Fremantle's Q1 Revenue: A 5.6% Drop Due To Reduced Buyer Spending

Table of Contents

Analyzing the 5.6% Drop in Fremantle's Q1 Revenue

Fremantle's Q1 2024 revenue figures paint a stark picture compared to Q1 2023. While precise figures require official company releases, the 5.6% decrease signifies a considerable challenge. This decline wasn't uniform across all revenue streams. Let's analyze the affected areas:

- Production: A likely contributor to the overall revenue decrease. Reduced commissions from fewer projects being greenlit likely played a role.

- Distribution: Lower demand for content from buyers could have impacted distribution revenue. This could reflect reduced licensing agreements and lower sales of finished programs.

- Licensing: Decreased licensing fees for existing intellectual property (IP) might also contribute to the lower overall revenue.

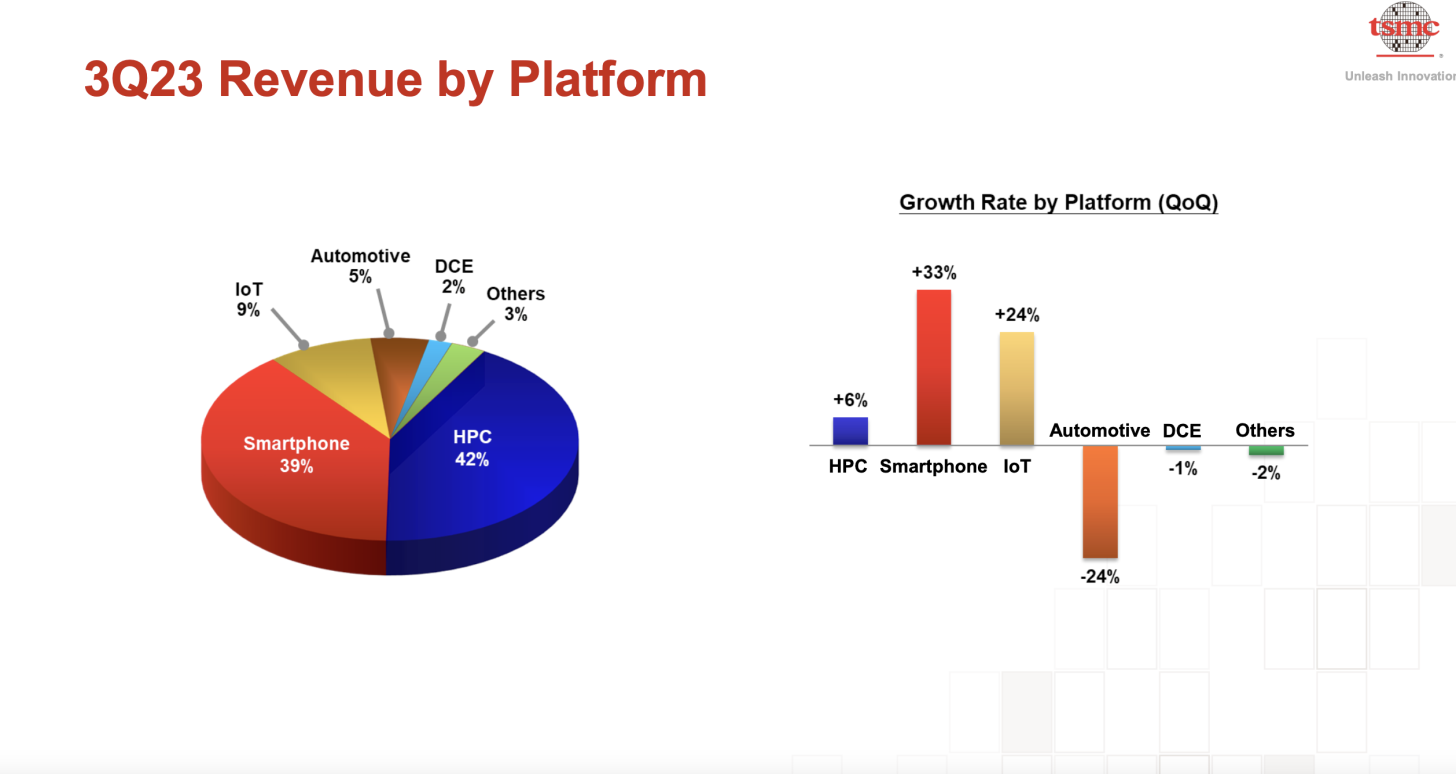

(Insert a chart/graph here visually representing the breakdown of revenue decline across different segments.)

