FTC's Appeal Could Block Microsoft's Activision Acquisition

Table of Contents

The FTC's Case Against the Merger

The Federal Trade Commission (FTC) is vehemently opposing Microsoft's Activision acquisition, arguing that it would stifle competition and harm consumers. Their core concerns revolve around several key areas:

- Anti-competitive behavior in the gaming console market: The FTC argues that Microsoft's acquisition of Activision Blizzard would give them an unfair advantage over competitors like Sony's PlayStation, particularly concerning access to exclusive content and franchises. This could lead to Xbox becoming the dominant console, potentially hurting consumer choice and innovation.

- Concerns about Microsoft's control over key gaming franchises: The FTC is particularly concerned about Microsoft's potential control over extremely popular gaming franchises, including Call of Duty, one of the world's most popular game series. They worry Microsoft could make these titles exclusive to Xbox, or leverage them to unfairly disadvantage PlayStation.

- Potential harm to competition and consumers: The FTC's broader argument is that this merger would reduce competition, leading to higher prices, less innovation, and a diminished overall experience for gamers. They believe the market will become less competitive, giving Microsoft undue leverage over developers and publishers.

- Specific examples cited by the FTC: While the exact details are subject to ongoing legal proceedings, the FTC's arguments likely include evidence of Microsoft's past behavior and statements indicating their intention to leverage Activision's properties for competitive advantage.

The FTC's legal strategy will likely involve presenting evidence of Microsoft's market power, showcasing the potential for anti-competitive practices, and demonstrating the negative consequences for consumers.

Microsoft's Defense Strategies

Microsoft is vigorously defending its acquisition, arguing that the deal will ultimately benefit consumers and increase competition. Their core defense strategies include:

- Claims of increased competition and consumer benefits: Microsoft claims that the merger will actually lead to greater competition, bringing more games to more platforms and offering broader access to Activision Blizzard's catalog. They contend that bringing Activision Blizzard titles to Xbox Game Pass, for example, benefits players.

- Arguments regarding the continued availability of Activision Blizzard games on other platforms: Microsoft has repeatedly pledged to continue releasing Activision Blizzard games on PlayStation and other platforms, attempting to alleviate the FTC's concerns about exclusivity. They have even offered contractual agreements to ensure continued access.

- Potential remedies or concessions offered by Microsoft to address FTC concerns: To counter the FTC’s concerns, Microsoft has explored various concessions, including potential licensing agreements to ensure the availability of titles like Call of Duty on competing platforms for a set period.

Microsoft's legal strategy will focus on refuting the FTC's claims of anti-competitive behavior, demonstrating the benefits of the acquisition, and highlighting the significant concessions made to address regulatory concerns.

Potential Outcomes and Implications

The FTC's appeal against Microsoft's Activision acquisition could result in several outcomes:

- The appeal is successful, blocking the acquisition: This would be a major victory for the FTC and a significant blow to Microsoft. It would set a strong precedent for future tech mergers and reinforce the regulatory scrutiny of large acquisitions in the tech sector.

- The appeal is unsuccessful, allowing the acquisition to proceed: This outcome would allow Microsoft to complete the acquisition, potentially reshaping the gaming industry. However, it could also raise concerns about the effectiveness of antitrust regulations in the tech sector.

- A negotiated settlement between Microsoft and the FTC: A settlement could involve Microsoft making further concessions, such as extending its commitment to keep Activision Blizzard games available on other platforms.

The implications for the gaming industry are far-reaching. A successful FTC appeal could lead to increased regulatory scrutiny of tech mergers and acquisitions, potentially chilling further consolidation in the industry. Conversely, if the acquisition proceeds, it could lead to significant changes in the competitive landscape, potentially affecting game prices, innovation, and consumer choice.

The Broader Context of Antitrust Law and Tech Mergers

The FTC's appeal against Microsoft's Activision acquisition is not an isolated incident. It reflects a broader trend of increased scrutiny of tech mergers and acquisitions by antitrust regulators globally.

- Reference to other recent high-profile tech mergers and antitrust cases: This case mirrors other high-profile antitrust battles involving major technology companies, highlighting a growing trend toward greater regulatory oversight.

- Discuss the evolving landscape of antitrust enforcement and its implications for future tech deals: The outcome of this case will shape the future of antitrust enforcement and influence the approach taken by regulators towards other large tech mergers in the coming years.

- Mention the role of regulatory bodies in preventing monopolies: The FTC’s action underscores the crucial role of regulatory bodies in maintaining a competitive marketplace and preventing the formation of monopolies that could stifle innovation and harm consumers.

This case is a landmark event that will have a significant impact on the future of the gaming industry and the broader tech sector.

Conclusion: The Future of the FTC's Appeal and Microsoft's Activision Acquisition

The FTC's appeal against Microsoft's Activision acquisition presents a complex legal and economic battle with significant implications for the gaming industry. Both sides have presented compelling arguments, and the ultimate outcome remains uncertain. The potential for either a blocked acquisition or a successful merger carries substantial ramifications for competition, innovation, and consumer choice. Staying informed about the developments in this case is crucial. Keep checking reputable news sources and legal updates for further developments regarding the FTC’s appeal and the future of Microsoft’s Activision acquisition. The outcome will significantly impact the future of gaming and tech mergers for years to come.

