FTC To Challenge Ruling Allowing Microsoft-Activision Deal

Table of Contents

The FTC's Antitrust Concerns Regarding the Microsoft-Activision Merger

The FTC's primary concern centers around the potential for the merger to stifle competition within the video game market. Their argument hinges on the belief that Microsoft's acquisition of Activision Blizzard, a powerhouse with iconic franchises like Call of Duty, World of Warcraft, and Candy Crush, could lead to anti-competitive behavior. The FTC fears that Microsoft might leverage its newfound control over these titles to harm competitors.

Specifically, the FTC is worried about several key areas:

- Reduced competition in the console gaming market: The FTC argues that Microsoft could use its ownership of Activision Blizzard's properties to gain an unfair advantage over its competitors like Sony and Nintendo, potentially driving up prices or limiting consumer choice.

- Potential for Call of Duty exclusivity: One of the most significant concerns revolves around Call of Duty, one of the best-selling and most popular game franchises globally. The FTC worries that Microsoft might make Call of Duty exclusive to its Xbox console and Game Pass subscription service, effectively harming competitors who rely on the game's widespread appeal.

- Concerns about the impact on cloud gaming competition: The rapidly growing cloud gaming market is another area of concern. The FTC argues that Microsoft could use its control over Activision Blizzard's games to stifle competition in this burgeoning sector, limiting innovation and consumer choice.

- Impact on the overall gaming market: The FTC's broader concern is that the merger could reduce innovation, lead to higher prices for consumers, and ultimately harm the overall health and competitiveness of the video game industry.

The Initial Court Ruling and its Implications

A federal judge initially rejected the FTC's attempt to block the merger, ruling that the evidence presented did not support the claim that the acquisition would substantially lessen competition. The judge's decision highlighted the arguments presented by Microsoft, which focused on the continued availability of Call of Duty on multiple platforms and the overall competitive nature of the gaming market.

- Details of the court's ruling: The court's decision emphasized the lack of sufficient evidence to demonstrate a substantial lessening of competition.

- Key arguments presented by Microsoft and Activision: Microsoft and Activision argued that the deal would benefit consumers through increased innovation and wider game accessibility. They also pointed to agreements made to keep Call of Duty on Playstation for several years.

- Key arguments presented by the FTC: The FTC countered with arguments focusing on the potential for future anti-competitive practices, emphasizing the potential for Call of Duty exclusivity and the impact on cloud gaming.

- Legal basis for the judge's decision: The judge's decision rested on the legal standard for antitrust violations, requiring a clear demonstration of a substantial lessening of competition.

The FTC's Appeal and Next Steps

The FTC has appealed the initial ruling, indicating their strong belief that the merger poses a significant threat to competition. The appeal process is likely to be lengthy and complex, involving detailed legal arguments and potentially extensive discovery.

- FTC's strategy for challenging the ruling: The FTC's appeal will likely focus on strengthening its case regarding potential future anti-competitive behaviors.

- Potential legal arguments the FTC may use: The FTC might present new evidence or refine existing arguments to better demonstrate the potential harm to competition.

- Possible outcomes of the appeal: The appeal could result in the initial ruling being upheld, overturned, or modified.

- Impact on the merger timeline: The appeal process will significantly delay the completion of the merger.

- Impact on the stock prices of Microsoft and Activision: The uncertainty surrounding the appeal will likely continue to impact the stock prices of both companies.

Analysis of the Competitive Landscape in the Gaming Industry

The gaming industry is dominated by a few key players: Microsoft, Sony, Nintendo, and others. The Microsoft-Activision merger would significantly reshape this landscape, potentially shifting power dynamics and market shares.

- Market share analysis of major gaming companies: Analyzing the current market share of consoles and gaming services is crucial for understanding the potential impact of the merger.

- Impact on consumer choice: The FTC's concern centers around whether the merger will limit consumer choice and potentially lead to higher prices.

- Long-term implications for the gaming industry's development: The merger's outcome will significantly influence the future trajectory of innovation and competition within the gaming industry.

Conclusion: The Future of the Microsoft-Activision Deal Remains Uncertain

The FTC's challenge to the Microsoft-Activision deal highlights the complexities of antitrust regulation in the rapidly evolving gaming industry. The potential consequences of this merger are far-reaching, impacting not only the involved companies but also the broader competitive landscape and consumers themselves. The outcome of the appeal remains uncertain, but its implications for the future of gaming are undeniable. Stay informed about further developments in the FTC's challenge to the Microsoft-Activision deal, and share your thoughts on this crucial issue – your opinion matters!

