Foreign Airlines Acquire 25% Of WestJet, Marking Onex Investment Exit

Table of Contents

Details of the Acquisition

Participating Foreign Airlines

While the exact names of the participating foreign airlines haven't been publicly disclosed (as of this writing), speculation points towards several key players in the global aviation industry. These airlines likely possess significant financial resources and established global networks, making them attractive partners for WestJet. Their involvement could bring considerable advantages, but also raises questions about potential competition and market dominance.

- Potential Airline A: Known for its strong presence in transatlantic routes, robust loyalty program, and efficient operations. This airline could bring substantial expertise in international expansion to WestJet.

- Potential Airline B: A leading carrier in Asia, renowned for its technological advancements and extensive route network within the Asia-Pacific region. This could open new routes and markets for WestJet.

- Potential Airline C: A major player in European aviation, experienced in low-cost carrier models and innovative approaches to customer service. This could lead to cost efficiencies and improved passenger experiences.

The formation of this consortium suggests a strategic alliance aiming for enhanced global connectivity and increased market share.

Acquisition Price and Structure

The financial details of the acquisition remain largely confidential, pending regulatory approvals. However, industry analysts estimate the total investment to be in the billions of dollars, reflecting WestJet's substantial market value. The acquisition likely involved a combination of direct purchase and tender offers to acquire shares from existing WestJet shareholders.

- Funding Sources: A mix of equity financing from the participating airlines and potentially debt financing from financial institutions.

- Financing Agreements: Specific terms of financing arrangements remain undisclosed but likely include various clauses related to performance and regulatory approvals.

- WestJet Valuation: The deal underscores WestJet's considerable market valuation, reflecting its position as a major player in the Canadian airline industry and its potential for future growth.

Regulatory Approvals and Antitrust Concerns

Securing regulatory approvals will be a critical phase for this acquisition. The deal faces potential scrutiny from the Canadian Competition Bureau and other relevant regulatory bodies, both domestically and internationally. Antitrust concerns regarding potential market dominance are likely to be a central focus of the regulatory review.

- Potential Delays: The approval process could experience delays due to extensive investigations and negotiations with regulators.

- Regulatory Framework: Canadian regulations regarding foreign investment in domestic airlines are stringent and aim to protect competition and national interests.

- International Approvals: Approvals might also be required from regulatory authorities in the countries where the participating foreign airlines are based.

Impact on WestJet and its Operations

Changes in Leadership and Strategy

The acquisition will likely trigger significant changes in WestJet's leadership and strategic direction. The influence of the new foreign investors could lead to a shift in WestJet's business model, potentially including increased focus on international routes, code-sharing agreements, and alignment with the global networks of the acquiring airlines.

- New Board Members: The foreign airlines are likely to appoint representatives to WestJet's board of directors, influencing key strategic decisions.

- Business Model Shift: WestJet may adopt more aggressive expansion strategies, focusing on profitable international routes and adopting new technologies.

- Existing Partnerships: The acquisition could reshape WestJet's existing alliances, potentially replacing some partnerships with stronger ties to the acquiring airlines.

Effects on WestJet's Network and Routes

The integration with the global networks of the participating foreign airlines will likely lead to significant changes in WestJet's flight network. We can anticipate expanded international routes, new code-sharing agreements, and potentially even the consolidation or elimination of certain domestic routes.

- Global Network Expansion: WestJet could gain access to new international markets through code-sharing agreements and potential joint ventures with the acquiring airlines.

- Route Optimization: WestJet may streamline its network by focusing on profitable routes and strategically adjusting its flight schedule based on market demand and synergies with its new partners.

- Increased Competition: This will impact competition within Canada, potentially leading to both increased and decreased flight options for specific routes.

Impact on Passengers and Employees

The acquisition will have significant implications for WestJet's passengers and employees. While there's potential for enhanced services and expanded routes, concerns regarding fare increases and job security remain.

- Fare Changes: The long-term impact on fares is uncertain. While initial increases are possible, the enhanced global network and increased competition may eventually lead to price stability or even reductions.

- Service Improvements: The acquisition could lead to enhanced services, including improved in-flight amenities, improved baggage handling, and enhanced customer service.

- Employee Concerns: Concerns regarding job security and potential changes in employment terms and conditions are natural, but transparency and clear communication from WestJet's leadership will be critical.

Onex's Exit Strategy and Investment Return

Onex Corporation's exit from WestJet marks the successful conclusion of a long-term investment strategy. Their initial investment, holding period, and final return on investment will be closely scrutinized by the financial community. This exit reflects Onex's assessment of market conditions and the potential for future returns from other investments.

