Global Financial System Under Threat: The Impact Of Trump's Trade War (IMF)

Table of Contents

Increased Global Uncertainty and Market Volatility

Trump's tariffs triggered significant global market uncertainty and volatility, impacting investor confidence worldwide. The unpredictable nature of the trade war created a climate of fear and uncertainty, impacting investment decisions and economic growth.

Impact on Stock Markets

- Increased market volatility and decreased predictability: The constant threat of new tariffs and retaliatory measures led to sharp fluctuations in stock markets globally. Investors became hesitant, leading to decreased investment and capital flight.

- Negative impact on global investment flows: Uncertainty surrounding trade policies discouraged foreign direct investment (FDI) and portfolio investment, hindering economic growth in affected countries.

- Example: The Dow Jones Industrial Average experienced significant drops during periods of escalated trade tensions, clearly demonstrating the negative correlation between trade war escalations and stock market performance. Similar trends were observed in other major global indices like the FTSE 100 and Nikkei 225.

Currency Fluctuations and Exchange Rate Instability

The trade war exacerbated existing currency fluctuations, creating further uncertainty for businesses engaged in international trade. The resulting instability made it harder for companies to plan and execute their global operations.

- Increased hedging costs for businesses: Businesses had to spend more on hedging against currency risk, eating into their profits and reducing their competitiveness.

- Potential for currency wars between nations: As countries retaliated against each other's trade policies, there was a risk of competitive devaluations, further destabilizing the global financial system.

- Examples of specific currencies affected: The US dollar (USD), Chinese Yuan (CNY), and Euro (EUR) all experienced significant fluctuations during the period of heightened trade tensions, impacting various industries across the globe.

Disruption of Global Supply Chains and Trade Flows

The imposition of tariffs and subsequent retaliatory measures significantly disrupted established global supply chains, leading to increased production costs and shortages. This had a cascading effect throughout the global economy.

