Global Bond Market Instability: A Posthaste Warning

Table of Contents

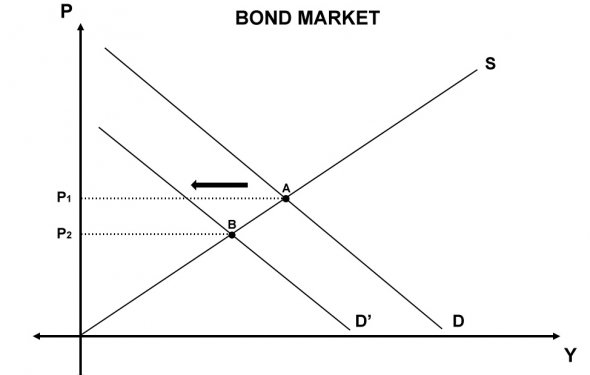

Rising Interest Rates and Their Impact

The aggressive monetary policy adopted by central banks globally is a primary driver of current global bond market instability.

The Fed's Aggressive Monetary Policy

The Federal Reserve's (Fed) series of interest rate hikes, aimed at curbing inflation, has significantly impacted global bond yields.

- Increased borrowing costs: Higher interest rates make borrowing more expensive for businesses and consumers, impacting economic growth and potentially leading to recessionary pressures.

- Reduced bond prices: As interest rates rise, the value of existing bonds falls, as their fixed interest payments become less attractive compared to newly issued bonds with higher yields. This creates a downward pressure on bond prices.

- Impact on corporate debt: Companies with significant debt exposure face increased refinancing costs, potentially leading to financial distress for some.

Keywords: Interest rate hikes, bond yield curve, monetary policy, quantitative tightening.

Global Interest Rate Synchronization

The Fed's actions are not isolated. Other major economies are also increasing interest rates, compounding the pressure on the global bond market.

- ECB policies: The European Central Bank (ECB) has also implemented interest rate hikes to combat inflation within the Eurozone, influencing the Euro and impacting global capital flows.

- Bank of Japan actions: While the Bank of Japan has maintained a relatively accommodative monetary policy for longer, the shift towards a more hawkish stance is generating increased uncertainty in the market.

- Impact on global capital flows: The synchronized tightening of monetary policy globally is leading to significant shifts in global capital flows, as investors seek higher returns in different markets, contributing to global bond market instability.

Keywords: global interest rates, central bank policies, currency fluctuations.

Geopolitical Uncertainty and its Influence on Bond Markets

Geopolitical events significantly influence investor sentiment and contribute to global bond market instability.

The War in Ukraine and Energy Prices

The ongoing war in Ukraine has had a profound impact on energy prices, fueling inflation and impacting investor sentiment.

- Increased inflation: Disruptions to energy supplies have led to soaring energy prices, driving up inflation globally.

- Supply chain disruptions: The conflict has exacerbated existing supply chain issues, further contributing to inflationary pressures.

- Flight to safety: Investors often seek "safe haven" assets during times of geopolitical uncertainty, leading to increased demand for government bonds from perceived safer countries.

- Impact on sovereign bond yields: The increased risk associated with investing in certain regions has pushed up sovereign bond yields in affected countries.

Keywords: geopolitical risk, inflation, energy crisis, sovereign debt.

Geopolitical Tensions in Other Regions

Beyond Ukraine, other geopolitical factors add to the overall instability.

- Trade wars: Ongoing trade tensions, particularly between the US and China, create uncertainty and impact investor confidence.

- Sanctions: The imposition of sanctions on certain countries can disrupt global trade and financial markets.

- Political instability: Political unrest in various regions increases uncertainty and can lead to capital flight.

- Investor confidence: Overall geopolitical uncertainty negatively impacts investor confidence, further contributing to global bond market instability.

Keywords: global political risk, emerging market debt, investor sentiment.

Inflation and its Erosive Effect on Bond Returns

Persistent high inflation is a major threat to bond returns.

Persistent Inflationary Pressures

Stubbornly high inflation erodes the purchasing power of bond returns.

- Inflation expectations: Investors' expectations of future inflation significantly influence bond yields. Higher inflation expectations generally lead to higher bond yields to compensate for the loss of purchasing power.

