Frankfurt Stock Exchange: DAX Ends Trading Below 24,000

Table of Contents

Factors Contributing to DAX Decline

Several intertwined factors have contributed to the recent DAX decline, creating a complex challenge for investors.

Geopolitical Uncertainty

Ongoing geopolitical tensions represent a significant headwind for the DAX. Global conflicts and uncertainty create ripples throughout the global economy, impacting investor confidence. The war in Ukraine, for example, has had a profound effect, leading to significant energy price increases and supply chain disruptions. Sanctions imposed on Russia also contribute to market instability.

- Impact on energy prices: The conflict has drastically increased energy costs, impacting businesses across multiple sectors and squeezing profit margins.

- Supply chain disruptions: The war has exacerbated existing supply chain issues, leading to shortages and increased production costs.

- Sanctions: International sanctions against Russia have created further economic uncertainty and volatility. These factors contribute significantly to geopolitical risk and market instability.

Inflationary Pressures and Interest Rate Hikes

Rising inflation remains a major concern, impacting the DAX index performance. Central banks, including the European Central Bank (ECB), are responding with interest rate hikes to combat inflation. This move, while aiming to curb price increases, also increases borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings.

- Inflation data: Persistent high inflation figures continue to fuel concerns about the economic outlook.

- ECB monetary policy: The ECB's aggressive interest rate hikes are designed to control inflation but could also dampen economic activity.

- Impact on corporate earnings: Increased borrowing costs and reduced consumer spending can negatively affect corporate profits, impacting stock valuations. This is a major factor influencing the DAX's recent performance.

Sector-Specific Performance

The DAX decline isn't uniform across all sectors. Some sectors are more vulnerable than others to the current economic headwinds. For example, energy companies, initially benefiting from high prices, might now face headwinds due to potential demand slowdown. The technology sector, often sensitive to interest rate changes, may also experience pressure. Analyzing the performance of individual DAX constituents reveals a nuanced picture.

- Performance of specific sectors: A detailed sector-by-sector analysis is needed to understand the varying impacts of the current market conditions. The energy, technology, and financial sectors are particularly worth monitoring.

- Analysis of individual company performance: Examining the financial reports and stock performance of individual companies within the DAX provides deeper insights into the factors influencing the overall index.

Market Analysis and Expert Opinions

Market analysts offer a range of perspectives on the DAX's recent performance and future outlook. Some believe the current decline is a temporary correction, while others express more caution, citing persistent global uncertainties. Many experts emphasize the importance of careful risk management in the current volatile market.

- Short-term and long-term outlooks for the DAX: Forecasts vary widely, reflecting the inherent uncertainty in the market.

- Predictions for future market trends: Analysts are closely monitoring inflation data, ECB policy decisions, and geopolitical developments to predict future market movement. Their opinions provide valuable insights for investors.

Investor Strategies and Potential Opportunities

Despite the current market uncertainty, the DAX's decline also presents potential investment opportunities for savvy investors. A well-diversified portfolio, incorporating risk management strategies, can help mitigate potential losses. However, careful due diligence and a long-term perspective are essential.

- Risk management strategies: Investors should implement appropriate risk management techniques to protect their portfolios during periods of market volatility.

- Portfolio diversification: Diversifying investments across different asset classes and sectors can help reduce overall portfolio risk.

- Potential investment opportunities: While risk remains, the decline could present opportunities for long-term investors to acquire undervalued assets.

Conclusion: Navigating the DAX's Dip – Future Outlook and Call to Action

The DAX closing below 24,000 reflects a confluence of factors including geopolitical uncertainty, inflationary pressures, and interest rate hikes. This highlights the current market volatility and the importance of careful monitoring. The Frankfurt Stock Exchange and the DAX index are vital indicators of European economic health, requiring careful attention from investors. Stay updated on DAX news and analysis to make informed decisions regarding DAX trading and investment strategies. Understanding the nuances of DAX performance is critical for successfully navigating this dynamic market. Stay informed and make your investment decisions wisely.

