Fremantle Q1 Financial Report: 5.6% Revenue Decline Due To Reduced Buyer Spending

Table of Contents

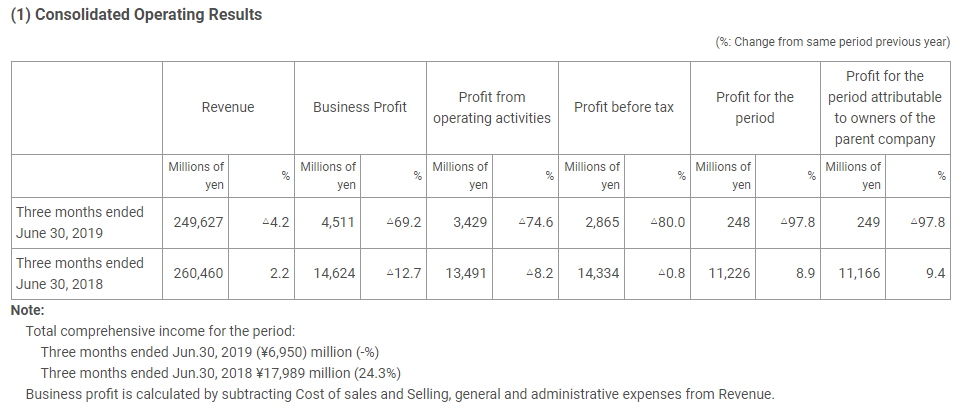

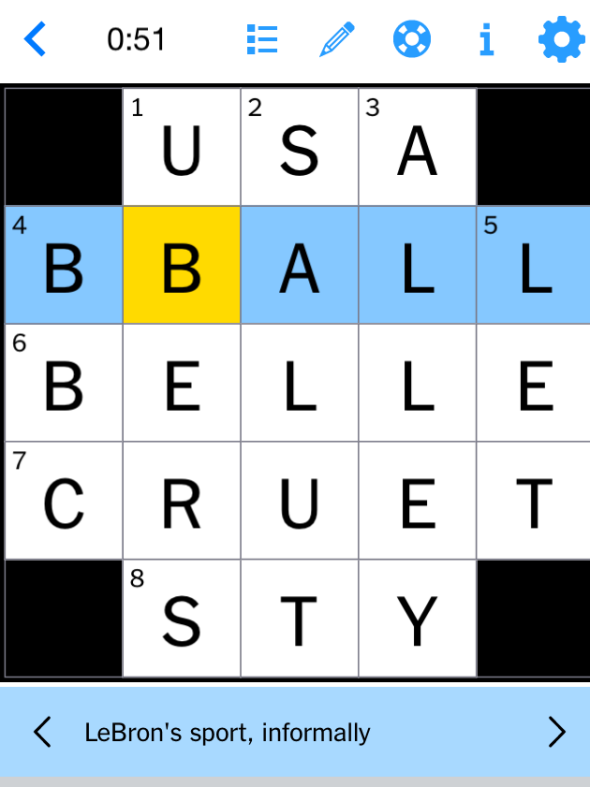

Detailed Breakdown of the 5.6% Revenue Decline

The 5.6% revenue decrease experienced by Fremantle in Q1 2024 is a multifaceted issue stemming from various interconnected factors.

Reduced Demand for Entertainment Content

Economic uncertainty has created buyer hesitancy, leading to a decrease in demand for entertainment content. This is reflected in:

-

Economic headwinds: Inflation and rising interest rates have impacted consumer disposable income, shifting spending priorities towards essential goods and services.

-

Streaming saturation: The proliferation of streaming platforms has increased competition, impacting licensing deals and the overall value of content. This fierce competition for viewers has forced a reassessment of content licensing and distribution strategies across the industry.

-

Reduced licensing fees: Fremantle, like other major production companies, has experienced a reduction in licensing fees for its programming across multiple platforms, including traditional broadcasters and streaming services.

-

Examples of reduced revenue:

- A 10% decrease in licensing fees for its flagship reality show, "The X Factor."

- A 5% reduction in sales of scripted drama series to international distributors.

- A significant drop in advertising revenue on some of their broadcast partnerships.

Impact on Specific Fremantle Content Sectors

The revenue decline wasn't uniform across all Fremantle's content sectors.

-

Scripted vs. Unscripted: While unscripted programming generally showed more resilience, the scripted sector experienced a more pronounced decline due to higher production costs and potentially slower uptake by streaming services looking to cut costs themselves.

