Frankfurt Stock Market: DAX Remains Stable Following Record Growth

Table of Contents

DAX Performance and Key Contributing Factors

The DAX reached unprecedented heights in [Insert Date and DAX Value], marking a significant milestone for the Frankfurt Stock Market. This record growth wasn't a sudden spike; it was the culmination of several positive factors.

- Strong corporate earnings reports from major DAX companies: Companies like [mention 2-3 specific examples, e.g., Allianz, SAP, Volkswagen] reported robust profits, boosting investor confidence and driving up share prices. These strong financials reflect the underlying health of the German economy.

- Positive economic indicators from Germany and the Eurozone: Favorable data on GDP growth, unemployment rates, and consumer spending signaled a strong economic outlook, further fueling investor optimism in the Frankfurt Stock Market.

- Global investor confidence boosted by positive economic news: Positive economic news from other major economies, particularly the US and China, contributed to a general sense of global optimism, benefiting the DAX and the broader Frankfurt Stock Market.

- Low interest rates maintaining investor appetite for equities: The European Central Bank's (ECB) policy of low interest rates made equities, including those listed on the Frankfurt Stock Market, a more attractive investment compared to bonds and other fixed-income securities.

This combination of factors not only propelled the DAX to record highs but also laid the foundation for its subsequent stability. The sustained positive economic environment and strong corporate performance have cushioned the DAX from significant market fluctuations.

Analysis of Sectoral Performance within the Frankfurt Stock Market

The performance of the Frankfurt Stock Market isn't monolithic; different sectors within the DAX exhibit varying degrees of strength and resilience.

- Strong performance in the technology sector: Driven by ongoing innovation and robust global demand for software, hardware, and digital services, the technology sector within the DAX has been a significant contributor to overall market stability. Companies like SAP continue to thrive.

- Moderate growth in the automotive sector: While facing challenges such as global chip shortages, the automotive sector has demonstrated moderate growth, indicating resilience within the Frankfurt Stock Market. Strategic investments in electric vehicles and software solutions are driving this positive trend.

- Resilience in the financial sector: The financial sector has shown relative stability, benefitting from stable interest rates and consistent demand for financial services.

- Underperforming sectors: [Mention specific underperforming sectors, e.g., certain energy companies, and provide brief explanations for their underperformance].

The diversified nature of the DAX, with representation from various sectors, contributes significantly to the overall stability of the Frankfurt Stock Market. The strength in certain areas often offsets weaknesses in others, creating a more resilient market.

Investor Sentiment and Future Outlook for the Frankfurt Stock Market

Investor sentiment towards the Frankfurt Stock Market and the DAX is currently characterized by cautious optimism. While the recent record growth and sustained stability are positive signs, several factors cloud the outlook.

- Cautious optimism among investors: Geopolitical events, inflation concerns, and the possibility of rising interest rates are tempering the enthusiasm of investors.

- Potential impact of inflation and rising interest rates: The ECB's monetary policy decisions regarding inflation will significantly influence the future trajectory of the DAX. Rising interest rates could dampen investor enthusiasm for equities.

- Expert opinions and forecasts: [Mention expert opinions and forecasts from reputable financial analysts about the future of the Frankfurt Stock Market].

- Potential risks and opportunities: The Frankfurt Stock Market, like any market, presents both risks and opportunities. Investors need to carefully evaluate these before making any investment decisions.

The short-term outlook for the DAX is likely to remain somewhat volatile, subject to global economic and geopolitical developments. The long-term outlook, however, remains positive, given the strong fundamentals of the German economy and the inherent resilience of the DAX.

Trading Strategies and Investment Opportunities on the Frankfurt Stock Market

The current market conditions on the Frankfurt Stock Market offer several investment opportunities for both short-term and long-term investors.

- Value investing: Investors can explore value investing opportunities in undervalued DAX companies with strong fundamentals. This approach focuses on identifying companies trading below their intrinsic value.

- Growth investing: High-potential sectors within the Frankfurt Stock Market, such as technology and renewable energy, offer attractive growth investment opportunities.

- Risk management strategies: Given potential market volatility, implementing effective risk management strategies, such as diversification and stop-loss orders, is crucial.

- Portfolio diversification: Diversifying investments across different sectors and asset classes is essential for mitigating risk in a dynamic market environment like the Frankfurt Stock Market.

Investors interested in gaining exposure to the Frankfurt Stock Market should conduct thorough due diligence and consider seeking professional financial advice.

