Technical analysis uses past price and volume data to predict future price movements. This approach is complementary to fundamental analysis and helps identify potential trading opportunities.

H3: Chart Patterns and Support/Resistance Levels: Identifying support and resistance levels on price charts helps predict potential price reversals or breakouts. Common chart patterns include head and shoulders, double tops/bottoms, and triangles. Indicators like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can confirm these patterns.

H3: Trendlines and Moving Averages: Trendlines and moving averages help visualize the overall trend of the stock price. Simple Moving Averages (SMA), Exponential Moving Averages (EMA), and Weighted Moving Averages (WMA) provide different perspectives on price momentum. Breakouts above resistance lines or below support lines often signal significant price movements.

H3: Volume Analysis: Analyzing trading volume provides context for price movements. High volume confirms breakouts and suggests strong conviction behind the price movement. Low volume during a price change, on the other hand, suggests weakness and potential for a reversal.

Risks and Uncertainties in Forecasting AAPL Stock Price

Despite the tools available, forecasting AAPL stock price is not without inherent risks.

H3: Market Volatility and Unexpected Events: The stock market is inherently volatile, and unexpected events like supply chain disruptions, regulatory changes, or unexpected economic downturns can significantly impact AAPL's price regardless of any forecast.

- Supply Chain Disruptions: Past disruptions have shown how easily unforeseen events can impact Apple's production and sales, causing significant price fluctuations.

- Regulatory Changes: Changes in regulations, particularly concerning data privacy or antitrust issues, can dramatically affect Apple's operations and valuation.

H3: Limitations of Forecasting Models: Both fundamental and technical analysis have limitations. No model can perfectly predict the future. Fundamental analysis may fail to capture unexpected market events, and technical analysis relies on historical patterns that may not always repeat.

Conclusion:

Forecasting Apple stock (AAPL) price requires a comprehensive approach, combining fundamental analysis of its financial health and product innovation, with technical analysis of price charts and volume. However, it's crucial to remember the inherent risks and limitations involved in any forecasting model. Market volatility and unforeseen events can significantly impact the accuracy of any prediction. Therefore, thorough research, diversification, and effective risk management are essential. Use this information as a building block in your own investment strategy – don't rely solely on any single method when forecasting Apple Stock (AAPL) Price. Continue your research and refine your understanding of AAPL stock price forecasting techniques to make well-informed investment decisions.

Featured Posts

-

Novo Ferrari 296 Speciale Motor Hibrido De 880 Cv E Desempenho Aprimorado

May 24, 2025

Novo Ferrari 296 Speciale Motor Hibrido De 880 Cv E Desempenho Aprimorado

May 24, 2025 -

Escape To The Country Overcoming Challenges And Embracing Rural Life

May 24, 2025

Escape To The Country Overcoming Challenges And Embracing Rural Life

May 24, 2025 -

Dax Stable At Frankfurt Stock Market Opening Following Record Run

May 24, 2025

Dax Stable At Frankfurt Stock Market Opening Following Record Run

May 24, 2025 -

South Florida Hosts Thrilling Ferrari Challenge Racing Days

May 24, 2025

South Florida Hosts Thrilling Ferrari Challenge Racing Days

May 24, 2025 -

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025