Gold Prices Climb Amidst Rising Trade War Concerns

Table of Contents

Trade Wars Fuel Gold's Rise as a Safe Haven Asset

Gold has long been considered a safe haven asset, meaning its value tends to increase during times of economic and geopolitical instability. There's an inverse relationship between market uncertainty and gold prices; as uncertainty rises, investors flock to the perceived security of gold, driving up demand and consequently, prices.

- Increased geopolitical risks (trade wars, political instability) boost gold demand. The escalating trade tensions between major global economies create uncertainty about future economic growth and stability. This uncertainty fuels demand for gold, a tangible asset perceived as a store of value.

- Investors seek refuge in gold during times of economic uncertainty. When stock markets fluctuate and currency values weaken, investors often shift their investments towards gold as a way to protect their capital from potential losses. This "flight to safety" significantly impacts gold prices.

- Weakening currencies (due to trade wars) often lead to gold price increases. Trade wars can weaken a nation's currency, making gold, priced in dollars, more attractive to international buyers using other currencies. This increased demand further pushes gold prices higher.

Gold acts as a hedge against inflation and currency devaluation. Historically, during periods of high inflation, gold prices have tended to rise as its value is not tied to fluctuating fiat currencies. For example, during the inflationary periods of the 1970s, gold prices saw a significant surge. Similarly, past trade disputes have often correlated with a rise in gold prices, demonstrating its role as a safe haven asset.

Weakening Dollar Strengthens Gold Prices

Gold is typically priced in US dollars. Therefore, there's an inverse correlation between the US dollar's strength and gold prices.

- A weaker dollar makes gold cheaper for buyers using other currencies, increasing demand. When the dollar weakens against other major currencies, the price of gold becomes more affordable for buyers outside the United States, boosting demand and subsequently driving up the price.

- Trade wars can weaken the dollar due to reduced global trade and investor confidence. Trade wars disrupt global supply chains and reduce investor confidence in the US economy, leading to a decline in the dollar's value.

- The dollar's performance correlates with gold price fluctuations. Historically, periods of dollar weakness have coincided with increases in gold prices. This relationship is well-documented and provides further evidence of the interplay between currency values and gold's price.

For example, [insert relevant statistic or chart showing the inverse relationship between the US dollar index and gold prices]. This visual representation clearly demonstrates the impact of a weakening dollar on gold prices.

Increased Investment Demand Pushes Gold Prices Higher

The recent increase in gold prices is not solely driven by trade war concerns; increased investment demand also plays a significant role.

- Central banks are increasing their gold reserves as a safe haven for their assets. Many central banks globally are diversifying their foreign exchange reserves by adding gold, recognizing its stability and role as a safe haven asset during times of uncertainty.

- Exchange-traded funds (ETFs) focused on gold are experiencing increased inflows. Investors are increasingly utilizing gold ETFs as a convenient and accessible way to gain exposure to gold without the need for physical storage. The rise in ETF inflows directly reflects growing investor interest.

- Growing interest from individual investors seeking portfolio diversification and protection. Individual investors are increasingly looking to diversify their portfolios and protect against market volatility by including gold as a component of their overall investment strategy.

[Insert data on recent ETF inflows or central bank gold purchases to support these claims]. This data quantitatively supports the narrative of increased investment demand driving up gold prices.

Analyzing the Impact on Different Market Sectors

The rise in gold prices has ripple effects across various market sectors.

