Frankfurt Stock Exchange: DAX Remains Unchanged After Recent Gains

Table of Contents

Analysis of DAX Performance Following Recent Gains

Factors Contributing to the DAX's Stalemate

The DAX's current state of relative inactivity is a complex issue with roots in several key macroeconomic and microeconomic factors. Understanding these factors is crucial for investors trying to navigate the current market climate.

-

Macroeconomic Influences: Rising inflation continues to exert pressure on consumer spending, impacting the profitability of many DAX-listed companies. Simultaneously, the European Central Bank's interest rate hikes increase corporate borrowing costs, further dampening investment and growth. Geopolitical instability, particularly the ongoing conflict in Ukraine, adds an element of uncertainty, making investors hesitant to commit to large-scale investments.

-

Sectoral Performance: The performance of individual sectors within the DAX has been varied. While the technology sector has shown some resilience, the automotive industry, a significant component of the DAX, has been grappling with supply chain disruptions and increased energy costs. The financial sector, too, remains sensitive to interest rate fluctuations and macroeconomic uncertainty.

-

Corporate News: Specific corporate announcements and earnings reports have also played a role. For example, [insert example of a recent significant corporate news event affecting the DAX]. This highlights the importance of staying updated on individual company performance to better understand the overall DAX movement.

-

Bullet Points:

- Impact of rising inflation on consumer spending: Reduced disposable income leads to decreased demand for goods and services.

- Effect of interest rate hikes on corporate borrowing costs: Higher borrowing costs make expansion and investment more expensive.

- Influence of geopolitical instability on investor sentiment: Uncertainty discourages investment and can lead to market sell-offs.

- Performance of specific DAX companies and their effect on the index: Strong performance from individual companies can offset weakness in other sectors, and vice-versa.

Investor Sentiment and Market Volatility

Assessing Investor Confidence

Gauging investor confidence is essential for understanding the DAX's current trajectory. Currently, there's a palpable sense of cautious optimism. While the recent gains were encouraging, the underlying macroeconomic headwinds are preventing a surge in investor confidence.

-

Investor Confidence Indices: Analysis of various investor confidence indices reveals a mixed picture. While some indicators point towards a slight improvement, others remain relatively subdued, reflecting the prevailing uncertainty.

-

Trading Volume: Trading volume on the Frankfurt Stock Exchange has been relatively moderate, suggesting a lack of strong conviction amongst investors. This subdued activity further supports the notion of a market currently consolidating after recent gains.

-

Short-Selling Activity: While not excessively high, short-selling activity remains present, indicating that some investors remain bearish on the DAX's short-term prospects. This highlights the persistent uncertainty in the market.

-

Bullet Points:

- Analysis of investor confidence indices: Several indices, such as the ZEW Indicator of Economic Sentiment, provide insights into investor outlook.

- Examination of short-selling activity: High short-selling activity can signal a bearish market sentiment.

- Discussion of potential market corrections: The possibility of a market correction remains a concern for many investors.

Comparison with Other Major European Indices

DAX Performance Relative to Peers

Comparing the DAX's performance to other major European indices provides valuable context. While the DAX has shown relative stability, other indices like the CAC 40 (France) and the FTSE 100 (UK) have exhibited different patterns.

-

DAX vs. CAC 40: The CAC 40 has shown [Describe the relative performance of the CAC 40 compared to the DAX, explaining potential reasons for differences].

-

DAX vs. FTSE 100: Similarly, the FTSE 100 has [Describe the relative performance of the FTSE 100 compared to the DAX, explaining potential reasons for differences].

-

Sector-Specific Differences: The variations in performance can be attributed to differences in sector composition. For instance, the UK's FTSE 100 has a higher weighting in the energy sector, which has benefited from higher oil prices. This sector-specific difference can significantly influence overall index performance.

-

Bullet Points:

- DAX vs. CAC 40 performance comparison: A direct comparison highlighting similarities and differences in their recent performance.

- DAX vs. FTSE 100 performance comparison: Another direct comparison highlighting similarities and differences in their recent performance.

- Analysis of sector-specific differences: Examination of how different sector weightings affect overall index performance.

Future Outlook for the DAX

Predicting Future Market Trends

Predicting the future direction of the DAX is inherently challenging, but analyzing upcoming economic data and key factors can provide a sense of potential future movement.

-

Upcoming Economic Data Releases: The release of key economic data, such as inflation figures and GDP growth estimates, will significantly influence investor sentiment and the DAX's trajectory. Positive data could lead to renewed optimism, while negative data could trigger a sell-off.

-

Technical Analysis: Technical analysis, based on chart patterns and historical data, can offer insights into potential short-term price movements. However, technical analysis should be used cautiously and in conjunction with fundamental analysis.

