Global Commodity Markets This Week: 5 Crucial Charts To Monitor

Table of Contents

Crude Oil Price Movements & Geopolitical Influences

Crude oil prices remain a central focus in global commodity markets. Recent events have significantly impacted both supply and demand, creating considerable volatility. Understanding these influences is critical for predicting future price movements and mitigating risk.

-

Impact of OPEC+ decisions on global oil supply: The Organization of the Petroleum Exporting Countries (OPEC+) continues to play a pivotal role in shaping global oil supply. Their production decisions, often influenced by geopolitical considerations, directly impact oil prices. A reduction in OPEC+ output can lead to higher prices, while increased production can put downward pressure. Monitoring OPEC+ announcements is crucial for anyone invested in or affected by the oil market.

-

Geopolitical instability and its effect on oil prices: Geopolitical instability, particularly the ongoing conflict in Ukraine, continues to exert significant influence. Sanctions imposed on Russia, a major oil producer, have disrupted supply chains and contributed to price increases. Any escalation of geopolitical tensions can trigger further price volatility. Tracking geopolitical risks is therefore essential for predicting oil price fluctuations.

-

The role of energy demand from key economies (US, China, Europe): The energy demand from major economies like the US, China, and Europe plays a significant role in shaping oil prices. Strong economic growth in these regions generally translates to higher energy consumption and increased demand for oil, thereby pushing prices upward. Conversely, economic slowdowns can lead to decreased demand and lower prices. Analyzing economic indicators from these key regions is vital for understanding future oil price trends.

-

Specific charts/indices related to crude oil: Investors and analysts closely follow key indices like Brent Crude and West Texas Intermediate (WTI) to gauge the direction of the oil market. These benchmarks reflect the price of crude oil in different regions and are crucial for understanding global price movements. Analyzing the daily, weekly, and monthly trends of these indices offers valuable insights into the oil market's dynamics.

Natural Gas Prices and the Energy Transition

Natural gas prices are also experiencing significant fluctuations, driven by a complex interplay of supply, demand, and the ongoing energy transition towards renewable sources.

-

Impact of weather patterns on natural gas demand: Extreme weather events, particularly cold snaps in winter, can dramatically increase natural gas demand for heating, leading to price spikes. Conversely, milder winters can reduce demand and lower prices. Predicting weather patterns, therefore, plays a crucial role in forecasting natural gas price movements.

-

The role of storage levels in influencing prices: Natural gas storage levels significantly influence prices. Low storage levels indicate limited supply, which can drive prices up, while high storage levels suggest ample supply, potentially leading to price declines. Monitoring storage levels is therefore a key indicator for understanding price trends in the natural gas market.

-

Government policies promoting renewable energy and their effect on natural gas demand: Government policies aimed at promoting renewable energy sources, such as solar and wind power, can gradually reduce demand for natural gas in the long term. This shift in energy consumption patterns can have a significant impact on natural gas prices over time. Staying informed about renewable energy policies is important for long-term forecasting.

-

Specific charts/indices related to natural gas prices: Various indices track natural gas prices in different regions. Analyzing these indices, alongside storage levels and weather forecasts, provides a comprehensive view of the natural gas market.

Agricultural Commodity Prices and Food Security

Agricultural commodity markets are essential for global food security, yet highly sensitive to weather patterns, global demand, and geopolitical tensions.

-

Impact of climate change on crop yields: Climate change, including extreme weather events such as droughts and floods, poses a significant threat to crop yields, impacting the supply of agricultural commodities and driving up prices. Understanding the impact of climate change on agriculture is crucial for anticipating future price trends.

-

Global food demand and its impact on prices: Rising global population and changing dietary habits are driving up demand for agricultural commodities like wheat, corn, and soybeans. Increased demand, coupled with supply disruptions, can lead to substantial price increases. Monitoring global food demand is therefore essential for understanding price fluctuations.

-

Trade restrictions and their influence on commodity availability and price: Trade restrictions and geopolitical tensions can disrupt the flow of agricultural commodities, impacting availability and driving up prices. Tracking trade policies and geopolitical events is crucial for assessing potential risks to food security and predicting price movements.

-

Specific charts/indices related to agricultural commodities: Futures contracts for various agricultural commodities, such as wheat, corn, and soybean futures, are important indicators of market sentiment and price trends. Analyzing these indices provides valuable insights into the agricultural commodity market.

Precious Metals: Gold and Silver as Safe Havens

Gold and silver, often considered safe haven assets, tend to perform well during times of economic uncertainty and inflation.

-

Correlation between inflation and precious metal prices: Inflation typically leads to increased demand for precious metals as investors seek to protect their purchasing power. Higher inflation often correlates with higher prices for gold and silver. Monitoring inflation rates is therefore crucial for understanding potential price movements in these markets.

-

Influence of interest rate hikes on precious metal demand: Interest rate hikes by central banks can impact the demand for precious metals. Higher interest rates can reduce the attractiveness of gold and silver, as they offer no yield, potentially leading to price declines. However, higher rates can also be a sign of a tightening economy, which might bolster the safe haven demand for gold and silver. Understanding this dynamic is key.

