Global Tech IPO Market Slowdown: Impact Of Tariffs

Table of Contents

Increased Costs and Reduced Profitability

Tariffs are directly impacting the bottom line of tech companies, making the already risky IPO process even more challenging. This section will explore how increased costs and reduced profitability are contributing to the global tech IPO market slowdown.

Impact on Manufacturing and Supply Chains

Tariffs significantly increase the cost of goods, particularly for tech companies with complex global supply chains. This impacts profitability, making IPOs less attractive to investors.

- Higher component costs for hardware manufacturers: The price of essential components, from microchips to rare earth minerals, increases directly with tariffs, squeezing profit margins.

- Increased logistics and shipping expenses: Tariffs often lead to increased transportation costs and complex customs procedures, adding to the overall cost of bringing products to market.

- Reduced competitiveness in the global market: Higher production costs make it more difficult for tech companies to compete on price with companies based in regions with lower tariffs.

- Impact on companies relying on overseas manufacturing: Companies heavily reliant on overseas manufacturing are disproportionately affected, experiencing sharper profit margin reductions.

Impact on R&D and Innovation

Reduced profitability due to tariffs often leads to cutbacks in research and development (R&D) budgets. This has a cascading effect, slowing innovation and delaying IPOs.

- Reduced investment in cutting-edge technologies: Companies prioritize cost-cutting measures, diverting funds away from long-term R&D projects.

- Delayed product launches: A lack of investment in R&D can delay the development and launch of new products, impacting revenue streams and investor confidence.

- Potential loss of competitive advantage: Slowed innovation allows competitors to gain a foothold, potentially hindering future growth and attractiveness for IPOs.

- Impact on long-term growth prospects: The long-term impact of reduced R&D spending can severely limit a company's future growth potential, making it less appealing to potential investors.

Investor Uncertainty and Risk Aversion

The unpredictable nature of tariffs creates a climate of uncertainty, significantly impacting investor sentiment and leading to risk aversion.

Geopolitical Instability and Market Volatility

The ever-changing landscape of trade policies and tariffs contributes to geopolitical instability and increased market volatility. This uncertainty makes investors hesitant to commit to high-risk tech IPOs.

- Decreased investor confidence: Unpredictable tariffs create uncertainty about future earnings and profitability, leading to reduced investor confidence.

- Increased market volatility: The shifting landscape of tariffs contributes to increased market volatility, making it challenging to predict market behavior.

- Higher perceived risk for tech investments: Tech IPOs, already considered relatively high-risk investments, become even riskier under the shadow of unpredictable tariffs.

- Shift in investment towards less volatile sectors: Investors may shift their capital towards less volatile sectors perceived as safer options during times of economic and geopolitical uncertainty.

Difficulty in Forecasting Future Earnings

Fluctuating component costs and unpredictable tariff policies make it extremely challenging for companies to accurately forecast future earnings—a critical factor in determining IPO valuations.

- Challenges in developing realistic financial projections: The variability introduced by tariffs makes it difficult to create reliable financial forecasts for investors.

- Difficulty in setting an appropriate IPO price: Inaccurate financial projections lead to difficulties in setting a fair and attractive IPO price, potentially resulting in underpricing or overpricing.

- Increased risk of underpricing or overpricing: An incorrectly set IPO price can severely impact a company's valuation and investor perception.

- Negative impact on investor perception and participation: Uncertainty around financial projections can deter investors from participating in the IPO, reducing demand and overall valuation.

Alternative Funding Strategies and Delays

Facing headwinds in the public market, tech companies are exploring alternative funding strategies, often delaying their IPO plans.

Increased Reliance on Private Funding

With the challenges of a public offering exacerbated by tariffs, many tech companies are increasingly turning to private equity and venture capital for funding.

- Higher valuations in private funding rounds: Private investors may be willing to pay higher valuations in private funding rounds compared to a potentially lower valuation in a public offering.

- Reduced need for public market capital: Private funding allows companies to delay or avoid the public market altogether, reducing exposure to tariff-related risks.

- Potential for longer timelines before going public: Reliance on private funding can extend the timeline before a company decides to pursue an IPO.

- Impact on liquidity for early investors: This shift to private funding may affect the liquidity for early investors who may have to wait longer to realize their returns.

Strategic Acquisitions and Mergers

To mitigate the negative impact of tariffs and the challenging IPO market, some tech companies may opt for strategic acquisitions or mergers.

- Consolidation within the tech industry: Mergers and acquisitions can lead to industry consolidation as companies seek stability and scale in a volatile market.

- Potential for reduced competition: Mergers can result in reduced competition, potentially leading to higher prices for consumers.

- Impact on overall market dynamics: These strategic moves can significantly impact the overall dynamics of the tech industry.

