Gambling On California Wildfires: A Growing Trend? The Los Angeles Example.

Table of Contents

The Role of Insurance Companies in Wildfire Risk Assessment

Insurance companies play a pivotal role in assessing and managing wildfire risk. Their involvement significantly shapes how society perceives and responds to this growing threat. Keywords: wildfire insurance, California insurance, risk mitigation, actuarial science, premiums, insurance payouts.

-

Data-Driven Risk Analysis: Insurance companies utilize sophisticated actuarial science and data analysis techniques to assess wildfire risk. This involves analyzing historical fire patterns, vegetation density, proximity to urban areas, and even climate models predicting future fire behavior. The more precise the data, the more accurate the risk assessment.

-

Premium Pricing and Policy Availability: These risk assessments directly influence premium pricing and the availability of insurance policies. Areas deemed high-risk, such as parts of Los Angeles situated in the urban-wildland interface, face significantly higher premiums or may even find it difficult to secure comprehensive coverage. This creates a financial incentive to mitigate risk.

-

Financial Implications of Wildfire Events: For insurance companies, a major wildfire event translates into substantial payouts. The sheer scale of losses from events like the Woolsey Fire significantly impact their bottom line. This highlights the inherent financial risk they take on.

-

Indirect "Gambling" on Wildfire Predictions: Through their risk models and pricing strategies, insurance companies are indirectly "gambling" on the accuracy of their wildfire predictions. If their risk assessments are inaccurate, they could face severe financial losses. Conversely, accurate predictions allow for more precise pricing and a healthier balance sheet.

Financial Markets and Wildfire Prediction Markets

The increasing sophistication of wildfire prediction models opens the door to speculation within financial markets. Keywords: prediction markets, financial derivatives, wildfire prediction models, investment strategies, speculative trading.

-

The Potential of Prediction Markets: The concept of prediction markets for wildfire severity and location is gaining traction. These markets would allow individuals and institutions to bet on the likelihood and intensity of future wildfire events.

-

Ethical and Regulatory Implications: The ethical and regulatory implications of allowing financial speculation on natural disasters are significant. Concerns exist regarding market manipulation, exacerbating societal inequalities, and the potential for irresponsible behavior driven by profit motives.

-

Advanced Modeling and Machine Learning: Advanced weather modeling, incorporating satellite imagery, climate data, and machine learning algorithms, is enhancing the accuracy of wildfire prediction models. This makes them more attractive for financial investment but also more prone to manipulation.

-

Market Instability and Manipulative Trading: The potential for manipulative trading and market instability is a significant concern. Information asymmetry and the inherent uncertainty of wildfire behavior could create opportunities for sophisticated traders to profit at the expense of others, potentially destabilizing the market.

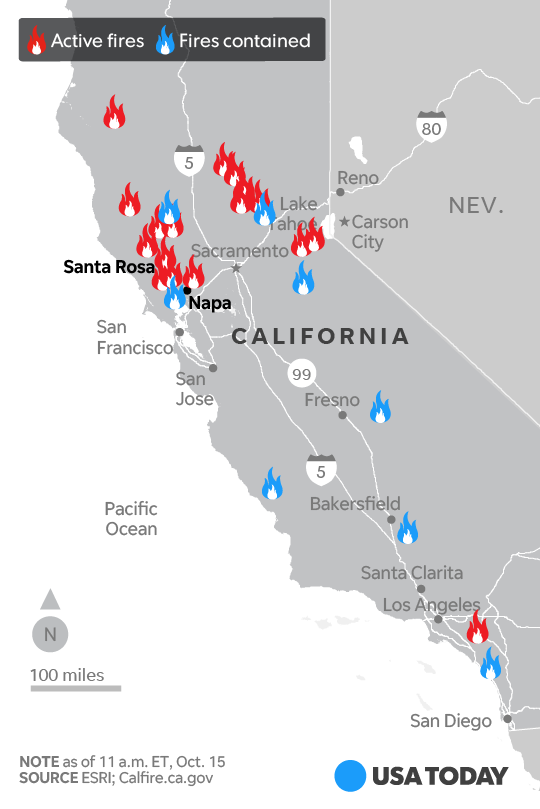

The Los Angeles Case Study: Specific Vulnerabilities and Risks

Los Angeles presents a unique case study due to its specific vulnerabilities and the substantial value of its assets at risk. Keywords: Los Angeles wildfires, Santa Ana winds, urban-wildland interface, wildfire mitigation, housing market.

