Gold Prices Surge Amidst Trump's Trade War Threats

Table of Contents

The Impact of Trade War Uncertainty on Gold Prices

Trade wars, by their very nature, create significant economic instability. The imposition of tariffs and the threat of further sanctions inject uncertainty into global markets, prompting investors to seek refuge in assets perceived as less volatile. Gold, with its long history as a store of value, consistently emerges as a preferred safe haven during periods of market turmoil. The impact of this trade war uncertainty on gold price volatility is undeniable.

- Increased market volatility: Trade disputes create unpredictable market swings, making riskier assets less appealing.

- Weakening of the US dollar: As investors lose confidence in the dollar amidst trade tensions, they often flock to gold, which is priced in USD, pushing its value higher.

- Decreased investor confidence in riskier assets: Stocks and other high-risk investments become less attractive during times of economic uncertainty.

- Safe haven demand pushes gold prices higher: The increased demand for a stable asset like gold directly translates to higher prices.

Trump's Trade Policies and Their Influence

President Trump's trade policies, characterized by tariffs and trade wars, have played a significant role in influencing gold prices. While the direct impact can be complex, the underlying uncertainty created by these policies is a major driver. The unpredictable nature of Trump's pronouncements and actions further fuels market anxiety.

- Analysis of specific tariffs: The impact of tariffs varies depending on the targeted goods and countries, but generally leads to increased costs and potentially, reduced global trade.

- Uncertainty surrounding future trade decisions: The constant threat of new tariffs or escalating trade conflicts keeps investors on edge, boosting demand for safe haven assets.

- Investor reactions to Trump's tweets and statements: Even seemingly minor pronouncements from the President can send shockwaves through the market, impacting gold prices. This demonstrates the power of geopolitical risk on gold's value.

Gold as a Safe Haven Asset in Times of Crisis

Gold's status as a safe haven asset is deeply rooted in history. Throughout economic downturns and geopolitical crises, investors have consistently sought refuge in gold, viewing it as a reliable store of value that transcends fluctuating market conditions. This enduring appeal stems from its inherent properties.

- Historical role of gold: Gold has historically maintained its value even during periods of significant economic turmoil, serving as a reliable hedge against inflation and currency devaluation.

- Hedge against inflation: During inflationary periods, when the purchasing power of fiat currencies declines, the value of gold tends to increase, protecting investors from erosion of their wealth.

- Benefits of diversification: Including gold in a diversified investment portfolio helps reduce overall portfolio risk, acting as a buffer against losses in other asset classes.

Investing in Gold: Options and Considerations

There are several ways to gain exposure to gold as an investment. Each option carries its own set of advantages and disadvantages, requiring careful consideration before making a decision.

- Physical gold (bars, coins): Owning physical gold provides a tangible asset, but it requires secure storage and insurance.

- Gold ETFs (exchange-traded funds): Gold ETFs offer a convenient and liquid way to invest in gold without the hassles of physical storage. They track the price of gold, offering easy buying and selling.

- Gold mining stocks: Investing in gold mining companies offers higher potential returns but also carries significantly higher risk compared to direct gold investment.

Conclusion

The recent surge in gold prices is undeniably linked to the uncertainty surrounding President Trump's trade war policies and the resulting economic anxieties. This underscores gold's enduring role as a safe haven asset, a reliable store of value during times of market instability. Understanding the impact of the trade war on gold prices is crucial for informed investment decisions. To protect your portfolio with gold, consider diversifying your investments. Learn more about gold investment options, but remember to consult with a financial advisor before making any investment decisions. Don't underestimate the potential of gold investment in navigating the complexities of the current economic climate.

Featured Posts

-

The Taylor Swift Kanye West Dispute A Legal Battle Over Explicit Lyrics

May 27, 2025

The Taylor Swift Kanye West Dispute A Legal Battle Over Explicit Lyrics

May 27, 2025 -

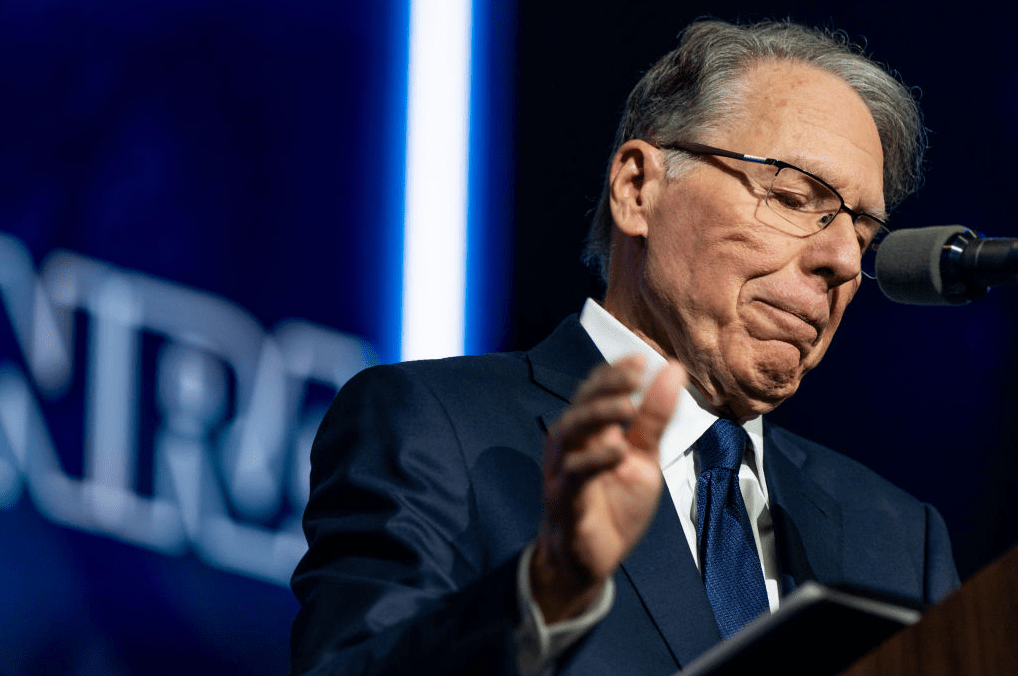

Muted Political Presence Marks Nra Convention In Atlanta

May 27, 2025

Muted Political Presence Marks Nra Convention In Atlanta

May 27, 2025 -

Free Streaming Options For 1923 Season 2 Episode 5 Tonight

May 27, 2025

Free Streaming Options For 1923 Season 2 Episode 5 Tonight

May 27, 2025 -

Kai Cenats Twitch Account Hacked Banner And Display Image Changed

May 27, 2025

Kai Cenats Twitch Account Hacked Banner And Display Image Changed

May 27, 2025 -

Exclusive Update Taylor Swift And Blake Lively Amidst The It Ends With Us Legal Dispute

May 27, 2025

Exclusive Update Taylor Swift And Blake Lively Amidst The It Ends With Us Legal Dispute

May 27, 2025