Gold Price (XAUUSD) Recovery: Rate Cut Bets Boost Precious Metal

Table of Contents

Rate Cut Bets: The Primary Catalyst for Gold Price (XAUUSD) Appreciation

The primary driver behind the recent gold price (XAUUSD) appreciation is the mounting anticipation of interest rate cuts globally. This expectation stems from a confluence of factors, primarily weakening economic indicators.

Weakening Economic Indicators and the Impact on Interest Rates

Recent economic data paints a concerning picture. Inflation, while showing signs of cooling in some regions, remains stubbornly high in others. GDP growth is slowing in several key economies, hinting at potential recessions. These factors significantly influence central bank decisions.

- Inflation Data: Persistent inflation, even at a reduced rate, forces central banks to consider monetary policy adjustments. For example, persistent inflation above the target rate in the Eurozone might influence the European Central Bank's (ECB) decisions regarding future rate hikes or even potential cuts.

- GDP Growth Slowdown: Decreasing GDP growth figures signal economic weakness, often prompting central banks to reduce interest rates to stimulate economic activity. A slowdown in US GDP growth, for instance, could lead the Federal Reserve (FED) to reconsider its aggressive monetary tightening stance.

- Unemployment Figures: Rising unemployment rates could also add pressure on central banks to lower interest rates, aiming to boost job creation.

These indicators are interconnected, and their correlation with interest rate expectations is clearly visible in various market analyses and forecasts. Many economic experts predict rate cuts in multiple regions within the next year.

Inverse Relationship Between Interest Rates and Gold Prices

Gold, unlike interest-bearing assets, doesn't pay dividends or interest. Therefore, higher interest rates make holding gold less attractive, as investors can earn returns through bonds or other interest-bearing instruments. Conversely, lower interest rates reduce the opportunity cost of holding gold, boosting its appeal. This inverse relationship has historically held true, evident in various periods.

- Historical Examples: Reviewing historical XAUUSD charts shows a clear inverse correlation between interest rate trends and gold price movements. Periods of aggressive interest rate cuts have often corresponded with significant gold price rallies.

Safe-Haven Demand: Gold's Role in Uncertain Economic Times

Beyond rate cut expectations, the increased demand for gold stems from its traditional role as a safe-haven asset. In times of economic uncertainty and geopolitical instability, investors flock to gold as a store of value.

Geopolitical Uncertainty and Gold's Safe-Haven Status

The current global geopolitical landscape is rife with uncertainty, including ongoing conflicts and rising international tensions. Such instability often leads investors to seek refuge in assets perceived as less risky, such as gold.

- Historical Precedents: Throughout history, during periods of crisis (e.g., the 2008 financial crisis, the COVID-19 pandemic), gold prices have generally risen as investors sought safety and diversification.

Inflationary Pressures and Gold as a Hedge

Persistent inflation erodes the purchasing power of fiat currencies. Gold, as a tangible asset with a limited supply, is often seen as a hedge against inflation. As inflation expectations rise, the demand for gold, and consequently the XAUUSD price, tends to increase.

- Inflation Correlation: Analysis shows a positive correlation between inflation expectations and gold price movements, making gold an attractive investment during inflationary periods.

Technical Analysis: Chart Patterns Suggesting Continued Gold Price (XAUUSD) Recovery

Technical analysis of the XAUUSD chart reveals several bullish patterns supporting the ongoing recovery.

Key Support and Resistance Levels

Analyzing recent price action using moving averages, Relative Strength Index (RSI), and other technical indicators reveals key support and resistance levels. The breaking of resistance levels often triggers further upward momentum, while support levels can indicate potential price floors.

- Moving Averages: The crossover of short-term moving averages above long-term moving averages often signals a bullish trend.

Chart Patterns and Predictions

Several bullish chart patterns, such as potential double bottoms or head and shoulders reversals (depending on future price action), suggest a continuation of the upward trend. These patterns, when combined with other indicators, provide a stronger signal. However, it’s crucial to remember that technical analysis is not foolproof, and predictions should be considered cautiously.

Factors That Could Limit Further Gold Price (XAUUSD) Gains

While the outlook for gold remains positive in the short to medium term, several factors could limit further price gains.

Potential Interest Rate Hike Reversals

Central banks might reverse course and resume interest rate hikes if inflation unexpectedly surges or economic growth proves stronger than anticipated. Such a move would likely exert downward pressure on gold prices.

Strengthening US Dollar

A strengthening US dollar typically exerts downward pressure on gold prices, as gold is priced in US dollars. A stronger dollar makes gold more expensive for holders of other currencies, reducing demand.

Conclusion: Navigating the Gold Price (XAUUSD) Recovery – A Strategic Outlook

The recent gold price (XAUUSD) recovery is primarily driven by anticipated interest rate cuts, heightened safe-haven demand amidst geopolitical uncertainty, and bullish technical indicators. Understanding these interconnected market forces is crucial for investors. While the outlook appears positive, potential interest rate hikes and a strengthening US dollar pose risks. Therefore, a balanced and well-informed approach is essential. Stay updated on the latest developments influencing the gold price (XAUUSD) and consider incorporating this precious metal into your investment strategy, diversifying your portfolio accordingly.