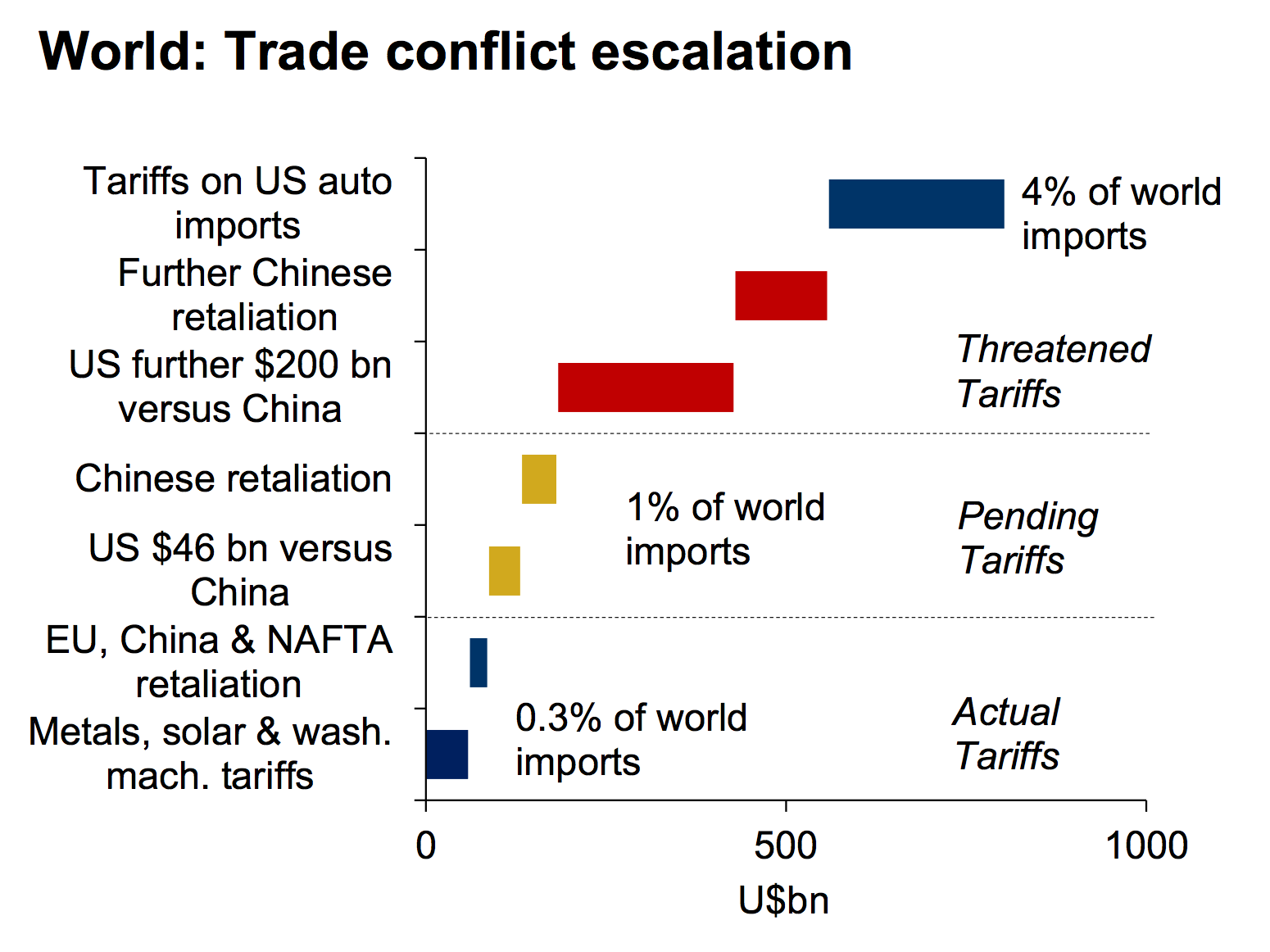

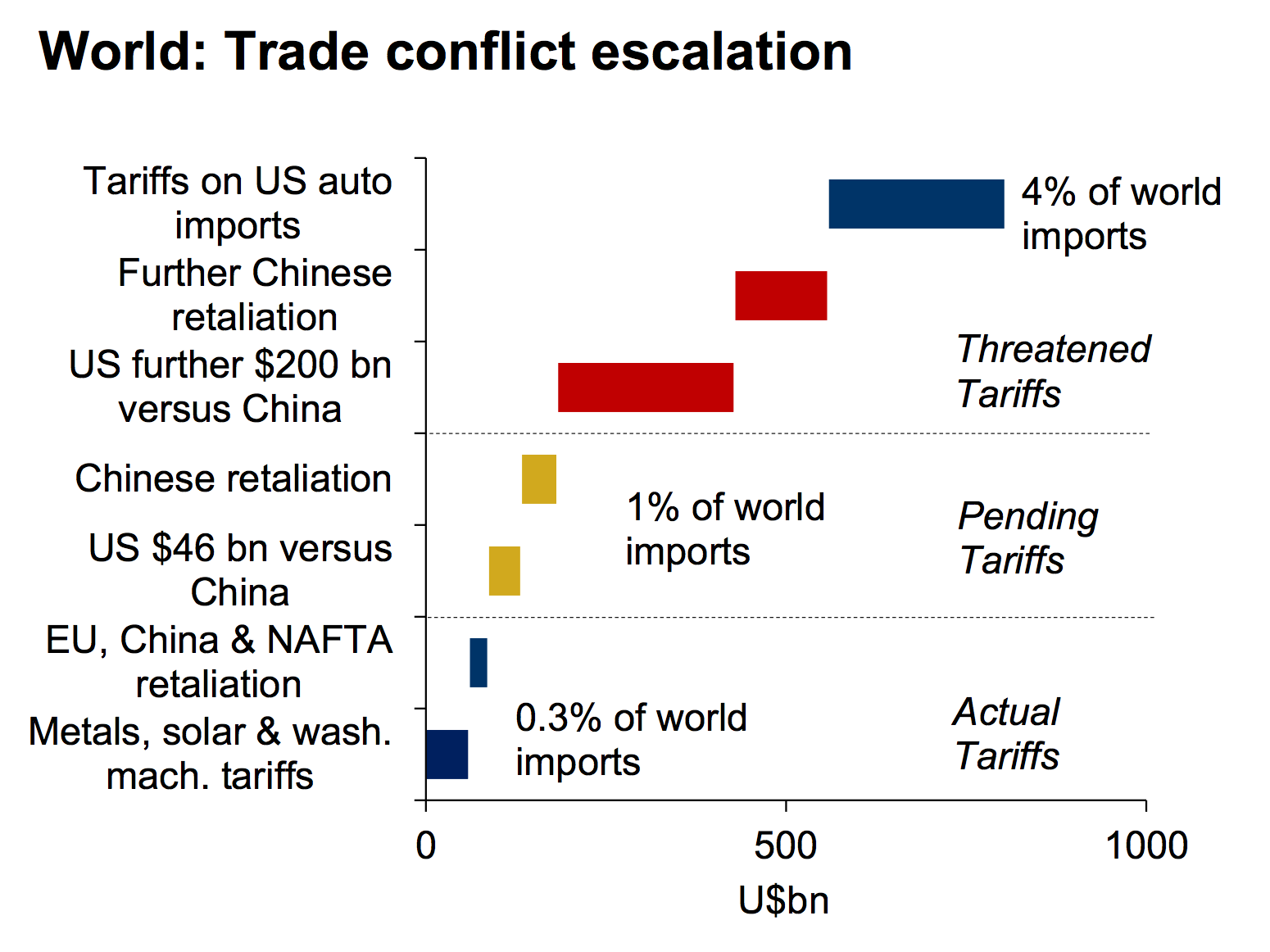

Tariffs and Retaliatory Measures

- Examples of specific industries affected: The agricultural sector, particularly soybean farmers in the US, and manufacturing industries reliant on imported components faced major challenges due to tariffs and retaliatory measures.