Conclusion

The Frankfurt Stock Market, as reflected in the stable DAX performance following record growth, presents a multifaceted investment landscape. While global uncertainties persist, the robust German economy and the DAX's diversified composition provide considerable resilience. Understanding the underlying economic factors, sectoral performances, and investor sentiment is key to making informed investment decisions. By carefully assessing opportunities and risks, investors can effectively navigate the Frankfurt Stock Market and potentially benefit from its continued growth. Stay informed about the latest developments in the Frankfurt Stock Market and the DAX to make the best investment choices. Consider consulting a financial advisor before making any investment decisions related to the DAX index or the Frankfurt Stock Market.

Featured Posts

-

Albert De Monaco Abandona Charlene El Princep I Una Actriu En Una Relacio Secreta

May 25, 2025

Albert De Monaco Abandona Charlene El Princep I Una Actriu En Una Relacio Secreta

May 25, 2025 -

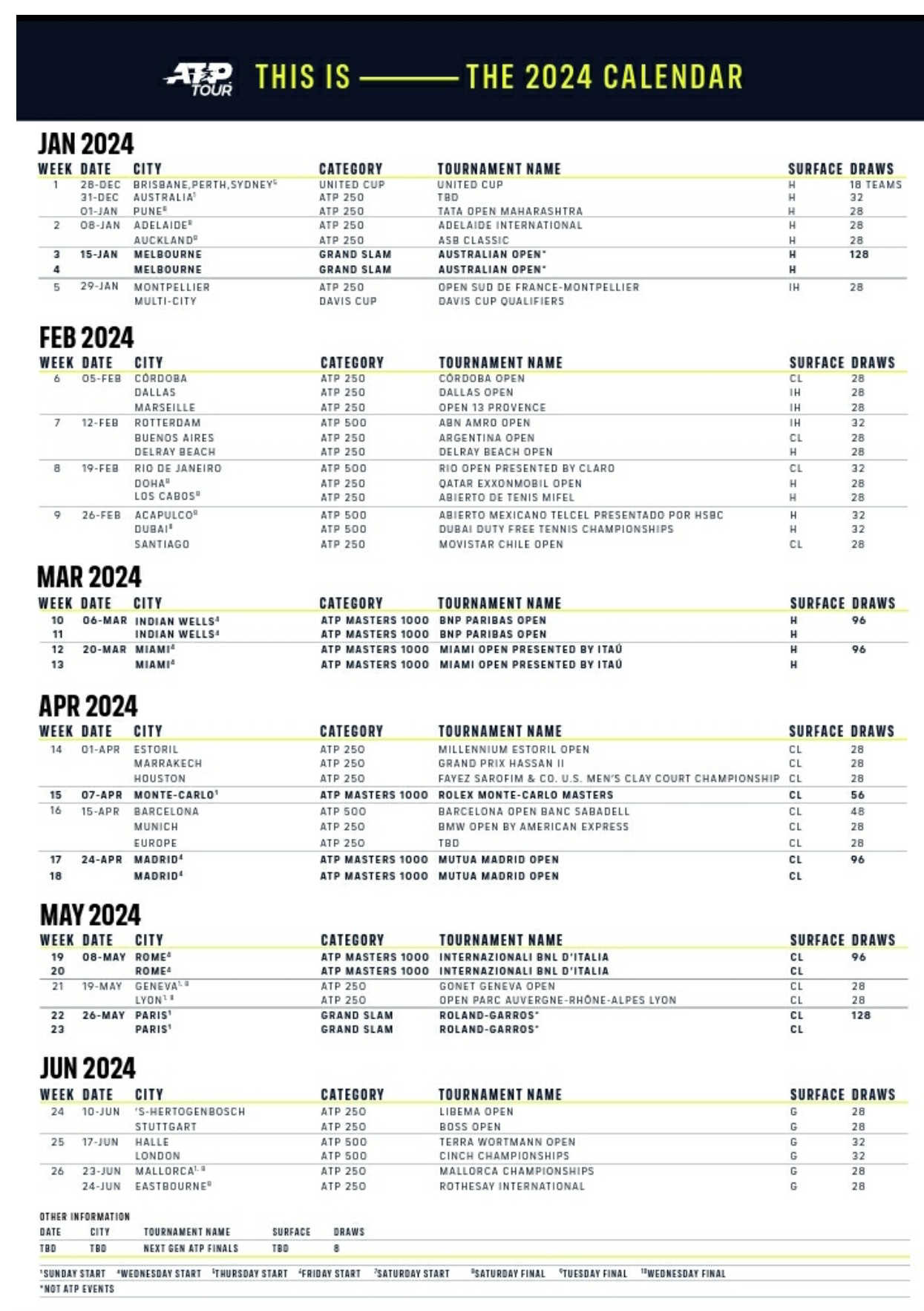

Wta Italian Open Chinese Tennis Ace Advances

May 25, 2025

Wta Italian Open Chinese Tennis Ace Advances

May 25, 2025 -

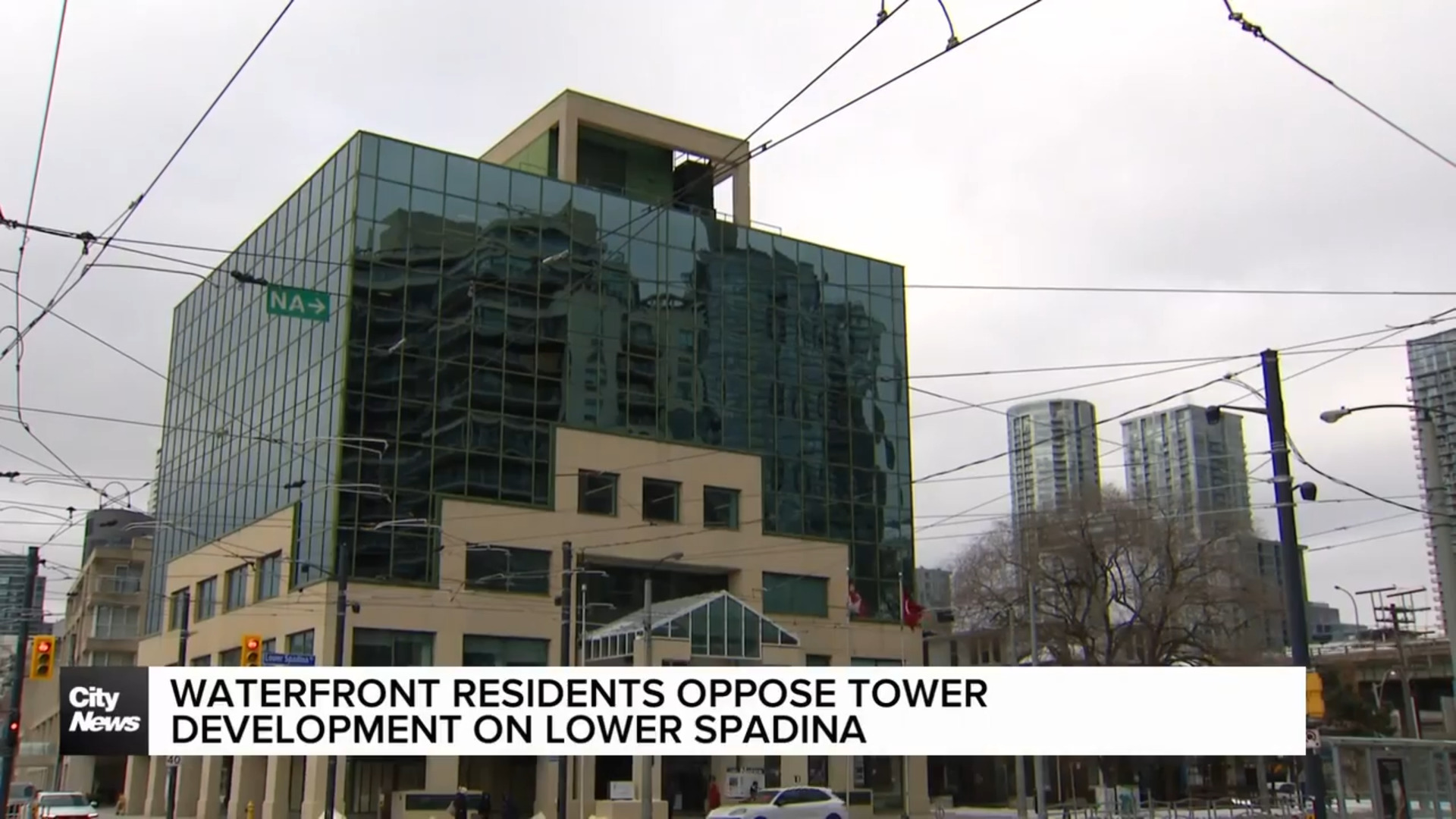

Shooting At Popular Southern Vacation Destination Prompts Safety Review

May 25, 2025

Shooting At Popular Southern Vacation Destination Prompts Safety Review

May 25, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Policy A Call For Accountability

May 25, 2025

Mia Farrow On Trumps Venezuelan Deportation Policy A Call For Accountability

May 25, 2025 -

The Challenges Of Dr Terrors House Of Horrors

May 25, 2025

The Challenges Of Dr Terrors House Of Horrors

May 25, 2025