Gold Market Update: Consecutive Weekly Losses For The First Time In 2025

Table of Contents

Analyzing the Reasons Behind the Gold Price Decline

Several interconnected factors have contributed to the recent gold price decline and the consecutive weekly losses. Let's examine the key players.

Impact of Rising Interest Rates

The inverse relationship between gold prices and interest rates is well-established. As interest rates rise, gold becomes less attractive because interest-bearing assets offer a higher return. This shift in investor preference is a significant driver of the current gold price weakness.

- Increased borrowing costs: Higher interest rates make it more expensive for businesses and individuals to borrow money, potentially dampening economic growth and reducing demand for gold as a safe-haven asset.

- Impact on investor sentiment: Rising rates generally shift investor sentiment towards fixed-income securities, diverting funds away from precious metals like gold.

- Alternative investment opportunities: Higher interest rates make other investment options, such as bonds and high-yield savings accounts, more appealing compared to gold, which doesn't offer interest payments.

Strengthening US Dollar's Role

The US dollar's strength plays a crucial role in influencing gold prices. Since gold is priced in US dollars, a stronger dollar makes gold more expensive for holders of other currencies, reducing demand and thus putting downward pressure on prices.

- Dollar Index (DXY) performance: The recent rise in the US Dollar Index (DXY), a measure of the dollar's value against other major currencies, is a direct contributor to the gold price decline.

- Implications for international investors: International investors purchasing gold with weaker currencies see their purchasing power reduced, leading to a decrease in gold demand.

- Currency exchange effects on gold demand: Fluctuations in exchange rates directly impact the affordability and demand for gold across the globe.

Geopolitical Factors and Their Influence

Geopolitical uncertainties often serve as a catalyst for gold price increases, as investors seek safe-haven assets during times of instability. However, recent geopolitical events haven't provided the usual boost to gold prices, suggesting a different market dynamic.

- Specific geopolitical events: While specific events need to be analyzed in context (e.g., ongoing trade tensions, regional conflicts), their impact on the gold market has been muted this time, possibly indicating a shift in investor sentiment.

- Investor risk appetite: Currently, investor risk appetite appears to be relatively high, with less of a flight to safety even amid geopolitical uncertainty.

- Safe-haven asset status of gold: While gold still holds its safe-haven status, its appeal as a hedge against risk has seemingly lessened in the face of the other factors discussed.

Technical Analysis of Gold Charts

Technical analysis of gold charts reveals several indicators contributing to the downward trend.

- Chart patterns observed: Support levels have been broken, indicating a weakening in the gold price. Bearish chart patterns, like head-and-shoulders formations, may also be visible to analysts.

- Technical indicators suggesting short-term/long-term trends: Moving averages are trending downwards, suggesting bearish momentum, while other indicators might point towards potential price targets.

- Potential price targets: Technical analysis can offer potential price targets for the short-term, but these are always subject to change based on evolving market conditions.

Impact on Gold Investors and Market Sentiment

The consecutive weekly losses in the gold market have significantly impacted investor behavior and market sentiment.

Investor Behavior and Portfolio Adjustments

Investors are reacting to the price drop in various ways.

- Selling pressure: Some investors are selling their gold holdings to cut losses or to re-allocate funds to other assets.

- Buying opportunities: Others view the price decline as a buying opportunity, anticipating a price rebound in the future.

- Hedging strategies: Investors are adjusting their hedging strategies, potentially reducing gold exposure in favor of other assets perceived as less volatile in the current market.

- Diversification among precious metals: Some may be diversifying their precious metal holdings, considering other metals like silver or platinum.

Short-Term vs. Long-Term Outlook for Gold

Predicting the future direction of gold prices is challenging.

- Predictions for gold price movement in the coming weeks/months: Short-term predictions vary greatly among analysts, depending on their interpretation of market signals.

- Factors that could reverse the trend: A weakening US dollar, increased geopolitical uncertainty, or a shift in monetary policy could potentially reverse the downward trend.

- Long-term investment perspective: The long-term outlook for gold remains relatively positive for many analysts, due to its historical role as a store of value and inflation hedge.

Expert Opinions and Market Forecasts

Reputable analysts offer diverse opinions on the gold market's future.

- Summary of expert views: Some analysts remain bullish on gold's long-term potential, while others express caution given the current macroeconomic environment.

- Range of predicted price movements: Predictions vary widely, reflecting the uncertainty surrounding the future direction of interest rates, the US dollar, and geopolitical events.

- Consensus on market sentiment: While a clear consensus is lacking, a cautious sentiment seems to prevail amongst many experts, advising a wait-and-see approach before making significant investment decisions.

