Gold ETFs And Cash Equivalents: The Current Market Trend

Table of Contents

The Rise of Gold ETFs as a Safe Haven Asset

Understanding Gold ETFs

Gold ETFs (Exchange-Traded Funds) offer investors a simple and cost-effective way to gain exposure to the gold market without the need to physically buy and store gold. They are essentially baskets of gold shares that trade on stock exchanges, offering several key benefits:

- Lower cost than physical gold: Avoids storage fees, insurance costs, and the complexities of physical gold transactions.

- Easy buying and selling: Traded like stocks, providing high liquidity and ease of access.

- Transparent pricing: Prices are readily available and reflect real-time market conditions.

- Regulated investment: Gold ETFs are subject to regulatory oversight, providing a layer of security and transparency.

Different types of Gold ETFs exist, including physically-backed ETFs (where the fund holds physical gold as an asset) and unbacked ETFs (whose value is derived from the gold price but doesn't directly hold physical gold). Understanding these differences is crucial for informed investment decisions.

Gold ETF Performance in Times of Uncertainty

Historically, gold ETFs have demonstrated a strong performance during periods of market uncertainty, inflation, and economic downturn. Their negative correlation with traditional assets like stocks makes them a valuable diversification tool.

- Hedge against inflation: Gold's value tends to rise during inflationary periods, preserving purchasing power.

- Negative correlation with stocks: When stock markets decline, gold often appreciates, providing a portfolio buffer.

- Preservation of capital: Gold acts as a store of value, helping protect capital during times of economic instability.

For example, during the 2008 financial crisis, gold prices surged, while many other asset classes experienced significant losses. Similarly, periods of high inflation have historically seen strong gold price appreciation. Analyzing historical charts correlating gold ETF performance with inflation rates and interest rates further reinforces this trend.

Cash Equivalents: A Liquidity and Stability Anchor

What are Cash Equivalents?

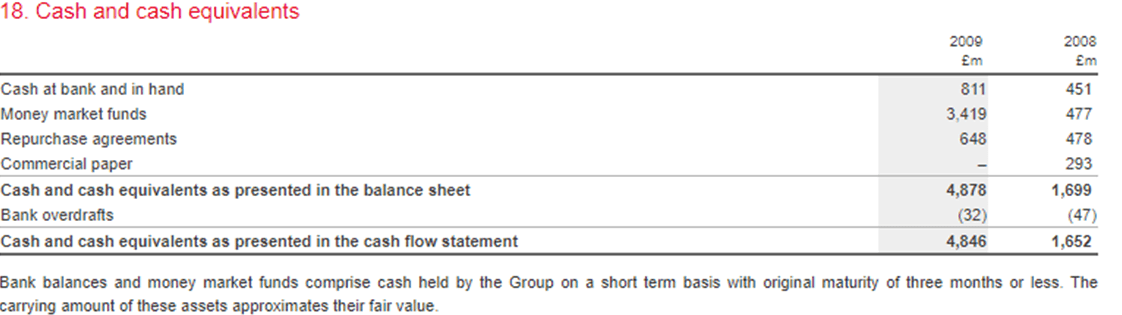

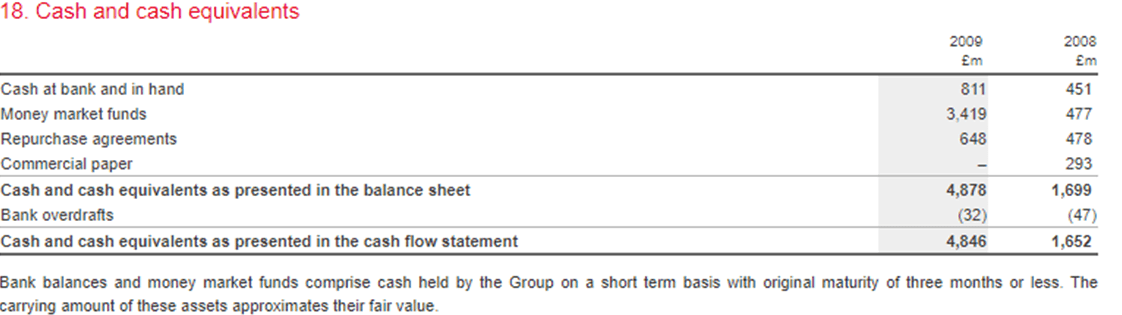

Cash equivalents are highly liquid, short-term investments that can be easily converted into cash with minimal risk of loss. Examples include:

- Money market accounts: Offer higher interest rates than traditional savings accounts.