Conclusion

The slowdown in the global tech IPO market is undeniably linked to the disruptive effects of international tariffs. Increased costs, investor uncertainty, and alternative funding strategies are all contributing factors. Understanding the multifaceted impact of tariffs on tech IPOs is crucial for both investors and companies navigating this challenging landscape. To stay informed about the evolving dynamics of the global tech IPO market slowdown and its implications for the future of tech investment, continue following reputable financial news sources and industry analysts. Careful analysis and a keen awareness of the impact of tariffs are essential for making informed decisions in this volatile environment.

Featured Posts

-

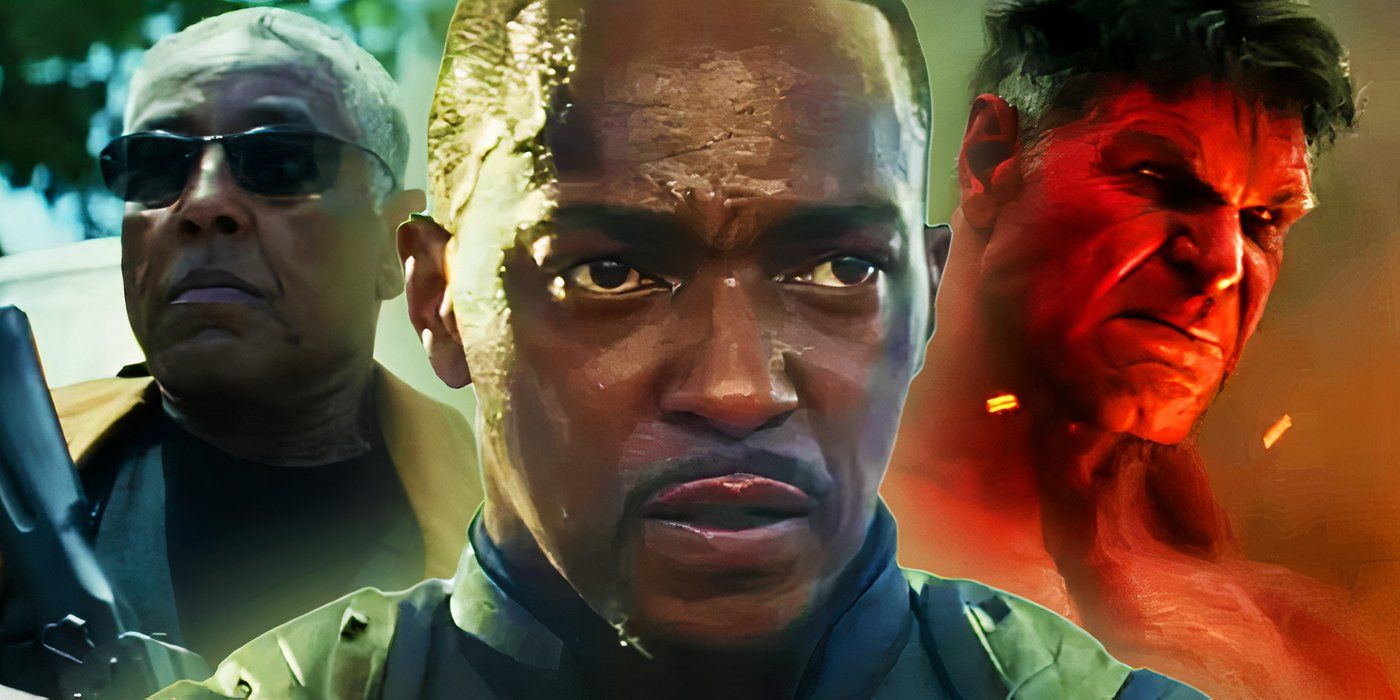

Captain America Brave New World Box Office A Disappointing Debut For The Mcu

May 14, 2025

Captain America Brave New World Box Office A Disappointing Debut For The Mcu

May 14, 2025 -

Jannik Sinners Branding A Comparison With Roger Federers Rf Logo

May 14, 2025

Jannik Sinners Branding A Comparison With Roger Federers Rf Logo

May 14, 2025 -

Analyzing The Brand Impact Sinner Vs Federers Iconic Rf

May 14, 2025

Analyzing The Brand Impact Sinner Vs Federers Iconic Rf

May 14, 2025 -

Captain America Brave New World 4 K Blu Ray Steelbook Available For Pre Order

May 14, 2025

Captain America Brave New World 4 K Blu Ray Steelbook Available For Pre Order

May 14, 2025 -

Societe Generale Alexis Kohler Prend La Fonction De Directeur General Adjoint

May 14, 2025

Societe Generale Alexis Kohler Prend La Fonction De Directeur General Adjoint

May 14, 2025