G-7 Nations Debate Lowering De Minimis Tariffs On Chinese Imports

Table of Contents

Current State of De Minimis Tariffs on Chinese Imports

De minimis tariffs refer to the value threshold below which imported goods are exempt from customs duties. Currently, these thresholds vary significantly across G7 nations, impacting the price and accessibility of Chinese imports. For example, while some countries might have a relatively high threshold (allowing for cheaper imports of many goods), others maintain lower thresholds, resulting in higher costs for consumers. This inconsistency creates an uneven playing field for businesses and consumers alike.

- Current tariff thresholds in each major G7 nation: The United States currently sets its de minimis value at $800, while Canada's threshold is significantly lower. Japan, Germany, France, Italy, and the UK have varying levels, often resulting in discrepancies in import costs. These differences impact the competitiveness of businesses operating within the G7.

- Impact of these tariffs on consumer prices and business costs: Higher de minimis thresholds lead to lower prices for consumers, but they can also raise concerns about fair competition and potential job losses in domestic industries. Conversely, lower thresholds increase costs for both businesses and consumers.

- Statistics on import volumes affected by the current tariff levels: A substantial portion of low-value goods imported from China are impacted by these varying thresholds, often influencing the overall cost of imported products. The precise figures vary depending on the specific good and country of import, but the impact is undeniable. Data from various import/export agencies could be used to further illustrate this point (e.g., data from the WTO or individual G7 nation's statistical offices).

Arguments for Lowering De Minimis Tariffs

Proponents of lowering de minimis tariffs on Chinese imports emphasize several key benefits:

- Increased consumer purchasing power: Lower tariffs translate to lower prices for consumers, enhancing their purchasing power and increasing consumer choice.

- Enhanced competitiveness for online retailers: Reducing tariffs levels the playing field for online retailers, allowing them to offer more competitive prices and expand their market reach.

- Reduced administrative burden for importers and customs: Simplified customs processes, resulting from higher thresholds, streamline import procedures and reduce bureaucratic burdens for both businesses and government agencies.

- Potential for increased trade volume between G7 and China: Lowering tariffs can stimulate trade between the G7 nations and China, fostering greater economic interdependence and potentially leading to overall economic growth.

Arguments Against Lowering De Minimis Tariffs

Opponents of lowering tariffs raise concerns about potential negative consequences:

- Risk of increased dumping of cheap goods: Lower tariffs might lead to an influx of cheap, subsidized goods from China, potentially harming domestic industries and displacing workers.

- Potential harm to domestic industries and jobs: The increased competition from cheaper imports could negatively impact domestic manufacturers and lead to job losses in various sectors. This is particularly relevant in industries like textiles and electronics.

- Concerns about intellectual property rights violation: Lowering tariffs could exacerbate existing concerns regarding intellectual property theft and counterfeiting from China.

- National security implications (reliance on Chinese supply chains): Over-reliance on Chinese supply chains due to cheaper imports could pose national security risks in certain strategic sectors.

Potential Implications of Lowering Tariffs

Reducing de minimis tariffs on Chinese imports would have far-reaching consequences:

- Impact on GDP growth: Lower prices and increased consumer spending could boost GDP growth in the short term, though the long-term impact on domestic industries needs careful consideration.

- Changes in employment patterns: Job losses in some sectors might be offset by job creation in others, but the overall effect on employment requires detailed analysis.

- Shift in consumer spending habits: Lower prices might lead to increased consumer spending on imported goods, potentially shifting consumption patterns.

- Geopolitical ramifications of closer economic ties with China: A move towards lower tariffs could deepen economic interdependence with China, influencing the geopolitical landscape and potentially impacting international relations.

Conclusion

The debate surrounding G-7 nations and their policies on lowering de minimis tariffs on Chinese imports is complex, with significant economic, political, and social implications. While lower tariffs could offer benefits such as increased consumer choice and lower prices, concerns about unfair competition, intellectual property rights, and national security remain valid. Understanding the potential consequences – both positive and negative – is crucial for policymakers as they navigate this critical decision. Stay informed about the evolving debate surrounding G-7 nations and their policies on lowering de minimis tariffs on Chinese imports, as the outcome will have a profound impact on global trade and the future of economic relations between the G7 and China.