- Real interest rates: Real interest rates (nominal interest rate minus inflation) are a key indicator of the true return on a bond investment. High inflation can lead to negative real interest rates, meaning investors are losing purchasing power.

- Purchasing power: Inflation reduces the purchasing power of future bond payments, making them less attractive to investors.

- Investor behavior: High inflation can lead to investors shifting away from bonds towards assets that are expected to better hedge against inflation, such as commodities or real estate.

Keywords: inflation, real yield, bond returns, purchasing power parity.

Central Bank Responses to Inflation

Central bank actions to combat inflation are crucial but can also cause market volatility.

- Effectiveness of monetary policy: The effectiveness of central bank policies in controlling inflation is debated and depends on various economic factors. Overly aggressive policies can lead to economic slowdowns.

- Trade-offs between inflation and growth: Central banks face a difficult trade-off between controlling inflation and supporting economic growth.

- Market volatility: Central bank actions and their impact on inflation expectations can lead to significant volatility in the bond market.

Keywords: monetary policy effectiveness, inflation targeting, bond market volatility.

Conclusion

The global bond market is experiencing significant instability driven by a confluence of factors including rising interest rates, geopolitical uncertainty, and persistent inflation. These interconnected challenges present substantial risks to investors. Understanding these complexities is critical for mitigating risk and making informed investment decisions.

Call to Action: Understanding the complexities of global bond market instability is crucial for mitigating risk. Investors need to carefully assess their portfolios, diversify strategically, and potentially seek professional financial advice to navigate this challenging environment. Stay informed about developments in global bond market instability to make informed investment decisions and protect your portfolio.