- Percentage Decrease in Each Revenue Segment: (Insert specific percentage decrease for each segment – Production: X%, Distribution: Y%, Licensing: Z% – replace X, Y, and Z with actual or estimated figures.)

- Factors Contributing to the Overall Decrease: Reduced buyer spending, increased competition, changing consumer viewing habits.

- Geographic Regions Most Affected: (Specify which geographic regions experienced the most significant revenue drops.)

The Impact of Reduced Buyer Spending on Fremantle's Production Pipeline

The relationship between buyer spending and Fremantle's production pipeline is direct. Reduced buyer spending translates to fewer commissioned projects. This can lead to:

-

Project Delays: Projects might be postponed indefinitely while Fremantle secures additional funding or revised budgets.

-

Project Cancellations: In some cases, projects may be canceled entirely due to insufficient funding.

-

Impact on Creative Talent: Project delays or cancellations can lead to uncertainty and potential job losses for writers, directors, and other creative personnel.

-

Examples of Projects Affected: (List examples, if available, of projects impacted by reduced spending.)

-

Strategies to Mitigate the Impact: Fremantle might explore co-productions, seek alternative funding sources, or focus on lower-budget projects.

-

Long-Term Consequences: Sustained reduced buyer spending could lead to a smaller production pipeline, impacting Fremantle's output and future revenue streams.

Market Trends and Competitive Landscape: Understanding the Reduced Buyer Spending

The decline in buyer spending isn't isolated to Fremantle. Several factors contribute to this industry-wide trend:

-

Economic Factors: Inflation, recession fears, and economic uncertainty influence how much buyers are willing to spend on entertainment content.

-

Increased Competition: The streaming wars have intensified competition, with numerous platforms vying for a share of the market and driving down content costs.

-

Changing Consumer Habits: Audience fragmentation and the rise of diverse content consumption methods impact demand and pricing.

-

Key Economic Factors: (Elaborate on inflation rates, recession predictions, and their impact on media budgets.)

-

Competition from Streaming Services: (Discuss the competitive pressures from Netflix, Disney+, Amazon Prime Video, etc.)

-

Shifting Consumer Preferences: (Analyze trends in viewer behavior, preferred content types, and the impact on demand.)

Fremantle's Strategic Response to Reduced Buyer Spending

Fremantle isn't passively accepting the challenges. They're actively implementing strategies to mitigate the impact of reduced buyer spending:

-

Cost-Cutting Measures: This might involve streamlining operations, reducing overhead, or negotiating better deals with suppliers.

-

New Revenue Generation: Exploring new revenue streams, such as branded content, interactive experiences, or expanding into new markets.

-

Diversification Efforts: Investing in diverse content formats and genres to appeal to a wider audience and reduce reliance on any single revenue stream.

-

Specific Examples of Cost-Cutting Measures: (Provide concrete examples of cost-cutting initiatives.)

-

New Revenue Streams: (Describe specific new avenues Fremantle is pursuing.)

-

Long-Term Strategic Goals: (Highlight Fremantle's overall vision for future growth and market leadership.)

Conclusion: Fremantle's Q1 Results and the Path Forward

Fremantle's Q1 revenue decline, largely attributed to reduced buyer spending, highlights the challenges facing the entertainment industry. However, Fremantle's strategic responses – including cost-cutting, exploring new revenue streams, and diversifying its content – demonstrate a proactive approach to navigating this difficult period. The success of these strategies will significantly impact Fremantle’s future financial performance and market position. To stay updated on Fremantle's progress and future performance, continue to follow their financial reports and announcements related to their Q1 revenue and buyer spending trends. Understanding these evolving dynamics is critical for anyone invested in the future of the entertainment industry.