-

Investment trends in gold and silver: Investment trends, including exchange-traded funds (ETFs) and physical purchases, significantly influence the price of gold and silver. Monitoring investment flows provides valuable insight into market sentiment and potential price movements.

-

Specific charts/indices related to gold and silver prices: Tracking the price of gold and silver through various indices provides essential data for understanding market trends and making informed investment decisions.

Base Metal Prices and Global Industrial Activity

Base metals, including copper, aluminum, and nickel, are closely tied to global industrial activity and economic growth.

-

Demand from key industrial sectors (construction, manufacturing): Strong economic growth and increased industrial activity, particularly in construction and manufacturing, lead to higher demand for base metals, pushing prices upward. Conversely, economic slowdowns can decrease demand and lower prices. Monitoring industrial production data is therefore important for predicting price movements.

-

Supply chain disruptions and their impact on base metal prices: Supply chain disruptions, such as those experienced during the pandemic, can restrict the availability of base metals, leading to price increases. Analyzing potential supply chain vulnerabilities is crucial for predicting price fluctuations.

-

Global economic growth forecasts and their impact on demand: Global economic growth forecasts provide a crucial indication of future demand for base metals. Positive growth forecasts generally translate to higher demand, while negative forecasts suggest lower demand. Keeping an eye on global economic indicators is therefore essential for understanding price trends.

-

Specific charts/indices related to base metals: Futures contracts for various base metals, such as copper and aluminum futures, serve as important indicators of market sentiment and price trends. Analyzing these indices offers valuable insights into the base metal market.

Conclusion

This week's global commodity markets present a complex picture, influenced by diverse factors including geopolitical events, weather patterns, and economic growth. By carefully monitoring the five crucial charts discussed above – crude oil, natural gas, agricultural commodities, precious metals, and base metals – investors and businesses can better understand current trends and make more informed decisions.

Call to Action: Stay informed on the dynamic landscape of global commodity markets. Regularly check back for updates on these crucial charts and further analysis of the evolving global commodity market trends. Understanding global commodity markets is key to navigating the complexities of the current economic climate.

