Gibraltar Industries (ROCK) Earnings Preview: What To Expect

Table of Contents

Q3 2024 Earnings Expectations for Gibraltar Industries (ROCK)

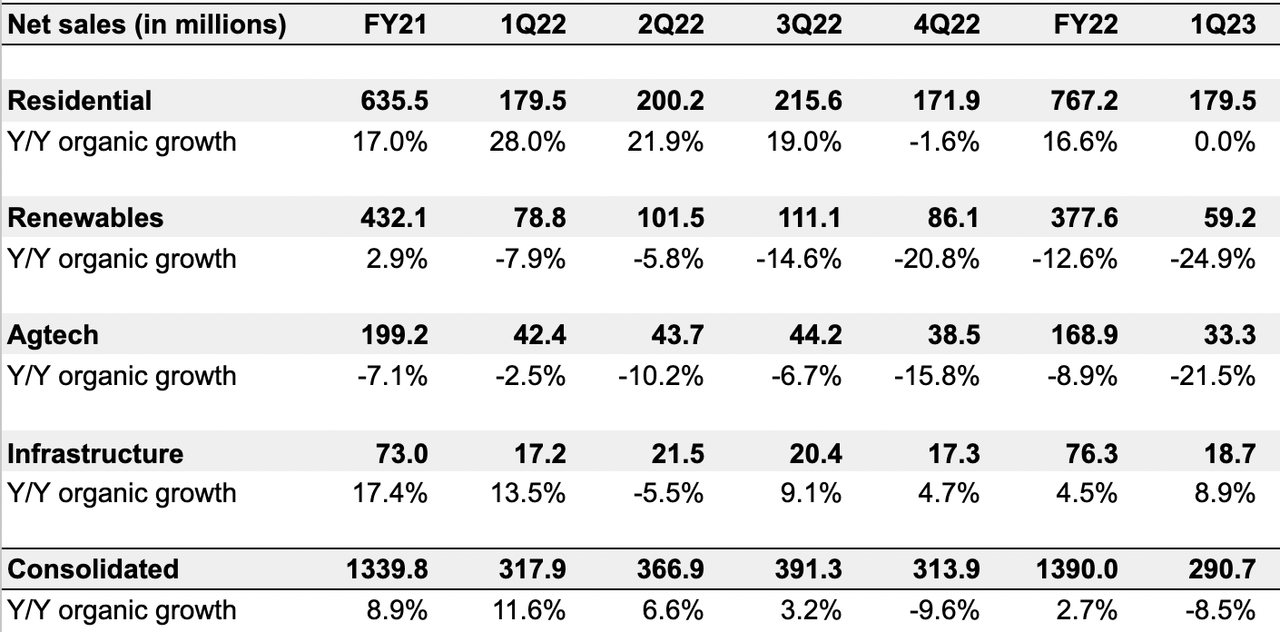

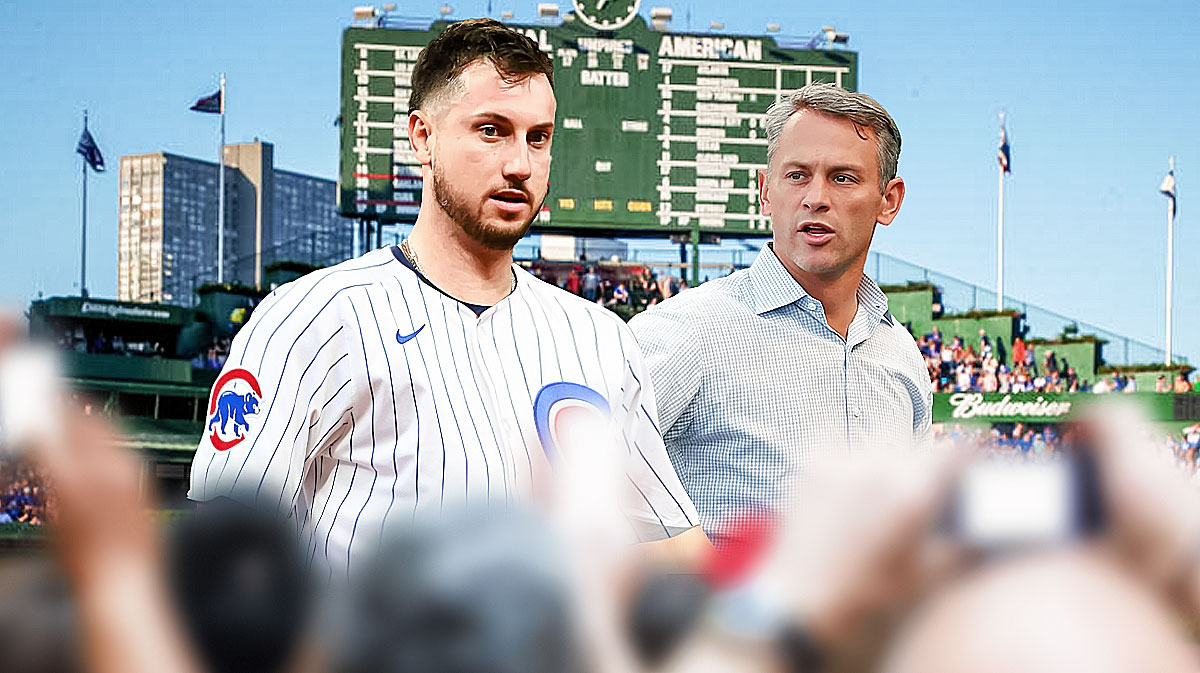

Revenue Projections:

