Gibraltar Industries (NASDAQ: ROCK) Earnings Preview And Stock Outlook

Table of Contents

Q2 2024 Earnings Expectations for Gibraltar Industries Stock

Investors are anticipating the release of Gibraltar Industries' Q2 2024 earnings report, eagerly awaiting insights into the company's financial performance. While precise figures remain under wraps until the official announcement, analyst predictions offer a glimpse into potential outcomes.

-

Expected Revenue and EPS: Consensus estimates from leading financial analysts point towards a [insert estimated revenue range] in revenue and an EPS of [insert estimated EPS range]. This represents a [percentage]% increase/decrease compared to Q2 2023 and a [percentage]% increase/decrease compared to Q1 2024. It's important to note that these are projections, and actual results may vary.

-

Key Factors Influencing Earnings: Several factors are expected to influence Gibraltar Industries' Q2 2024 earnings. These include:

- Material Costs: Fluctuations in raw material prices, particularly steel, can significantly impact profitability. Higher steel prices could squeeze margins, while lower prices could boost earnings.

- Demand: Demand for Gibraltar Industries' building products and renewable energy solutions will be a critical factor. Strong demand would likely translate into higher revenue, while weak demand could lead to lower-than-expected earnings.

- New Product Launches: The success of any new product launches will be closely watched. New offerings can contribute to revenue growth, but their impact on earnings will depend on their market acceptance and production costs.

- Potential Surprises: Unexpected events, such as supply chain disruptions or changes in government regulations, could significantly impact the Gibraltar Industries stock price. Investors should be prepared for potential volatility.

Analysis of Gibraltar Industries' Recent Performance and Key Business Segments

Analyzing Gibraltar Industries' recent performance requires a segment-by-segment evaluation. The company operates in several key areas, each with its own dynamics.

- Building Products Segment: This segment is typically sensitive to the overall construction market. Recent performance indicators should be analyzed in the context of housing starts, commercial construction activity, and overall economic growth.

- Market Share Trends: Assess Gibraltar Industries’ market share within the building products sector compared to its main competitors.

- Growth Potential: Consider factors affecting growth potential, such as new construction trends and the adoption of sustainable building materials.

- Renewable Energy Segment: This segment's performance is tied to government policies, technological advancements, and the broader adoption of renewable energy sources.

- Growth Potential: This rapidly growing market presents a significant opportunity for Gibraltar Industries. However, competitive pressures and technological changes warrant careful monitoring.

- Recent Acquisitions/Divestitures: Any recent acquisitions or divestitures significantly influence the overall performance and should be analyzed for their immediate and long-term effects on the Gibraltar Industries stock.

Factors Influencing Gibraltar Industries Stock Price: A Comprehensive Overview

The Gibraltar Industries stock price is subject to a wide range of influences.

-

Macroeconomic Factors: Broad economic conditions play a crucial role. Inflation, interest rates, and overall economic growth directly impact the construction and renewable energy sectors, thereby influencing Gibraltar Industries' performance.

-

Industry Trends and Competitive Landscape: The competitive landscape and prevailing industry trends are key.

- Raw Material Prices: The impact of fluctuating raw material prices (especially steel) on profitability and margins needs constant monitoring.

- Government Regulations: Changes in building codes, environmental regulations, or government incentives for renewable energy directly impact Gibraltar Industries' operations and profitability.

- Competitor Strategies: Analyzing competitors' actions, market share dynamics, and new product introductions provides valuable context for assessing Gibraltar Industries' competitive positioning.

- Supply Chain Disruptions: Any disruption to the company’s supply chain poses a significant risk. The impact on production, delivery times and consequently on the Gibraltar Industries stock price must be considered.

Gibraltar Industries Stock Valuation and Investment Implications

Evaluating the Gibraltar Industries stock requires analyzing key valuation metrics.

- Valuation Metrics: The Price-to-Earnings (P/E) ratio, compared to industry peers, offers a perspective on the stock's valuation relative to its earnings. Other relevant metrics should be considered.

- Investment Strategies: Based on the analysis of the Gibraltar Industries stock valuation, different investment strategies might be appropriate. A "buy" strategy may be suitable if the stock is undervalued, while a "hold" or "sell" strategy might be more appropriate if overvalued or if significant risks exist.

- Investment Implications:

- Strengths: Identify the company’s key strengths, such as its diversified business model, strong market position in certain segments, and potential for growth in renewable energy.

- Weaknesses: Acknowledge any weaknesses, such as dependence on commodity prices, exposure to cyclical industries, or potential competition.

- Risk Assessment: Thoroughly assess the potential risks involved in investing in Gibraltar Industries stock, including market volatility, macroeconomic factors, and competitive pressures.

- Long-Term Growth Prospects: Consider the long-term growth potential of Gibraltar Industries. The company’s strategic initiatives, innovation efforts, and overall industry trends will all play a role.

Conclusion

This Gibraltar Industries stock preview offers valuable insights into the Q2 2024 earnings expectations and the overall outlook for the company. Several factors, including macroeconomic conditions, industry trends, and the company's own performance, will significantly influence the Gibraltar Industries stock price. While the potential for growth exists, particularly in the renewable energy sector, investors should remain aware of the inherent risks involved in any investment.