- Analysis of the impact on global trade volumes: The trade war led to a noticeable reduction in global trade volumes, as businesses adjusted to the new trade landscape.

- Discussion of the shift in global supply chains: Many companies began to diversify their supply chains, relocating production facilities to reduce their reliance on specific countries and mitigate the risk of future trade disruptions.

Impact on Multinational Corporations

Multinational corporations (MNCs) faced significant challenges adapting to the changing trade landscape, impacting profitability and investment decisions. Their complex global operations were directly impacted by the changing regulatory environment.

- Increased complexity of global operations: Managing tariffs, navigating retaliatory measures, and adapting to changing regulations added significant complexity to the operations of MNCs.

- Need for restructuring and relocation of production facilities: Many MNCs were forced to restructure their operations and relocate production facilities to mitigate the impact of tariffs and other trade barriers.

- Case studies of specific multinational corporations affected: Several large corporations experienced significant financial losses and operational disruptions as a direct result of Trump's trade war. These real-world examples illustrate the far-reaching effects of the conflict.

Slowdown in Global Economic Growth

Trump's trade war negatively impacted global demand, contributing to a slowdown in economic growth across many countries. The uncertainty and increased costs associated with trade directly hampered economic expansion.

Reduced Global Demand

- IMF forecasts showing reduced GDP growth projections: The IMF consistently lowered its global GDP growth forecasts during the period of heightened trade tensions, reflecting the negative impact of the trade war.

- Impact on consumer spending and business investment: Increased prices due to tariffs reduced consumer purchasing power and dampened business investment, leading to a slowdown in economic activity.

- Analysis of the ripple effect across different economies: The trade war's impact wasn't limited to the directly involved countries. The ripple effect spread across the globe, affecting even those nations not directly participating in the trade conflict.

Increased Inflationary Pressures

Tariffs added to the cost of goods, contributing to inflationary pressures in several countries. This further strained consumer budgets and reduced purchasing power.

- Discussion of the impact on consumer prices: Tariffs translated into higher prices for consumers, affecting their purchasing power and overall economic well-being.

- Analysis of the relationship between tariffs and inflation: Economic analyses clearly demonstrated a direct correlation between the imposition of tariffs and an increase in consumer prices.

- Comparison of inflation rates before and after the trade war: A comparison of inflation rates before and after the trade war reveals a clear surge in inflationary pressure in several countries.

The IMF's Response and Policy Recommendations

The IMF consistently warned of the negative economic consequences of Trump's trade war and offered policy recommendations to mitigate the damage. Their analysis provided valuable insight into the trade war's impact on the global economy.

IMF Warnings and Assessments

- Quotes from IMF reports and publications highlighting concerns: The IMF published numerous reports and statements expressing serious concern about the negative economic effects of the trade war.

- Analysis of the IMF's economic forecasts during the period: The IMF's economic forecasts during the period clearly reflected the downward pressure on global growth caused by the trade war.

- Summarizing the IMF's recommendations for mitigating the damage: The IMF consistently advocated for de-escalation, international cooperation, and multilateral solutions to address the trade conflict.

Policy Recommendations for Mitigating the Impact

- Emphasis on international cooperation and multilateralism: The IMF stressed the importance of international cooperation and adherence to multilateral trade agreements to prevent similar crises in the future.

- Recommendations for fiscal and monetary policy adjustments: The IMF recommended specific fiscal and monetary policy adjustments to mitigate the negative economic effects of the trade war, including targeted support for affected industries.

- Suggestions for reforms to improve the resilience of the global financial system: The IMF highlighted the need for reforms to strengthen the resilience of the global financial system against future economic shocks, including those stemming from trade conflicts.

Conclusion

Trump's trade war posed a significant threat to the global financial system, causing increased uncertainty, market volatility, disruptions to supply chains, and a slowdown in global economic growth. The IMF's analysis and warnings underscored the severity of the situation. Understanding the lasting impacts of this trade conflict is crucial for policymakers and businesses alike. It's vital to learn from this experience to prevent similar disruptions in the future and build a more resilient global financial system. To stay informed on the ongoing challenges to the global economy and the impact of future trade policies, continue to follow updates and analyses on the effects of Trump's trade war and other international economic developments. Understanding the long-term consequences of Trump's trade war remains crucial for navigating future global economic uncertainties.

