Friday Forecast: Continued Slide For Live Music Stocks

Table of Contents

Weakening Demand and Ticket Sales

The most significant factor contributing to the predicted slide in live music stocks is the weakening demand and declining ticket sales. Higher ticket prices, fueled by inflation and increased operational costs, are deterring many potential concertgoers. Economic uncertainty, with rising interest rates impacting household budgets, is also playing a significant role. Furthermore, the emergence of alternative entertainment options, including streaming services and virtual concerts, is siphoning off a considerable portion of the market share.

- Declining ticket sales: Reports indicate a double-digit percentage drop in ticket sales for several major artists in the past quarter compared to the same period last year. For example, [insert example of a specific artist or venue with declining sales and source].

- Reduced concert attendance: Statistics show a noticeable decrease in overall concert attendance, particularly in mid-sized and smaller venues struggling with higher operational costs. [Insert relevant statistic and source].

- News reports: Several reputable financial news outlets have reported on this trend, highlighting the challenges facing the live music industry. [Cite relevant news articles]. These reports directly impact investor confidence and contribute to the negative sentiment surrounding live music attendance and concert ticket sales.

Impact of Inflation and Rising Interest Rates on Live Music Businesses

The current inflationary environment is significantly impacting the profitability of live music businesses. Venue rentals, artist fees, marketing costs, and transportation expenses have all skyrocketed, squeezing profit margins. Simultaneously, rising interest rates are making it increasingly difficult for live music companies to secure financing for expansion projects and operational expenses. This financial strain is directly reflected in the performance of live music industry economics.

- Increased Costs: The cost of staging a major concert has increased by an estimated [insert percentage]% in the past year, primarily due to inflation. This includes increased costs for [list specific examples like stage production, security, and artist fees].

- Interest Rate Impact: The increase in interest rates has made obtaining business loans significantly more expensive for live music promoters, hindering their ability to invest in growth and potentially impacting concert promoter stocks.

- Financial Expert Analysis: [Cite analysis from financial experts or reports that support the claim of economic vulnerability in the sector]. These analyses confirm the significant financial pressure on live music companies.

Increased Competition and Shifting Consumer Preferences

The live music industry is facing stiff competition from other entertainment sectors. The rise of streaming services, offering a vast library of music at a fraction of the cost of attending a live concert, has fundamentally altered consumer behavior. Furthermore, the growing popularity of virtual concerts offers a more convenient and affordable alternative for many music fans. These changes are reflected in the shifting consumer preferences and the overall live music market share.

- Alternative Entertainment: Streaming platforms like Spotify and Apple Music, along with the rise of virtual concert experiences, are offering strong competition to live music events.

- Consumer Spending Habits: Data shows a significant shift in consumer spending habits, with a decreased allocation towards live entertainment and an increase towards more affordable digital alternatives. [Include supporting data and sources].

- Competitive Landscape: The entertainment industry competition is fierce, and live music promoters are constantly battling to attract audiences in a rapidly evolving entertainment landscape. This competition significantly impacts the value and stability of live music stocks.

Analyzing Key Live Music Stocks and Their Performance

Several publicly traded companies dominate the live music industry, including Live Nation stock and Ticketmaster stock. Recent performance has been disappointing, reflecting the challenges outlined above. Analyst ratings and predictions for these stocks are largely negative, suggesting continued downward pressure in the near term. [Insert specific examples of stock prices and analyst ratings for key companies in the sector]. This negative outlook contributes to the anticipated decline in concert promoter stocks.

- Live Nation Stock Performance: [Discuss the recent performance and trends of Live Nation stock].

- Ticketmaster Stock Performance: [Discuss the recent performance and trends of Ticketmaster stock].

- Company Announcements: [Discuss any relevant news or announcements from these companies that may impact their stock prices]. These announcements often influence investor sentiment surrounding investment in live music.

Conclusion: Friday Forecast: Continued Slide for Live Music Stocks

In summary, the anticipated decline in live music stocks on Friday is driven by a combination of declining demand, significant economic pressures (inflation and rising interest rates), and the increasing competition within the entertainment sector. The weakening concert ticket sales and reduced live music attendance are clear indicators of a challenging market environment. While there's potential for recovery in the future, the near-term outlook remains uncertain. The short-term challenges are substantial for the live music industry.

Stay tuned for further updates on the Friday forecast for live music stocks and consider diversifying your investment portfolio to mitigate risk. Careful monitoring of live music industry economics and the performance of individual concert promoter stocks is crucial for investors in this sector.