Featured Posts

-

Broadways Best Celebrate Jonathan Groffs Just In Time Opening Night

May 23, 2025

Broadways Best Celebrate Jonathan Groffs Just In Time Opening Night

May 23, 2025 -

Female Pub Landlords Explosive Reaction To Staff Notice

May 23, 2025

Female Pub Landlords Explosive Reaction To Staff Notice

May 23, 2025 -

Kermit The Frogs Umd Commencement Speech A Hilarious Internet Sensation

May 23, 2025

Kermit The Frogs Umd Commencement Speech A Hilarious Internet Sensation

May 23, 2025 -

Big Rig Rock Report 3 12 96 1 The Rocket Comprehensive Analysis

May 23, 2025

Big Rig Rock Report 3 12 96 1 The Rocket Comprehensive Analysis

May 23, 2025 -

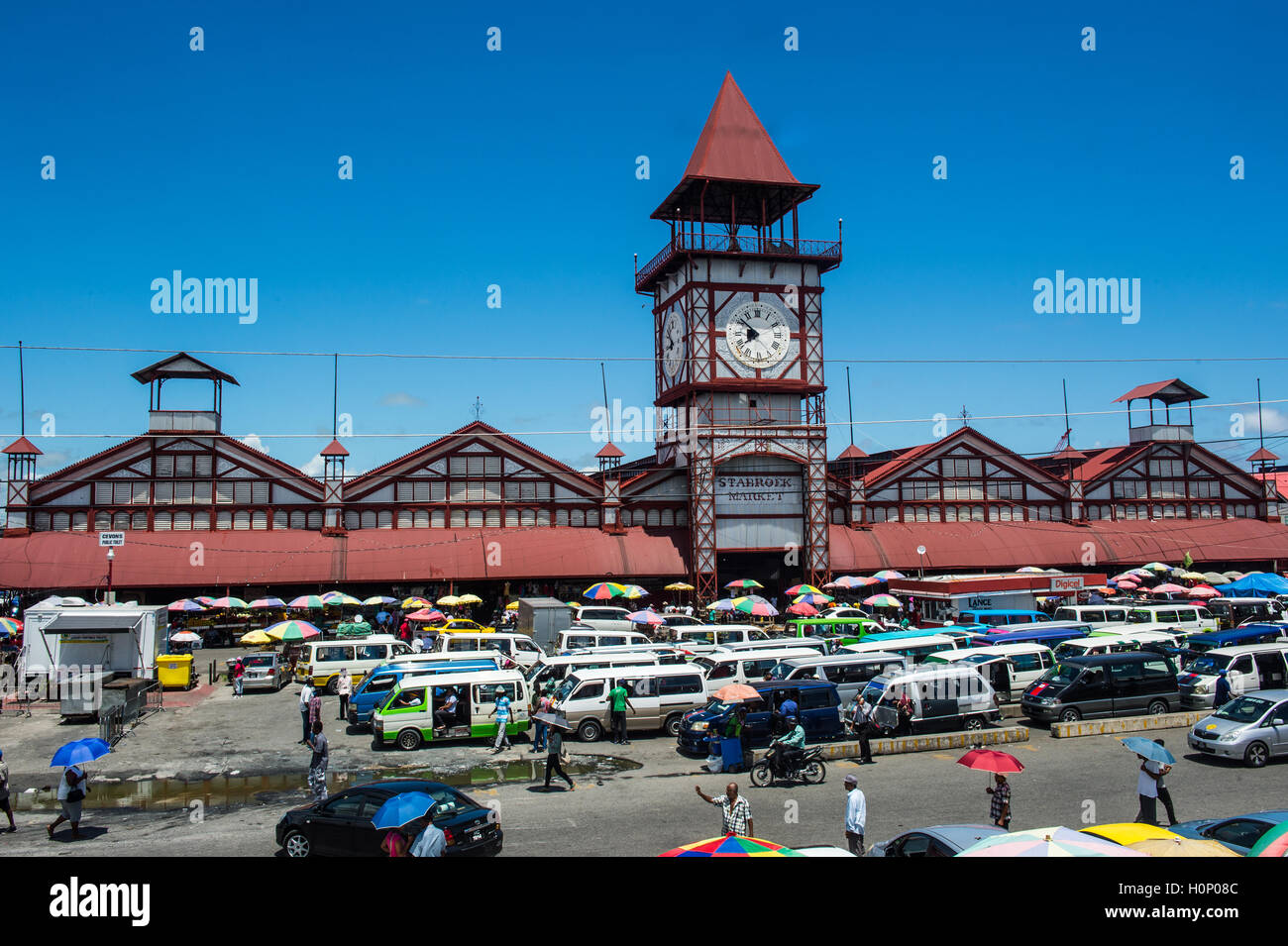

The Rum Trade And Kartel Activity Examining Stabroek News Findings

May 23, 2025

The Rum Trade And Kartel Activity Examining Stabroek News Findings

May 23, 2025