Featured Posts

-

Mastering The Sabrina Carpenter Fortnite Challenges A Comprehensive Guide

May 06, 2025

Mastering The Sabrina Carpenter Fortnite Challenges A Comprehensive Guide

May 06, 2025 -

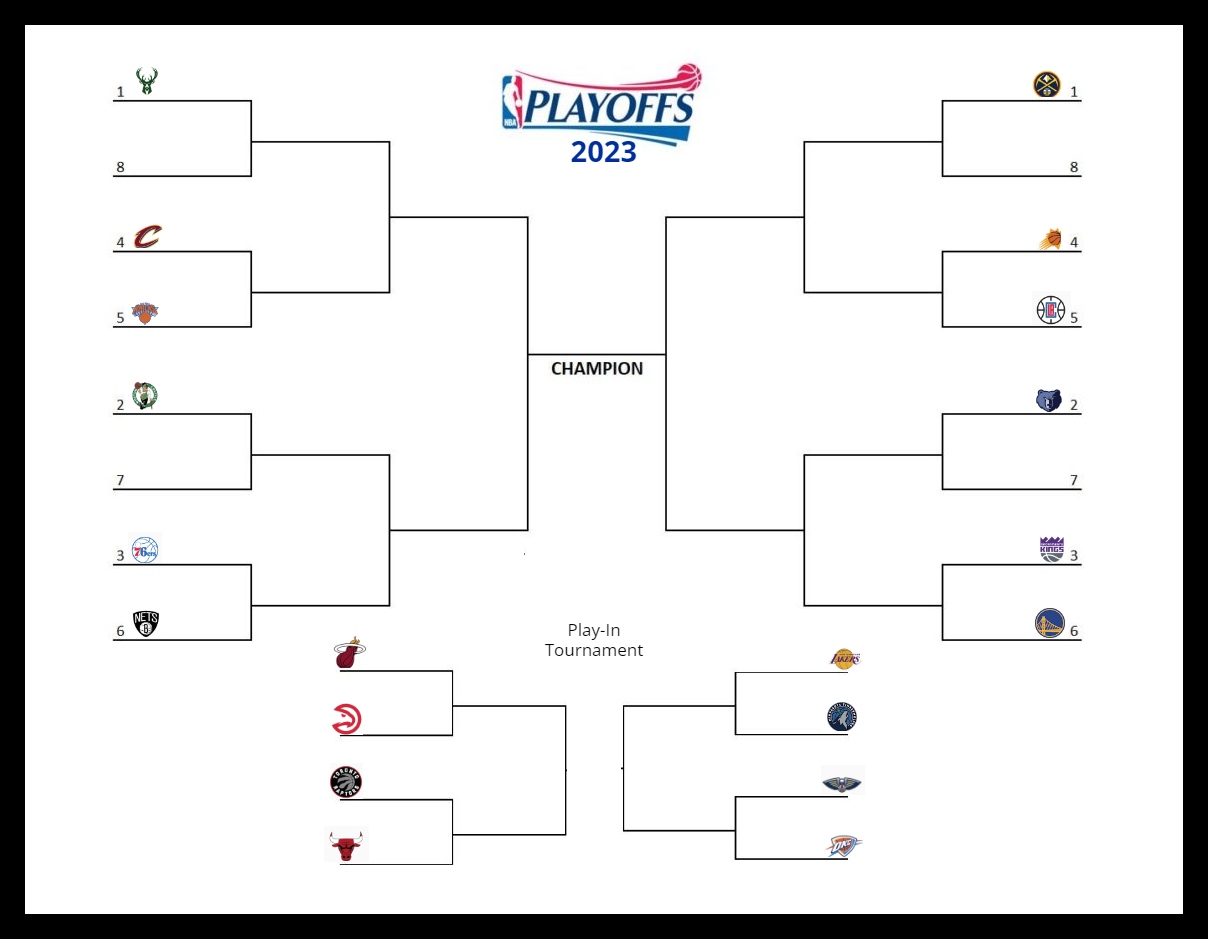

2025 Nba Playoffs Bracket Full Tv Schedule For Round 1

May 06, 2025

2025 Nba Playoffs Bracket Full Tv Schedule For Round 1

May 06, 2025 -

Priyanka Chopras Miss World Two Piece Refusal Madhu Chopra Reveals All

May 06, 2025

Priyanka Chopras Miss World Two Piece Refusal Madhu Chopra Reveals All

May 06, 2025 -

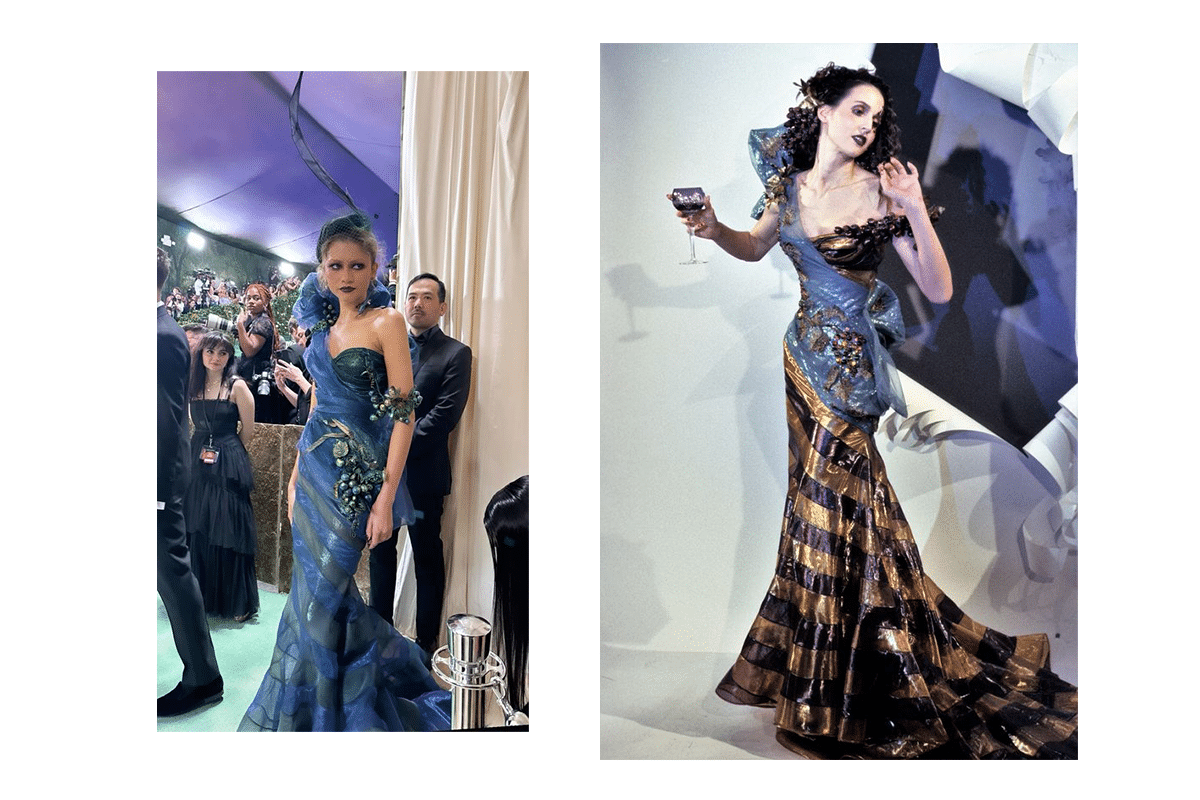

Met Gala 2025 Celebrities Confirmed To Attend

May 06, 2025

Met Gala 2025 Celebrities Confirmed To Attend

May 06, 2025 -

Clash Among House Democrats Age And Power In The Spotlight

May 06, 2025

Clash Among House Democrats Age And Power In The Spotlight

May 06, 2025