Featured Posts

-

Engelsk Klub Jagter Kasper Dolberg London Rygter

May 30, 2025

Engelsk Klub Jagter Kasper Dolberg London Rygter

May 30, 2025 -

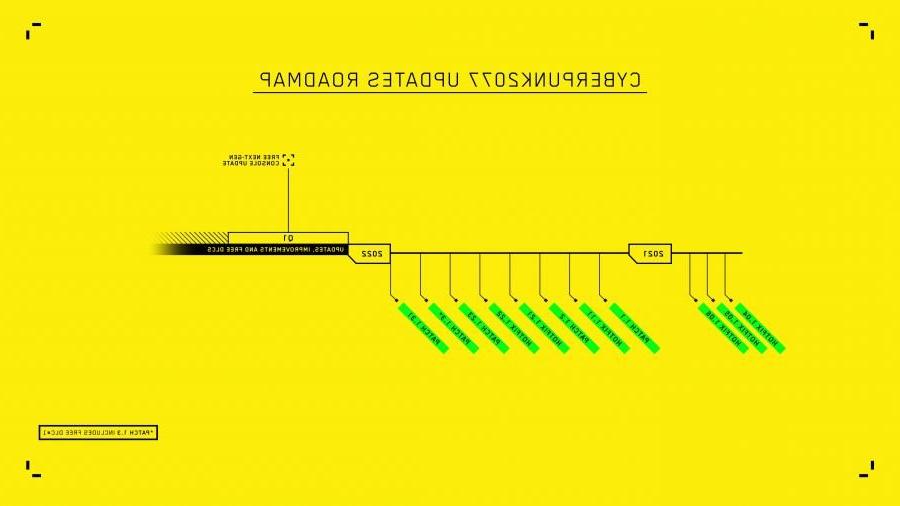

Cd Projekt Red On Cyberpunk 2 Development Updates And Future Plans

May 30, 2025

Cd Projekt Red On Cyberpunk 2 Development Updates And Future Plans

May 30, 2025 -

French Open Borges Defeats Ruud Hampered By Knee Issue

May 30, 2025

French Open Borges Defeats Ruud Hampered By Knee Issue

May 30, 2025 -

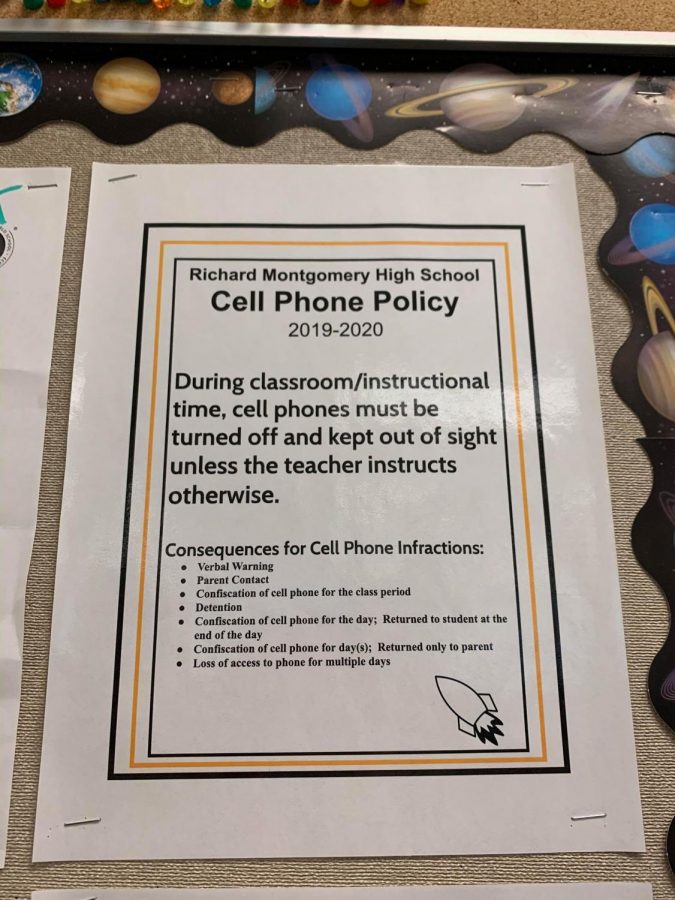

Dmps Implements District Wide Cell Phone Policy For Upcoming School Year

May 30, 2025

Dmps Implements District Wide Cell Phone Policy For Upcoming School Year

May 30, 2025 -

Taylor Swift Ticketmaster Queue Your Spot In Line Revealed

May 30, 2025

Taylor Swift Ticketmaster Queue Your Spot In Line Revealed

May 30, 2025