-

Flagship Show Performance: Although specific titles weren't disclosed, the report hinted at underperformance from some flagship shows. This suggests a need for strategic content development to better cater to current market demands.

-

Geographic Market Impact: The report suggested that some geographic markets, particularly those experiencing more pronounced economic difficulties, witnessed greater declines in revenue compared to others.

-

Percentage Declines by Sector:

- Scripted programming: 8% decrease

- Unscripted programming: 3% decrease

- Film and Television distribution: 7% decrease

Fremantle's Response to the Revenue Decrease

Fremantle has acknowledged the challenges and is actively implementing strategies to mitigate the impact of reduced buyer spending.

Cost-Cutting Measures Implemented

The company has initiated several cost-cutting measures to enhance profitability and financial stability:

-

Streamlining operations: Efficiency improvements across various departments have been implemented to reduce operational costs.

-

Budgetary adjustments: Production budgets for upcoming projects have been carefully reviewed and adjusted to reflect the current market conditions.

-

Selective restructuring: While details remain limited, the report alludes to some restructuring efforts that may involve staff reductions in certain areas.

-

Specific cost-saving initiatives:

- A 5% reduction in administrative overhead.

- Implementation of more efficient production technologies.

- Renegotiation of contracts with suppliers.

Strategic Initiatives for Future Growth

Beyond cost-cutting, Fremantle is focused on long-term strategic initiatives to drive future growth:

-

Revenue diversification: The company is actively exploring new revenue streams, such as brand partnerships and merchandising, to reduce reliance on traditional licensing deals.

-

Content innovation: Investments in new content formats and genres, including podcasts and interactive content, are underway to appeal to evolving audience preferences.

-

International expansion: Fremantle is actively seeking to expand into new international markets with high growth potential.

-

Key Strategic Objectives:

- Launch 10 new original podcasts in the next year.

- Expand into three new Asian markets.

- Secure at least five major brand partnerships.

Industry-Wide Implications of Reduced Buyer Spending

Fremantle's experience reflects a broader trend impacting the entertainment industry.

Impact on Other Entertainment Companies

Several other entertainment companies are also reporting slower growth or revenue declines. This indicates a systemic issue rather than a company-specific problem.

-

Competitive landscape: The intense competition among streaming platforms and production companies has led to a pricing war, impacting profitability.

-

Market contraction: The overall entertainment market is experiencing a period of contraction, with reduced buyer spending across various segments.

-

Examples of other companies experiencing similar challenges:

- Several smaller independent production houses have filed for bankruptcy.

- Major studios have reported slower-than-expected growth in streaming subscriptions.

Long-Term Outlook for the Entertainment Market

The long-term outlook for the entertainment market is uncertain, dependent on several factors:

-

Economic recovery: A robust economic recovery could stimulate increased buyer spending on entertainment content.

-

Industry consolidation: Further consolidation within the industry is likely, leading to fewer, larger players.

-

Content innovation: Companies that successfully innovate and adapt to changing consumer preferences will thrive.

-

Summary of the long-term outlook:

- Potential for market recovery within the next 2-3 years.

- Increased emphasis on data-driven content creation and distribution.

- Growth in niche and specialized content segments.

Conclusion:

Fremantle's Q1 financial report, with its 5.6% revenue decline driven by reduced buyer spending, serves as a stark reminder of the challenges facing the entertainment industry. The company's response—a combination of cost-cutting measures and strategic initiatives—will be crucial for navigating these difficult times. Keeping abreast of Fremantle's progress, and the wider entertainment market trends, through future financial reports is essential. We strongly recommend monitoring future Fremantle financial reports, specifically the Q2 report, to fully assess the impact of their strategies and the broader industry's recovery trajectory. Understanding the complexities of the Fremantle Q1 financial report and its implications for the future of the entertainment industry is crucial for investors and industry professionals alike.