Featured Posts

-

Trump Tariffs Feeling The Pinch In Everyday Repairs Like Phone Batteries

May 17, 2025

Trump Tariffs Feeling The Pinch In Everyday Repairs Like Phone Batteries

May 17, 2025 -

Nba Playoffs 76ers Vs Celtics A Winning Prediction

May 17, 2025

Nba Playoffs 76ers Vs Celtics A Winning Prediction

May 17, 2025 -

Investing In The Autonomous Future The Uber Etf Opportunity

May 17, 2025

Investing In The Autonomous Future The Uber Etf Opportunity

May 17, 2025 -

Beyond China Lynass Impact On The Global Heavy Rare Earths Market

May 17, 2025

Beyond China Lynass Impact On The Global Heavy Rare Earths Market

May 17, 2025 -

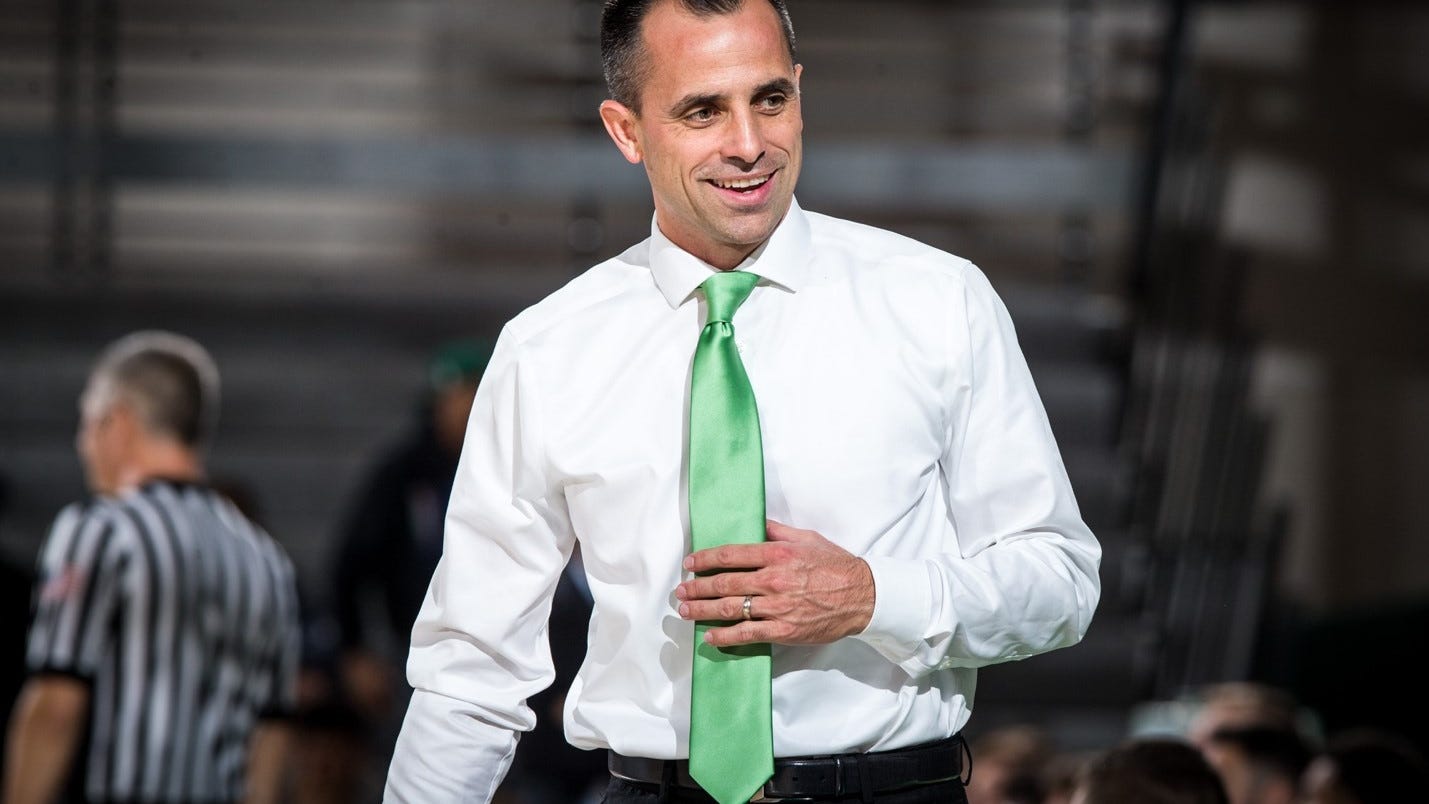

Ben Mc Collum Joins Iowa After Successful Season At Drake

May 17, 2025

Ben Mc Collum Joins Iowa After Successful Season At Drake

May 17, 2025