Frankfurt Stock Market Closes Lower: DAX Below 24,000 Points

Table of Contents

Key Factors Contributing to the DAX Decline

Several interconnected factors contributed to the DAX's fall below 24,000 points. Understanding these is crucial for navigating the current market volatility.

Inflationary Pressures

Rising inflation rates are significantly impacting investor sentiment and corporate earnings within the Frankfurt Stock Market. The persistent increase in prices is squeezing profit margins for many companies, leading to reduced investment and decreased consumer spending.

- Rising energy prices: The ongoing energy crisis in Europe is driving up production costs across various sectors.

- Supply chain disruptions: Global supply chain bottlenecks continue to hamper production and increase input costs.

- Impact on consumer spending: High inflation is eroding purchasing power, leading to decreased consumer demand for many goods and services.

- Central bank responses: While central banks are raising interest rates to combat inflation, these measures can also slow economic growth and negatively impact stock markets.

Geopolitical Uncertainty

Geopolitical uncertainty, particularly stemming from the ongoing conflict in Eastern Europe, is creating significant market volatility. This uncertainty impacts investor confidence and leads to a "flight to safety" strategy, where investors move funds into safer assets like government bonds.

- The conflict in Ukraine: The war continues to disrupt global supply chains and fuel energy price increases, impacting investor confidence and the overall economic outlook.

- Impact on investor confidence: The ongoing geopolitical instability fuels uncertainty and risk aversion among investors.

- Flight to safety: Investors are shifting their portfolios towards less risky assets, leading to capital outflows from the stock market, including the Frankfurt Stock Market.

Weak Corporate Earnings

Underperformance by several key companies within the DAX has further exacerbated the market decline. Several sectors are facing specific headwinds, impacting overall market sentiment.

- Examples of underperforming companies: [Insert examples of specific companies and their recent financial performance. Mention specific sectors affected, e.g., automotive, energy, technology].

- Sector-specific challenges: Specific sectors are disproportionately affected by inflation, supply chain issues, and geopolitical risks.

- Impact on overall market sentiment: Negative corporate earnings reports contribute to a bearish market sentiment, leading to further selling pressure.

Technical Analysis

Technical indicators suggest a downward trend in the DAX. Several key indicators point towards a continuation of the sell-off.

- Moving averages: Short-term moving averages have crossed below long-term moving averages, signaling a bearish trend.

- RSI (Relative Strength Index): The RSI indicates oversold conditions, suggesting a potential short-term rebound, but the overall trend remains bearish.

- Chart patterns: [Mention specific chart patterns, e.g., head and shoulders, bearish flags, that indicate further downside potential].

Impact on Investors and the German Economy

The decline in the DAX has significant implications for both investors and the broader German economy.

Investor Sentiment

Investor sentiment is currently negative, characterized by increased risk aversion and a potential for further sell-offs.

- Increased risk aversion: Investors are becoming more cautious and less willing to take on risk.

- Potential for further sell-offs: The current downward trend may continue, leading to further losses for investors.

- Shifts in investment strategies: Investors are likely to adjust their portfolios to reduce exposure to riskier assets.

Economic Implications

The stock market decline could signal a potential slowdown in the German economy. Decreased business confidence and reduced consumer spending can impact overall economic growth.

- Consumer confidence: Falling stock prices can negatively impact consumer confidence and lead to decreased spending.

- Business investment: Businesses may postpone or reduce investment plans in response to market uncertainty.

- Potential for economic slowdown: The weakening stock market could be a leading indicator of a broader economic slowdown.

Potential Future Outlook for the DAX

Predicting the future of the DAX is challenging, but analyzing both short-term and long-term prospects is essential for investors.

Short-Term Predictions

The short-term outlook for the DAX remains cautious. Several factors could trigger a rebound, but significant risks persist.

- Potential support levels: [Identify potential support levels for the DAX index based on technical analysis].

- Factors that could trigger a rebound: Positive news regarding inflation, geopolitical developments, or improved corporate earnings could lead to a short-term rally.

- Ongoing risks: The risks associated with inflation, geopolitical uncertainty, and weak corporate earnings remain significant.

Long-Term Prospects

The long-term prospects for the German stock market depend on various factors, including economic fundamentals and potential growth sectors.

- Economic fundamentals: The long-term health of the German economy will influence the DAX's performance.

- Potential growth sectors: Identifying and investing in sectors with strong growth potential is key for long-term success.

- Investor strategies for the long term: A long-term investment strategy that considers diversification and risk management is crucial.

Conclusion

The DAX's fall below 24,000 points reflects the combined impact of persistent inflation, ongoing geopolitical uncertainty, and weak corporate earnings. This decline has significant implications for investors and the German economy, potentially leading to decreased consumer confidence and business investment. While a short-term rebound is possible, navigating the current market volatility requires close monitoring of market news and careful consideration of investment strategies. Stay informed about the evolving situation in the Frankfurt Stock Market and the DAX index. Monitor market news closely and consider adjusting your investment strategy based on the latest developments. Understanding the factors influencing the Frankfurt Stock Market is crucial for navigating market volatility and making informed decisions. Continue to follow our coverage for further updates on the DAX and its performance.