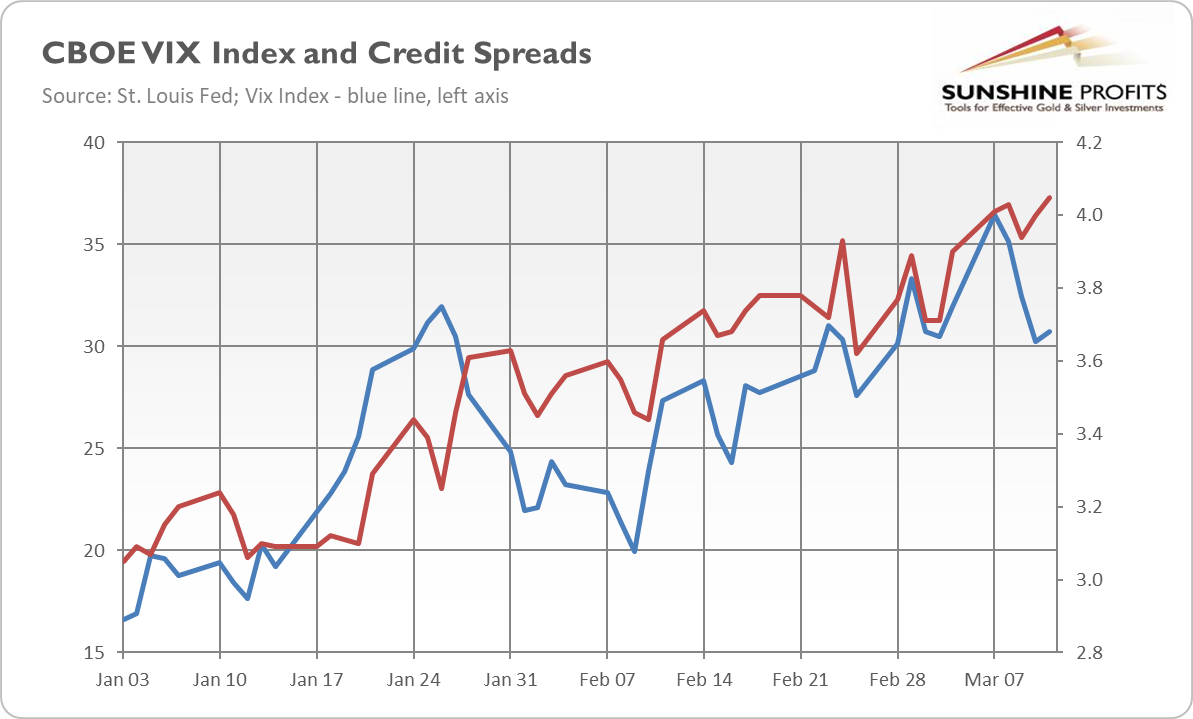

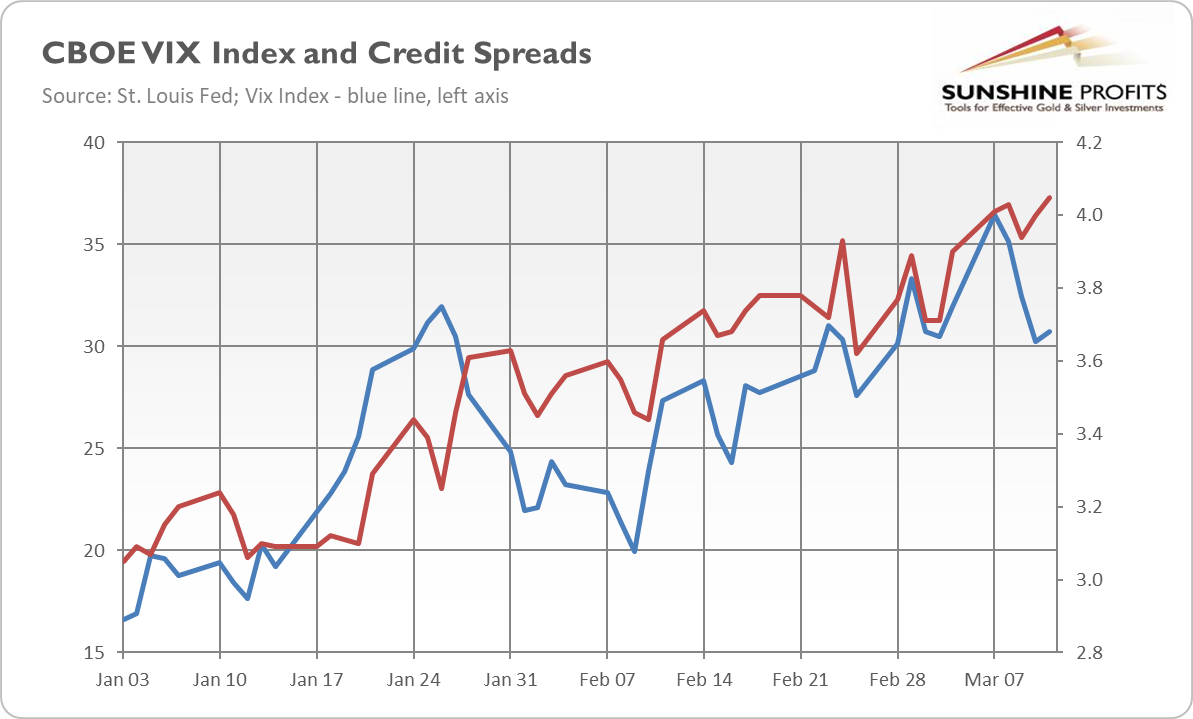

- Impact on stock markets: Increased demand for gold may sometimes indicate a flight from riskier assets like stocks, leading to potential declines in stock market performance.

- Impact on other precious metals: The price movements of gold often influence the prices of other precious metals like silver and platinum, creating correlations between these commodities.

- Impact on the currency markets: As mentioned earlier, the relationship between the US dollar and gold is inversely correlated, influencing currency exchange rates.

Conclusion

The recent surge in gold prices is a multi-faceted phenomenon driven by a confluence of factors. Trade war concerns, a weakening dollar, and increased investment demand from central banks, ETFs, and individual investors have all contributed to this upward trend. Gold's role as a safe haven asset during times of economic and geopolitical uncertainty is being reaffirmed. Monitor gold price fluctuations closely and consider diversifying your portfolio with gold as a means of mitigating risk in the face of rising trade war concerns. Learn more about gold as a safe haven asset during trade wars and how it can protect your investment portfolio.

Featured Posts

-

Porsche 956 Tavan Sergisinin Teknik Ve Tarihsel Aciklamalari

May 25, 2025

Porsche 956 Tavan Sergisinin Teknik Ve Tarihsel Aciklamalari

May 25, 2025 -

Hair Trimmers Used In Failed Escape Attempt At Louisiana Jail

May 25, 2025

Hair Trimmers Used In Failed Escape Attempt At Louisiana Jail

May 25, 2025 -

Arrest In Deadly Myrtle Beach Hit And Run Case

May 25, 2025

Arrest In Deadly Myrtle Beach Hit And Run Case

May 25, 2025 -

From Afar To Dc A Love Story Cut Short

May 25, 2025

From Afar To Dc A Love Story Cut Short

May 25, 2025 -

Impact Of Trumps Tariffs Amsterdam Stock Exchange Down 2

May 25, 2025

Impact Of Trumps Tariffs Amsterdam Stock Exchange Down 2

May 25, 2025