- Treasury bills: Short-term debt securities issued by the government, considered virtually risk-free.

- Commercial paper: Short-term unsecured promissory notes issued by corporations.

While offering minimal returns, cash equivalents provide essential liquidity and stability:

- High liquidity: Easily accessible funds for immediate needs.

- Low risk: Minimal risk of capital loss.

- Easy access to funds: Funds can be readily withdrawn or utilized.

The minimal risk associated with cash equivalents needs to be weighed against their typically lower returns compared to other asset classes. Understanding the nuances between different types of cash equivalents is crucial for optimizing their role within a portfolio.

The Role of Cash Equivalents in Portfolio Management

Cash equivalents play a vital role in effective portfolio management. They provide a crucial buffer during market fluctuations and offer readily available capital for opportunistic investments.

- Provides stability during market fluctuations: Reduces portfolio volatility and protects against unexpected losses.

- Readily available capital for opportunities: Allows investors to seize attractive investment opportunities when they arise.

- Risk mitigation: Acts as a safety net, reducing overall portfolio risk.

A well-diversified portfolio typically incorporates a percentage of cash equivalents for emergency funds, short-term expenses, and to balance risk. Understanding asset allocation principles is crucial for determining the optimal percentage of cash equivalents within your portfolio.

Gold ETFs vs. Cash Equivalents: A Comparative Analysis

Return Potential and Risk Tolerance

Gold ETFs and cash equivalents offer vastly different return potentials and risk profiles:

- Gold ETFs offer higher potential returns but higher risk: Prices are subject to market fluctuations, influenced by various economic factors.

- Cash equivalents offer lower returns but lower risk: Returns are modest, but the risk of capital loss is minimal.

The correlation between these assets and others is also significantly different. Gold ETFs often have a negative correlation with stocks, while cash equivalents have a weak correlation with most asset classes.

Strategic Allocation and Diversification

The optimal allocation between gold ETFs and cash equivalents depends on individual investor needs, risk tolerance, and investment goals.

- Consider investment goals: Short-term vs. long-term investment horizons will influence asset allocation.

- Time horizon: Longer time horizons allow for greater exposure to potentially higher-return assets like gold ETFs.

- Risk appetite: Conservative investors may prefer a larger allocation to cash equivalents, while more aggressive investors may favor a higher allocation to gold ETFs.

For example, a conservative investor might allocate 70% to cash equivalents and 30% to gold ETFs, while a more aggressive investor might opt for a 30/70 split or even higher allocation to gold ETFs. It is highly recommended to seek professional financial advice to determine the most suitable allocation strategy for your unique circumstances.

Conclusion

Gold ETFs and cash equivalents represent valuable tools in navigating today's complex market landscape. While cash equivalents offer stability and liquidity, gold ETFs provide a potential hedge against inflation and market uncertainty. By strategically allocating assets between these two asset classes, investors can build a more diversified and resilient portfolio. Understanding the current trends in both gold ETFs and cash equivalents is key to making informed investment decisions. Start exploring your options today and find the right balance of gold ETFs and cash equivalents for your financial goals.

Featured Posts

-

Colis Reutilisables Hipli Optimisez Vos Envois Et Reduisez Votre Impact Environnemental

Apr 23, 2025

Colis Reutilisables Hipli Optimisez Vos Envois Et Reduisez Votre Impact Environnemental

Apr 23, 2025 -

Yankee Success A Testament To Team Cohesion Not Just Home Runs

Apr 23, 2025

Yankee Success A Testament To Team Cohesion Not Just Home Runs

Apr 23, 2025 -

Ftc To Appeal Microsoft Activision Deal Ruling Whats Next

Apr 23, 2025

Ftc To Appeal Microsoft Activision Deal Ruling Whats Next

Apr 23, 2025 -

Yankees Smash Team Record With 9 Home Runs Judges 3 Hrs Lead The Charge

Apr 23, 2025

Yankees Smash Team Record With 9 Home Runs Judges 3 Hrs Lead The Charge

Apr 23, 2025 -

Bfm Bourse Le Flash Info De 15h Et 16h Du 17 02

Apr 23, 2025

Bfm Bourse Le Flash Info De 15h Et 16h Du 17 02

Apr 23, 2025