Featured Posts

-

Eldorados Fall A Behind The Scenes Look At A Failed Bbc Soap Opera

May 25, 2025

Eldorados Fall A Behind The Scenes Look At A Failed Bbc Soap Opera

May 25, 2025 -

2 2 Million Treatment One Fathers Unwavering Dedication And Perseverance

May 25, 2025

2 2 Million Treatment One Fathers Unwavering Dedication And Perseverance

May 25, 2025 -

Glastonbury 2025 Full Lineup Revealed After Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed After Leak Get Your Tickets Now

May 25, 2025 -

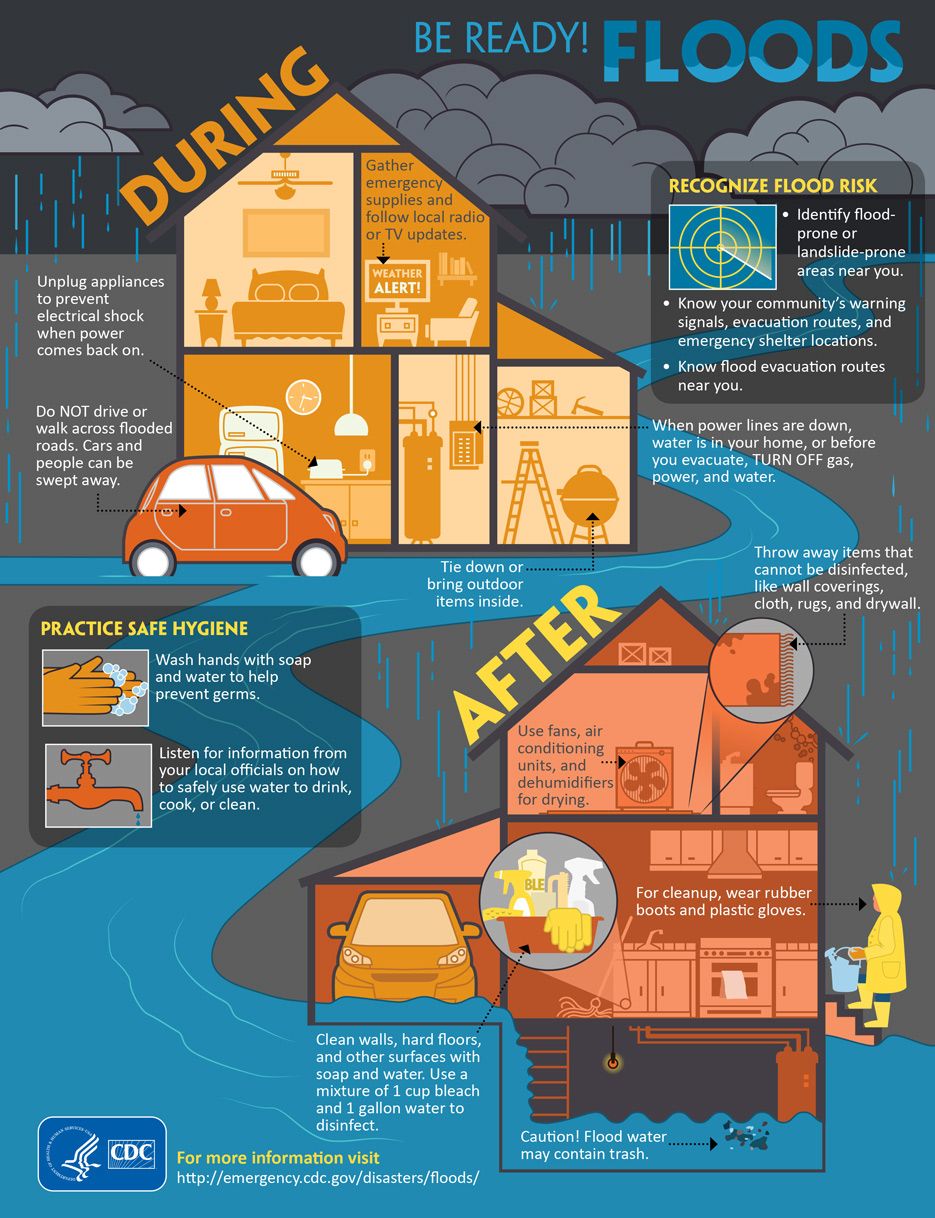

Staying Safe During Floods Essential Flood Safety Measures For Severe Weather Awareness Week

May 25, 2025

Staying Safe During Floods Essential Flood Safety Measures For Severe Weather Awareness Week

May 25, 2025 -

Kyle Walkers Actions A Look At Recent Events Surrounding Annie Kilner

May 25, 2025

Kyle Walkers Actions A Look At Recent Events Surrounding Annie Kilner

May 25, 2025