Analysts are closely watching Gibraltar Industries' (ROCK) revenue growth for Q3 2024. Several factors are influencing projections, including robust demand in certain sectors like residential construction and the company's pricing strategies to counter inflationary pressures.

- Analyst estimates vary: While precise figures are subject to change, several analysts predict revenue growth in the low-to-mid single-digit percentage range compared to the same period last year. One analyst projects a 3.5% increase, while another anticipates a more conservative 1.8% growth.

- Upside potential: Strong performance in specific product lines could drive revenue above expectations. Increased market share or successful new product launches could contribute to positive surprises.

- Downside risks: A potential slowdown in the housing market or unexpected supply chain disruptions could negatively impact revenue. Macroeconomic factors such as inflation and a potential recession remain key downside risks.

Earnings Per Share (EPS) Estimates:

EPS is a crucial metric investors will scrutinize. Analysts' EPS estimates for Q3 2024 are generally aligned with modest revenue growth predictions, suggesting a continuation of profitability.

- EPS projections: Estimates currently range from $0.85 to $0.92 per share, a slight increase compared to Q3 2023.

- Year-over-year comparison: A direct comparison of Q3 2024 EPS with Q3 2023's figures will highlight the company's progress and ability to manage costs effectively. A significant deviation from expectations will likely trigger a market reaction.

- Impact on investors: The EPS results will directly influence Gibraltar Industries' (ROCK) stock price. A positive surprise could lead to an upward price movement, while a negative one may trigger a sell-off.

Key Metrics to Watch:

Beyond revenue and EPS, several other metrics provide valuable insights into Gibraltar Industries' (ROCK) financial health.

- Gross margin: Changes in gross margin reflect the company's ability to manage input costs and pricing effectively. A decline could signal increasing pressure on profitability.

- Operating margin: Operating margin reveals the efficiency of Gibraltar Industries' operations. Tracking changes in this metric over time is crucial for understanding operational performance.

- Debt levels: Investors will monitor Gibraltar Industries' (ROCK) debt levels to assess its financial stability and risk profile. Higher debt could constrain future growth and increase vulnerability to economic downturns.

- Free cash flow: Free cash flow indicates the cash generated by the company's operations after accounting for capital expenditures. Strong free cash flow suggests financial health and potential for dividends or share buybacks.

Factors Influencing Gibraltar Industries (ROCK) Earnings

Supply Chain Dynamics:

The ongoing impact of supply chain disruptions on Gibraltar Industries (ROCK) is a major concern.

- Material shortages: The availability and pricing of key raw materials, such as steel and aluminum, can significantly affect production costs and profitability. Potential shortages could constrain output and increase prices.

- Mitigation strategies: Gibraltar Industries' success in mitigating supply chain challenges through diversification of suppliers, strategic inventory management, and long-term contracts will be a key element influencing their results.

Market Demand and Competition:

The competitive landscape and market demand for Gibraltar Industries' (ROCK) products are critical factors.

- Competition: The company faces competition from other manufacturers of building products. Analyzing market share trends and competitive dynamics is vital to understanding Gibraltar Industries' performance.

- Demand trends: The demand for building materials is heavily influenced by macroeconomic factors, such as housing starts and infrastructure projects. Any shift in these trends will have a significant impact.

Recent Company Developments:

Recent strategic initiatives undertaken by Gibraltar Industries (ROCK) could impact their Q3 2024 results.

- Acquisitions: Any recent acquisitions or divestitures will affect their financial performance, potentially influencing revenue and earnings.

- New product launches: The successful launch of new products could boost revenue and market share.

Gibraltar Industries (ROCK) Stock Price Performance and Valuation

Stock Price Trends:

Monitoring Gibraltar Industries (ROCK) stock price movements leading up to and following the earnings announcement provides crucial context. Sudden price changes may be indicative of market sentiment and expectations.

- Recent price movements: Analyzing the stock's performance in recent weeks and months reveals any significant price fluctuations that might reflect market anticipation or reaction to other news.

- Catalysts: Identifying factors driving price changes (such as news regarding supply chain issues or positive industry reports) helps in understanding the current market sentiment.

Valuation Analysis:

A crucial aspect of assessing investment potential is evaluating Gibraltar Industries' (ROCK) valuation.