Featured Posts

-

From Real Life To Fiction The Men Who Inspired The Great Gatsbys Characters

May 12, 2025

From Real Life To Fiction The Men Who Inspired The Great Gatsbys Characters

May 12, 2025 -

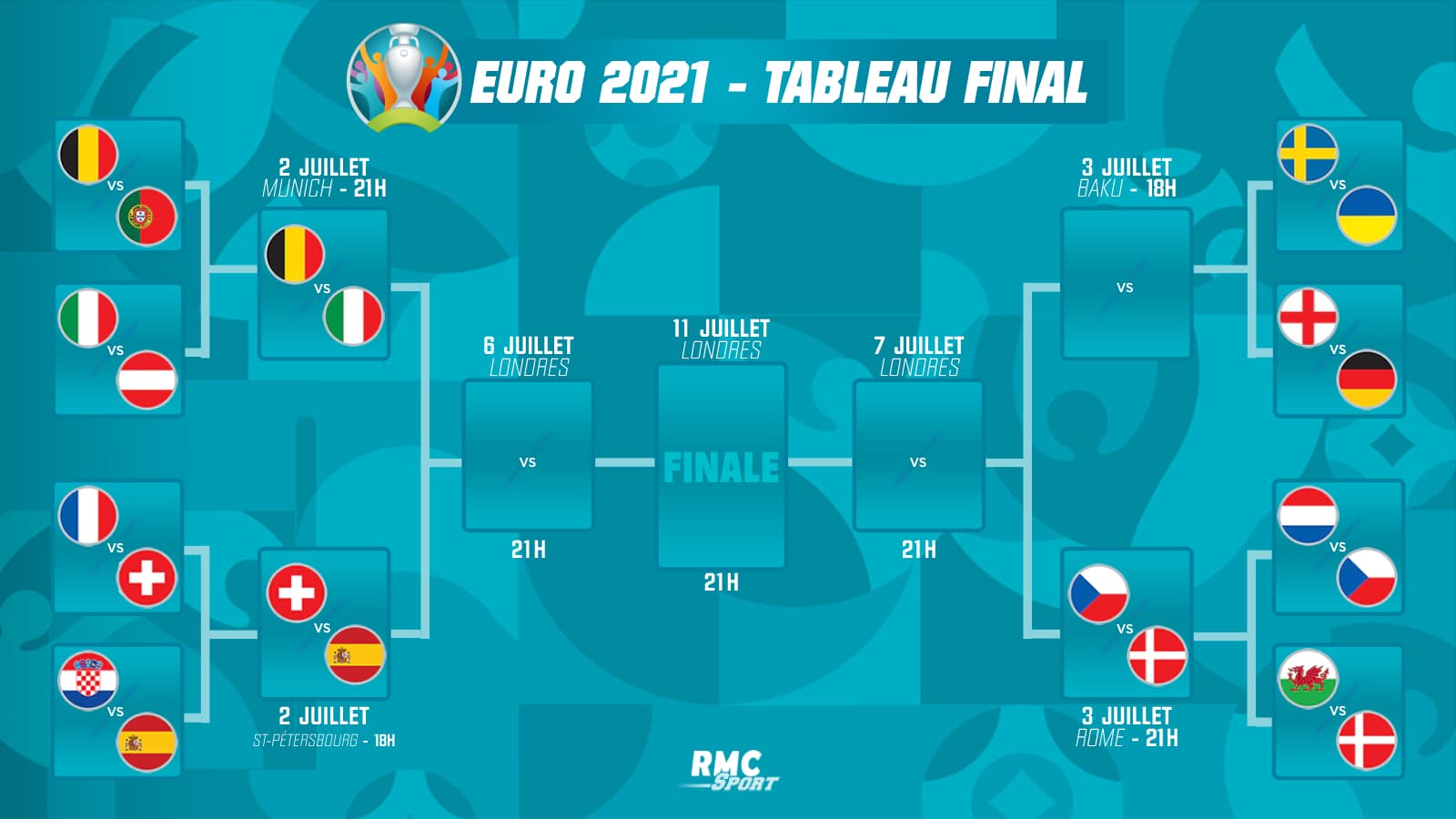

Quarts De Finale C1 Mueller Decisif Pour Le Bayern Face A L Inter

May 12, 2025

Quarts De Finale C1 Mueller Decisif Pour Le Bayern Face A L Inter

May 12, 2025 -

Cbs News Astronauts Extended Nine Month Space Mission

May 12, 2025

Cbs News Astronauts Extended Nine Month Space Mission

May 12, 2025 -

Montego Bay A Jamaican Gem Worth Exploring

May 12, 2025

Montego Bay A Jamaican Gem Worth Exploring

May 12, 2025 -

Selena Gomezs Edgy Leather Outfit Get The Look

May 12, 2025

Selena Gomezs Edgy Leather Outfit Get The Look

May 12, 2025