-

Santa Ana Winds and Urban-Wildland Interface: The Santa Ana winds, notorious for their dry and strong gusts, significantly increase wildfire risk in Los Angeles. The city's extensive urban-wildland interface exacerbates this risk, creating a high-stakes environment.

-

Impact on Property Values and the Housing Market: Wildfires dramatically impact property values and the housing market. Areas affected by recent fires experience decreased property values, impacting residents financially and destabilizing the local economy.

-

Effectiveness of Wildfire Mitigation Strategies: The effectiveness of existing wildfire mitigation strategies in Los Angeles is constantly under scrutiny. This includes measures like fuel reduction programs, building codes, and evacuation planning. The efficacy of these programs varies across the city, highlighting inequalities in risk mitigation.

-

Disproportionate Impact: Specific areas, particularly those with lower socioeconomic statuses and limited access to resources, are often disproportionately affected by wildfire risk and the associated financial speculation.

The Human Element: Individual Decisions and Risk Perception

Individual decisions and risk perception play a critical role in shaping the impact of wildfires. Keywords: wildfire preparedness, risk perception, individual decision making, community resilience, evacuation planning.

-

Insurance Coverage and Property Protection: Individual risk perceptions directly influence decisions regarding insurance coverage, property protection measures (e.g., defensible space), and evacuation planning. Those who underestimate the risk may be less likely to invest in these protective measures.

-

Misinformation and Media Coverage: Misinformation and sensationalized media coverage can distort risk perception, leading to either panic or complacency. Accurate and accessible information is vital for effective decision-making.

-

Community Preparedness and Resilience: Community preparedness and resilience are essential in mitigating the impact of wildfires. Effective communication, evacuation plans, and mutual aid networks can significantly improve outcomes.

Conclusion

This exploration of "gambling" on California wildfires, particularly in the context of Los Angeles, reveals a complex interplay between insurance, finance, and environmental risk. While risk assessment is crucial for responsible insurance practices and financial planning, the potential for financial speculation raises significant ethical and practical concerns. The increasing use of sophisticated predictive models necessitates careful regulation to prevent market manipulation and ensure responsible risk management. The future requires a balanced approach: leveraging data and technology for accurate prediction while prioritizing community resilience and responsible financial practices to mitigate the effects of these devastating events.

Call to Action: Understanding the multifaceted risks involved in California wildfires, particularly in Los Angeles, is crucial. Learn more about California wildfire risk assessment and how to protect yourself and your community from the devastating impact of these events. Further research into responsible wildfire prediction and mitigation is vital to mitigate both the environmental damage and the potential for irresponsible gambling on this devastating natural phenomenon.

Featured Posts

-

Nba Skills Challenge 2025 Players Teams And Competition Breakdown

Apr 30, 2025

Nba Skills Challenge 2025 Players Teams And Competition Breakdown

Apr 30, 2025 -

Famosos Que Vieram Ao Brasil Sem Avisar Mais Que Angelina Jolie

Apr 30, 2025

Famosos Que Vieram Ao Brasil Sem Avisar Mais Que Angelina Jolie

Apr 30, 2025 -

Eurovision 2025 Analyzing The Top Contenders Weeks Before The Contest

Apr 30, 2025

Eurovision 2025 Analyzing The Top Contenders Weeks Before The Contest

Apr 30, 2025 -

Ai And Process Safety A Patent For Enhanced Hazard Mitigation

Apr 30, 2025

Ai And Process Safety A Patent For Enhanced Hazard Mitigation

Apr 30, 2025 -

Ekklisi Le Maire Patriotismos Gallikon Epixeiriseon Enantia Stoys Dasmoys Trump

Apr 30, 2025

Ekklisi Le Maire Patriotismos Gallikon Epixeiriseon Enantia Stoys Dasmoys Trump

Apr 30, 2025