- Investment Timeline: The duration of Onex's investment in WestJet and the stages of its involvement will influence the overall assessment of the investment's success.

- ROI Analysis: The return on investment will be a key indicator of the success of Onex's strategy, taking into account the initial investment, dividends received, and the final sale price.

- Future Investment Strategies: Onex's decision to divest from WestJet will likely influence its future investment strategies within the airline and broader transportation sectors.

Conclusion

The acquisition of a 25% stake in WestJet by a consortium of foreign airlines marks a pivotal moment for the airline and the Canadian aviation sector. This deal, leading to Onex's complete exit, will undoubtedly reshape the competitive landscape and potentially lead to transformative changes in WestJet's operations. The coming months will be critical in observing the full ramifications of this investment on passengers, employees, and the broader Canadian economy. Stay informed about the ongoing developments concerning foreign airlines acquiring WestJet and the future of this influential Canadian airline. We will continue to update you as this story unfolds. Keep checking back for further updates on this significant development in Canadian aviation.

Featured Posts

-

The Juan Soto Michael Kay Controversy And Its Effect On Sotos Performance

May 12, 2025

The Juan Soto Michael Kay Controversy And Its Effect On Sotos Performance

May 12, 2025 -

Accidental Leak Selena Gomezs Photo Hints At Benny Blancos Relationship

May 12, 2025

Accidental Leak Selena Gomezs Photo Hints At Benny Blancos Relationship

May 12, 2025 -

Chantal Ladesou Le Fil D Ariane Fait Son Grand Retour Sur Tf 1

May 12, 2025

Chantal Ladesou Le Fil D Ariane Fait Son Grand Retour Sur Tf 1

May 12, 2025 -

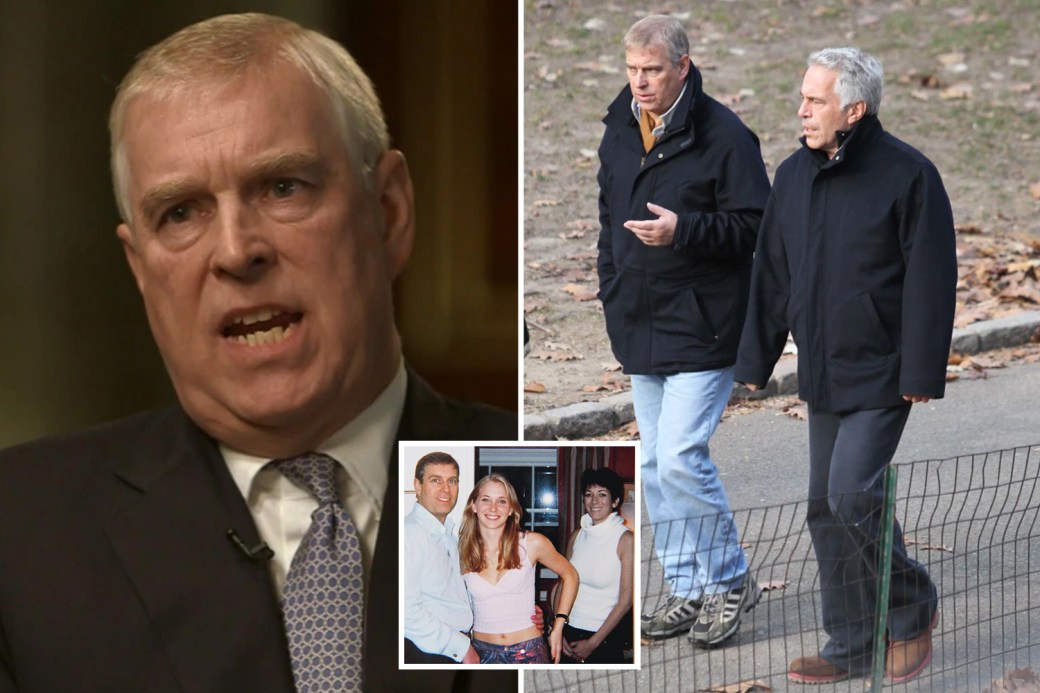

Prince Andrew Accusers Grave Claim 4 Days Left To Live

May 12, 2025

Prince Andrew Accusers Grave Claim 4 Days Left To Live

May 12, 2025 -

Tam Krwz Awr Mdah Jwte Ka Waqeh Awr Adakar Ka Jwab

May 12, 2025

Tam Krwz Awr Mdah Jwte Ka Waqeh Awr Adakar Ka Jwab

May 12, 2025