Four Essential Reads On The Growing Power Of Private Equity

Table of Contents

Understanding the Fundamentals of Private Equity Investing

Defining Private Equity

Private equity represents equity investments in privately held companies. Unlike publicly traded stocks, private equity investments are not readily bought or sold on public exchanges, offering a different risk-reward profile. Several strategies exist within the private equity world:

- Leveraged Buyouts (LBOs): Acquiring a controlling stake in a company using significant debt financing.

- Venture Capital (VC): Investing in early-stage companies with high growth potential.

- Growth Equity: Providing capital to established companies to fuel expansion and strategic initiatives.

- Distressed Debt/Turnarounds: Investing in financially troubled companies to restructure and improve their performance.

Private equity investments differ significantly from public market investing, characterized by:

- Illiquidity: Shares are not easily traded.

- Higher Risk/Reward Potential: The potential for higher returns is offset by the increased risk.

- Long-Term Investment Horizon: Private equity investments typically involve a longer time commitment compared to public market investments. Private equity funds often have a predetermined lifespan of 7-10 years.

The Private Equity Lifecycle

A typical private equity investment progresses through several key stages:

- Sourcing: Identifying potential investment targets.

- Due Diligence: Thoroughly investigating the target company's financials, operations, and management team.

- Acquisition: Completing the purchase of the target company.

- Portfolio Management: Actively managing the investment, implementing operational improvements, and driving growth.

- Exit Strategy: Selling the investment, typically through an Initial Public Offering (IPO) or a sale to a strategic buyer.

Each stage involves significant considerations, including valuation, negotiation, regulatory approvals, and financial modeling. Successfully navigating this lifecycle requires expertise in finance, operations, and legal matters.

The Impact of Private Equity on Industries and Economies

Reshaping Industries Through Acquisitions and Investments

Private equity firms significantly reshape industries through acquisitions and investments. They often consolidate fragmented markets, leading to industry consolidation and increased efficiency. Moreover, they frequently inject capital to fuel innovation and operational improvements within portfolio companies.

- Healthcare: Private equity has played a significant role in consolidating hospital systems and healthcare providers.

- Technology: Private equity funds have invested heavily in software, SaaS, and other technology companies, driving innovation and market leadership.

- Real Estate: Private equity firms actively invest in real estate development, property management, and REITs.

These investments drive job creation in some instances, and influence how companies operate and innovate.

Economic Impacts

The economic impact of private equity is multifaceted and subject to ongoing debate.

- Positive Impacts: Private equity can create jobs, stimulate economic growth, and improve the operational efficiency of businesses. Investments often lead to restructuring and streamlining which can boost a company's profitability and sustainability.

- Negative Impacts: Critics argue that private equity firms prioritize short-term profits over long-term sustainability, leading to excessive debt loads, job cuts, and reduced competition. The use of leverage in LBOs can increase financial risk.

A balanced perspective requires considering both the potential benefits and drawbacks within the context of specific investments and market conditions. The economic impact is context-specific and should be evaluated on a case-by-case basis.

Key Players and Trends in the Private Equity Landscape

The Largest Private Equity Firms

The global private equity landscape is dominated by several large firms, each with its unique investment strategies and areas of focus. Examples include:

- Blackstone: A global leader with a diversified portfolio across various sectors.

- KKR: Known for its expertise in leveraged buyouts and operational improvements.

- Carlyle: A global investment firm with a significant presence in private equity, real estate, and other asset classes.

- The Carlyle Group: Active across numerous sectors, with a strong focus on technology.

These firms often manage billions of dollars in assets and play a substantial role in shaping the global economy.

Emerging Trends in Private Equity

The private equity industry is constantly evolving, with several key trends shaping its future:

- ESG Investing: Growing emphasis on environmental, social, and governance factors in investment decisions.

- Technology-Enabled Dealmaking: Utilizing technology to improve deal sourcing, due diligence, and portfolio management.

- The Growing Role of Alternative Assets: Increased interest in investments beyond traditional private equity, including infrastructure, real estate, and other asset classes.

- Increased Competition: The industry is becoming more competitive, with a rise in the number of private equity firms and investors.