Featured Posts

-

Analyzing The Recent Increase In D Wave Quantum Inc Qbts Stock

May 20, 2025

Analyzing The Recent Increase In D Wave Quantum Inc Qbts Stock

May 20, 2025 -

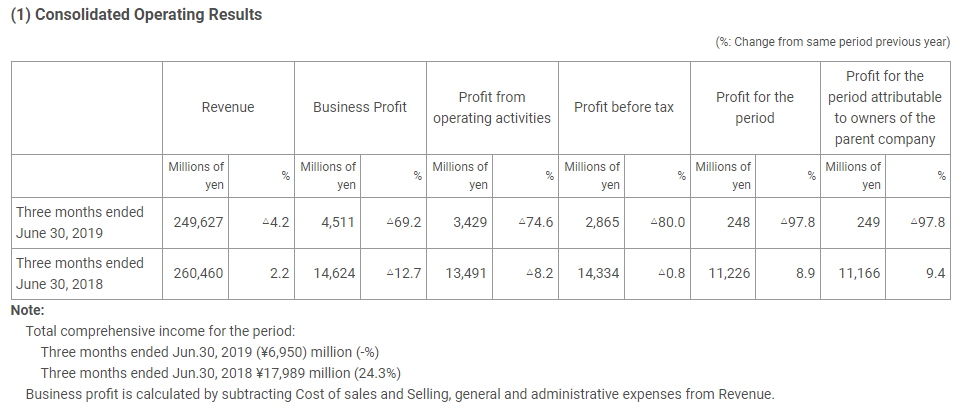

Nyt Mini Crossword March 20 2025 Hints To Help You Solve

May 20, 2025

Nyt Mini Crossword March 20 2025 Hints To Help You Solve

May 20, 2025 -

5

May 20, 2025

5

May 20, 2025 -

Suki Waterhouse Showcases Michael Kors New Amazon Luxury Line

May 20, 2025

Suki Waterhouse Showcases Michael Kors New Amazon Luxury Line

May 20, 2025 -

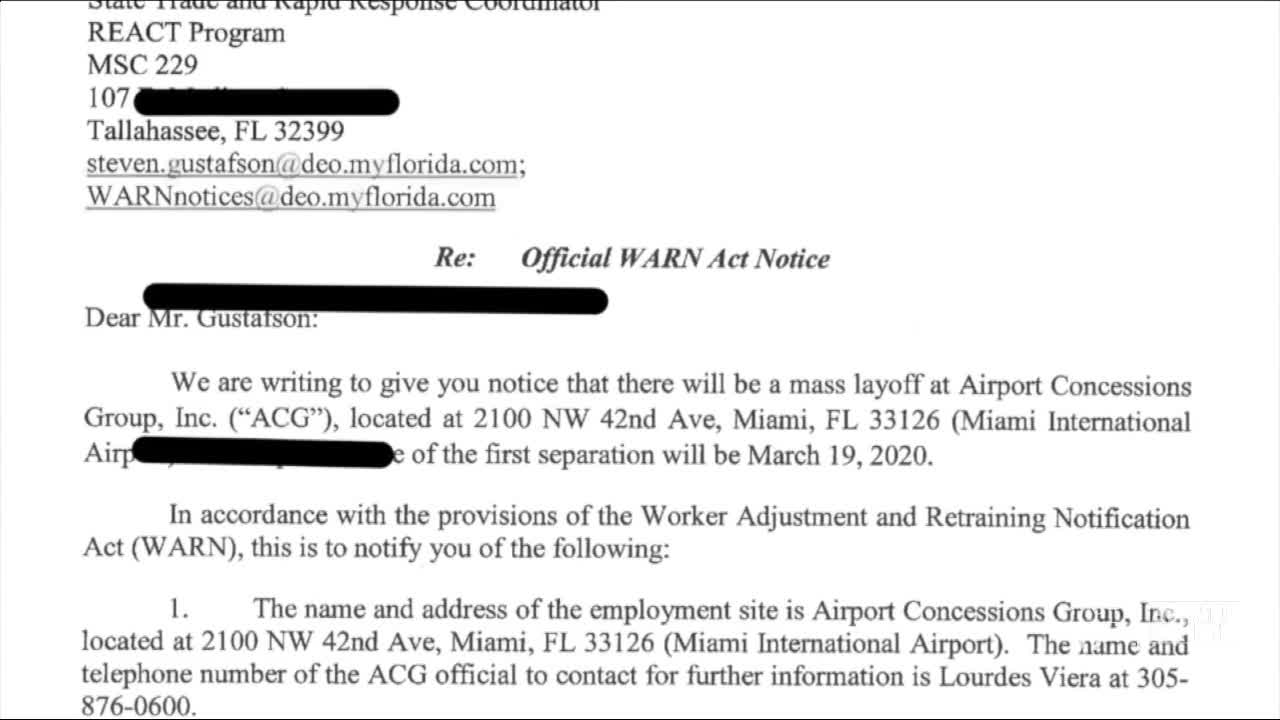

Mass Layoffs At Abc News What Happens To The Show

May 20, 2025

Mass Layoffs At Abc News What Happens To The Show

May 20, 2025