- Valuation multiples: Examining key metrics like the Price-to-Earnings (P/E) ratio compared to industry peers and historical data reveals whether the stock is currently undervalued or overvalued.

- Peer comparison: Comparing Gibraltar Industries' (ROCK) valuation to similar companies offers insights into its relative attractiveness to investors.

Conclusion: Investing in Gibraltar Industries (ROCK) – Your Next Steps

Gibraltar Industries' (ROCK) Q3 2024 earnings are anticipated to reflect modest growth, but several factors—including supply chain dynamics, market demand, and competition—will play a crucial role in determining the final results. Key metrics such as revenue growth, EPS, gross margin, and free cash flow will be closely analyzed. While there is potential for upside, investors should be aware of the downside risks posed by macroeconomic factors. Based on the current analysis, Gibraltar Industries (ROCK) stock may present a moderate opportunity, but further investigation is needed.

Before making any investment decision regarding Gibraltar Industries (ROCK) stock, conduct thorough due diligence. Carefully review the official earnings announcement and related financial reports after their release. Monitor the post-earnings reaction in the market, and continue to analyze Gibraltar Industries (ROCK) investment potential based on the evolving economic landscape. Remember to consult with a financial advisor before making any investment decisions related to Gibraltar Industries stock or ROCK earnings.

Featured Posts

-

Raptors Lottery Odds Seventh Best Chance At Nba Draft Success

May 13, 2025

Raptors Lottery Odds Seventh Best Chance At Nba Draft Success

May 13, 2025 -

Persipura Butuh Dukungan Masyarakat Papua Kata Ayorbaba

May 13, 2025

Persipura Butuh Dukungan Masyarakat Papua Kata Ayorbaba

May 13, 2025 -

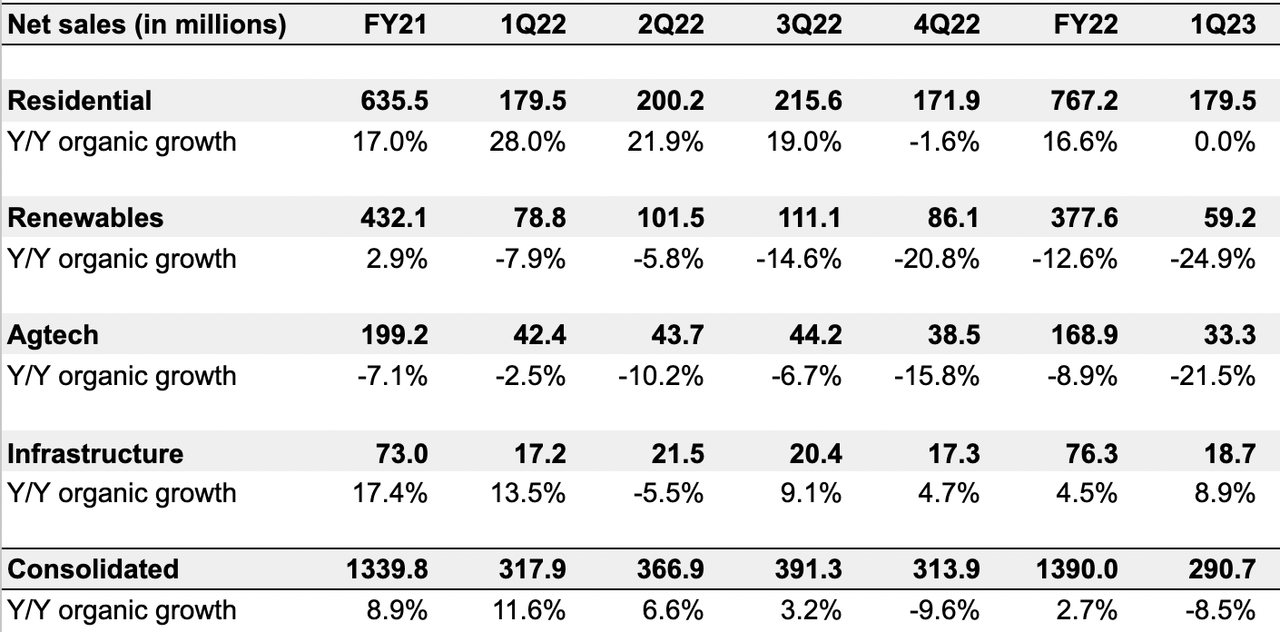

Unending Nightmare The Plight Of Hostage Families In Gaza

May 13, 2025

Unending Nightmare The Plight Of Hostage Families In Gaza

May 13, 2025 -

New Details Emerge Tory Lanezs Alleged Role In Megan Thee Stallion Deposition Interference

May 13, 2025

New Details Emerge Tory Lanezs Alleged Role In Megan Thee Stallion Deposition Interference

May 13, 2025 -

Dissecting The Kyle Tucker Report Cubs Fans Concerns Explained

May 13, 2025

Dissecting The Kyle Tucker Report Cubs Fans Concerns Explained

May 13, 2025