Featured Posts

-

From Struggling Brewer To Clutch Hitter A 2025 Success Story

Apr 23, 2025

From Struggling Brewer To Clutch Hitter A 2025 Success Story

Apr 23, 2025 -

Life As A Chalet Girl Challenges And Rewards In European Ski Resorts

Apr 23, 2025

Life As A Chalet Girl Challenges And Rewards In European Ski Resorts

Apr 23, 2025 -

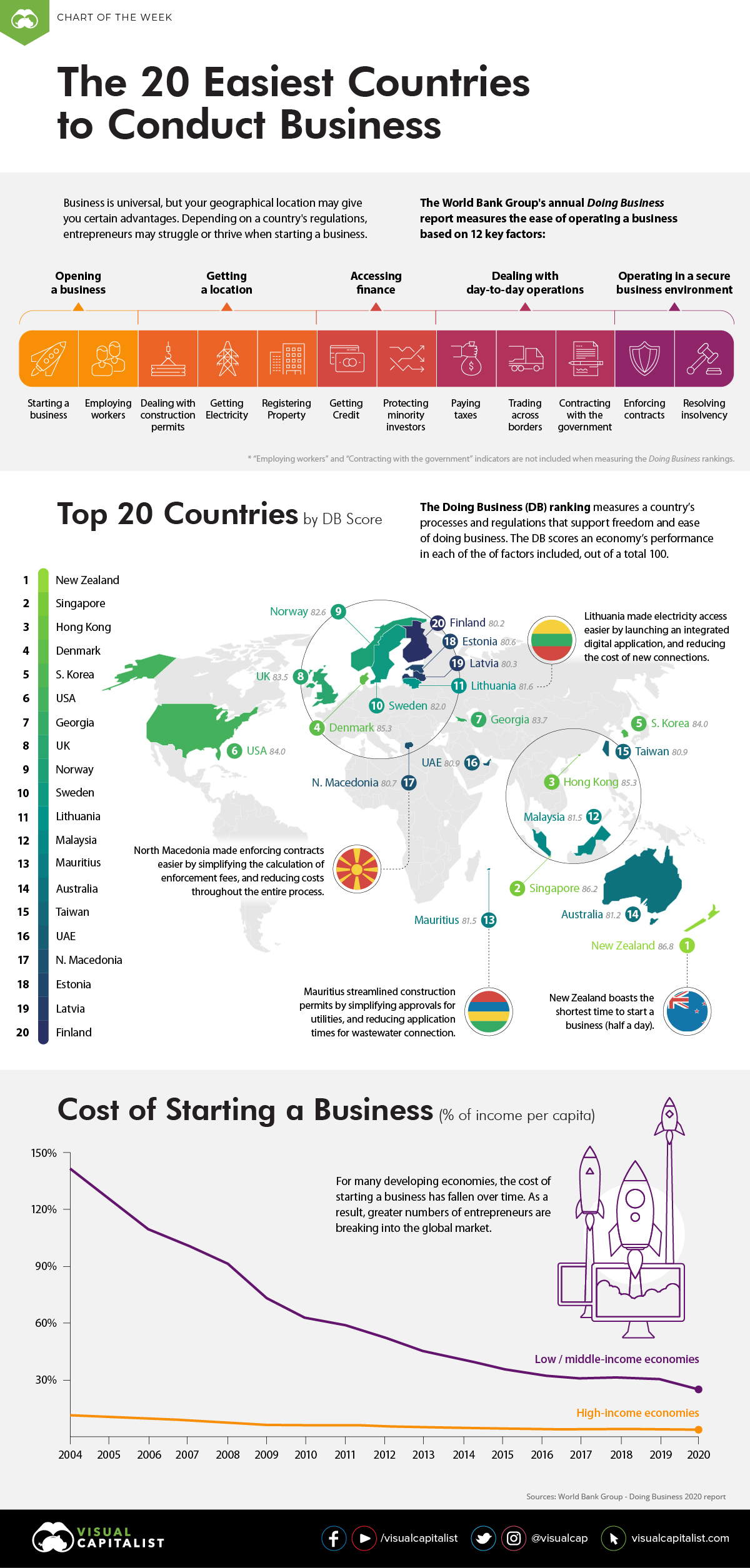

Identifying And Analyzing The Countrys Fastest Growing Business Areas

Apr 23, 2025

Identifying And Analyzing The Countrys Fastest Growing Business Areas

Apr 23, 2025 -

Program Tv Ramadan 2025 Jadwal Tayang And Sinopsis Acara Menarik

Apr 23, 2025

Program Tv Ramadan 2025 Jadwal Tayang And Sinopsis Acara Menarik

Apr 23, 2025 -

10 Mart 2025 Pazartesi Ankara Iftar Ve Sahur Saatleri Ne Zaman

Apr 23, 2025

10 Mart 2025 Pazartesi Ankara Iftar Ve Sahur Saatleri Ne Zaman

Apr 23, 2025