Featured Posts

-

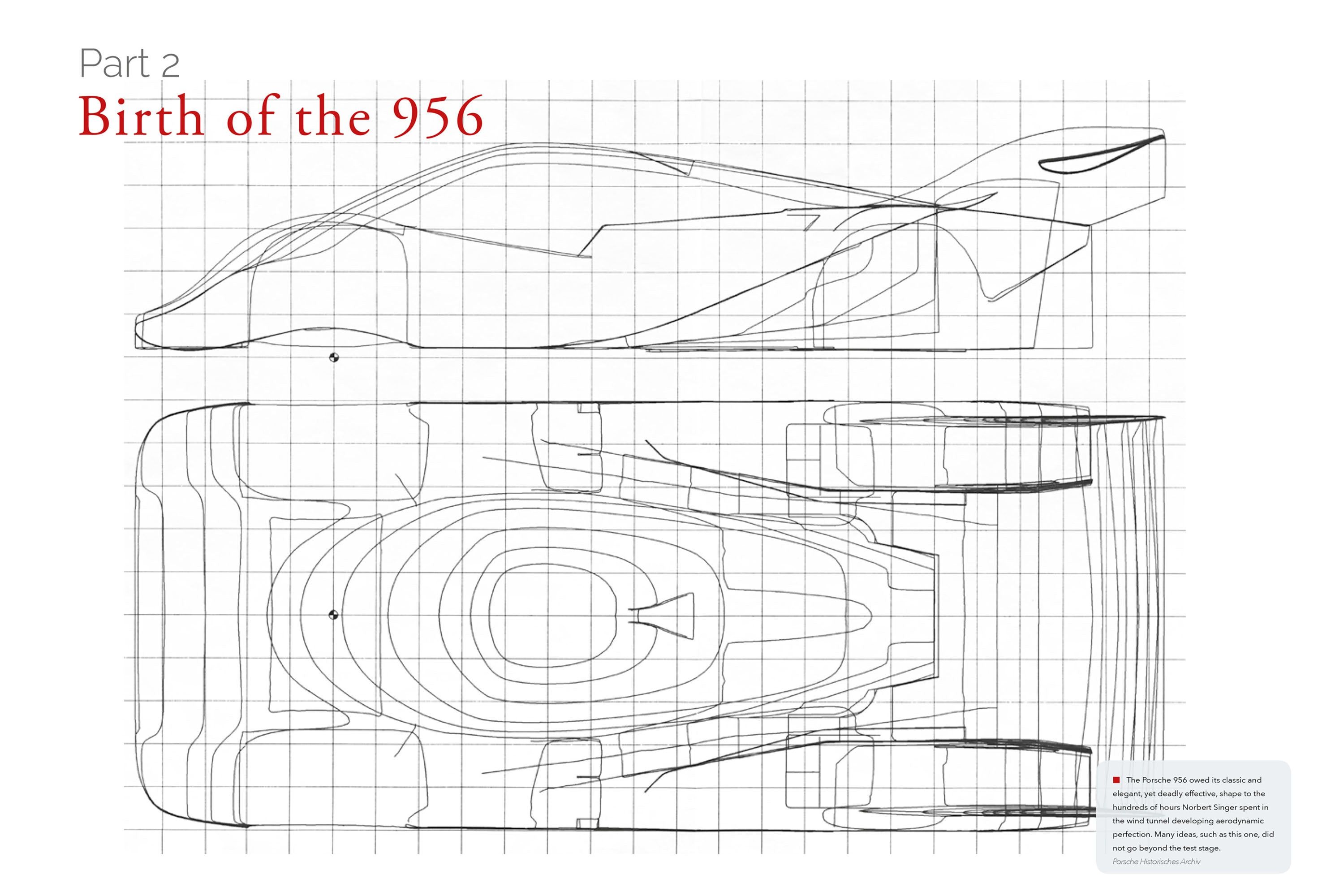

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 24, 2025 -

Aleksandrova Pobezhdaet Samsonovu V Pervom Kruge Shtutgartskogo Turnira

May 24, 2025

Aleksandrova Pobezhdaet Samsonovu V Pervom Kruge Shtutgartskogo Turnira

May 24, 2025 -

H Nonline Sk Prehlad Prepustania V Najvaecsich Nemeckych Spolocnostiach

May 24, 2025

H Nonline Sk Prehlad Prepustania V Najvaecsich Nemeckych Spolocnostiach

May 24, 2025 -

Snelle Marktdraai Europese Aandelen Tijdelijke Verschuiving Of Blijvende Trend

May 24, 2025

Snelle Marktdraai Europese Aandelen Tijdelijke Verschuiving Of Blijvende Trend

May 24, 2025 -

Massachusetts Gun Trafficking Ring Dismantled 18 Brazilians Charged Over 100 Firearms Seized

May 24, 2025

Massachusetts Gun Trafficking Ring Dismantled 18 Brazilians Charged Over 100 Firearms Seized

May 24, 2025