While this Gibraltar Industries stock preview provides valuable insights, remember to perform your own due diligence before making any investment decisions. Stay informed about Gibraltar Industries' financial performance and market trends to make well-informed choices regarding your Gibraltar Industries stock portfolio. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Where To Stream Eva Longorias Searching For Spain

May 13, 2025

Where To Stream Eva Longorias Searching For Spain

May 13, 2025 -

Predvybornaya Programma Edinoy Rossii Predlozheniya Ot Deputatov

May 13, 2025

Predvybornaya Programma Edinoy Rossii Predlozheniya Ot Deputatov

May 13, 2025 -

Doshkolnoe Obrazovanie Obnovlennye Standarty Po Fizike I Khimii

May 13, 2025

Doshkolnoe Obrazovanie Obnovlennye Standarty Po Fizike I Khimii

May 13, 2025 -

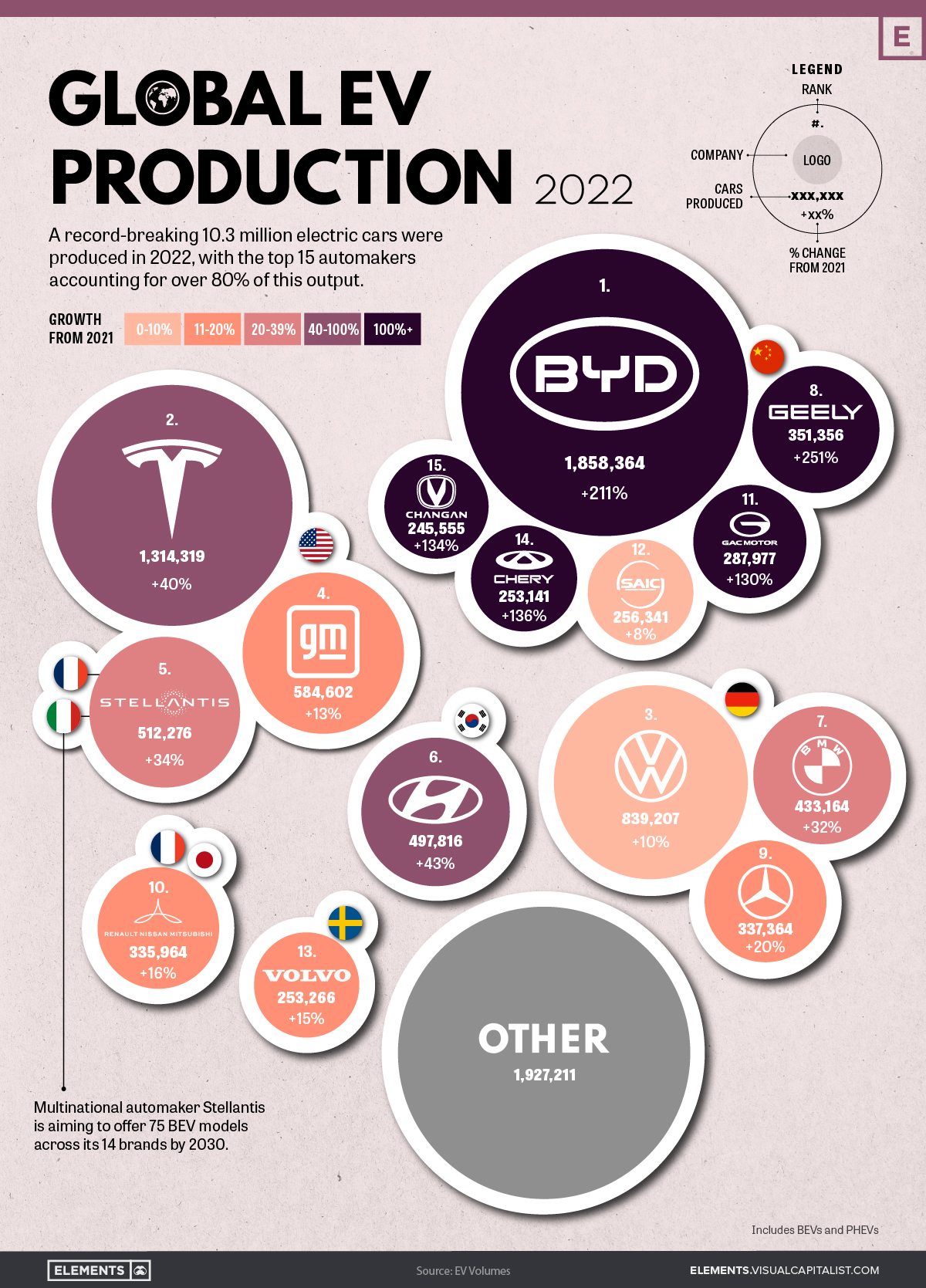

Maluf Fords Brazilian Legacy Fades As Byds Global Ev Dominance Rises

May 13, 2025

Maluf Fords Brazilian Legacy Fades As Byds Global Ev Dominance Rises

May 13, 2025 -

Extreme Heat Emergency Record Temperatures In La And Orange Counties

May 13, 2025

Extreme Heat Emergency Record Temperatures In La And Orange Counties

May 13, 2025