Featured Posts

-

Potential Ban And Age Restrictions For Kartels Upcoming Trinidad Show

May 21, 2025

Potential Ban And Age Restrictions For Kartels Upcoming Trinidad Show

May 21, 2025 -

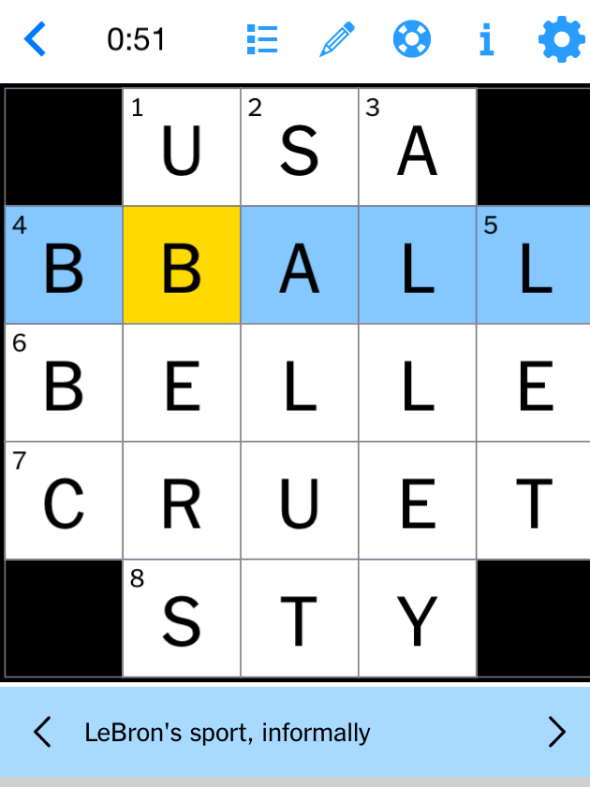

Find The Answers Nyt Mini Crossword March 20 2025

May 21, 2025

Find The Answers Nyt Mini Crossword March 20 2025

May 21, 2025 -

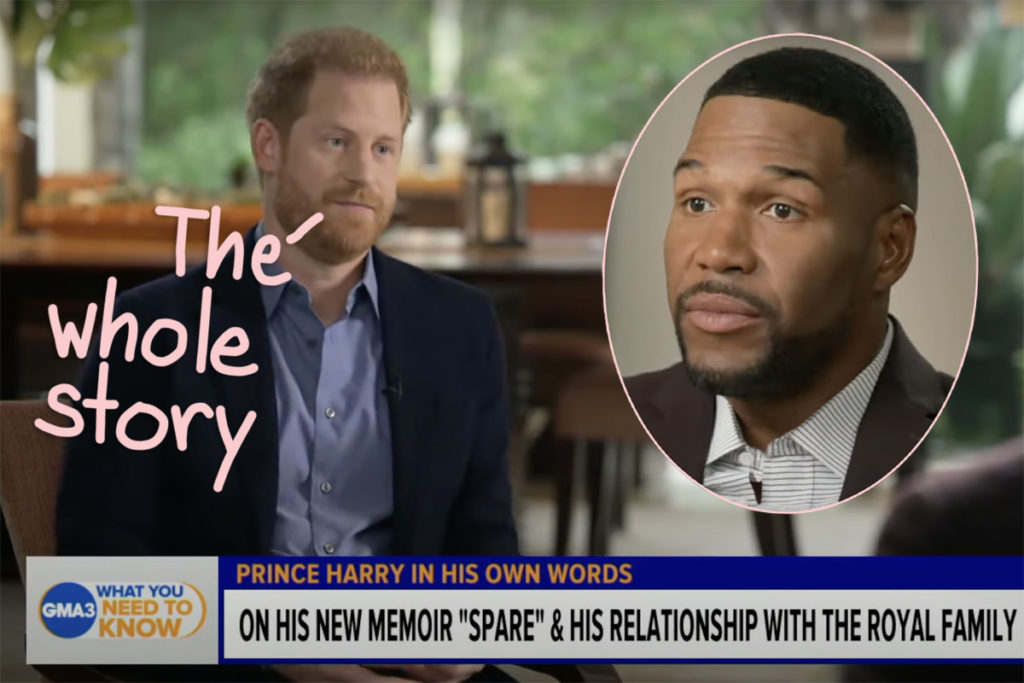

Analysis Michael Strahans Interview Coup And The Ratings Competition

May 21, 2025

Analysis Michael Strahans Interview Coup And The Ratings Competition

May 21, 2025 -

Wwe Backstage Buzz Hinchcliffes Segment Receives Negative Feedback

May 21, 2025

Wwe Backstage Buzz Hinchcliffes Segment Receives Negative Feedback

May 21, 2025 -

The Goldbergs Exploring The Shows Humor And Heart

May 21, 2025

The Goldbergs Exploring The Shows Humor And Heart

May 21, 2025