Featured Posts

-

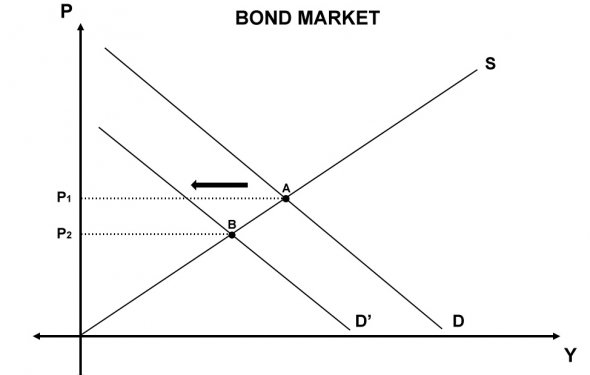

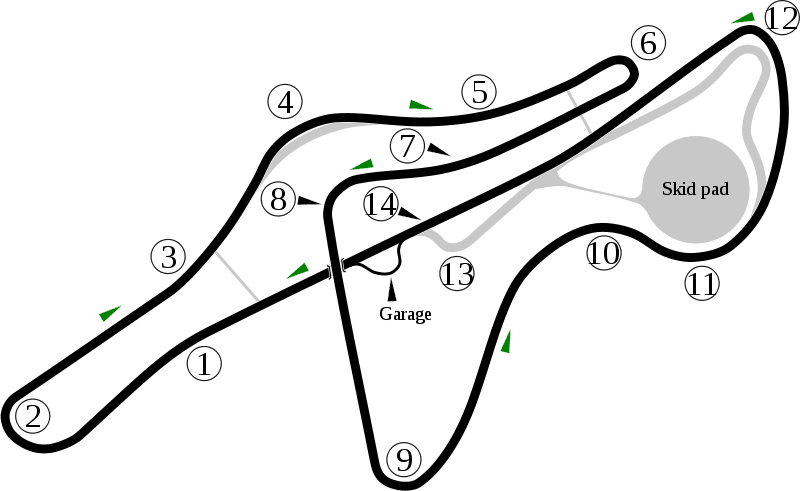

The 10 Fastest Standard Production Ferraris Around Fiorano

May 24, 2025

The 10 Fastest Standard Production Ferraris Around Fiorano

May 24, 2025 -

Unerwarteter Eis Trend In Nrw Der Beliebteste Geschmack

May 24, 2025

Unerwarteter Eis Trend In Nrw Der Beliebteste Geschmack

May 24, 2025 -

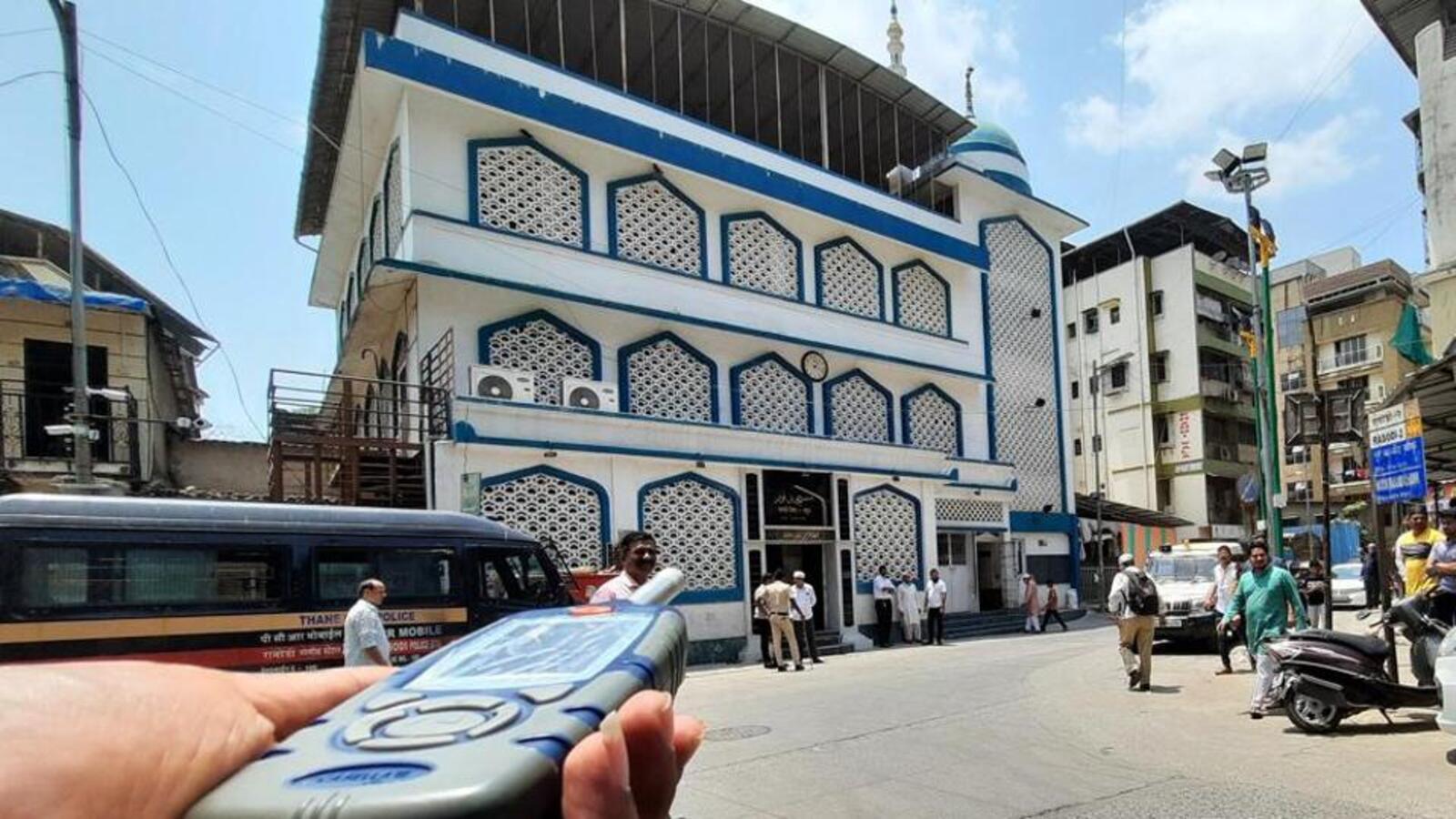

Inside Ferraris First Official Bengaluru Service Centre A Detailed Look

May 24, 2025

Inside Ferraris First Official Bengaluru Service Centre A Detailed Look

May 24, 2025 -

Trumps Budget Examining The Potential Loss Of Museum Programs And Funding

May 24, 2025

Trumps Budget Examining The Potential Loss Of Museum Programs And Funding

May 24, 2025 -

Low Gas Prices Expected For Memorial Day Weekend Travel

May 24, 2025

Low Gas Prices Expected For Memorial Day Weekend Travel

May 24, 2025