Four Essential Reads to Deepen Your Understanding

This section provides four essential resources for anyone looking to delve deeper into the world of private equity:

- "Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist" by Brad Feld and Jason Mendelson: A practical guide to navigating the complexities of venture capital deals. (Link to book if available)

- "Private Equity and Venture Capital: An Overview" by the CFA Institute: A comprehensive overview of the private equity and venture capital industry. (Link to report if available)

- (Insert relevant academic journal article here): Focus on a peer-reviewed article offering valuable insights into a specific area of private equity. (Link to article)

- (Insert relevant industry report here): Choose a credible report from a reputable source like PwC or Deloitte. (Link to report)

Conclusion: Harnessing the Growing Power of Private Equity

The growing power of private equity continues to reshape industries and economies. Understanding the fundamentals of private equity investing, its economic impact, key players, and emerging trends is crucial for anyone seeking to navigate the modern financial landscape. By exploring the recommended reads and continuing your research, you can gain a deeper understanding of this dynamic force. Stay informed on the evolving landscape of private equity by delving into our recommended reads and continuing your research. Understanding this dynamic force is key to navigating the modern financial world.

Featured Posts

-

How To Watch 1923 Season 2 Episode 5 Online Free Tonight

May 27, 2025

How To Watch 1923 Season 2 Episode 5 Online Free Tonight

May 27, 2025 -

Debut Muscle Au Ps Faure Et Bouamrane Une Riposte Virulente

May 27, 2025

Debut Muscle Au Ps Faure Et Bouamrane Une Riposte Virulente

May 27, 2025 -

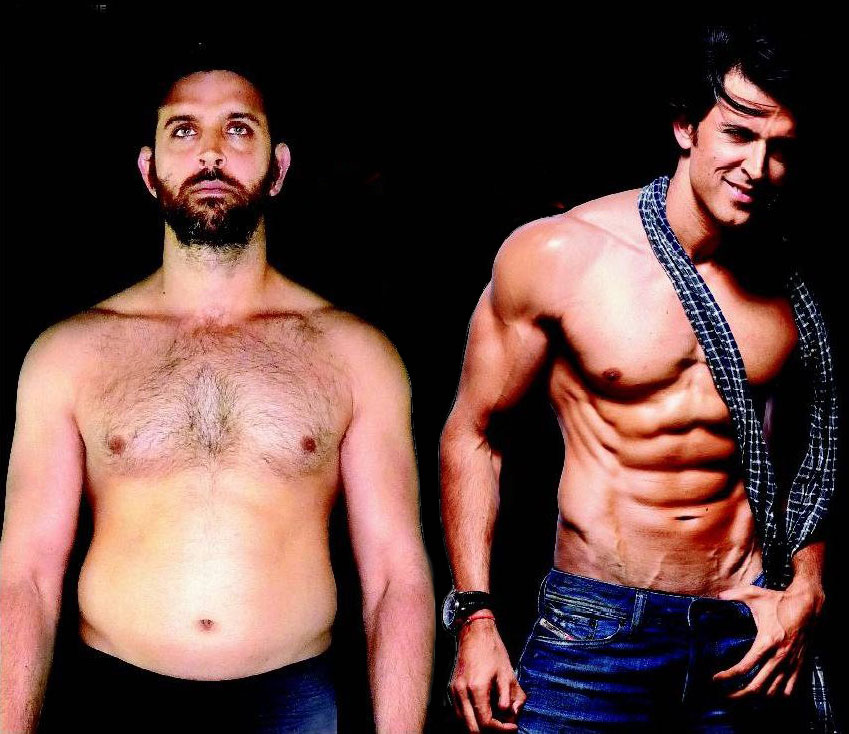

Hrithik Roshans Krrish 4 New Plot Details And Cast Additions Revealed

May 27, 2025

Hrithik Roshans Krrish 4 New Plot Details And Cast Additions Revealed

May 27, 2025 -

Canadas Liberals Reject Leadership Review Rules For Mark Carney

May 27, 2025

Canadas Liberals Reject Leadership Review Rules For Mark Carney

May 27, 2025 -

Gwen Stefani And Blake Shelton Baby News Pregnancy Rumors Explained

May 27, 2025

Gwen Stefani And Blake Shelton Baby News Pregnancy Rumors Explained

May 27, 2025