Conclusion: Navigating the Shifting Sands of the Gold Market in 2025

The consecutive weekly losses in the gold market represent a significant shift, primarily driven by rising interest rates, a strong US dollar, and a currently muted reaction to geopolitical uncertainty. The impact on investors has been varied, with some selling while others view it as a buying opportunity. The short-term outlook remains uncertain, while the long-term potential of gold continues to be debated among experts. To navigate these shifting sands, it's crucial to monitor the gold market closely, stay updated on gold price fluctuations, and make informed gold investments. Consider consulting a qualified financial advisor before making any investment decisions related to gold or other precious metals. Stay informed, and make wise choices in this dynamic gold market!

Featured Posts

-

Catch Seventh Wonders Fleetwood Mac Tribute Show Wa Tour Dates Announced

May 05, 2025

Catch Seventh Wonders Fleetwood Mac Tribute Show Wa Tour Dates Announced

May 05, 2025 -

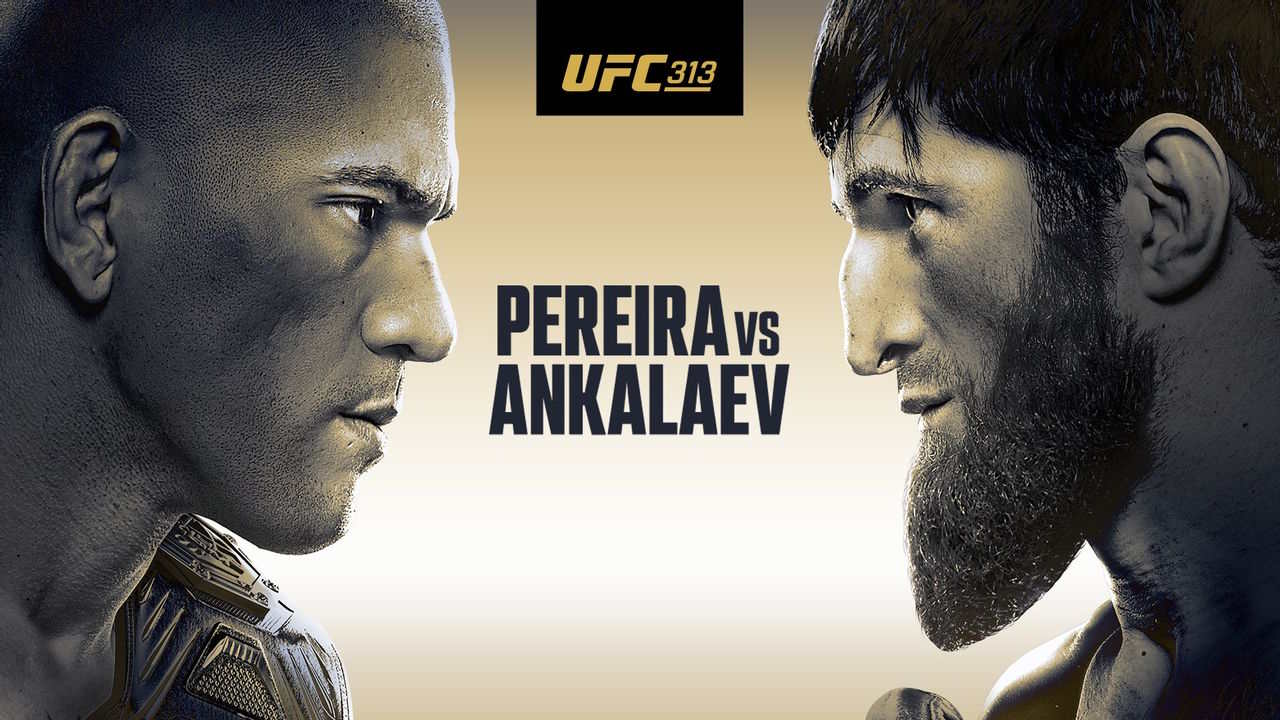

Ufc 313 Picks Pereira Vs Ankalaev Dfs Preview And Predictions

May 05, 2025

Ufc 313 Picks Pereira Vs Ankalaev Dfs Preview And Predictions

May 05, 2025 -

Understanding Peter Greens Influence On Fleetwood Macs 96 1 The Rocket

May 05, 2025

Understanding Peter Greens Influence On Fleetwood Macs 96 1 The Rocket

May 05, 2025 -

Gigi Hadid And Bradley Cooper Unseen Details Of Their Relationship

May 05, 2025

Gigi Hadid And Bradley Cooper Unseen Details Of Their Relationship

May 05, 2025 -

Navigating The Dating Scene Gigi Hadid Prioritizes Drama Free Relationships With Bradley Cooper And Others

May 05, 2025

Navigating The Dating Scene Gigi Hadid Prioritizes Drama Free Relationships With Bradley Cooper And Others

May 05, 2025