Featured Posts

-

Monday Night Viewing 10 Must See Tv Shows And Streaming Picks

May 25, 2025

Monday Night Viewing 10 Must See Tv Shows And Streaming Picks

May 25, 2025 -

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 25, 2025

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 25, 2025 -

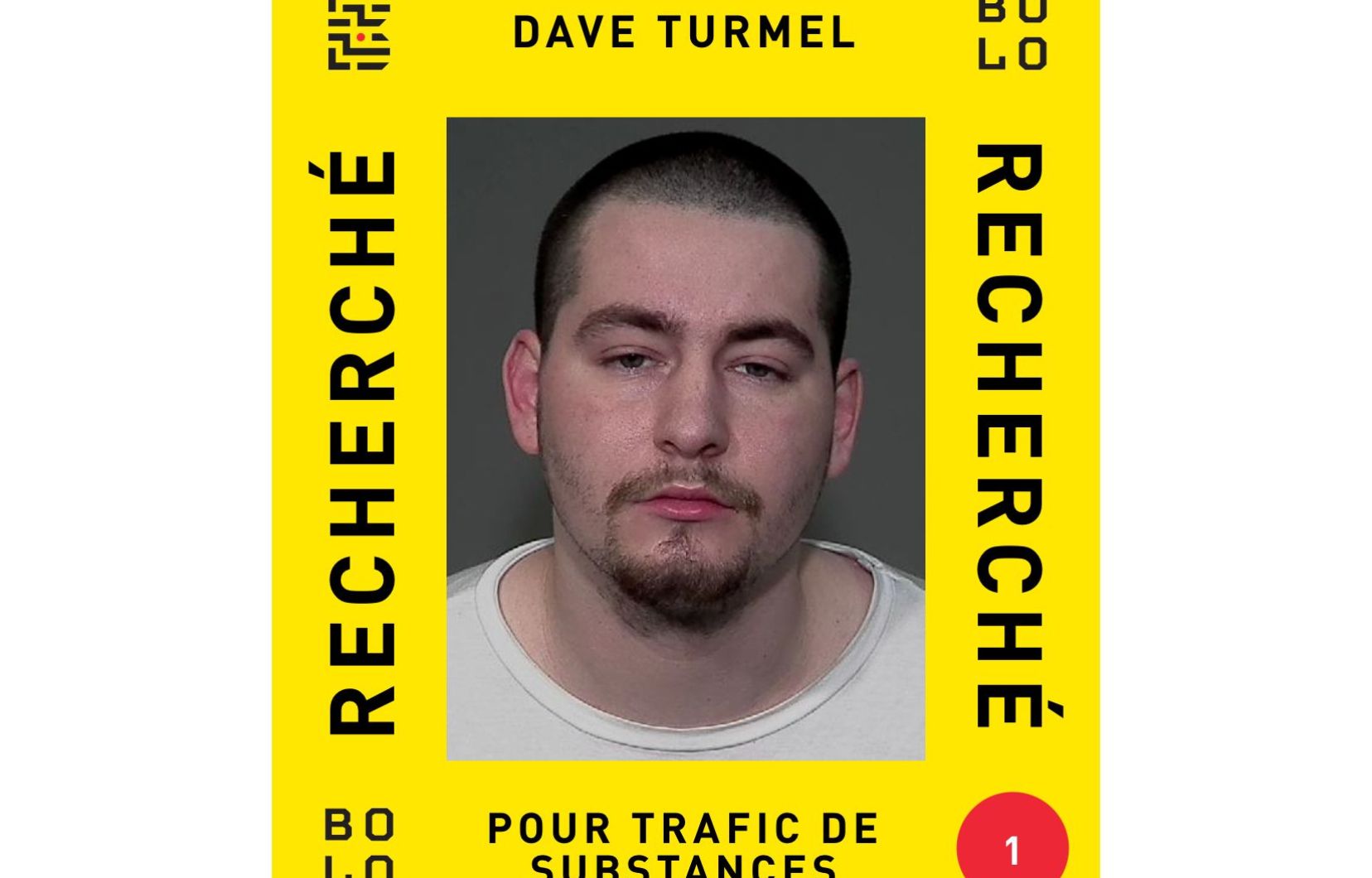

Dave Turmel Canadas Top Fugitive Captured In Italy

May 25, 2025

Dave Turmel Canadas Top Fugitive Captured In Italy

May 25, 2025 -

Is Naomi Campbell Banned From The 2025 Met Gala A Wintour Feud Explored

May 25, 2025

Is Naomi Campbell Banned From The 2025 Met Gala A Wintour Feud Explored

May 25, 2025 -

Dax Kurs Eroeffnung In Frankfurt Und Auswirkungen Des Futures Verfalls

May 25, 2025

Dax Kurs Eroeffnung In Frankfurt Und Auswirkungen Des Futures Verfalls

May 25, 2025