-

Expert Opinions: Following the opinions of seasoned market analysts and economists can provide a broader perspective on potential future trends. Consolidating different viewpoints can offer a more well-rounded outlook.

-

Bullet Points:

- Potential impact of upcoming economic data releases: Highlight specific data releases and their potential effects.

- Predictions based on technical analysis: Mention potential technical indicators and their interpretations.

- Expert opinions and forecasts on the DAX: Reference opinions from reputable financial institutions or analysts.

Conclusion: Frankfurt Stock Exchange: DAX Remains Unchanged – What's Next?

In conclusion, the DAX's current state reflects a complex interplay of macroeconomic factors, investor sentiment, and sectoral performance. While recent gains have provided some optimism, the underlying uncertainties prevent a significant upward surge. The DAX’s relative stability following recent increases is a noteworthy development, demanding close monitoring. Key influences include persistent inflation, interest rate adjustments, and geopolitical tensions. The future direction of the DAX hinges on upcoming economic data, investor confidence, and the performance of key sectors. To stay abreast of the ever-evolving dynamics of the Frankfurt Stock Exchange and the DAX index, subscribe to our updates, follow us on [Social Media Links], and continue your research into the intricacies of the German stock market. Understanding the DAX is crucial for successful investment in the German and broader European markets.

Featured Posts

-

Dylan Dreyers Post Mishap Relationship With Today Show Colleagues

May 24, 2025

Dylan Dreyers Post Mishap Relationship With Today Show Colleagues

May 24, 2025 -

Maryland Softballs Comeback Victory Over Delaware

May 24, 2025

Maryland Softballs Comeback Victory Over Delaware

May 24, 2025 -

La France Face A La Repression Chinoise Des Dissidents Sur Son Sol

May 24, 2025

La France Face A La Repression Chinoise Des Dissidents Sur Son Sol

May 24, 2025 -

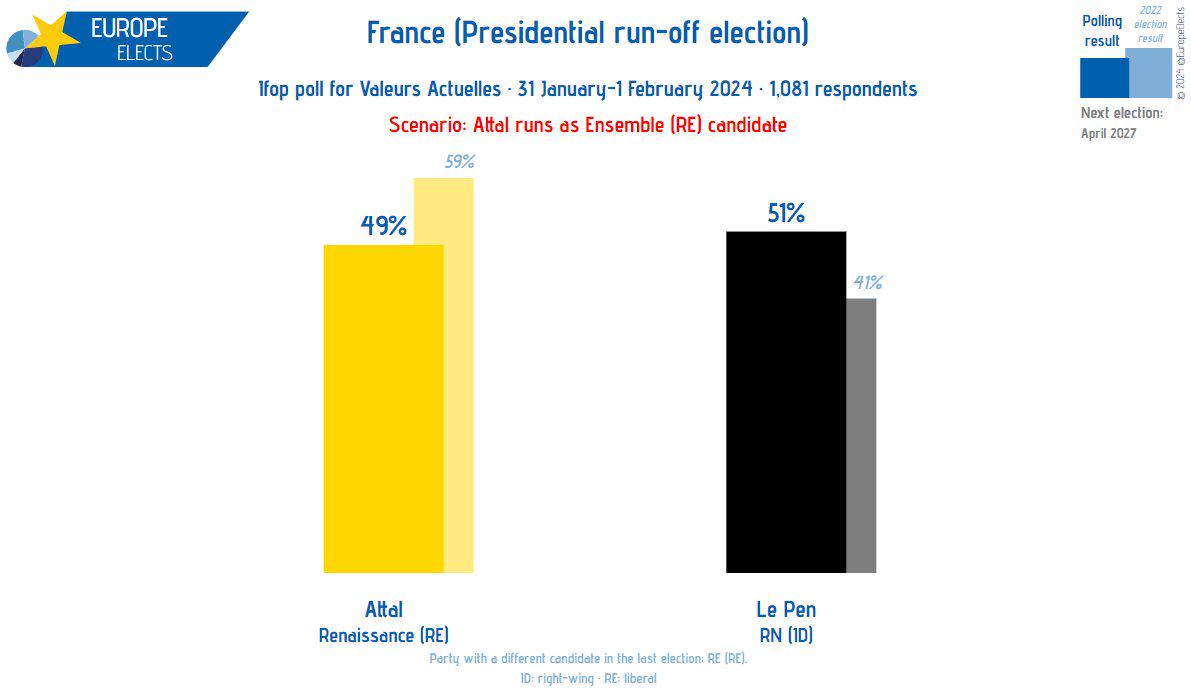

French Presidential Election 2027 Assessing Bardellas Chances

May 24, 2025

French Presidential Election 2027 Assessing Bardellas Chances

May 24, 2025 -

The Ultimate Escape To The Country Choosing The Right Lifestyle

May 24, 2025

The Ultimate Escape To The Country Choosing The Right Lifestyle

May 24, 2025